Fresh Graduate: JKYL Investment Blog Shares His Best Financial Advice And Investment Portfolio For Investors With Low-Risk Appetite

Kicking Off Your Investment Journey

Most of us have a misconception that kicking start our investing journey requires huge capital, and having a portfolio that consists of a crazy number of stocks and investment instruments. Due to this misconception, lots of young working adults avoid having an early start, missing out on a lot of good years.

JYKL Investment Blog‘s portfolio and financial advice in our opinion is a really good example of how most fresh graduates should view investing. It is not necessarily always about having the best stocks with out of the world returns. Having your money parked in the best savings account, in fact, is more than half the battle won.

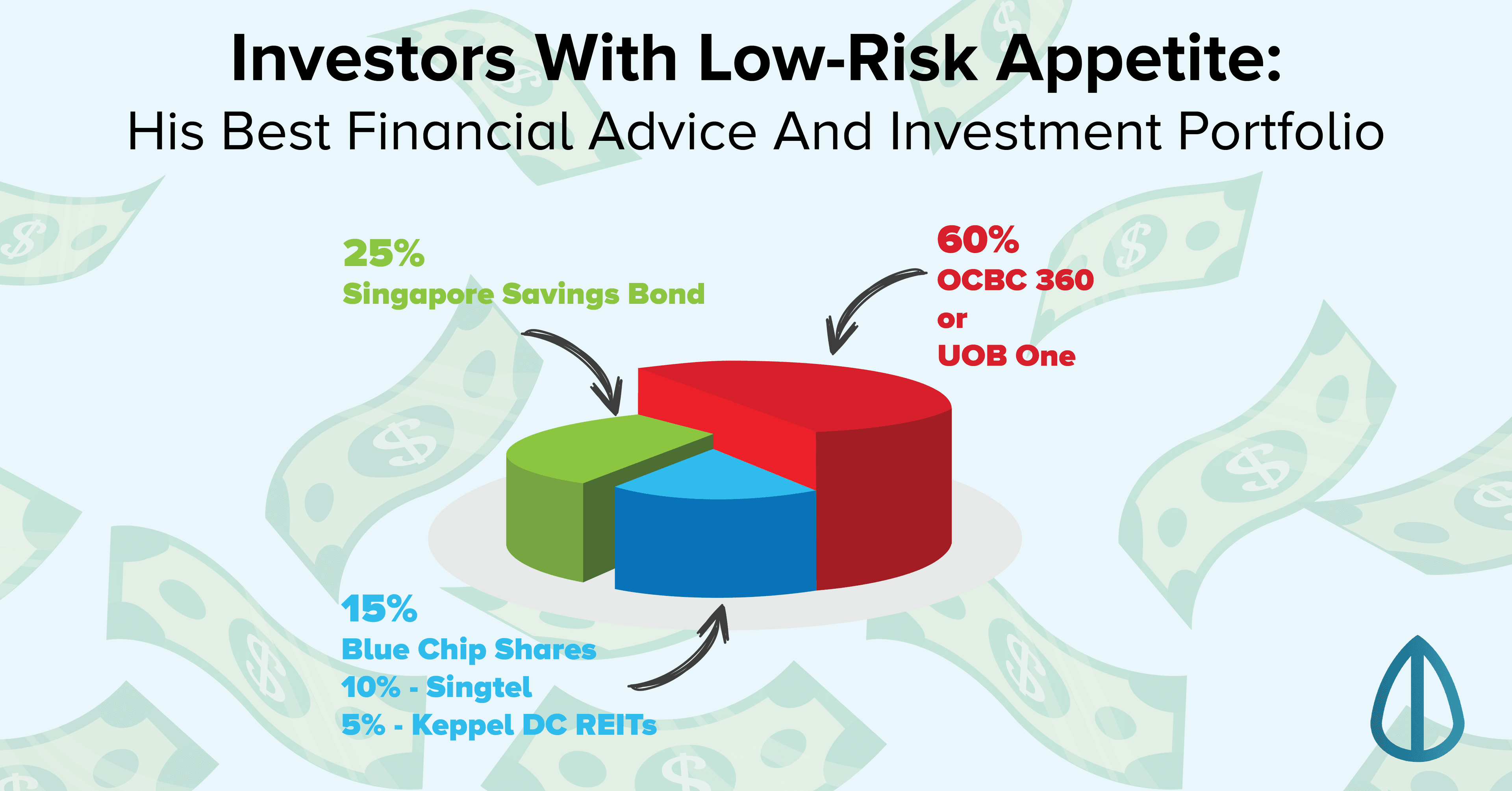

JYKL Investment Blog, through simple investment and with the best savings accounts managed to save up an asset of more than $300k at the moment. Here’s how his portfolio looks like.

What Percentage Of Your Monthly Income Do You Invest?

What Are Some Of The Areas You Look Out For When Choosing The Right Instrument To Invest In?

- OCBC 360, UOB one account can earn good interest by satisfying the requirements set by the banks and your money is pretty safe.

- Singapore Savings Bond (SSB) because it is backed by the government and it is a good way to start with investing with as little as $500. It provides a reasonable return of 2% to 3% returns which will be sufficient for conservative investment approach.

- Another thing that I look out for is going for stable blue chips (take note that it is important to understand what they do and the business model of the company that you buying matters)

Can You Share With Us A Quick Overview Of Your Portfolio?

Any Advice For Singaporeans Who Are Just Getting Started On Their Investment Journey?

Advertisement