Investment Blogger Shares His Best Financial Advice And Investment Portfolio - STE's Stocks Investing

We assume you had enough nagging from financial blogs regarding the importance of investing. For most people, their investing journey ends after they applied for a Central Depositary Account (CDP), and embark on a regular savings plan. Good effort, but there should be a lot more to getting closer to your financial goals.

Guideline Of Investing

If you are not sure about how to get started, we have a general step-by-step guideline here for you.

- Setting up your CDP and brokerage account

- Learning to use the brokerage account to trade (at least know how to sell and buy shares)

- Read up and understand what instruments and portfolio suits your risk profile

- Be humble and constantly learn from more experienced investors! It can be your uncle, a friend or like this article, some of Singapore’s best investment bloggers.

- You never truly learnt the art of investing until you buy your first share, so do it. Back that decision up with research of course.

In this series of article, Seedly is thick-skin enough to get financial advice from some of the best investment bloggers in the market for our readers. At the same time, we peep into their investment portfolio to check out what they have, up their sleeves. For this week, we have STE Stocks Investing Journey share with us some of his secrets to his investments.

Just this year, his portfolio accumulated an impressive dividend and interest income of S$146,097 in the first three-quarters.

STE’s Stocks Investing Journey

STE’s Stocks Investing Journey

What Percentage Of Your Monthly Income Do You Invest?

As I have highlighted in my previous blog post, I am now living on “dividend income “ and after all the expenses, we managed to save and invest around $80-100K each year which is also around 50% of our total passive income. During the time when I was still working, I managed to save and invest around 50% of our salary.

Wealth accumulation is not just about achieving higher Return on Investment (ROI), but also about building and having a good career path which eventually would increase your “ human capital “ as part of the capital to deploy for your investment.

I have a blog post about the topic of “Human Capital “.

What Are Some Of The Areas You Look Out For When Choosing The Right Instrument To Invest In?

For me, any investment which can “beat the inflation” in the “long run” is a good investment be it equities, commodities or bonds. Investors, especially the young and new, should avoid investing in “alternative investments“ which promise you a double-digit return in a month or even a year. One should always question the “sustainability” of the return on such investment.

We should always remind ourselves that if an investment is “too good to be true”, it probably is. We should be on a lookout for such and it should raise a red flag in our mind.

In the long run, I believe equities are still the best investment and will form the majority of my investment portfolio. This is, of course, subject to the stage of “investment lifecycle “ and risk profile, one should diversify by adjusting the percentage he holds in Equities, Bonds and Cash accordingly.

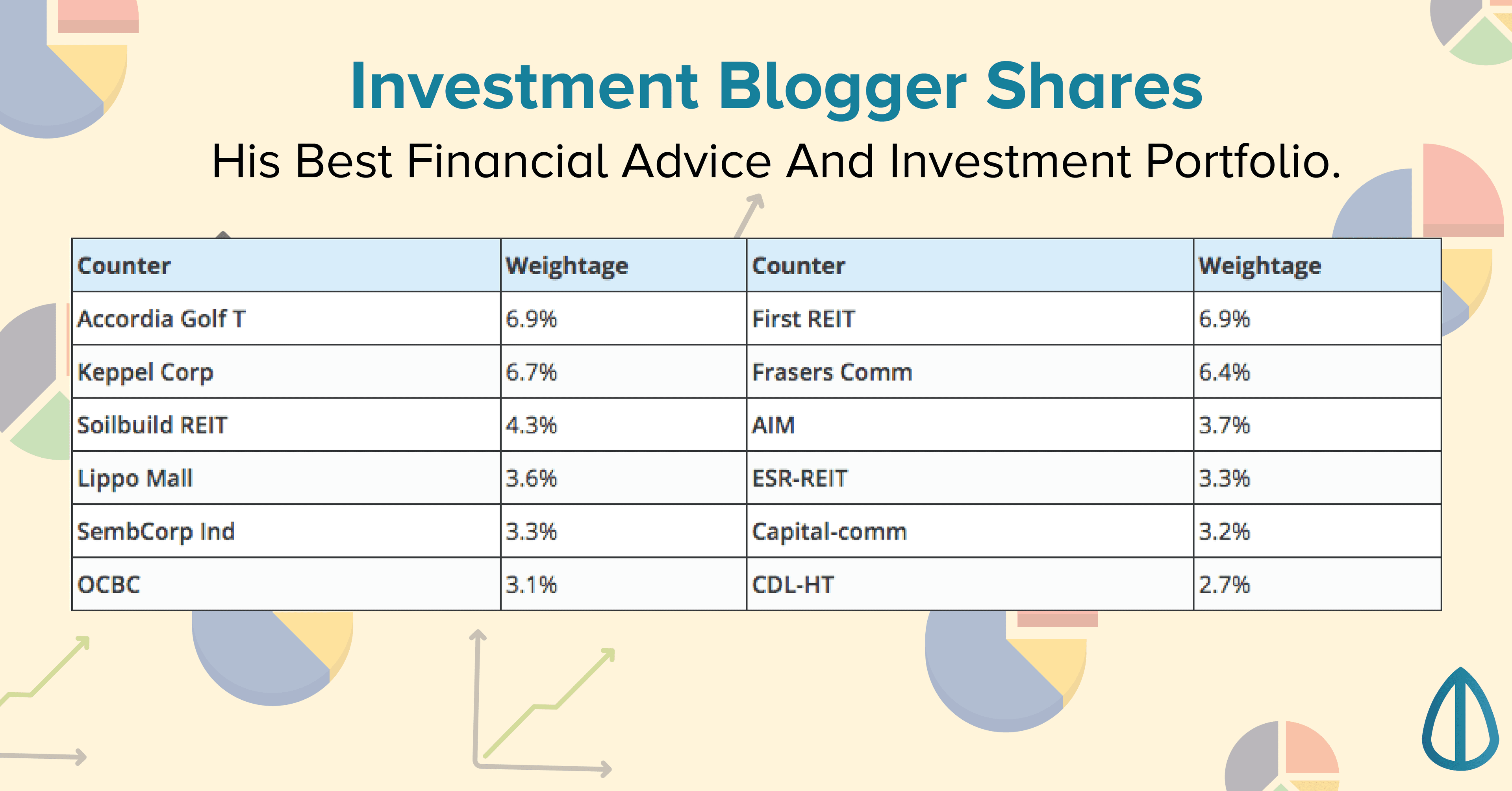

Can You Share With Us A Quick Overview Of Your Portfolio?

Below is my portfolio as of 18th August 2017. I don’t change much as of today.

You may notice that my portfolio is heavily skewed towards “income and yield “ stocks such as REITs, Business Trust as well as some Banks and Telcos.

Such portfolio may not be suitable for young investors who are in early stage of wealth accumulation, looking for more “growth stocks “ rather than “income stocks“. For myself, I depend very much on “dividend income” to survive.

By investing in “high yield “ stocks, investors should avoid the most common pit-fall or “value trap “. One way to do so is to look out for the company’s “Free Cash Flow “ and payout ratio. Debts ratio should be taken into consideration too, to ensure that the dividend payout is sustainable in the long run.

| Counter | Weightage | Counter | Weightage |

|---|---|---|---|

| Accordia Golf T | 6.9% | First REIT | 6.9% |

| Keppel Corp | 6.7% | Frasers Comm | 6.4% |

| Soilbuild REIT | 4.3% | AIM | 3.7% |

| Lippo Mall | 3.6% | ESR-REIT | 3.3% |

| SembCorp Ind | 3.3% | Capital-comm | 3.2% |

| OCBC | 3.1% | CDL-HT | 2.7% |

| M1 | 2.6& | Ascendas HT | 2.5% |

| Global Inv | 2.5% | Croesus RT | 2.4% |

| Singtel | 2.2% | Frasers H Trust - FHT | 2.0% |

| Viva Ind T | 2.0% | Hotung Inv | 1.9% |

| DBS | 1.6% | Frasers L&I Trust | 1.6% |

| Design Studio | 1.5% | Suntec | 1.5% |

| Far East H Trust | 1.3% | ComfortDelGro | 1.2% |

| Mapletree GCC | 1.0% | TTJ Holding | 0.9% |

| Manulife REIT (USD) | 0.8% | Asian Pay TV | 0.8% |

| Thai Bev | 0.8% | BHG R REIT | 0.7% |

| SIA Eng | 0.7% | Starhub | 0.7% |

| I REIT Global | 0.6% | SPH | 0.6% |

| UOB | 0.6% | Fu Yu | 0.6% |

| Singpost | 0.6% | Starhill | 0.5% |

| KSH | 0.5% | ST Eng | 0.3% |

| Mapletree Comm | 0.3% | ||

| Total: 100% | |||

Any Advice For Singaporeans Who Are Just Getting Started On Their Investment Journey?

Read my blog! haha! just kidding. (If you are interested in stocks investing, you should totally read his blog. We are not kidding. – Seedly)

I have 3 very important things to highlight here:

Be Patient

I have a favourite quote from Warren Buffet, which is “The stock market is a device for transferring money from the impatient to the patient “.

Deep down, we know that investing in any kind of asset needs time and is a long journey before we see the result. Singaporeans are able to see property investment, starting a business, to planting durian trees in our orchard as a long term plan. Yet, when come to stocks investing, we do not apply the same principle and expect to see returns as soon as possible.

If we do not constantly as for the value of our property or business we have established every day, we should not do the same for stocks investing. The stocks market might have provided us with liquidity which allows us to buy and sell our shares, but our views on investing should not change.

We should be patient in our investment and allow “compounding effect “ to work its magic. Personally, it took us more than 19 years to build and accumulate the value of the portfolio today.

“ Rome wasn’t built in one day “

Understanding the “Behavioral Finance “ and The Psychology of Investing

知己知彼,百战百胜

This saying above is from “The Art of War “ by Sun Tzu, which loosely translates into “If you know yourself and your enemy well, you’ll never be defeated.”

Another famous quote from Germany’s stock market guru, Andre Kostolany, is that “Psychological create 90% of Market “.

Behavioral finance combines psychology and economics in decision making. Studies show that our brain does not during decision making and is usually full of biases. That explains why we hold on to loss making stocks and sell the ones which made money aka “Loss aversion “ in Prospect Theory.

I personally recommend reading up on books about “Behavioral Finance and Psychology of Investing“. Reading materials such as “How to become Millionaire by 30” or “How to make 30% return in a month by using our Trading strategy“ should be avoided.

For more detail, you may find it on my blog post here.

Understand the concept of “ Mean Reversion and Market Cycle “

We have to understand the reality that market moves in a cycle where we will experience “boom & bust “occasionally from time to time. Understanding the concept of “Mean Reversion” will help us avoid a situation where we buy at the peak of a stock and help us take advantage of price movement during a crisis.

Volatility does not necessarily equal to risk. There can be a few opportunities in our lifetime to buy stocks during a crisis and have extraordinary return subsequently.

Advertisement