Are you hesitating to invest in Singapore due to uncertainty about your length of stay?

Or, have you been cautious with your finances because you lack knowledge about the local regulations and guidelines? If that’s the case, you might be overlooking potential investment opportunities.

Is Singapore an attractive investment destination?

Singapore stands out as a regional financial hub known for its stringent regulations, stable currency, and ease of initiating investments.

Besides, the Monetary Authority of Singapore (MAS) closely monitors the well-established and thriving financial markets to ensure the safety of your investments within an open and free economy. Some benefits of investing in Singapore include the absence of capital gains tax and a wide array of sectors to explore and invest in.

Besides stocks or equities, what other options do you have?

As always, you must do your due diligence to assess if it suits your risk profile.

Let’s find out what’s available!

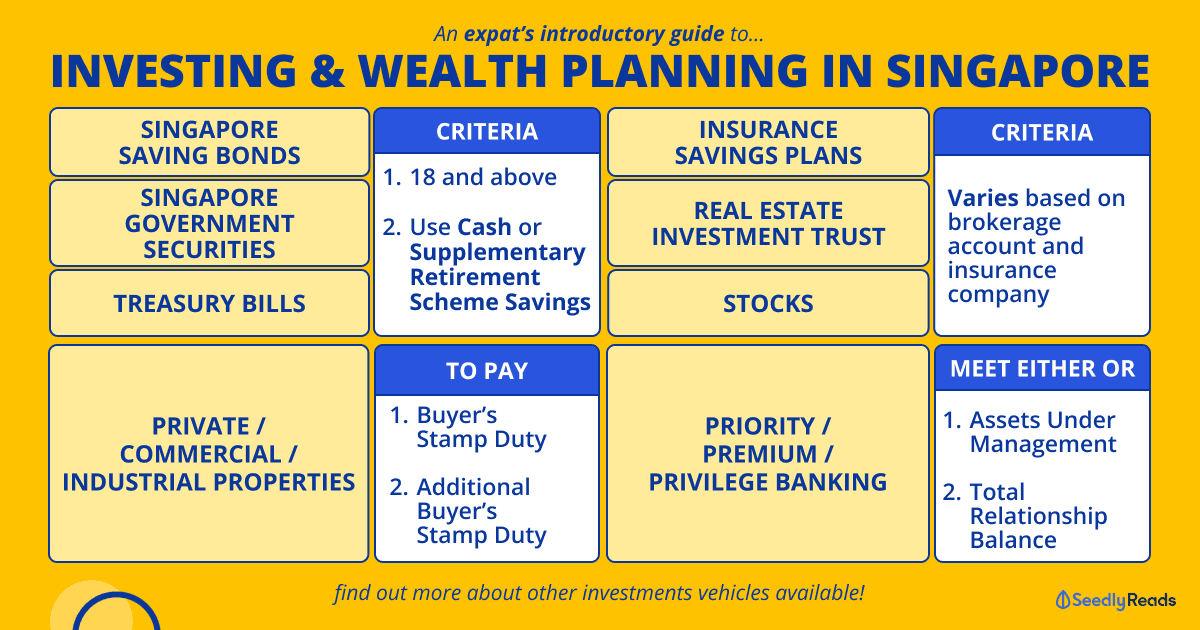

TL;DR: Expat’s Guide to Understanding Financial Products in Singapore

Click here to jump:

- Bonds

- Exchange Traded Funds

- Fixed Deposits

- Insurance Savings Plans

- Priority, Premium And Privilege Banking

- Property Investing in Singapore

- Real Estate Investment Trusts (REITs)

- Robo-advisors

- Stocks investing

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any financial product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a financial advisor or related professionals before purchasing any products and/or services.

Low-risk Investments For Risk-averse And High Liquidity

You have a few choices if you want virtually risk-free investments backed by the Singapore government.

Singapore Savings Bonds (SSB)

The Singapore Savings Bond (SSB) is a decade-long bond with flexible redemption and decent interest and is one of the more common options for Singaporeans to invest their money and one of the easier ways for risk-averse investors to fight inflation in Singapore.

For as little as S$500, you can invest in SSBs for up to 10 years and enjoy the flexibility to exit the investment anytime without any capital loss or penalty.

Individuals aged 18 and above, including Singapore Permanent Residents and foreigners, can buy SSBs using cash or Supplementary Retirement Scheme (SRS) savings.

For the uninitiated, SRS is a voluntary scheme with local banks that is particularly useful for those planning for their retirement in Singapore. If you’re a foreigner, there’s a contribution cap of $35,700.

Read more about SRS:

- Why You Should Top Up $1 Into Your Supplementary Retirement Scheme (SRS) Account

- SRS Account Hack: Why You Should Top Up $1 to Your Supplementary Retirement Scheme Account

Here’s how you can purchase SSB:

- Cash – Open a local bank account (DBS/POSB, OCBC or UOB) and an individual Central Depository (CDP) securities account with Direct Crediting Service activated to allow interest payments from your SSB to be credited directly into your bank account. Once this is completed, you can apply for SSB via ATM or Internet banking.

- SRS – Open an SRS account with one of the SRS operations (same local banks as above), and apply for SSB via the internal banking of one of these banks. Do note that SRS’s maximum yearly contribution limit is $35,700 for foreigners.

Singapore Government Securities (SGS) Bonds

Meanwhile, the Singapore Government Securities (SGS) Bonds pay you a fixed interest rate and flexibility in maturities ranging from 2 to 50 years.

While SSB requires a minimum investment amount of S$500, you will need S$1,000 if you were to invest in SGS Bonds.

We have an ultimate guide on SGS Bonds below so you can understand the mechanics deeply.

What Do You Need?

Before applying, make sure you have the following:

- A bank account with any local banks in Singapore (DBS/POSB, OCBC or UOB)

- Central Depository (CDP) account that is linked to the bank account you intend to invest with

- An SRS account if you are using funds from your SRS

What are “Competitive” and “Non-competitive” bidding?

As you apply for new SGS bonds, you will have the option of a “competitive” and “non-competitive” bid.

A non-competitive bid does not specify the yield. Instead, you only specify the amount you want to invest, and those funds will be invested regardless of the yield. This is the option that the average Singaporean should go for.

On the other hand, a competitive bid is usually for institutional investors or the more investment-savvy. Opting for a competitive bid means that your funds will only be invested if the cut-off yield exceeds your specified yield.

Do note that you may not get the full amount that you applied for, depending on how your bid compares to the cut-off yield (i.e. If your bid is lower than the cut-off yield, you will get the full amount. If your bid is equal to the cut-off yield, your return amount might be lower as the allocation is pro-rata.)

Unlike SGS bonds, however, you are not paid with coupons. Instead, you buy T-bills at a discount to the face (par) value and are given the full value at maturity.

Treasury Bills (T-Bills)

If you’re looking for an alternative, the T-bills (Treasury bills) are government bonds that pay a fixed interest rate, have a six-month or one-year maturity, have the same backing as the Singapore Government, and are well-known for their high credit (AAA) rating.

It typically has a higher interest rate than SSB but less liquidity; The interest rate for T-bills changes every month and is only determined at the auction.

SSB vs SGS Bonds vs T-bills – What Are The Differences?

| Singapore Savings Bonds (SSB) | Singapore Government Securities (SGS) Bonds | Treasury Bills (T-Bills) | |

|---|---|---|---|

| What is it? | Safe and flexible bond option for investors | Tradable government debt securities | Short-term tradable government debt securities |

| How does it work? | Pays interest every 6 months | Pays a fixed couple every 6 months | Investors buy it at a discount. Upon maturity, investors will then receive the full face value of the bill |

| Investment duration | 10 years | 2, 5, 10, 15, 20, 30, 50 years | 6 months or 1 year |

| Minimum investment | $500, and in multiples of $500 | $1,000, and in multiples of $1,000 | $1,000, and in multiples of $1,000 |

| Maximum limit per investor | $200,000 | Auction: up to allotment limit for auctions Syndication: None | No Limit; up to the allotment limit for auctions |

| Fees | Cash: $2 | Cash: $2 (Waived if you apply through DBS internet banking) | Cash: $2 (Waived if you apply through DBS internet banking) CPFIS: $2.50 transaction fee, $2 quarterly service fee per counter |

| Type of Interest Payment | Fixed coupon, steps up each year | Fixed coupon | No coupon; issued and traded at a discount to the face (par) value |

| Payment of interest | Every 6 months, starting from the month of issue | Every 6 months, starting from the month of issue | At maturity |

| How is the price and rate determined? | The interest rate is fixed and published by Monetary Authority of Singapore (MAS) every month The interest rate is announced before the application | Determined by auction | Determined by auction |

| How to apply? | Apply through DBS/POSB, OCBC and UOB ATMs or internet banking | Apply through DBS/POSB, OCBC and UOB ATMs or internet banking | Apply through DBS/POSB, OCBC and UOB ATMs or internet banking |

| How to redeem? | Redeem the full principal with accrued interest through Online Bank or ATM There will be no penalty for early withdrawal | No early redemption | No early redemption |

| Can we buy/sell on secondary markets? | No | At DBS, OCBC or UOB main branches; on SGX through brokers | At DBS, OCBC or UOB main branches |

| Transferable? | No | Yes | Yes |

| Can we invest using our SRS account? | Investors can invest through their respective SRS Operator's internet banking portal | Investors can invest through their respective SRS Operator's internet banking portal | Investors can invest through their respective SRS Operator's internet banking portal |

| Can we invest using our CPF/SRS? | CPF: No SRS: Yes | Auction: Yes Syndication: No | Yes |

| Tax | There is no capital gains tax in Singapore | ||

Fixed Deposits in Singapore

Fixed deposits (or time deposits) are an extremely low-risk way to grow your money without losing your capital.

Think of it as stashing away your money in a secure vault, letting it peacefully grow without any worries. Just set it, forget it, and watch your wealth blossom.

Every bank offers different interest rates almost every month, which typically vary according to the minimum deposit amount and agreed-upon tenor.

This is the latest rates as of June 2023:

| Banks | Promotional Interest Rate (p.a.) | Tenure (Months) | Promotion's Minimum/ Qualifying Amount (SGD) | Valid Till |

|---|---|---|---|---|

| DBS/POSB Fixed Deposit Rates | 3.20% | 12 months | $1,000 | Further notice |

| Maybank Fixed Deposit Rates | 3.15%* | 6 months | $20,000 (Fresh funds) | Further notice |

| Bank of China Fixed Deposit Rates | Mobile Banking: 3.00% Over the Counter: 2.90% | 3 months | $500 and above (Via Mobile Banking*) $10,000 and above (Over Counter) | Further notice |

| ICBC Fixed Deposit Rates | E-banking: 3.00% Over Counter: 2.85% | 3 months | E-banking: $500 Over Counter: $20,000 | Further notice |

| RHB Fixed Deposit Rates | Premier Customers: 3.00% Personal Customers: 2.90% | 3, 6, 12, 18 months | $20,000 | Further notice |

| CIMB Fixed Deposit Rates | Preferred Banking: 2.80% Personal Banking: 2.75% | 3, 6 months | $10,000 | Further notice |

| Hong Leong Finance Fixed Deposit Rates | 2.75% | 7, 8 months | $20,000 | Further notice |

| Sing Investments & Finance Limited (SIF) Fixed Deposit Rates | 2.70% | 3, 12 months | $10,000 (Fresh funds) | Further notice |

| OCBC Fixed Deposit Rates | 2.60% (Online) | 6 months | $30,000 (Fresh funds) | Further notice |

| Standard Chartered Fixed Deposit Rates | Priority Private Banking: 2.75% Priority Banking: 2.65% Promotional Rate: 2.55% | 6 months | $25,000 (Fresh funds) | 31 Dec 2024 |

| HSBC Fixed Deposit Rates | 2.45% | 3 months | $30,000 (Fresh funds) | 31 Dec 2024 |

| UOB Fixed Deposit Rates | 2.50% | 6 months | $10,000 (Fresh funds) | 31 Dec 2024 |

| Citi Fixed Deposit Rates | Existing/New Customer: 2.40% | 3 months | $50,000 (Fresh funds) | 31 Dec 2024 |

*For every $1,000 deposited into Maybank Current or Savings Accounts (min. $2,000), you can deposit $10,000 into the Deposit Bundle Promotion ($20,000)

Exchange Traded Funds in Singapore

For: Medium risk; Individuals who want to diversify at lower costs.

‘What is an ETF or Exchange Traded Funds?”

An Exchange Traded Fund (ETF) is an investment that commonly tracks the performance of an underlying index.

By investing in an ETF, investors can get access to a range of companies within the ETF instead of trying to pick individual companies. They are traded on a stock exchange and can be purchased the same way you would for any stock. Investing in an ETF gives you a small stake in many different companies and is more cost effective than investing in 30 different companies individually.

You’re in for luck. We’ve covered pretty extensively about buying your first ETF to deep-diving into different ETFs:

- A Beginner’s Guide On How To Invest in ETFs in Singapore

- ETFs in Singapore (SGX): What Investors Should Know

- How To Choose The Right Exchange Traded Fund (ETF) To Invest In?

- STI ETF: A Simple Way To Invest In Singapore’s Top 30 Companies

- Best U.S. ETFs

- A Dummies Guide To Investing In Ireland-Domiciled S&P 500 ETFs

- Popular ETFs Listed in Hong Kong

- The Ultimate Compilation of Exchange-Traded Funds (ETFs)

Regular Savings Plan

For: Medium risk; Individuals who want to cultivate the habit of investing monthly.

Regular Savings Plan (RSP), also known as Regular Shares Savings Plan (RSSP), is an investment plan that allows you to invest a small and fixed amount of money (as low as S$50) into a particular investment product, such as exchange-traded funds (ETFs), real estate investment trusts (REITs), and stocks, on a monthly basis.

A major benefit of the RSP is that investors can take advantage of dollar-cost averaging, which avoids trying to time the market, especially during a bear market.

Investing at regular intervals means more units are bought when prices are low and fewer units when prices are high. But overall, the average cost for all the units is likely to be lower than using a lump sum and buying units in one go.

Read more:

- Regular Shares Savings Plan: The Piggy Bank For Young Working Adults

- Investing for Kids: How to Give Them the Financial Headstart You Never Had

- Which Regular Shares Savings (RSS) Plan Is The Cheapest? DBS vs FSMOne vs OCBC vs PhillipCapital

Robo Advisors

For: Medium risk; Individuals who want to cultivate the habit of investing monthly.

Robo advisors are digital platforms providing investment services with little human supervision. They usually invest in instruments like ETFs, unit trusts (or mutual funds), and bonds.

They will help to build and manage your investment portfolio based on your risk profile and investment goals in a low-cost and passive manner.

Here are some guides for you:

- A Dummy’s Guide to Investing in Robo Advisors

- Best Robo Advisors Comparison Guide: Stashaway vs Syfe vs Endowus & More

- Best Digital Wealth Management Services: SaxoWealthCare vs Endowus vs MoneyOwl

- Robo-Advisor vs Financial Advisor: Which Is Better?

- Robo Advisors Singapore: 6 Reasons Why You Should Invest With Robos And 3 Reasons Why You Should Not

- Robo Advisors Returns Revealed: StashAway, Endowus, Syfe, Kristal.AI and More!

Stocks Investing

For: High Risk; Individuals who are risk-seeking and want more than just to beat inflation.

Stocks (also known as shares or equities) are a type of investment available on the stock market that gives you part ownership of a listed company.

If you ask around, most people tell you stocks are “high risk = high return”, but how true is this? Well, it’s important to note that higher risks could possibly give you higher returns as you cannot time the market.

Getting to learn about stocks is like climbing a mountain. It takes time, effort, a lot of patience and strength to do it in the long run.

Here are some guides that are helpful:

- What Is The Stock Market?

- What Is Price-to-Sales (P/S) Ratio?

- What Is A Financial Statement?

- Dividend Stocks vs Growth Stocks vs Value Stocks: Which Is the Best Investment Strategy for You?

- New to Investing? Here Are The Best Investing Strategies You Need to Learn Before Investing

Once you’ve almost gotten the hang of it, it’s time to set up your brokerage account.

As a starter, here’s a compilation of the cheapest online brokerages in Singapore.

Real Estate Investment Trusts (REITs)

For: High Risk; Individuals who are risk-seeking and want to receive good distribution yields.

Real Estate Investment Trusts are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of income-generating assets. These assets can include shopping malls, office buildings, industrial properties, hotels, and data centres.

As an investor in a REIT, you are entitled to receive regular distributions, typically on a quarterly basis, based on your investment. REITs are professionally managed, and the managers earn fees such as REIT management and property management fees.

One notable advantage of investing in REITs is that they are traded just like stocks on the stock market, providing investors with liquidity and the opportunity to gain exposure to the property market without requiring a significant upfront capital investment.

One distinctive feature of REITs compared to common stocks is their special tax transparency treatment. Singapore REITs must meet a requirement of distributing at least 90% of their taxable income to unitholders in the same year it is earned to qualify for this treatment.

This characteristic makes Singapore REITs highly appealing as an investment option, especially for individuals seeking a consistent and passive source of income. With regular and substantial payouts, Singapore REITs offer investors an attractive opportunity to generate ongoing returns.

Priority, Premium And Privilege Banking

For: High-income earners who want someone to manage their portfolios for them.

Priority Banking / Premier Banking / Privilege Banking is an exclusive banking service designed for high-net-worth individuals who meet specific eligibility criteria set by the bank.

These criteria often include maintaining a substantial level of deposits, investments, or assets under management with the bank.

While priority banking offers a higher level of personalised service and a wider range of exclusive benefits, premium/privilege banking provides tailored solutions and privileges for customers who may not meet the stringent eligibility requirements of priority banking. But there’s not much difference as these terms are used interchangeably.

In return for your investment, Priority Banking customers enjoy perks like:

- Having a personal banker or relationship manager to attend to your queries

- Access to a whole host of wealth management solutions

- Preferential rates on loans, savings accounts and fixed deposits

- Priority counter at bank branches so you can skip the regular line to get your banking done

- Waiver of banking fees like convenience fees and other fees.

To qualify for a Priority Banking relationship in Singapore, you would need to deposit or transact a minimum qualifying amount with the banks. In bank speak, this is called Assets Under Management (AUM) or Total Relationship Balance (TRB).

Also, this qualifying AUM amount with a bank for a Priority Banking relationship is not limited to cash deposits. It can comprise cash, investments and insurance products.

But note that Singapore’s minimum qualifying AUM for a Priority banking relationship ranges anywhere from S$200,000 to S$350,000.

How Do I Open a Priority Account?

Opening a Priority Banking account is simple as applying online, in person, or at the bank’s physical branch.

It is not that much different from opening a regular savings account.

With that out of the way, here are some of the best Priority Banking accounts to consider.

Which Bank to Go For?

Almost every bank in Singapore has a priority banking programme, so what should you go for?

If you’re looking for an investment-focused option and one in which your bank privileges are extended worldwide, these are some programmes that may appeal to you:

| Priority Banking Programme | Min. Total Relationship Balance (TRB) / Other Criteria |

Benefits extended overseas |

|---|---|---|

| CIMB Preferred | TRB of S$250,000 OR S$1M Total Mortgage Loan size |

Preferred status across CIMB branches across ASEAN |

| TRB of S$250,000 | Citigold privileges are extended worldwide | |

| HSBC Premier | TRB of S$200,000 OR Credit monthly salary >S$15,000 OR S$800,000 SG Home Loan / AU$200,000 AU Home Loan |

HSBC Concierge Service Worldwide |

| Maybank Premier | TRB of S$300,000 | Priority service at all Maybank branches in Singapore, Malaysia and Bank Internasional Indonesia (BII) Branches in Indonesia |

| Standard Chartered Wealth $aver | TRB of S$200,000 OR S$1.5 million in housing loans |

SC Priority Banking Visa Infinite Credit Card with a complimentary Priority Pass membership allows you to access more than 1,000 airport lounges worldwide. |

| UOB Privilege | TRB of S$350,000 | Exclusive access to five UOB Wealth Banking Centres across Singapore and four overseas |

Buying Property in Singapore

Singapore’s property market is on fire now, and we’ve been crowned the most expensive Asia-Pacific city to own or rent a private home.

When it comes to buying a residential property in Singapore, residency status matters. Assuming you are not a Singapore Permanent Resident, you’re restricted to purchasing private condominiums and landed properties or Executive Condominiums over a decade old.

Besides paying the Buyer’s Stamp Duty (BSD) that’s calculated based on the property’s purchase price or the property or the market value of the property (whichever is higher), you will need to pay the Additional Buyers Stamp Duty (ABSD), which is an additional fee imposed on the purchase of any residential property in Singapore.

The amount of ABSD you will need to pay is based on your residency status and nationality at the point of making the property purchase.

This is reflected in the date of issue reflected on the IC collection slip. It is also dependent on whether the buyer is an individual or entity.

The ABSD percentages shown below will be applicable to the property’s market value or purchase price (whichever is higher).

Another thing to note is that so long as a buyer owns any interest in a property, that property will be included in the number of properties owned.

Let’s say a person was to jointly own residential property with their partner and own a 30 per cent share of another property with his/her sibling.

IRAS considers that as the person owning two properties.

| Profile of Buyer | ABSD Rates from 16 Dec 2021 to 26 Apr 2023 | ABSD Rates on or after 27 Apr 2023 |

|---|---|---|

| Singapore Citizens (SC) buying their first residential property | Not applicable | Not applicable |

| SC buying second residential property | 17% | 20% |

| SC buying third and subsequent residential property | 25% | 30% |

| Singapore Permanent Residents (SPR) buying their first residential property | 5% | 5% |

| SPR buying second residential property | 25% | 30% |

| SPR buying third and subsequent residential property | 30% | 35% |

| Foreigners (FR) buying any residential property | 30% | 60% |

| Entities buying any residential property | 35% | 65% |

| Housing Developers buying any residential property | 35% | 35%

(Plus Additional 5% (non-remittable)) |

| Trustee buying any residential property | 35% | 35% |

*ABSD is rounded down to the nearest dollar, subject to a minimum duty of $1.

If you’re buying a property to invest in, there are other options: shophouse (commercial titled only) and commercial and industrial properties.

Before making a property purchase, you can also use the Stamp Duty Calculator from the IRAS website to calculate the exact amount of ABSD you’ll need to pay.

Are You Ready to Invest?

it is essential to maintain a long-term perspective in your investment strategy.

By emphasising long-term goals and staying committed to your investment plan, you can navigate through various market cycles and maximize the potential for growth and success.

Most importantly, you need to have a sound investment strategy. Here are some useful articles to help you out:

- How Much Investment Risk Should You Take as You Grow Older?

- Practical Tips on Investing During the Stock Market Volatility

- Here’s How to Invest Well over the Long-Term (Includes Views from Warren Buffett)

- 3 Warren Buffett Quotes To Keep Us Sane During the Current Stock Market Crash

- How to 6X an Investment Portfolio: Lessons From How Temasek Invests

- $12,000 Dividend Per Year: Here’s How Much You Need To Invest!

- Budget 2023 Singapore Summary

If you have any questions regarding investing, feel free to hop onto the community and start a discussion!

Related Articles:

- Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

- What Are Singapore Depository Receipts (SDRs)? SDR Singapore Explained

- Should You Invest In Commodities During A Bearish Stock Market?

- Investing for Kids: How to Give Them the Financial Headstart You Never Had

- ESG Investing Explained: How To Invest in a Better, More Sustainable Future

Advertisement