Best Investments In Singapore That Caters To Every Risk Profile, For Short, Medium and Long-Term Investors

If you are not a crazy shopaholic, there should be a point where you accumulate a good amount of savings with no idea of what to do.

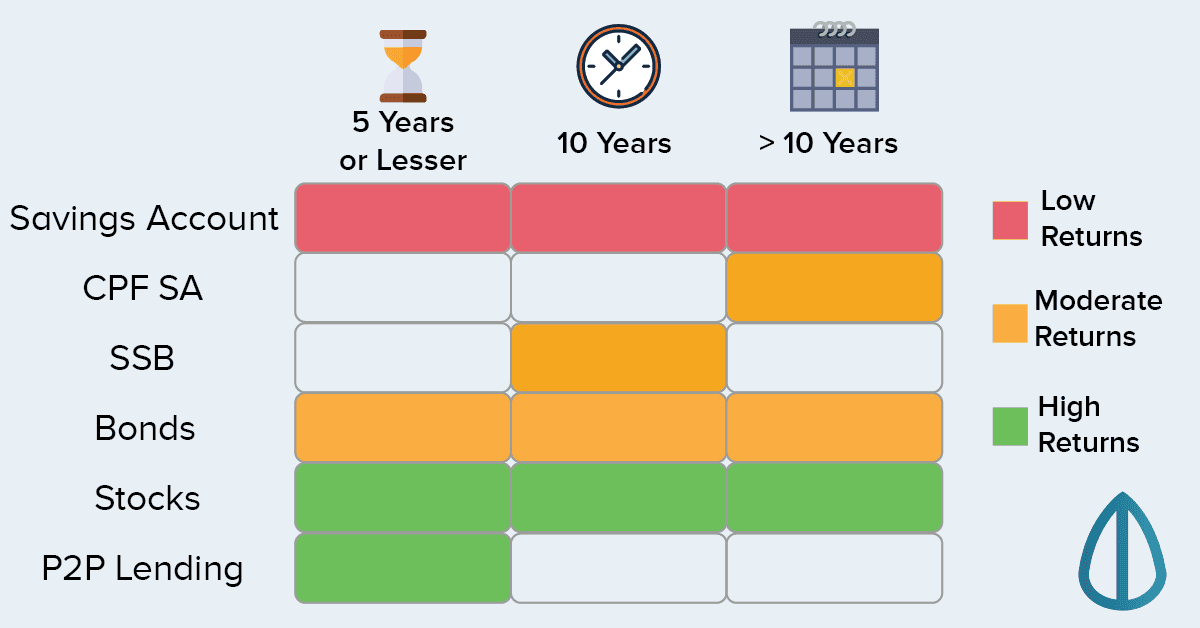

TL;DR- “Given X years to invest, what is the best investment product?”

Splitting up the investment horizon into 5 years, 10 years and more than 10 years, here are some of the investment product one can look at.

Further Reading: Pros And Cons Of Each Product

Point to note: Taking inflation to be 1.9%, we aim to have our investment returns exceed that percentage.

Investment products for 5 years or less:

Short-term Endowment Plan

Pros

- Relatively low risk given that they are products of reputable insurance companies

- No worry about losing principal sum upon maturity

- Beats inflation with as little as $1,000

Cons

- Locks up your cash, illiquid

Example:

- FWD Insurance Endowment Plan – 2.02% per annum for 3 years

Peer-to-peer lending platforms (P2P lending)

Pros

- Good returns

- Investor gets back a portion of his investment back every month, offsetting his risk

- Quick process and everything can be done online

- Some of the platforms are regulated by Monetary Authority of Singapore (MAS)

Cons

- Lending to small business which is a high-risk activity

- Investors are not able to invest as and when they like. Opportunities arise only when there are borrowers.

Returns

- Depending on the loan, usually 6% to 18% (according to Funding Societies)

Investment products for mid-term (10 years):

Singapore Savings Bond (SSB)

Pros:

- No penalty for early redemption

- Safe (backed by Singapore government)

- Invest as little as $500

Cons:

- Rates of return are fixed at time of investment

Returns

- 2.06% – 2.44% based on interest rates for the year 2017

Investment products for long-term (more than 10 years):

Central Provident Fund Special Account (CPF SA)

Pros

- Relatively good returns on interest rate

- Very safe

- Low effort

- If you are in a bad financial situation, creditors can never touch your money that is locked in the CPF. (Not saying it is a good thing!)

- Tax relief you top up your CPF

Cons

- Very illiquid as monies remain in SA until age 55 and any withdrawal of monies would be subject to CPF withdrawal rules.

Returns

- At least 4% per annum

Investment products for all time frames:

Investment products for all time frames:

Savings Account

Pros

- Low risk

- Very liquid, able to draw out your money anytime

- Low effort

Cons

- Interest may be below inflation

Returns

- 1.5% – 3% depending on the bank and amount of money you deposit with them

Bonds

Pros

- Relatively good returns. Corporate bonds usually pay out higher interest rates than government bonds

- Investors get regular coupon payment for their investment

- Possibility of selling bonds at higher price

Cons

- Investors may face default risk or credit risk from bond issuer

- Price of bonds fluctuates

- Moderate amount of effort required

- High fees and charges

Returns

- Depends on the bond investors invest in

Robo-Advisors

Pros

- Low-cost (0.5% to 1% fees)

- Diversified portfolio

- Opportunity to be exposed to the global economy

- No minimum balance

- Quick process and everything can be done online

- Some of the platforms are regulated by Monetary Authority of Singapore (MAS)

Cons

- Relatively new with little track record

- Considered relatively high risk

- Lacks flexibility for investors to make changes to his own portfolio

Returns

- Depends on the risk appetite of investors, robo-advisor will tailor made an investment strategy for each individual.

Stocks

Pros

- Good returns (if you know what you are doing)

- Allows full flexibility for investors to create his own portfolio

- Rather liquid, able to sell shares as long as there’s volume

- Allows a combination of growth investing and dividend investing according to investor’s needs and age profile

- Instruments on the exchange catered to all risk level: REITs and STI ETF catered to mid to long-term investors, growth stocks for those with higher risk appetite

Cons

- Risky due to volatility

- Rather high fees and charges

- High level of effort, complicated and takes time to research

Returns

- STI ETF – 9.2% total returns year to date

- Stocks return varies according to investor’s decision (here are some advice from seasoned investors)

Cryptocurrencies

Pros

- Possible Good returns

Cons

- Very risky

- Complicated to understand for now

Returns

- Depends on market forces and currently unclear on the potential

- You can find out more here on what moves the price of Bitcoin (a type of cryptocurrency)

Seedly’s Community: “10 Years To Invest, What Is The Best Investment?”

A member of ours opened up this question to the community and here are some of the advice from our very supportive members! Thanks, everyone! 🙂

Yappilee, LM Lim and Zhen Hong

- Invest in the Singapore Savings Bond

Kelvin Soh and Jan

- CPF SA: If you are 45 years old and you are able at least hit $86K, top up your SA for 4% yield.

Jiahui:

- Try out the robo advisor calculators for your level of proposed risk

screenshot of Autowealth’s calculator

Alisa Kuan

- Conservative approach will be to stick to Fixed Deposits/Bonds/Endowment insurance

- Manage your expectations as low risk = low return

Matt Lim and Khuan Yew Cheah:

Our decision when selecting any investment products should depend heavily on 3 factors:

- How long you plan to invest

- How much you plan to invest

- Amount of risk you are willing to take

With these factors in mind, do add the cost of investment into consideration

source: Picture Quotes

source: Picture Quotes

When deciding on a product, the personality of the investor plays a huge part. I guess, in a way you are the hero of your own investment story.

Summary – Choosing Your Investments Based On Liquidity, Risk, Returns And Length Of Investment

| Liquidity | Risk | Returns | Length | |

|---|---|---|---|---|

| Short-term Endowment (FWD Endowment, Great205) | Low | Low | Low | Short (3 years) |

| CPF SA | Low | Low | Moderate | Long |

| Peer-to-peer lending Platforms (Moolahsense, Funding Societies) | Moderate | High | High | Short (Depends on term) |

| Bonds | Moderate | Moderate | Moderate | Short/ Moderate (Depends on maturity) |

| Singapore Savings Bonds (SSB) | High | Low | Moderate | Moderate (10 years) |

| Stocks | High | High | High | Depends on investor |

| Robo-advisor (Stashaway, Autowealth) | High | High | High | Depends on investor |

| STI ETF | High | High | High | Moderate/ Long |

| Cryptocurrency | High | High | High | Depends on investor |

| REITs | High | High | High | Moderate/ Long |

Advertisement