TL;DR: Here’s What You Need To Know About The Jobs Support Scheme (JSS)

Now that we’re back to Phase 2 (Heightened Alert) until 18 August 2021.

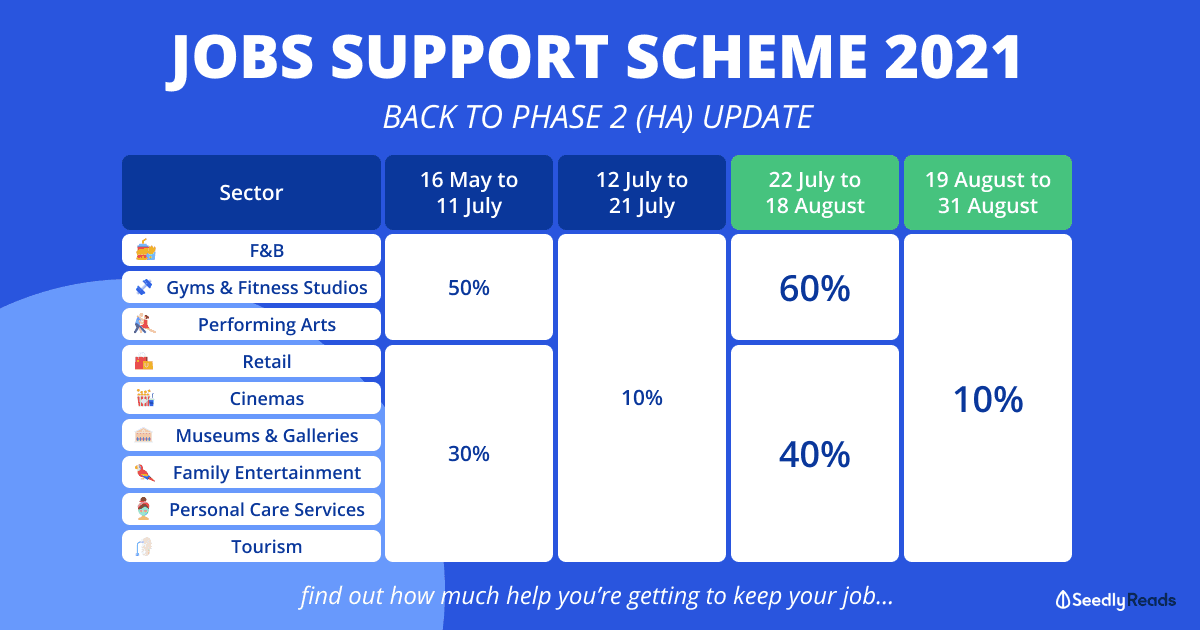

JSS support will be enhanced for sectors hardest hit by the tightened safe management measures.

| Sectors | 16 May to 11 July | 12 to 21 July | [NEW] 22 July to 18 August | [NEW] 19 to 31 August |

|---|---|---|---|---|

| Food & Beverage | 50% | 10% | 60% | 10% |

| Gyms & Fitness Studios | ||||

| Performing Arts & Arts Education | ||||

| Retail | 30% | 40% | ||

| Cinemas | ||||

| Museums, Art Galleries, Historical Sites | ||||

| Family Entertainment | ||||

| Affected Personal Care Services | ||||

| Tourism |

JSS support will be enhanced to 60% for sectors and businesses such as:

- food & beverage

- gyms and fitness studios

- performing arts organisations and arts education centres

that will have to suspend most, if not all, of their activities due to the restrictions implemented.

JSS support will also be enhanced to 40% for sectors such as:

- retail sector

- affected personal care services

- tourist attractions

- licensed hotels

- cruise and regional ferry operators

- MICE organisers

- travel agents

- museums

- art galleries

- cinema operators

- family entertainment centres

that will be significantly affected by the restrictions.

The JSS support for all the abovementioned sectors will taper to 10% from 19 to 31 August 2021.

Rental Support Scheme (RSS)

On top of the earlier announced rental relief for the following properties:

| Rental Relief for Qualifying Commercial Properties | Examples Include |

|---|---|

| Hotel room or function room of a hotel registered under the Hotels Act | - |

| Serviced apartment or serviced apartment function room | - |

| Meetings, Incentive Travel, Conventions and Exhibitions (MICE) venues | Suntec Singapore Convention and Exhibition Centre, Singapore EXPO, and Changi Exhibition Centre |

| Premises of a prescribed international cruise or regional ferry terminal | Singapore Cruise Centre, Marina Bay Cruise Centre Singapore, Tanah Merah Ferry Terminal |

| Premises of tourist attractions | Singapore Zoological Gardens, Singapore Flyer, Haw Par Villa |

| Shop | Retail shop, furniture shop, supermarket, take-away food shop, bakery & confectionery, pawnshop, dispensary, beauty salon, gym, spa, ticket agency, travel agency, laundry or dry-cleaning shop, department store, post office, showroom, bank & vet clinic |

| Warehouse retail | - |

| Restaurant | Restaurant, cafe, cyber cafe, food court, coffeeshop, market & hawker stalls, bar and night clubs |

| Amusement centre | Video games arcade, computer gaming centre, and billiard saloon |

| Cinema or theatre | - |

| Sports and recreational building | Social club, golf club, clan and association, skating rink, and bowling alley |

| Child care centre or kindergarten | - |

| School | Tuition centre, language school, computer school, art school, dancing school etc. |

| Health and medical care building | Medical clinic, medical centre, dental clinic, hospital, nursing home, hospice, etc. |

| Backpackers' hostel, boarding house, guest house, hotel or students' hostel that is not a registered hotel | - |

| Carpark used in connection with the operation of the qualifying properties listed in this table | - |

| Spaces used in connection with the operation of the qualifying properties listed in this table but excluding certain premises | - |

| Shophouses that are used for the purposes listed in this table but excluding certain premises | - |

The RSS will also see these enhancements:

- Additional 4-week rental waiver for qualifying tenants on Government-owned commercial properties

- Additional 2-week rental relief cash payout for privately-owned commercial properties

- Looking into sharing of rental obligations between the Government, landlords, and qualifying tenants (more will be outlined by Ministry of Law in due course)

What Is the Jobs Support Scheme (JSS)?

The Jobs Support Scheme (JSS) helps to retain jobs by subsidising salaries for employees working in sectors hard-hit by the COVID-19 pandemic.

Basically, the Government will help businesses retain local workers by co-funding a percentage of your gross monthly wages.

FYI: your gross monthly wage is the amount you get before deduction of employee CPF contribution and personal income tax

The JSS was first introduced during Budget 2020 and has been extended during Budget 2021 as well as whenever any tightening measures are announced.

The level and duration of support your employer receives will depend on the sector, which they operate:

| Jobs Support Scheme Tier | Oct 19 to Aug 20 (First JSS) | Sep 20 to Dec 20 | Jan 21 to Mar 21 | Apr 21 to Jun 21 (Extended in Budget 2021) | Jul 21 to Sep 21 |

|---|---|---|---|---|---|

| Tier 1 | 75% | 50% | 30% | 10% | |

| Tier 2 | 50% | 30% | 10% | 0% | |

| Tier 3A | 25% | 10% | 0% | ||

| Tier 3B | 25% | 10% | 0% | 0% | |

Note: this table doesn’t take into account the most recent enhanced JSS announced

You’ll notice that for sectors that are managing well, the Jobs Support Scheme support more or less ended in December 2020.

Any extension or enhancements to the JSS will only be targeted at affected sectors.

If you’re wondering, “Where is the government getting all the money from sia? I thought we overdraw our reserves?!”

Chill, bruv.

The latest enhanced JSS support announced on 23 July will be funded by reallocated monies from one-off underutilised budgets — from projects which were delayed by COVID-19 — as well as funds set aside earlier just in case, there’s a need to extend support measures.

Which Tier Do I Belong To And How Much Jobs Support Scheme Wage Support Do I Get?

Businesses are tiered according to how hard-hit they are by COVID-19.

So… the level and duration of support your employer receives will depend on the sector in which they operate.

Under Budget 2021, here’s how much JSS wage support your employer will get at the following tiers.

| Jobs Support Scheme Tier | Oct 19 to Aug 20 (First JSS) | Sep 20 to Dec 20 | Jan 21 to Mar 21 | Apr 21 to Jun 21 (Extended in Budget 2021) | Jul 21 to Sep 21 |

|---|---|---|---|---|---|

| Tier 1 | 75% | 50% | 30% | 10% | |

| Tier 2 | 50% | 30% | 10% | 0% | |

| Tier 3A | 25% | 10% | 0% | ||

| Tier 3B | 25% | 10% | 0% | 0% | |

Tier 1 Sectors (aviation, aerospace, tourism)

You will receive 30 per cent wage support from April to June 2021.

And 10 per cent wage support from July to September 2021.

Tier 2 Sectors (retail, arts and culture, food services, built environment)

You will receive 10 per cent wage support from April to June 2021.

Tier 3A Sectors (all other employers with the exception of selected Tier 3 sectors)

No change for firms in Tier 3A sectors as they are generally recovering.

The JSS will cover 10 per cent of wages up to March 2021 as previously announced.

Note: if you’d like to find out more about the specific industries in the various tiers, you can refer to this

Who Qualifies for the Jobs Support Scheme?

All employers who have made CPF contributions for their resident employees (Singapore Citizen and Permanent Resident) will qualify for the JSS.

Employees who are shareholders and directors of a company will also be covered if they are also salaried employees of the company and have an assessable income of $100,000 or less for the Year of Assessment of 2020.

Business owners, including sole proprietors and partners of general partnership, limited liability partnerships and limited partnerships, are not eligible.

Employers who trade in their own capacity — such as hawkers or those hiring personal drivers and domestic helpers — who do not have UEN, are also not eligible.

.

.

.

It’s your livelihood that’s at stake.

So if your employer is unsure whether the business qualifies for the JSS…

Let them know that they can check their JSS Employer Eligibility to see whether they qualify and how much JSS wage support they can get!

How To Apply For The Jobs Support Scheme?

As an employee, you can’t “apply for JSS”.

Because it’s not like you’re actually getting extra money with this scheme.

The JSS is meant to help your employers retain you as an employee and continue to pay you a baseline monthly salary.

Your employers do NOT need to apply for it either.

As long as your employer makes CPF contributions for you.

IRAS will notify them via post of the tier which their business belongs to as well as how much JSS wage support they will receive.

When Will We Receive The JSS Wage Support?

If you are eligible in 2021, your employer will receive 3 main payouts in March 2021, June 2021, and September 2021.

The JSS payouts will be credited via the following means (in order of priority):

- Credited to the employers’ GIRO bank account used for Income Tax or GST

- Credited to the employers’ bank account registered with PayNow Corporate (if they don’t have a GIRO bank account)

- Paid out via cheque

How Is The Jobs Support Scheme Wage Support Computed?

The JSS wage support payouts are computed based on past wages.

For example… for the first payout in 2021, IRAS will compute the amount based on wages paid from September to December 2020.

Here’s how the IRAS will compute the payout for the 2021 JSS wage support payouts:

| Jobs Support Scheme Payout for 2021 | Month of Payout | Payout Computed Based on Wages Paid In | Wages derived based on mandatory CPF contributions paid on or before |

|---|---|---|---|

| Payout 1 | March 2021 | September to December 2020 | 14 January 2021 |

| Payout 2 | June 2021 | January to March 2021 | 14 April 2021 |

| Payout 3 | September 2021 | April to to June 2021 | 14 July 2021 |

MOM Guidelines For Salary and Leave Arrangements

Okay.

PAY ATTENTION HERE.

Besides the Jobs Support Scheme, MOM has a few guidelines for employers too.

This is their recommended salary arrangement:

| MOM Recommended Salary Arrangements | Gross monthly salary (up to $4,600) | Gross monthly salary (more than $4,600) |

|---|---|---|

| Employer assigns work to employee to complete | Continue to pay prevailing salaries including employer's CPF contributions | Use JSS payout to provide baseline monthly salary including employer's CPF contributions AND Provide for work done on a pro rata basis (subject to a cap of employee's prevailing salary) |

| Employer does not assign work to employee | Use JSS payout to provide baseline monthly salary including employer's CPF contributions | |

If there is any shortfall in your salary after implementing the above-recommended salary arrangements, your employer should consider the following measures:

- Send you for training courses approved for Absentee Payroll Funding so that overall salary paid during the training period is mostly supported by the Government

- Apply for Flexible Work Schedule which allows “time banking” of additional salary payments to offset overtime payments in the future

- Grant additional paid leave

- Allow you to consume your existing leave entitlements

Where possible, your employer should also allow and support you to take on a second job (part-time or temporary) in other companies or agencies that are still operating.

This will allow you to make up for your loss of income and help make your life easier during this COVID-19 pandemic.

Advertisement