We know life is filled with unpredictability and sometimes, we may run into emergencies where we need money.

But, how?

When you’re caught in a financial rut, besides banks, do you know that money lender exist?

I’m referring to licensed money lenders and not unlicensed money lenders aka loan sharks.

These services allow you to make a quick turn to relieve your finances temporarily, but of course, you will incur interest in the process of borrowing.

Let’s find out how this entity works, and whether it can be an option for you to consider when borrowing!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment or financial advice. Readers should always do their due diligence and consider their financial goals before buying or investing in any products.

TL;DR: What Are Licensed Money Lenders & Their Interest Rates

- Difference between a licensed money lender and a bank

- What to do if you’re unable to repay a licensed money lender in Singapore

- Best Licensed Money Lenders in Singapore

What Is a Licensed Money Lender?

‘Licensed’ says that these money lenders are legal entities that operate within the Moneylenders Act and Rules.

These moneylenders are certainly not the typical Ah-Longs you know who spray O$P$ on walls!

They are restricted by law on the amount they can lend, the fees they charge and the acceptable interest rate.

One Seedly contributor has rightfully pointed out the differences between borrowing from a money lender versus a bank.

How Much Can I Borrow?

Before we jump into how much you can borrow, let’s define the two types of loans – secured and unsecured loans.

By definition, a secured loan is backed by something you own, and you can lose the asset if you default. And on the flip side, an unsecured loan means that you are not required to put up any collateral (e.g., house, car) to borrow the money.

With a licensed money lender, you can obtain a loan of any amount for secured loans.

For unsecured loans, however, there is a total maximum amount that you may borrow at any time across all moneylenders in Singapore:

| Borrower's Annual Income | Singapore Citizens & Permanent Residents | Foreigners Residing in Singapore |

|---|---|---|

| < $10,000 | $3,000 | $500 |

| $10,000 to $19,999 | $500 | |

| ≥ $20,000 | 6 times monthly income | |

Licensed moneylenders are essentially small businesses that loan out small amounts that are pegged to your income.

With lesser processes, borrowing from licensed moneylenders may be faster, and there may be fewer restrictions on citizenship and income.

What Is the Interest Rate for Licensed Moneylenders?

Based on guidelines set by the Ministry of Law, a licensed moneylender is only permitted to impose the following charges, interests and expenses:

- The monthly interest rate is capped at 4%;

- The monthly late interest rate is capped at 4% for each late repayment, and the late interest can only be charged on an amount that is repaid late;

- A late fee of not more than S$60 per month;

- A fee not exceeding 10% of the principal of the loan when a loan is granted;

- Legal costs ordered by the court for a successful claim by the moneylender for the recovery of the loan;

- An administrative fee that must not exceed 10% of the principal loan granted;

- The total cost charged by a legal lender, including interest, late interest, administrative fees, late fees, and other related charges, must not exceed the principal loan amount.

The interest rate should be computed based on the monthly outstanding balance of the principal remaining after deducting the payments made.

For instance, if your loan amount is $10,000 and you have already paid $5,000, then the 4% interest rate should only be computed for the remaining $5,000.

A licensed moneylender may also impose other fees such as loan approval fees or legal costs incurred by the moneylender to recover their loans in the event that the borrower fails to make payment.

A good point to note is that rumour has it that some moneylenders could potentially charge you up to 30% of the interest rate even though the Government’s guidelines as they may have other hidden fees.

Is It Safe To Borrow From a Licensed Money Lender?

Red flags, hello?

Licensed money lenders will have their names on the Ministry of Law’s list of licensed moneylenders in Singapore.

That said, there is also a red flag checklist that a licensed moneylender SHOULD NOT BE DOING! These actions are:

- Use abusive language, or behave in a threatening manner toward you

- Ask for your SingPass user ID and/or password

- Retain your NRIC card or any other personal ID documents (e.g. driver’s licence, passport, work permit, employment pass or ATM card)

- Ask you to sign on a blank or incomplete Note of Contract for the loan

- Grant you a loan without giving you a copy of the Note of contract for the loan and/or without properly explaining to you all the terms and conditions

- Grant you a loan without exercising due diligence (e.g. approving a loan over the phone, SMS or email before even receiving your loan application form and supporting documents, such as the income tax assessment and payslips)

- Withhold any part of your principal loan amount for any reason.

What Happens if I Am Unable To Repay the Licensed Money Lenders?

Bounded by laws and regulations, they will usually attempt to collect the debt through these means:

- Mail you a letter of demand

- Visit your home (and as a last resort, your office) to deliver a letter of demand

- Attempt to make contact with you over the phone and text messages at reasonable hours

- Take legal action against you

You should be aware of the implications if you’re not disciplined in your borrowing:

- You might lose your collateral

- Legal action may be brought against you as these licensees are legally entitled to do so

- It will be hard for your future loan applications to be approved as the Moneylender Credit Bureau will have a track record of your poor repayment behaviour

Renegotiate Debt Repayment Schedule, Debt Counselling & Debt Repay Methods

As a last resort, besides filing for bankruptcy, there are some practical steps to take.

You can first, renegotiate a repayment schedule with the money lender – extending it and lowering your monthly repayment amounts. Do note that your interest might also increase as your loan tenure becomes longer.

Do not borrow to repay your loans!

Otherwise, try Debt Counselling.

Debt counselling is a social service that helps those in debt come to terms with their situation and provides tools, resources, and support geared towards working a way out.

There are social service agencies dedicated to helping you:

- Adullam Life Counselling

- Association of Muslim Professionals

- Arise2Care Community Services

- Blessed Grace Social Services

- One Hope Centre

- Silver Lining Community Services

Lastly, if you have loans from other financial institutions, perhaps it’s time to relook at your finances so that you can get out of debt soon.

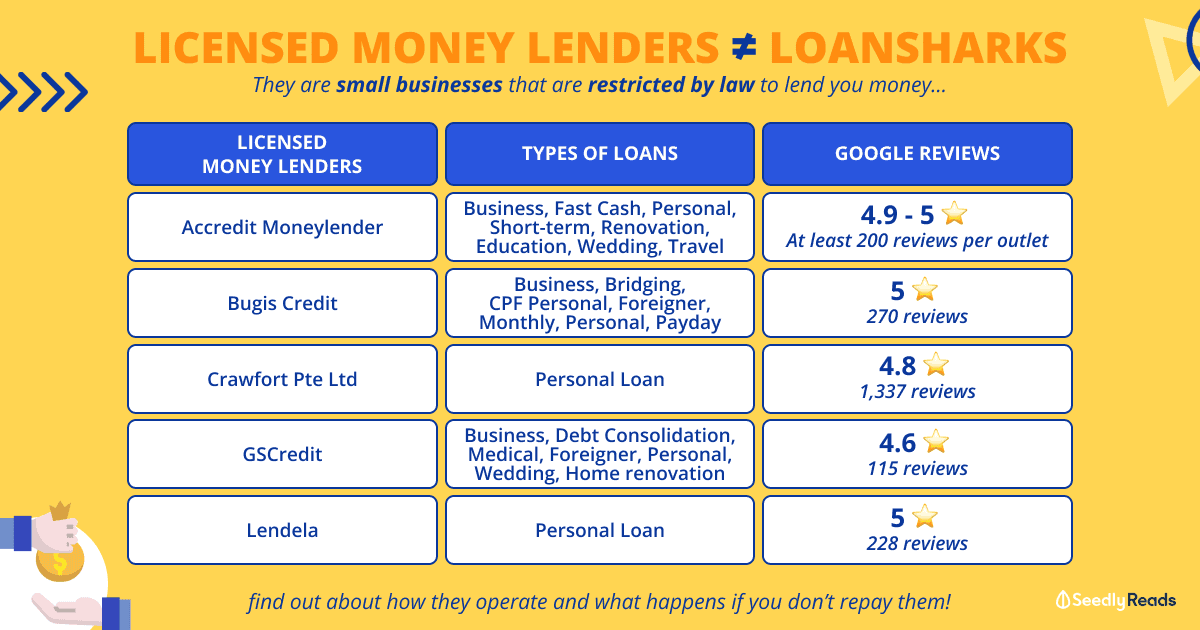

Best Licensed Money Lender in Singapore

We’ve picked out those with at least a 4.6⭐ rating on Google Reviews.

| Licensed Money Lenders | Loans Offered | Operating Hours | Rating |

|---|---|---|---|

| Accredit Moneylender | Business Loan Fast Cash Loan Personal Loan Short-term Loan Renovation Loan Education Loan Wedding Loan Travel Loan | Mon to Fri: 10am – 8pm Sat & Sun: 10am – 5pm | 4.9 - 5⭐ (at least 200 Google reviews for each outlet) |

| Bugis Credit | Business Loan Bridging Loan CPF Personal Loan Foreigner Loan Monthly Loan Personal Loan Payday Loan | Mon to Fri: 11am - 8pm Sat & Sun: 11am to 5pm (Closed on Public Holidays) | 5⭐ (270 Google reviews) |

| Crawfort Pte Ltd | Personal Loan | Mon to Sat: 10.30am - 7.30pm (Closed on Sunday & Public Holidays) | 4.8⭐ (1,337 Google reviews) |

| GSCredit | Business Loan Debt Consolidation Loan Medical Loan Foreigner Loan Personal Loan Wedding Loan Home Renovation Loan | Mon to Fri: 11am - 8pm Sat: 11am to 4pm (Closed on Sunday & Public Holidays) | 4.6⭐ (115 Google reviews) |

| Lendela | Personal Loan Note: Instead of charging you an interest rate, Lendela charges an Annual Percentage Rate, which is total cost of borrowing, which includes the interest rate plus all the fees you're paying directly to the lender | Mon to Fri: 9am - 6pm Sat: 10am - 3pm (Closed on Sunday & Public Holidays) | 5⭐ (228 Google reviews) |

Would You Borrow From a Licensed Money Lender?

Most people would not have chosen to borrow if they don’t need to.

However, in times of emergencies, such a service may come in handy.

Regardless, you should always be aware of the risks involved in borrowing from a licensed money lender and pay it back as soon as you can.

Have an opinion on this topic? Share them with us in the Seedly Community!

Related Articles:

Advertisement