It’s official.

Monetary Authority of Singapore (MAS) has predicted that Singapore will enter a recession in 2020 after the economy contracted sharply in Q1 2020 with the onset of COVID-19.

That’s bad news because this potentially means pay cuts, wage freezes, and higher rates of unemployment (touchwood) for the foreseeable future.

Sadly, we’re already seeing it happen to ourselves and the people around us.

.

.

.

In order to support Singaporeans facing financial difficulties during COVID-19.

MAS, the Association of Banks in Singapore (ABS), and the Finance Houses Association of Singapore (FHAS), first announced measures which lower short-term repayment obligations for residential property loans, insurance commitments, and unsecured credit debts.

But with the extension of Circuit Breaker till 1 June 2020, they have announced a second wave of support measures to hopefully help more Singaporeans.

Let’s have a look at what they are and how they can help ease your cashflow or reduce your debt.

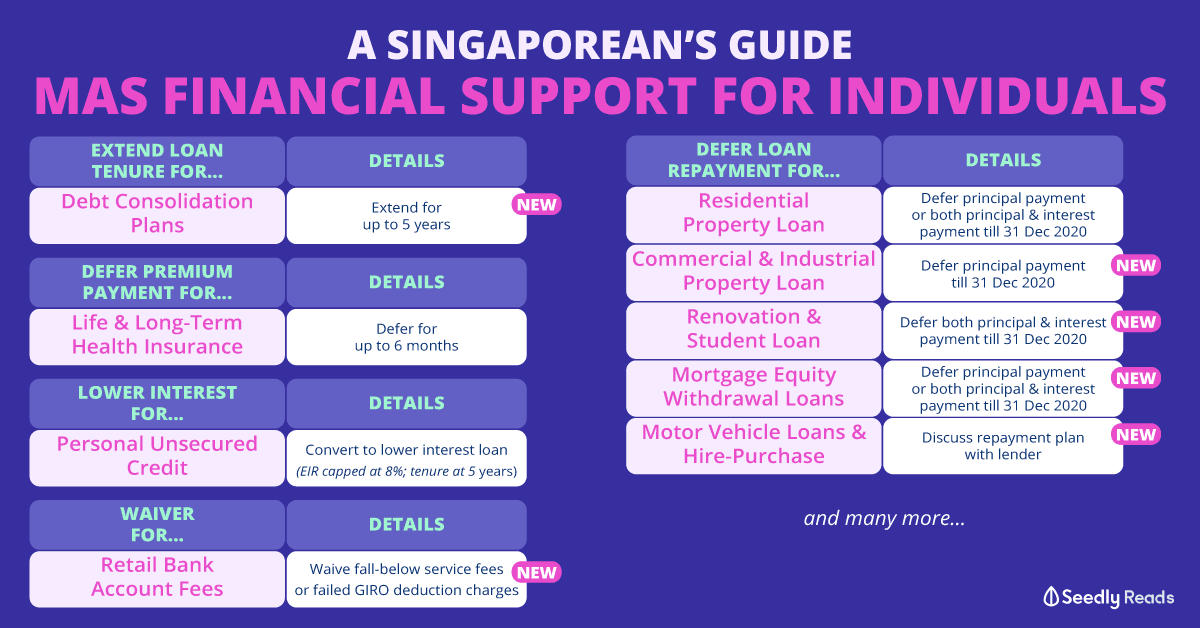

TL;DR: MAS Financial Support for Individuals During COVID-19

Here are all of the announced MAS relief measures for individuals at a glance:

| MAS Financial Support | For | Details | Status of Relief Measure |

|---|---|---|---|

| Defer Loan Repayment | Residential Property Loans | Apply to defer either (i) principal payment OR (ii) both principal and interest payments till 31 Dec 2020 Note: interest will only accrue on deferred principal account | Existing |

| Commercial and Industrial Property Loans | Apply to defer principal payment till 31 Dec 2020 | New | |

| Renovation and Student Loans | Apply to defer both principal and interest payment till 31 Dec 2020 Note: interest will only accrue on deferred principal account | New | |

| Mortgage Equity Withdrawal Loans (granted after 6 Apr 2020) | Apply to defer either (i) principal payment OR (ii) both principal and interest payments till 31 Dec 2020 Note: interest will only accrue on deferred principal account | New | |

| Motor Vehicle Loans and Hire-Purchase Agreements | Approach lender to discuss suitable repayment plan | New | |

| Extend Loan Tenure | Debt Consolidation Plans | Apply with lender to extend loan tenure for up to 5 years | New |

| Defer Premium Payment | Life and Long-Term Health Insurance | Apply to defer premiums for up to 6 months Note: only policies with renewal or premium due date 1 Apr - 30 Sep 2020 are eligible | Existing |

| Flexible Instalment Plan | General Insurance | Apply with insurer to pay for general insurance premiums (eg. property and vehicles) in instalments | Existing |

| Easier Refinancing or Repricing | Investment Property Loans | Apply to refinance or reprice without being subjected to TDSR and MSR till 31 Dec 2020 | New |

| Lower Interest | Personal Unsecured Credit | Apply with lender to convert outstanding balances to lower interest term loan by 31 Dec 2020 Note: effective interest rate capped at 8% and tenure is up to 5 years | Existing |

| Waiver | Retail Bank Account Fees | Apply to waive fall-below service fees or failed GIRO deduction charges till 31 Dec 2020 | New |

So… Should I Defer My Payment or Extend My Loan Tenure?

The relief measures are on an opt-in basis only as everyone’s financial situation is different.

But before you apply for a deferment or extension with any financial institution or lender.

It’s important to ask about the payment schedule and increased interest cost (if any) before committing to it.

This is because payment deferment and loan tenure extensions will usually result in HIGHER overall interest costs.

Remember.

These relief measures are only meant to help those who need temporary cashflow relief.

You will have to bear the accumulated interest costs eventually.

Helping You Ease Your Cashflow

If you find yourself cash strapped, these measures might help you during these difficult times.

1) Defer Repayment for Residential Property Loans

The deferment of residential property loans falls under the Special Financial Relief Programme (Mortgage) and will cover all owner-occupied (private or HDB) and investment properties.

You can apply to defer your residential property’s mortgage or housing loans, home equity loans, and debt reduction plans.

Homeowners can choose to defer (up to 31 December 2020) either:

- the principal portion of the monthly instalment BUT still pay monthly interest

- the full monthly instalment (principal portion + monthly interest)

Either way, interest will still be charged on the deferred principal amount.

Although no interest will be charged on the interest portion of the deferred payment.

Should I Defer My Residential Property Loan Repayment?

Deferring payments and extending your tenure means that you will be paying more interest in total.

This means that it’s best not to defer repayments if you do not need to.

If you really, really need to take this up.

Go for the shortest loan tenure possible that you can comfortably manage.

Although this relief measure doesn’t address those on an HDB Housing Loan, HDB will review requests for deferment of HDB loan payments “on a case-by-case basis”.

You can make your request through the HDB Branch Office Service hotline at 1800 2255 432.

2) Defer Repayment for Commercial and Industrial Property Loans [NEW]

You can choose to defer principal repayment up to 31 December 2020.

Interest will continue to be payable during the deferment period.

While you do not need to demonstrate any impact from COVID-19 to obtain the deferment

Lenders will only approve the request if you are not in arrears as at 1 February 2020.

Should I Defer My Commercial and Industrial Property Loan Repayment?

Deferring payments and extending your tenure means that you will be paying more interest in total.

Since you own a commercial or industrial property, it’s probably for business or investment purposes.

In that case, it’s in your best interest not to defer repayments (if you do not need to) in order to keep your overheads low.

3) Defer Repayment for Mortgage Equity Withdrawal Loans [NEW]

If you have a Mortgage Equity Withdrawal Loans obtained after 6 April 2020, and cannot qualify for the Residential or Commercial or Industrial Property Loan Deferment.

You can apply to defer repayments up to 31 December 2020.

Should I Defer My Mortgage Equity Withdrawal Loans Repayment?

It really depends since the options may vary between different banks and finance companies.

While you do not need to demonstrate any impact from COVID-19 to obtain the deferment, it’s best to find out more about the terms of deferment before committing to it.

4) Defer Repayment for Renovation Loans [NEW]

Homeowners who have taken a renovation loan can choose to defer both principal and interest payment till 31 Dec 2020.

Interest will continue to accrue on the outstanding loan principal.

But additional interest will not be charged on the deferred interest payments.

Lenders will only approve the request if you are not in arrears for more than 90 days at point of application.

Should I Defer My Renovation Loans Repayment?

IMO, a home renovation loan should only be taken in a bobian (Hokkien: no choice) situation.

Ideally, you should have planned and saved up for it before buying your first home.

And even if you take one, it should be for the essentials you need in order to live in your new home (read: a 65″ TV is a want and NOT a need)

Considering that interest will accrue on the deferred outstanding loan principal, that means ultimately you’ll have to pay more interest in the long-run.

5) Defer Repayment for Student Loans [NEW]

You can choose to defer both principal and interest payment till 31 Dec 2020.

However, interest will continue to accrue on the outstanding loan principal.

But additional interest will not be charged on the deferred interest payments.

Lenders will only approve the request if you are not in arrears for more than 90 days at point of application.

Should I Defer My Student Loan Repayment?

I know that it’s tough if you’re a fresh grad who’s just started working, or you’ve just finished your studies and are looking for a job.

Even though an education or student loan is an investment in your future.

The interest accrued on the deferred outstanding loan principal means you’ll have to pay more interest in the long-run, turning it into a dragged out liability.

So if you can afford to continue paying your student loans, you should try your very best not to defer the payment unless you have no choice.

Note: for those who have just finished school, some bank loans have clauses where loan repayment will only start once you have secured employment or after a stipulated period of time.

Try talking to the banks to either extend this grace period or see how you can work things out to your benefit instead.

6) Defer Repayment for Motor Vehicle Loans and Hire-Purchase Agreements [NEW]

You may approach your bank or lender to discuss suitable repayment plans.

Should I Defer My Motor Vehicle Loan Repayment?

Well… this is one’s mostly out of your hands.

You can apply for a deferment but it is subject to a case-by-case basis.

The bank or lender will look at:

- your financial condition

- your need for the use of the motor vehicle

- current market value of the motor vehicle

- estimated market value after the deferment period

7) Extend Repayment of Debt Consolidation Plans [NEW]

You can apply to extend the loan tenure of your existing Debt Consolidation Plan for up to 5 years, anytime between 18 May to 31 December 2020.

Should I Extend My Debt Consolidation Plan Repayment?

You’ll need to demonstrate that your income has been affected by COVID-19.

And lenders will only approve the request for extension as long as you are in arrears for between 30 and 90 days as at the point of application.

8) Defer Premium Payments for Life and Health Insurance

You may apply to your insurer to defer premiums for life and health insurance policies for up to 6 months while still maintaining insurance protection.

This deferment is available for all individual life and health insurance policies with a policy renewal or premium due date between 1 April and 30 September 2020.

This is also subject to your insurer’s assessment and approval.

Should I Defer My Premium Payments for Life and Health Insurance?

The good news is — unlike loan deferment — you do not have to pay more even if you choose to defer paying your premiums.

This is a good option to manage your cash flow and retain protection.

Instead of having to reduce your protection or converting it to a paid-up one.

Just remember to set aside money to pay for your premiums at the end of the deferment period!

9) Flexible Instalment Plans for General Insurance

Instead paying a lump-sum premium for the entire policy period at the start, you can now apply to pay your premiums in smaller amounts while enjoying coverage for the paid-up period.

This should help those who are burdened with general insurance policies like:

- Personal motor insurance policies

- Personal travel insurance policies

- Personal property (structure and contents) insurance policies

- Foreign domestic maid insurance policies

Should I Apply For Flexible Instalment Plans for General Insurance?

Seeing that there’s no interest or additional fees charged.

(Disclaimer: it might differ between different insurers)

This is extremely useful in helping ease your personal cash flow throughout the year.

Helping You Reduce Your Debt Obligations

1) Lower Interest on Personal Unsecured Credit

This lower interest is under the Special Financial Relief Programme (SFRP) (Unsecured) and will cover unsecured debt from credit cards and revolving credit lines issued by banks and credit card companies.

You may apply with your lender to convert outstanding balances to lower interest term loans by 31 December 2020.

The effective interest rate is capped at 8% (compared to the usual 26% typically charged)and tenure is up to 5 years.

Should I Apply For Lower Interest on Personal Unsecured Credit?

This option is only available to those who suffered a loss of 25% or more of their monthly income after 1 February 2020.

And are between 30 and 90 days past due on their unsecured debts.

The application period is anytime from 6 April to 31 December 2020.

Do note that once your term loan has been approved, you will not be able to utilise the remaining credit limit you have on your credit facility.

Overall, this opens up another option for Singaporeans to refinance their debt.

And it generally looks like a good deal as the interest rate is much, much lower.

Alternatively, you could turn to personal loans instead.

But whatever you choose, go with an option that allows you to pay off your debt as soon as possible.

2) Easier Refinancing or Repricing of Investment Property Loans [NEW]

To lower your monthly payments, you can apply to refinance or reprice your loan without being subject to MAS’ Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR), up to 31 December 2020.

Should I Refinance or Reprice My Investment Property Loan?

It really depends.

If your loan is still within the lock-in period, contractual penalties may apply.

Ensuring Your Access to Basic Banking Services

This might be a small relief, but it’ll be a huge help to those who really need it.

1) Waiver of Retail Bank Account Fees [NEW]

If you are unable to meet the minimum average daily or monthly balance for your bank accounts you can apply to have the fall-below service fees waived up to 31 December 2020.

And if you’ve set up any GIRO arrangements for automated payments, you can apply to have the failed deduction fees waived up to 31 December 2020 as well.

Take note that this does not cover stuff like late payment fees.

The banks will need you to demonstrate that your income has been affected by COVID-19.

Bend, not Break

These are tough times.

But I’m glad that these measures have been rolled out to provide assistance to those whose finances have taken a big hit due to the COVID-19 pandemic.

And I sincerely hope that you will bend, and not break.

If you’ve got questions or feel like you’re alone in this, fret not!

Feel free to reach out to the friendly Seedly Community and we’ll get through this together.

Stay safe everyone!

Advertisement