Received Some CNY Ang Bao Money? Here's How to Maximise it for the Future

New Year, New Huat!

As we usher in the new year, let’s start things on the right foot by reviewing our lifestyle choices.

After all, the real huat (Hokkien: prosper) starts with not buying 4D and making smarter day-to-day personal finance decisions for your future with your Angbao money!

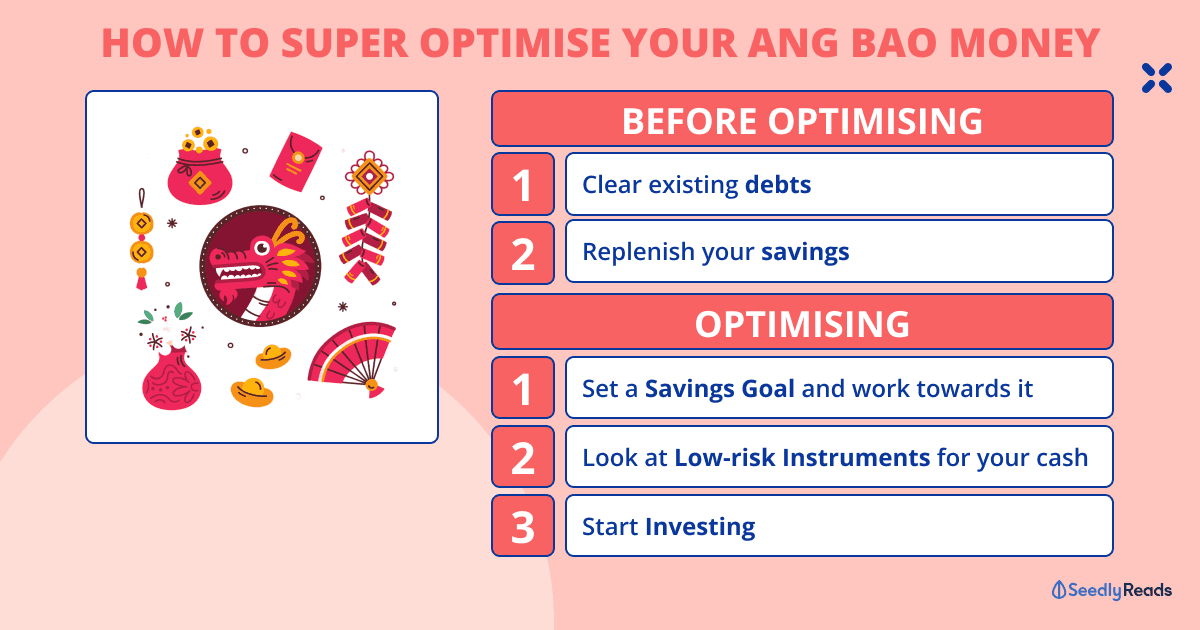

TL;DR: Maximise Your Ang Bao Money This CNY

Disclaimer: The information provided by Seedly serves as an educational piece and does not constitute an offer or solicitation to buy or sell any investment product(s). It does not consider the specific investment objectives, financial situation or particular needs of any person. Readers should always do their due diligence and consider their financial goals before investing in any investment product(s).

Click to Teleport

- Clear Existing Debts

- Replenish Your Savings and Make Up For Your CNY Expenditure

- Set a Savings Goal

- Put Your Money Into Low-Risk Investments

- Use Your Ang Bao Money to Kickstart Your Investment Journey

Before Maximising Your Ang Bao Money…

1. Clear Existing Debts

Depending on your luck this year, you may have racked up some debts from all the late-night poker or mahjong games, unforeseen emergencies or periods of unemployment.

If you are on the losing end, remember to start the year right by clearing those debts so that you can enjoy the rest of your Ang Bao Money with peace of mind.

Not to mention that with some of these debts, the interest rate on them is guaranteed.

In our article A Beginner’s 4-Step Checklist Before Starting Your First Investment, we explored why you should look to clear your debt first:

Simply put, if you are in debt, you are fighting a losing battle where you are paying off a loan at an interest rate which may be rendered redundant if you are trying to invest also.

Here is a simple illustration:

You have a debt of $15,000 student loan with a guaranteed interest of about 5% per annum (p.a.).

Instead of allocating more funds to pay off the debt, you are trying to invest that additional funds into an exchange-traded fund (ETF) that yields a non-guaranteed ~5% p.a.

There are two main problems with this.

Firstly, you need to know that your investment returns are not guaranteed, while the interest on your student loan is guaranteed to keep accumulating.

Volatility in the stock market means that your investment might crash, like what happened with the stock market in 2022:

Also, even if your investment does well and yields about 5% p.a., your net gain will still be about 0%…

Thus, you effectively waste the costs incurred from investing (brokerage fees, etc.) to return to square one.

Instead, you should fight the negative yield (in this case, clearing your loan first).

This is actually a pretty common situation we observe with individuals with student loans. My answer would be to focus on clearing that down before moving to the next step of building up your savings reserve.

Another big red flag is credit card debt. Never get into such deep waters because these debts generally have an interest rate of about 26% p.a., which can get you neck-deep in financial trouble real quick.

Thus, you should prioritise clearing your credit card debt or other high-interest debt if you have it.

Here are two tried and tested ways to clear debt:

Manageable Debt

Even though the interest on these debts is guaranteed, the interest rate is generally lower.

For example, you have your housing and mortgage loans where you can actually predict the interest rate (e.g. ~1.0% to 2.6%) or use your CPF every month.

Granted, this method is still risky as investment returns are not guaranteed.

But you can actually build wealth at a yield above that interest rate.

2. Replenish Your Savings and Make Up For Your CNY Expenditure

Bought a new $100 Cheongsam this CNY?

Spent too much on Bak Kwa or Abalone?

Set aside a portion of your ang bao money to cover these costs!

How To Grow Your Ang Bao Money?

For those who have not gambled away your ang bao money, here are some ways to consider growing your cash!

1. Set a Savings Goal

If you have extra cash to spare from your ang baos this year, you can always create a savings goal and deposit your money in it!

For example, if your goal is to go on a 6D5N trip to Osaka; you will need about ~$1,200 (via the Travel Intern).

You can set up a savings goal accordingly and deposit your money into the fund.

2. Put Your Money Into Low-Risk Instruments

If you can’t stomach volatility.

You might consider these low-risk investments to park your money and grow your savings.

Whether you’re new to investing or seeking shelter in low-risk investments from the volatile stock market, here are some of Singapore’s safest, low-risk investments to consider.

3. Use Your Ang Bao Money to Kickstart Your Investment Journey

For those new to investing, the extra ang bao money you get on hand can kickstart your investment journey.

Just ensure that you have checked off the items on this list first:

How Do I Start Investing?

If you’d like to learn more about how you’d want to grow your money, you can take a look at our comprehensive guide to investing in Singapore:

In addition, here is a beginner-friendly instrument you can consider:

Maximising Your Ang Bao Savings in 2024

As you enjoy this festive season, we’ve provided some tips to stretch your ang bao money!

Read More

Advertisement