Million Dollar Round Table (MDRT) Explained: What Does Achieving It Really Mean?

Million Dollar Round Table (MDRT): What Does MDRT Mean?

We’ve all been there. Financial agents always make a special effort to tell us they are “Million Dollar Round Table (MDRT)” members.

In all honesty, most consumers would really love to share the joy, but we have little idea of what this… “Title” really means.

With insurance being an important part of personal finance, we break down what goes behind attaining MDRT status, as well as explain the hype that surrounds it.

Disclaimer: This article only covers MDRT certification and does not include other certifications such as Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC)

What Does It Take for Financial Advisors & Insurance Agents To Earn Million Dollar Round Table Status?

Founded in 1927, the Million Dollar Round Table (MDRT) is a global and independent association consisting of life insurance and financial services professionals from more than 500 companies in 70 nations and territories.

- MDRT has eliminated the requirement that a minimum of 50 per cent of an applicant’s qualifying production comes from Risk-Protection Credit or “core products”

- First-time applicants for MDRT must use either the commission or premium methods to demonstrate qualification for membership

- Any individual with prior MDRT membership is eligible to apply using the income qualification method

- Each MDRT status designation is granted for one year only. All members must apply every year to continue their affiliation with MDRT.

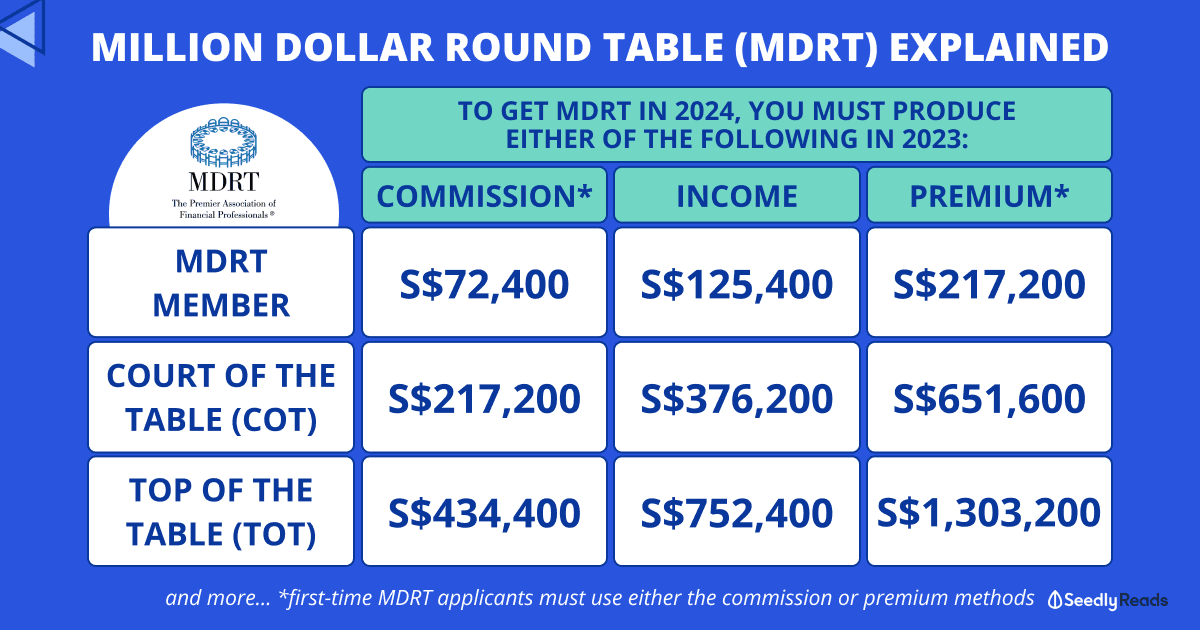

MDRT Member Requirements for Singapore

Here are the requirements to become an MDRT member in Singapore for the years 2022, 2023 and 2024:

| Qualifier | Year 2021 Production (Qualification For 2022) | Year 2022 Production (Qualification For 2023) | Year 2023 Production (Qualification For 2024) |

|---|---|---|---|

| Commission | S$69,900 | S$79,000 | S$72,400 |

| Income* | S$121,000 | S$136,800 | S$125,400 |

| Premium | S$209,700 | S$237,400 | S$217,200 |

*A minimum of ~S$49,203 (US$37,000) must be income from new business generated during the production year.

Note that MDRT applicants may not combine production credit from the methods above to attain the minimum requirement. Applicants will be approved only under one method.

Achieving MDRT is just the start. Members who manage to perform exceptionally well are awarded the Court of the Table (COT) or Top of the Table (TOT) accolade.

MDRT Court of the Table (COT) Requirements for Singapore

Whereas Court of the Table (COT) status means that the financial advisor is required to achieve about three times more than an MDRT member:

| Qualifier | Year 2021 Production (Qualification For 2022) | Year 2022 Production (Qualification For 2023) | Year 2023 Production (Qualification For 2024) |

|---|---|---|---|

| Commission | S$209,700 | S$237,000 | S$217,200 |

| Income* | S$363,000 | S$410,400 | S$376,200 |

| Premium | S$629,100 | S$711,000 | S$651,600 |

*A minimum of ~S$49,203 (US$37,000) must be income from new business generated during the production year.

MDRT Top of the Table (TOT) Requirements for Singapore)

Last but not least, Top of the Table (TOT) status means that the financial advisor must achieve six times more than an MDRT member:

| Qualifier | Year 2021 Production (Qualification For 2022) | Year 2022 Production (Qualification For 2023) | Year 2023 Production (Qualification For 2024) |

|---|---|---|---|

| Commission | S$419,400 | S$474,000 | S$434,400 |

| Income* | S$726,000 | S$820,800 | S$752,400 |

| Premium | S$1,258,200 | S$1,422,000 | S$1,303,200 |

*A minimum of ~S$49,203 (US$37,000) must be income from new business generated during the production year.

What Does the MDRT Status Really Mean to Consumers?

Attaining MDRT can be a difficult process for some agents should they lack high net worth contacts or have few referrals.

A more important question to ask here is:

- How important is this recognition in the eye of consumers?

- Is the message that MDRT is sending positive and significant enough?

- While trying to achieve MDRT, has the requirement for MDRT clouded your decision to recommend the most suitable products to your client?

In order to get a feel for the significance of MDRT to BOTH consumers and financial advisors/insurance agents, we looked to Seedly for answers.

The Seedly Community’s Thoughts on MDRT

- While people tend to assume that MDRT means that the agents have earned millions from clients, that is actually not true. If an agent is an MDRT member, they are in the top 10% of their industry. With it, there is a higher level of ethics to uphold.

While it also boils down to each individual financial advisor, MDRT actually has their code of ethics which is monitored by the association. Should a consumer find an MDRT member unethical, do not hesitate to report them. Ultimately, it still boils down to the character of the individual agent. - In the early 1900s, qualifying for Million Dollar Round Table status meant that a financial consultant had sold at least 1 million dollars worth of life insurance. This meant that he/she has managed to cover many people (given that people only bought small sums a long time ago), which could potentially help thousands of people in the agent’s service lifetime.

Fast forward to today, the meaning of MDRT is a little diluted (No longer the requirement of 1 million dollars) but rather shows the type of commitment a person has to his/her clients. The experience to reach such a milestone would have enabled them (at least theoretically) to possess the knowledge and skills required to service any client anytime, anywhere, on any concern.

There’s no quantifiable proof per se, but if an agent qualifies time after time for MDRT, it could mean that he/she is doing something right with his/her service. Otherwise, clients won’t trust the agent time after time to continue footing renewal premiums and taking up new plans. So in a way, MDRT is like a form of accreditation of sorts. - Coming from someone in life insurance for more than half my life, to me, MDRT means a lot to the agents, their managers and the insurers they represent, mainly for reasons of prestige rather than professionalism.

To clients who want to be served by “premium” agents, it feels good that their agents are of “MDRT” material.

To most of us, it does NOT matter if our agents have MDRT status or not as long as they serve our policies well.

It is never easy to continue performing at the peak like MDRT, Court of Table ( 3x MDRT production) or Top of Table (6x MDRT production).

But I have seen more agents being client-centric when they are not “pressured” to perform such sales productions. - I don’t think there are any benefits for us. It’s just a recognition for the agents that they closed a specific amount of sales.

It could simply mean that he/she has good sales skills. - How does MDRT show a higher level of ethics? To be fair, most clients have no idea that they are a victim of misselling until some time later. Even then, most of such cases go unreported due to the troublesome nature of the process, or it could be a case of supporting a friend.

For those who have an agent who has been an MDRT member for many years, it is a good sign. It demonstrates the strong client trust and relationship to maintain the accolade. - My ex-agent was almost MDRT for life. She left the trade for her family ultimately. A good takeaway here is that MDRT does not mean that the agent will stay in the trade.

- It is a career milestone. Nothing more, nothing less. Ethics should be a basic requirement, so by implication, as long as there’s no actionable ethical breach filed against the agent, there’s no problem.

MDRT ethics guidelines are very general, as they are left to each jurisdiction to manage. In Singapore, there are already practice guidelines and standards coded into the Financial Advisers Act (FAA), and if the person is a Certified Financial Planner (CFP), for example, the code of ethics and conduct and practice standards are binding on him, so again it’s another validation.

MDRT only means agents are good at getting and managing their clients. To consumers, it means nothing because it is part of our ethical duty to always put the client’s interest before ourselves. As I said, it’s more of a career milestone an agent will be proud of, and he likes to share this special moment with his client, who trusts him. Nothing else.

Further Reading: Code of Ethics for MDRT

Members of MDRT are obliged to a list of the code of ethics for MDRT. Below is the code of ethics taken from the MDRT website:

- Always place the best interests of their clients above their own direct or indirect interests.

- Maintain the highest standards of professional competence and give the best possible advice to clients by seeking to maintain and improve professional knowledge, skills and competence.

- Hold in strictest confidence, and consider as privileged all business and personal information pertaining to their client’s affairs.

- Make full and adequate disclosure of all facts necessary to enable clients to make informed decisions.

- Maintain personal conduct, which will reflect favourably on the insurance and financial services profession and the MDRT.

- Determine that any replacement of an insurance or financial product must benefit the client.

- Abide by and conform to all provisions of the laws and regulations in the jurisdictions in which they do business.

Does it matter to you if your financial advisor or an insurance agent has MDRT status?

Let us know on Seedly!

Similar Articles:

Advertisement