Ever wished you had more time and money to spend on things you truly enjoy? I sure do.

But in order to lead a happier life, we have to take intentional steps towards those goals.

“Money doesn’t buy happiness” as they say, but having more wouldn’t hurt right?

As we grow older, many of us start to get hit in the face with adulting: having to work, taking care of family and of course, managing our finances.

However, having to constantly worry about money simply isn’t healthy.

So, if you’re at that stage with a wallet full of credit cards, too many bills to pay, or can’t seem to figure out where all your money has disappeared to, let me introduce you to the beautiful concept of financial minimalism.

Financial Minimalism: What is It?

Simply put, financial minimalism is a balanced lifestyle that incorporates minimalist habits into finance. It allows you to focus on the things that matter more in your life while reducing noise in other aspects.

If you’re thinking that minimalism is a strict code that requires you to live with a pair of shoes, a few outfits, and a bare room filled with only the basic necessities, you would be wrong.

Anyone can be a minimalist, and everyone will have their own way of living a minimalist lifestyle.

Benefits of Financial Minimalism

1. Spending Less

As you practice financial minimalism in your life, the most obvious benefit is reducing your expenditure (on things you most likely won’t need such as impulse buys).

With fewer things to buy and perhaps some things to sell as you declutter your items Marie Kondo style, you’ll see a healthier bank balance and be better positioned to live within or below your means.

2. Worrying Less

Naturally, spending less will also lead to worrying less.

With fewer subscription services, credit cards and other financial expenses, you can focus on budgeting for necessities.

3. Living More

One of the best things about financial minimalism is that you will have more money for the things you care about. With fewer financial burdens, you can spend more on your family, hobbies and live a better lifestyle.

4. Saving the Environment

As an added bonus, leading a minimalist lifestyle helps you consume less and cuts down on your carbon footprint.

Leading a Financial Minimalist Lifestyle

Ready for your first foray into your financial minimalism journey? Strap right in and let’s begin!

1. Outline Your Goals

Before diving into the nitty-gritty, it is important for us to identify what matters most in our lives. Doing so allows us to focus on what we should be investing in, rather than spending on things that do not build upon those goals.

As a simple example, I love music and playing the electric guitar. One of my life goals is to play in a band and produce music someday.

But instead of spending my finite resources of time and money on my hobby, I find myself going on Shopee to buy things I don’t really need or random shopping sprees for clothes that I only wear a couple times.

After discovering financial minimalism and evaluating what my goals were, I now have more to spend on my hobbies instead of purchasing random stuff that adds up in costs over time.

This process may seem daunting at first, and some of us have much bigger goals such as achieving financial independence and retiring early (FIRE), but here are some easy questions to get you started:

- If you could only pick three things that matter most to you, what would they be?

- Are your spending habits in line with the things that you value in life?

2. Create/Re-evaluate Your Budget

Once you’ve identified your goals, it is time to create your budget.

For those who are new to budgeting, you can check out various budgeting apps or use an excel sheet if you like it old-school.

Budgeting like a minimalist doesn’t mean you have to live under $600 a month (although it is doable if you really want to), but you can take some inspiration from it if you’re living with your parents.

For the rest of us, budgeting like a minimalist should cover all your necessities, along with categories that align with your life/financial goals.

You can follow the 50-20-30 rule where you spend 50 per cent of income, save 20 per cent and invest the rest. Of course, if it is within your means, make it your goal to drop that 50% expenditure as low as possible and allocate more to savings and investments.

For a more in-depth guide to personal finance, you can also check out the Seedly Money Framework.

The hard part though is sticking to the budget that you’ve made. Many of us are guilty of overspending during sales just because something is cheap.

Moreover, it is imperative that you review your budget frequently so you can adjust as needed and cut out any unnecessary spending (No longer using Netflix? Don’t forget to cancel the subscription!).

I would recommend doing so once every month and checking for better deals too, such as the best SIM-only plans or subscription services.

3. Simplify Your Finances

Alongside having a minimalist budget, simplifying your finances will go a long way in helping you manage your money.

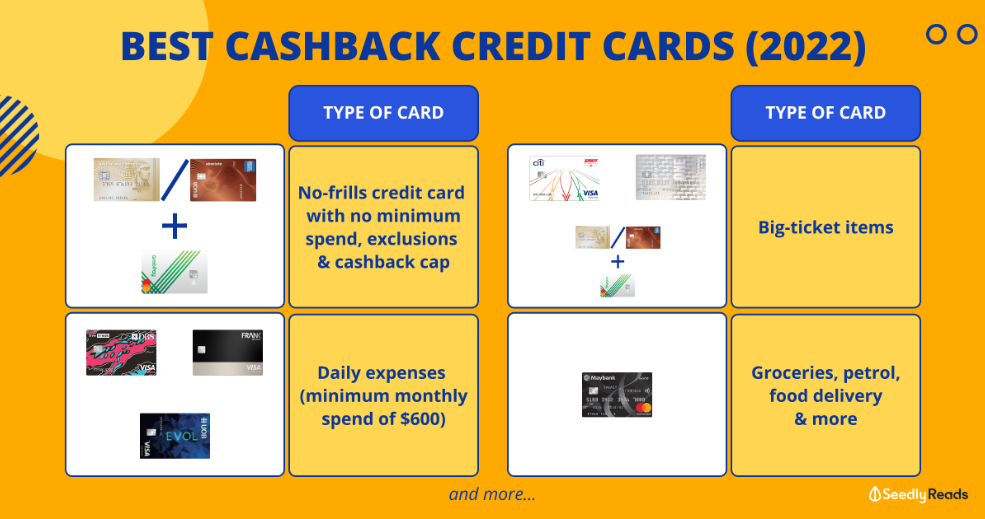

Some might argue that financial minimalists are missing out on all the juicy cash rebates from having multiple credit cards or the cashback and deals from various digital payment apps.

However, having only what you need and use frequently helps streamline your finances and outweighs that extra 1% cashback or points you get once in a blue moon.

If you have a multitude of credit cards, savings accounts and other financial products, it’s time to narrow it down to the ones that are used most frequently.

For those who are just starting out and have only one bank account and a debit card, you can start to research more about the various financial products out there such as savings accounts, cash management accounts and credit cards.

But of course, we don’t want all our eggs in one basket, so having two or three accounts for example is a healthy start.

As a guide, you should have one account for transactions, one for savings, and one for emergencies. Some people would opt for three separate bank accounts, while others would put their emergency funds in cash management accounts and have their bank account used for transactions.

Personally, I use a mix of financial products to help manage my finances. A cash management account for emergency funds, a bank account (DBS Multiplier) for savings, a prepaid Crypto.com VISA card for transactions (2% cashback) and GrabPay (0.67%-1% cashback) as a safety net for when I can’t use VISA.

Again, financial minimalism is a personal finance journey, so you can use the framework as a guide. Remember, the lesser things you have to manage, the easier it will be for you.

4. Adopt Minimalist Habits

As you go along with your financial minimalism journey, it is good to cultivate a few minimalist habits along the way to further reduce the financial clutter. You could also create your own habits with the mindset of a minimalist: less is more.

This could range from anything like:

- Having a shopping list (and only buying those products)

- Meal prepping to save costs on food

- Being mindful about your purchases by buying fewer but higher quality products

- Avoid shopping temptations by going out less or disabling notifications from shopping apps.

Buy Experiences and Not Things

If you’ve read this far, remember that financial minimalism is a journey that takes time. But each small effort you make will go a long way in improving your finances and ultimately, your life.

Most importantly, it teaches you to focus on what you care about the most and helps you to appreciate experiences rather than materialistic things.

After all, life is about the experiences that bring us happiness and the people we share them with.