Circuit Breaker Mode On

Singapore swung into full-circuit breaker mode starting 7 April 2020.

With the latest COVID-19 (temporary measures) bill, Singaporeans are highly encouraged to stay home all the way until 4 May 2020.

I mean…

Can we blame them for treating us like kids?

Guess not.

The circuit breaker mode in place can bring about some “minor problem” for some.

For a group of Singaporeans, the problem is way bigger.

What Can You Do If You Suffered A Loss of Income?

The COVID-19 outbreak is taking a toll on the economy. There are Singaporeans who lost their jobs or a dip in income received.

The worst part of this is the uncertainty that comes with it.

When will the economy recover?

How long will it take for the world to deal with COVID-19?

How long will I be, without a paycheque?

While we do not have all the answers for all the questions, it is important to FOCUS ON OURSELVES during this period of time. If you experienced a loss of income or lose your job, here’s a guide for you.

Step-by-step Guide For Singaporeans Who Lost Their Jobs or Suffered A Loss of Income

Now take a deep breath…

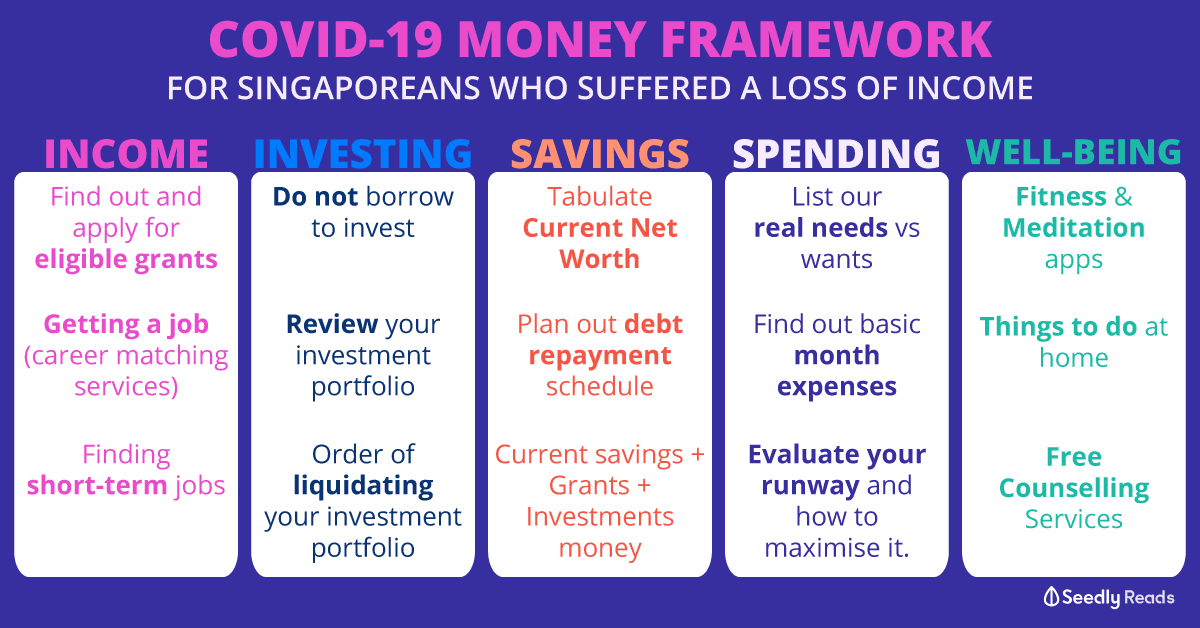

While we do have a Seedly money framework for Singaporeans, we are dealing with a very different situation right now.

With that, we came out with a different framework that Singaporeans can work on during this period of time.

COVID-19 Money Framework

For this money framework, we are going to focus a lot on a rather medium-term approach. Throughout this article, we will take on the assumption of a Singaporean with less than 3 months worth of savings.

The key here is simple:

- Survive the COVID-19 impact for a period of 6 months to 1 year

- Having a riskless and more predictable financial planning

- A framework that is easy to follow and better equip you once we get through this period

Income

For someone who suffered a loss of income during this period of time, it is important to

- Find out the types of government grants which you are eligible for, and apply for them if need be

- Look for jobs available to earn some income

We have compiled a list of government grants which you can look to apply. It is important to keep track of the amount of grant that you will receive to help you better plan your budget.

Here’s a List of Grants You Can Apply For

| Grant | How Much? | How to Apply? | Who is Eligible? |

|---|---|---|---|

| Temporary Relief Fund | $500 | Website: go.gov.sg/temporary-relief-fund or fill up a form at SSOs and CCs | - Singapore Citizen or PR - Aged 16 and above - Prior gross monthly Household Income (HHI) of ≤$10,000, or monthly Per Capita Income (PCI) of ≤$3,100 - Not on ComCare assistance |

| COVID-19 Support Grant | $800 per month for 3 months (one-time) | Application starts in May 2020 | - SC/PR aged 16 years and above - Prior gross monthly HHI of ≤$10,000, or monthly PCI of ≤$3,100 - Live in a property with annual value of ≤$21,000 - Previously employed as full-time/part-time permanent or contract sta - Not on ComCare assistance |

| Self-Employed Person Income Relief Scheme (SIRS) | $9,000 ($3,000 in May, July and October 2020) | No need to apply | - Started work as an SEP on or before 25 Mar 2020 - No employee income - Net Trade Income of ≤$100,000 - Live in a property with annual value of ≤$13,000 - Do not own two or more properties - For married SEPs, SEP and spouse together do not own two or more properties - Assessable Income of spouse is ≤$70,000 |

| Workfare Special Payment | $3,000 ($1,500 in July and October 2020) | Received Workfare Income Supplement (WIS) in 2019 |

You can also refer to the list of GST Vouchers, Solidarity Payment and Care & Support payout which you are eligible for:

There is also a full compilation of all grants available, including those for healthcare and frontline workers.

We suggest plotting out a compilation of the grants you will be receiving to better plan your finances moving forward.

Here’s an example of a “Grant Tracking Sheet”:

| Date | Grant | Amount |

|---|---|---|

| 14 April 2020 | Solidarity Payment | $600 |

| April 2020 | Temporary Relief Fund | $500 |

| May 2020 | COVID-19 Support Grant | $800 |

| June 2020 | COVID-19 Support Grant | $800 |

| July 2020 | COVID-19 Support Grant | $800 |

The idea here is to track it closely, so you know the exact amount of income coming in every month.

Getting a Job

The government grants and relief can only help you temporary.

Getting a job to generate more streams of income is definitely encouraged, given that in times like this, every dollar counts.

We got in touched with Workforce Singapore (WSG) to find out some of the help Singaporeans can get if they lose their jobs.

WSG has a job portal to help you find a job.

To help Singaporeans during this period of time, WSG also has a career matching service.

All you need to do is to complete a short survey.

If you are keen on more short-term, temporary jobs with immediate opportunities!

You can check out the #SGUnitedJobs Telegram channel set up by WSG too.

On top of that, we have also compiled a list of job platforms which you can use during this period of time.

Job Switch

There is also another group of Singaporeans who might be looking to change their job at the current COVID-19 situation.

The general consensus from the Community right now when it comes to a job switch is that:

- If you are looking to move into the public sector, you should not be affected much.

- If your job change is within the private sector, you might wish to reconsider, given that many companies are actually cost-cutting or freezing their headcounts.

Investing

If your savings account is going to deplete in less than 3 months, you should not be investing. Neither should you borrow to invest.

Spending money which you do not have is a huge mistake!

In fact, if you are in need of money right now, review your investment portfolio:

- Most of your investments might be losing money at the moment

- If you are in need of liquidity, liquidate those investments that are not making any losses.

- In fact, if you invested in Singapore Savings Bonds (SSB), you can choose to liquidate those first before touching any of your stocks or bonds.

This is because liquidating the Singapore Savings Bonds incurs zero loss. You can even get some interest out of it depending on your investment duration. - You can move on to the profit-making stocks (factor in cost)

- Before making your way down to make the decision of liquidating the loss-making ones.

Here’s the order that you can liquidate your investment portfolio when you are in need of liquidity:

| Investments | How Much Will You Receive? |

|---|---|

| Singapore Savings Bonds | Amount you invested + Interest generated over the years |

| Profit making stocks | Amount you invested + Profit - Transaction cost |

| Stocks making slight losses | Amount you invested - Slight losses - Transaction cost |

| Stocks making huge losses | Amount you invested - Huge losses - Transaction cost |

Savings

Now that you have a full picture of your income and grants, combine that with your savings to find out how much you have in your “war chest”.

- Review your current overall net worth (Assets and liabilities)

- Tabulate all the monthly loans you need to repay and plan out a debt repayment schedule.

Truth is, a late payment on your loans can cost you more money and you should not spend such money unnecessarily.

We are now in a unique environment. The lack of income will also indicate that your high-interest savings account will not fetch you as much interest as it used to. But we will survive!

TOTAL SAVINGS = Current Savings + Grant Money + Money from selling your non-loss making investments

Now that you have your total savings, we can work on your monthly expenses to stretch that runway.

Spending or Expenses

Rationing your savings and increasing the “life span” of your savings is important during this period of time.

Your objective is to outlive this difficult period of time. With little idea on when the economy will pick up again, every dollar counts.

If you do not have the habit of tracking your expenses, this is the best time to sit down and plan it out.

COVID-19: Needs vs Wants

The key here is to live simple. With the circuit breaker being implemented, it is important to sieve out your real needs and your wants.

| Needs during COVID-19 | Wants |

|---|---|

| Groceries/ Food | Everything else! |

| Utility Bills (Electricity, gas and water Bills) |

|

| Phone and internet (Phone bill and broadband bill) |

|

| Medical Bills | |

| Insurance Coverage | |

| Rental |

- Now that you understand your total monthly expense

- Compare that with your savings to find out how long your runway is

Your objective now is to stretch that runway for as long as possible!

There are also little tips that you can still apply to stretch every dollar:

- Cook your own meals

- Bring your own container, save the environment, and also save on that extra takeaway cost

- If you must shop, learn to maximise cashback on your purchases (Am excluding miles during this period of time, because every dollar counts)

Well-being

The importance of our mental health during this period of time is extremely important. Some of us are experiencing a high level of stress due to uncertainties and your movement being restricted to our own homes and neighbourhood.

Things To Do

There are a few ways we can keep ourselves occupied during this period of time.

I personally picked up meditation a while back and it benefits me a lot. Here are some meditation apps you can try:

Keeping yourself active at home is important for your body and soul. If you can set yourself a weekly routine, go for it!

You can do so with apps such as:

- Down Dog (Yoga)

- 7 Minute Workout (HIIT)

- Home workout- No Equipment (App store/ Play)

Some gyms are also coming out with routines to keep fit at the comfort of your home:

We have also previously compiled a list of things you can do at home, from touring the museums online, to online services.

If you are facing stress and anxiety, there are free counselling services available during this time of uncertainty.

| Counselling Services | Service Provided | Website |

|---|---|---|

| Fei Yue Community Services | Free Online Counselling | https://www.ec2.sg/ |

| Silver Ribbon Singapore | Free Video Call Counselling | https://www.silverribbonsingapore.com/counselling.html |

| MHC Asia | 24/7 fully subsidised support helpline | Download the MHC BetterHealth app to access: IOS: https://apps.apple.com/sg/app/mhc-careplus/id1397286060 Play store: https://play.google.com/store/apps/details?id=com.mhcasia.teleconsultpatient&hl=en_SG |

You should also know that your friends and family members are always there for you and they are just a phone call away.

Tough times don’t last; tough people do.

There is always a community out there willing to lend a helping hand. You can always reach out to Singapore’s Biggest Personal Finance Platform with any of your questions to get insights and help from fellow Singaporeans.

Remember to stay healthy and stay safe everyone!

Advertisement