YouTrip vs Revolut vs amaze vs Wise vs Wirex & More: Multi-Currency Cards Comparison (2024)

Planning for an overseas trip and still going to money changers to exchange large amounts of cash?

Aside from the risk of misplacing your foreign currencies, you’re also paying for expensive foreign exchange fees and charges.

Of course, I’m not advocating for being completely cashless overseas, but with the advent of digital multi-currency cards and many countries now accepting contactless payments, why not manage the bulk of your foreign currencies in a fuss-free way…

AND save on pesky fees?

Plus, these digital multi-currency cards can help you save money on overseas e-commerce sites like ASOS, eBay or TaoBao, where you might have to pay a foreign currency conversion (FCY) fee if you are not transacting in your local currency.

So, without further ado, let’s dive into the best digital multi-currency cards that you should consider opening before transacting in foreign currencies.

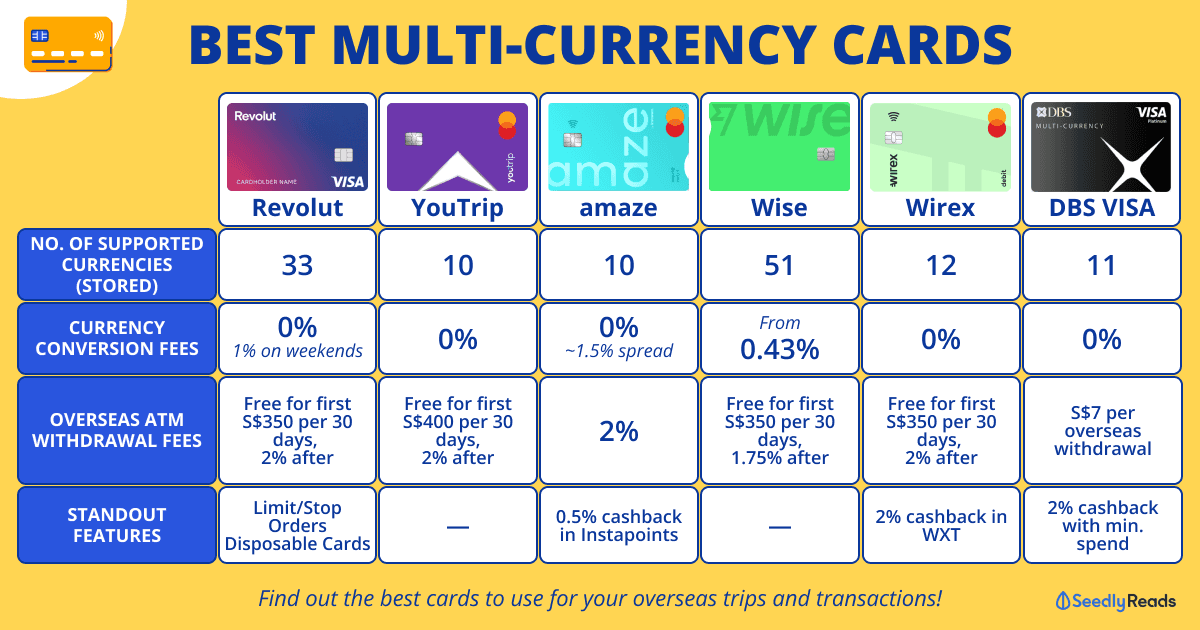

TL;DR: Multi-Currency Cards in Singapore Comparison

In this article:

- Revolut vs YouTrip vs amaze vs DBS VISA Debit Card & More

- How Does a Digital Multi-Currency Card/Account Work?

- Revolut Review

- YouTrip Review

- DBS VISA Debit Card Review

- amaze wallet by Instarem Review

- Wise Review

- Wirex Review

- iChange Review

- Bonus: Trust Card

Revolut vs YouTrip vs amaze vs DBS VISA Debit Card & More

| Multi-Currency Card/Account | Currency Conversion Fees | No. of Supported Currencies (Exchange & Store Currencies) | No. of Currencies Available for Overseas Spend | Overseas ATM Withdrawal Fees | Note |

|---|---|---|---|---|---|

| Revolut Apply Now | 0% - 1% Weekdays: 0% Weekends (between Friday 5pm (New York time) and Sunday 6pm (New York time): 1% | 33 (AED, AUD, BGN, CAD, CHF, CLP, COP, CZK, DKK, EGP, EUR, GBP, HKD, HUF, ILS, INR, JPY, KRW, KZT, MXN, NOK, NZD, PHP, PLN, QAR, RON, SAR, SEK, SGD, THB, TRY, USD, ZAR) | 150+ | Free for first S$350 or first five withdrawals (Standard members) per rolling month 2% thereafter or $1.49 whichever is higher | Expensive to use on the weekends |

| YouTrip | 0% | 10 (SGD, USD, EUR, GBP, JPY, HKD, AUD, NZD, CHF, SEK) | 150+ | Free cash withdrawals of up to S$400 per calendar month, 2% thereafter | Unable to transfer money out |

| DBS Visa Debit Card | 0% | 11 (AUD, CAD, EUR, HKD, JPY, NZD, NOK, GBP, SEK, THB, USD) | 11 (AUD, CAD, EUR, HKD, JPY, NZD, NOK, GBP, SEK, THB, USD) | Up to S$7 per cash withdrawal depending on ATM | 2% cashback on all foreign spend with S$500 min. spend and cash withdrawals limit of S$400 and below in the same month. |

| amaze wallet (Instarem) Apply Now | 0% | 10 (SGD, EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, and CAD.) | 150+ | 2% | 0.50% cashback in InstaPoints |

| Wise | From 0.43% (dynamic, depends on forex market and currencies) | 51 (AUD, GBP, HRK, HUF, JPY, MYR, NOK, NZD, PLN, RON, SEK, SGD, TRY, USD and more) | 150+ | Free for first S$350 & the first 2 withdrawals per 30-day cycle 1.75% thereafter for amounts >S$350 + S$1.50/transaction fee after first two free withdrawals | $8.33 - $8.55 card issuance fee |

| WireX | 0% | 12 (AUD, CAD, CHF, CZK, USD, EUR, GBP, HKD, JPY, MXN, NZD, SGD) | 150+ | Free for first S$200 per 30-day cycle 2% thereafter | 2% cashback in WXT (cryptocurrency) $5 card delivery fee via SingPost |

iChange is not included in the table as it did not instil much confidence when we tested it and lacks important features.

The best multi-currency card/account would be Revolut, not only for its features but also for its extremely competitive exchange rate.

Here is a quick snapshot of how much Japanese Yen I would get when exchanging on the following platforms (taken within minutes of each other):

- Revolut: S$1 = ¥111

- YouTrip: S$1= ¥112

- Instarem: S$1 = ¥112

- DBS: S$1 = ¥111.19

Do note that this is only a snapshot on 28 Mar 2024 for Japanese Yen and your results may differ depending on where you’re heading to!

Revolut doesn’t have the best rates above, but really, these rates tend to fluctuate alot and for most non-bank multi-currency cards, the rates are all pretty competitive.

Thus, we should look for features to determine the best card for overseas spending.

Unlike YouTrip, Revolut allows you to withdraw any spare cash you have post-trip back into your bank account! Plus, it has virtual disposable cards that you can delete immediately after your trip for more security.

Last but not least, Revolut now has a huge edge over its competitors with its limit/stop order feature. To put it simply, you can set a target exchange rate and the app will automatically convert your money for you when it hits that specified rate!

However, do note that you may be hit with the 1% currency conversion fees during the weekend (between Friday 5pm (New York time) and Sunday 6pm (New York time)).

A close runner-up would be DBS’ new DBS VISA Debit card. This card gives an awesome 2% cashback, but only if you hit the minimum spend requirement of S$500 and a cash withdrawal limit of S$400 and below in the same month. If you are able to hit the cashback, it will completely offset the FX spread loss you will incur compared to Revolut, and you can earn about 0.8% net cashback.

The only reason it isn’t at the top is that it charges you $7 for overseas cash withdrawals and only supports 11 stored currencies compared to Revolut’s 33.

There are some things to take note of though:

- Under the Payment Services Act (PS Act) these digital multi-currency accounts have a wallet limit of S$5,000 and an annual spend limit of S$30,000.

- Your bank or card issuer may charge you a fee for adding money to these accounts.

- Overseas ATM withdrawals may still incur charges by partner banks. These fees are beyond the control of digital banks.

- Likewise, foreign merchants and retailers may also impose a Dynamic Currency Conversion (DCC) fee.

How Does a Multi-Currency Card or Account Work?

Before we go ham into the nitty-gritty of the best multi-currency accounts and their associated cards, we need to understand what they are and how they work.

A multi-currency card is linked to a multi-currency account. When you spend on a multi-currency card, you are tapping on the funds in the multi-currency account. A multi-currency card is hence akin to a debit card linked to a bank account.

There are primarily two ways to spend with multi-currency cards. The first is to convert your SGD into foreign currency to be stored in the multi-currency account before heading overseas to spend it. This lets you “lock in” the exchange rate which can be a good thing if you foresee that the exchange rate will become unfavourable in the future. In this article, we will refer to this feature as “Exchange & Store Currencies”.

The second way is to top up your multi-currency account with local currency and pay with your multi-currency card overseas. If you do not have foreign currency in your account, the foreign currency conversion will take place instantly during the transaction using real-time foreign exchange rates. Most multi-currency cards support over 150 currencies using this feature.

All multi-currency accounts listed here are free to open unless you want to upgrade your plan with Revolut or Wirex.

P.S. The Trust card is not a multi-currency card as it does not allow you to store currency in a multi-currency wallet. It functions like a regular credit card overseas but with no FX fees! For a fuller comparison of the best cards to use overseas, check this article.

Revolut Review

Revolut is a London-based digital bank launched in 2015 with over 25 million retail as announced in July 2022.

And for good reason, too!

The company aims to be an all-encompassing platform for personal finance management, complemented by its multi-currency card for everyday use.

What We Like About Revolut

- One of the most competitive exchange rates

- 33 currencies available to exchange and store

- 150+ currencies for spending

- Disposable virtual cards for extra security overseas

- Free overseas ATM withdrawals for the first S$350 every 30-day cycle

- Limit/Stop orders for buying/selling currencies

- Ability to withdraw leftover currency to your bank account

- Expense tracking feature

- Apple Pay and Google Pay support

- Has multiple price plans to cater to all your currency needs, including insurance coverage for premium and metal plans

Revolut Limit Orders

Revolut has introduced two features – Buy/Sell Limit Orders and Buy/SellStop Orders.

For the uninitiated, a limit order is an order to buy or sell currency at a price you choose or better, and you can, therefore, lock in the price of the currency you want.

Buy limit orders are executed at your specified price or lower, and Sell limit orders are executed at your specified price or higher.

To illustrate, the current market rate for buying Euros is €1 = £0.68, but you’re only interested in buying if the rate goes down to £0.66 or lower, so you set your limit price to €1 = £0.66.

- If the FX rate drops from £0.68 to £0.66 or lower, your order will be executed (in full or partially) at £0.66 or lower

- If the FX rate doesn’t drop to £0.66, your order will not execute

The currency is sold at your limit price or higher for Sell limit orders. Hence, your limit price should be the minimum rate you wish to sell the currency.

For example, the current market rate for buying Euros is €1 = £0.68, but you’re only interested in buying if the rate goes up to £0.87 or lower, so you set your limit price to €1 = £0.70.

- If the FX rate goes up from £0.68 to £0.70 or higher, your order will be executed (in full or partially) at £0.70 or higher

- If the FX rate doesn’t rise, your order will not execute

But do note that limit orders aren’t guaranteed – they will only be exchanged if the price of a currency increases or decreases to your set limit price. If it doesn’t, your order is left unfilled.

Revolut Stop Orders

You might have guessed how this works as it’s similar to how you might invest in stocks – a stop order is an order to buy or sell a currency once the price reaches a specific price, known as the stop price.

Traditionally, a stop order is designed to limit losses or trigger an entry at a specific price, and this concept has been adopted in Revolut. When the stop price is reached, a stop order becomes a market order and is executed at the best available price (which can be lower or higher than the stop price).

The advantage of a stop order is you don’t have to monitor how the exchange rate changes daily, and you can be guarded against adverse exchange rate changes.

For a Buy Stop Order, you would first place a threshold (or ‘stop’) on how much you will buy a currency for. Your order then triggers when the current price goes beyond your ‘stop price’, and it may execute at a different price depending on fluctuations.

Example: You see that the Euro is steadily rising. The current market rate is €1 = £0.68, and you decide to buy Euros as soon as the rate rises to £0.70. You suspect Euros might rise beyond that price, and you want to buy before the rate increases any further, saving you money. You set your limit price to £0.70.

- If the FX rate rises from £0.68 to £0.70, your buy-stop order will become a buy-market order, and your order will be executed at the best price available

- If the FX rate doesn’t rise to £0.70, your order will not execute

Then, how do Sell Stop Orders work?

Similarly to a Buy Stop Order, you would first place a threshold (or ‘stop’) on how much you will sell a currency for. Your order then triggers when the current price goes below your ‘stop price’, and it may execute at a different price depending on fluctuations.

Example: You see that the Euro is steadily falling. The current market rate is €1 = £0.68, and you decide to sell Euros as soon as the rate falls to £0.66. You think Euros might fall further, so you set your stop price to €1 = £0.66.

- If the FX rate drops from £0.68 to £0.66, your sell-stop order will become a sell-market order, and your order will be executed at the best price available

- If the FX rate doesn’t drop to £0.66, your order will not execute

What We Don’t Like About Revolut

- 1% currency conversion fees apply during the weekend (between Friday 5pm (New York time) and Sunday 6pm (New York time)).

Is Revolut Safe?

Revolut Technologies Singapore Pte. Ltd. is regulated as a major payment institution by the Monetary Authority of Singapore (MAS) to provide

- Account Issuance Service

- Domestic Money Transfer Service

- Cross-border Money Transfer Service

- E-money Issuance Service

Revolut Review: Is Revolut Worth It?

100% yes! With its features and highly competitive exchange rates, it has a huge leg up over the competition right now.

So, if you aren’t using this card when travelling, you are definitely missing out!

Revolut Singapore Referral Programme

The company is also running a referral programme for new users.

The referrer will receive S$80 in their Revolut account if the referee fulfils all the following conditions:

- Signs up using a Revolut account using a referral link from existing Revolut users.

- Verifies their identity (Pass KYC).

- Adds money by debit card or bank transfer. Please note: internal transfers do not count.

- Order a free Revolut card.

- Makes three card payments of at least S$10 each (can be using a virtual card while they wait for their physical one).

Remember to ask the friend who referred you to split the referral reward with you!

YouTrip Review

Incepted in 2016 by You Technologies Pte Ltd, YouTrip lays claim to being the first digital multi-currency account in Singapore.

The card is quite popular among Singaporeans because of its ease of use, and it was created by a local Singaporean company.

What We Like About YouTrip

- One of the most competitive exchange rates

- 0% foreign currency conversion fees

- 150+ currencies to spend

- Free overseas ATM withdrawals for the first S$400 every 30-day cycle

- Simple app with a focus on foreign currency wallets

- Deals with many partners

- Apple Pay support

What We Don’t Like About YouTrip

- Only supports 10 currencies to exchange and store

- Inability to transfer money to a bank account

- No Google Pay support yet (will be rolled out this year!)

Is YouTrip Safe?

You Technologies Group (Singapore) Pte Ltd (“YouTrip”, “our”, “we” or “us”) is licensed by MAS as a major payment institution to provide:

- Account Issuance Service

- Domestic Money Transfer Service

- Cross-border Money Transfer Service

- E-money Issuance Service.

YouTrip Review: Is YouTrip Worth It?

The YouTrip card is popular among Singaporeans due to its first-mover advantage. However, in the current landscape, other multi-currency cards have an edge with features like virtual disposable cards and the ability to exchange and store way more currencies.

Another downside is that your cash is “stuck” in YouTrip once you top it up. You can’t transfer leftover money from your trips to your bank account and the only way you can get it out is to spend it.

Pro Tip: One workaround is to find a friend who is going overseas and transfer any leftover amount in your YouTrip account to theirs! Just make sure they transfer that amount back to your bank account.

YouTrip Singapore Promo

Sign up for YouTrip with promo code: YTPERKS and activate your card to receive S$5 in your YouTrip account.

DBS VISA Debit Card Review

Yes, DBS has finally caught up with the competition with their refreshed DBS VISA multi-currency Debit Card.

It is a little different from the other multi-currency cards here as this card is linked to your DBS My Account. You must convert your currency to store in the respective foreign currency wallet before you spend overseas to enjoy 0% FCY fees. Otherwise, you will be hit with the typical 3.25% FCY fee.

What We Like About DBS VISA Debit Card

- 2% cashback on all foreign currency spent (Valid with a minimum of S$500 on Visa and cash withdrawals limit of S$400 and below in the same month)

- Links to a DBS My Account, which most Singaporeans have (no need to sign up for another account)

- Apple Pay and Google Pay support

What We Don’t Like About DBS VISA Debit Card

- Only supports 11 currencies to exchange and store

- Must convert currency beforehand into foreign currency wallet to enjoy 0% FCY

- Terrible exchange rate compared to the competition

- S$7 overseas ATM cash withdrawal fee

Is DBS Safe?

They are the biggest bank in Singapore soooo

DBS VISA Debit Card Review: Is the DBS VISA Debit Card Worth It?

If you can hit the S$500 minimum spend and limit your withdrawals to below $400 for the 2% cashback, it will be worth it even though it has a worse exchange rate than Revolut.

Other than that, however, it really loses out when it comes to features especially when it comes to the number of currencies that you can spend and enjoy 0% FCY.

To make matters worse, it has the heftiest fee for overseas cash withdrawals at S$7.

amaze Wallet by Instarem Review

Here, we have another homegrown company, Instarem, which has made waves with its amaze card since it came into the scene in 2014.

Updates as of 27 March 2024: Amaze Will Impose a 1% Fee on Local Spends Above S$1,000 & Remove 1% MCC Fee From Most Categories

Also, for those of you who may know about the amaze card hack – which turns your regular tap-and-pay (offline) at retail outlets into online transactions, allowing you to earn four miles per dollar (mpd) using the Citi Rewards card – note that the spending cap is also S$1,000.

So, there’s no need to be alarmed unless you consistently exceed this cap. However, you should still be aware of this new rule as Citi Rewards is based on statement month instead of calendar month.

For example, your Citi Rewards statement cycle is from the 13th to the 12th of each month, and you spent $1,000 on the 10th and 16th of April. Technically, you can still earn 10x bonus points (or 4mpd) across two statement months, but you will incur a 1% fee (or $10) for spending above S$1,000 within the same calendar month.

And, on a related note, amaze will remove its 1% Merchant Category Code (MCC) fee from all categories except MCC 6540 (Wallet Top-ups) and MCC 4111 (EZ-Link Wallet Top-ups and TransitLink GTM):

| Merchant Category | Code |

| Insurance and specialty retail stores | 6300, 5999 |

| Healthcare Services | 8099, 8011, 8062, 8021, 8041) |

| Advertising and Business Services | 7311, 7399 |

| Government Services | 9399 |

| Education | 8299, 8220 |

| Automotive services/car dealers | 5511, 7538 |

What We Like About amaze Wallet

- One of the most competitive exchange rates

- Link up to five Mastercard credit/debit cards

- Converts overseas transactions into SGD, allowing you to continue earning credit card rewards

- 0.50% cashback for transactions processed in any foreign currency (i.e. non-SGD)

- 0% foreign currency conversion fees

- Expense tracking feature

- Google Pay support.

What We Don’t Like About amaze Wallet

- It only supports 10 currencies for exchange and storage

- 2% overseas ATM cash withdrawal fee

- Cashback criteria are rather restrictive

- 1.5% Visa top-up fee

- ~1.5% spread when using the Instarem card.

Is Instarem Safe?

NIUM Pte. Ltd. (formerly known as Instarem Pte. Limited) is the holding company of NIUM and Instarem subsidiaries globally. NIUM’s is regulated by the Monetary Authority of Singapore (MAS) as a major payment institution in Singapore under License No. PS20200276 to provide:

- Account Issuance Service

- Domestic Money Transfer Service

- Cross-border Money Transfer Service

- E-money Issuance Service.

amaze Wallet Review: Is amaze Worth It?

The amaze Wallet has one of the top competitive exchange rates based on my testing.

Sadly, with only 10 currencies to exchange and store, a 2% overseas cash withdrawal fee, and a rather restrictive cashback requirement (plus a long as-hell wait time for the cashback to be funded into your account), it is hard to recommend the amaze wallet.

The amaze card feature that links up to five Mastercards though is another story!

Note: Converts all transactions into SGD with no foreign currency conversion fees and allows you to earn credit card rewards locally or overseas. However, it is subject to a foreign exchange spread by Mastercard of around 1.50% which will be charged to your underlying credit/debit card.

Wise Review (Formerly TransferWise)

Wise was founded in 2011, and the Wise multi-currency account offers a mid-market exchange rate for foreign currency conversions.

What We Like About Wise

- One of the most competitive exchange rates

- 53 currencies to exchange and store

- 150+ currencies to spend

- Free overseas ATM cash withdrawals for the first S$350 & the first 2 withdrawals per 30-day cycle

- Virtual cards for extra security overseas

- Apple Pay and Google Pay support

What We Don’t Like About Wise

- From 0.43% foreign currency conversion fee

- S$8.50 card issuance fee

Is Wise Safe?

Wise Asia-Pacific Pte. Ltd. is licensed by MAS as a major payment institution under the Payment Services Act 2019 (PSA) to provide:

- Account Issuance Service

- Domestic Money Transfer Service

- Cross-border Money Transfer Service

- E-money Issuance Service.

Wise Review: Is Wise Worth It?

Wise is undoubtedly a great multi-currency card with competitive exchange rates and a whopping 53 currencies you can exchange and hold. It also has free cash withdrawals up to a limit and virtual cards for extra security.

Feature-wise, it is quite similar to Revolut, but what holds it back is the S$8.50 card issuance fee. Wise will be worth it if you want more currencies to exchange and store. Otherwise, Revolut would be the cheaper option.

Wise Singapore Promo

Sign up via referral links to remove or reduce the fee on your first transfer.

Wirex Review

Wirex is another London-based payments company founded in 2014. While other multi-currency card companies also have features related to cryptocurrency, Wirex has a heavier emphasis on a cashback program that rewards users with up to 8% cashback (for the basic plan) in terms of WXT, their native cryptocurrency.

What We Like About Wirex

- One of the most competitive exchange rates

- Up to 8% cashback in WXT

- 0% foreign currency conversion fee

- 150+ currencies to spend

- Free overseas ATM cash withdrawals for the first S$200 per 30-day cycle

- Virtual cards for extra security overseas

- Apple Pay and Google Pay support

What We Don’t Like About Wirex

- Only supports 12 currencies to exchange and store

- Cashback is in cryptocurrency

- S$5 card delivery fee

Is Wirex Safe?

Before you use Wirex, you need to be aware of the risks of dealing with cryptocurrency.

As Wirex is an unregulated digital payment token (DPT) service provider, MAS regulation requires them to publish this risk warning:

Before you pay your DPT service provider any money or DPT, you should be aware of the following.

Your DPT service provider is exempted by MAS from holding a license to provide DPT services. Please note that you may not be able to recover all the money or DPTs you paid to your DPT service provider if your DPT service provider’s business fails.

You should not transact in the DPT if you are not familiar with this DPT. Transacting in DPTs may not be suitable for you if you are not familiar with the technology that DPT services are provided.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens.

But Wirex has been temporarily exempted from operating in Singapore under the PS Act. This means your funds are not covered by the Singapore Deposit Insurance Scheme by the SDIC.

The company is also applying for a license under the new PS Act.

Wirex Review: Is Wirex Worth It?

If you’re into crypto, Wirex could be a great card for you to spend with cryptocurrencies. Feature-wise, it is also up there with Revolut and Wise. However, the S$5 card delivery fee and limited currencies to exchange and store hold it back from taking the top spot.

iChange Review

iChange is the newest kid on the block! What started as a money exchange aggregator has now introduced its multi-currency card and wallet.

What We Like About iChange

- One of the most competitive exchange rates

- 50 currencies to exchange and store

- 0% foreign currency conversion fee

- One of the few cards that can store Malaysian Ringgit (MYR), and with REALLY good rates

- Apple Pay and Google Pay support

What We Don’t Like About iChange

- Glitchy Apple & Android app

- No cash withdrawal from overseas ATMs yet

Is iChange Safe?

iChange is under iAPPS Pte. Ltd. and licensed by MAS as a standard payment institution to provide:

- Account Issuance Service

- Domestic Money Transfer Service

- Merchant Acquisition Service

- E-money Issuance Service

iChange Review: Is iChange Worth It?

With a rather tedious signup process and a glitchy Android app experience, using iChange didn’t instil much confidence. It doesn’t help that their website doesn’t provide much information about the multi-currency account and card. Moreover, it still lacks many of the security features that its competitors have.

That said, some of our Seedly community members are using the app (on iOS) with no issues, and the exchange rates seem to beat every other account on this list! So, if you don’t mind the lack of features and are an Apple user, iChange could be handy.

Bonus: Trust Card

I know, I know. The Trust card is technically not multi-currency card, but I have good reasons to include it in this bonus section.

For the uninitiated, the Trust card was debuted by Trust Bank, a digital bank backed by Standard Chartered and FairPrice Group. It can also be switched between a credit card and a debit card.

Most credit card users who use their credit cards overseas will know that a foreign currency exchange fee or a Visa charge may be imposed, and we know that sometimes, banks may not have the best rates.

What sets Trust apart is that it does not charge foreign currency fees; hence, there are no transaction/markup fees, not even the usual 1% Visa charge.

Plus, as you can toggle the settings, such as whether it can be used as a credit or debit card, you don’t have to top up every time, unlike a multi-currency wallet. You can also transfer your excess funds to your bank account using the Trust debit card.

What about the exchange rate?

Users from the Seedly Community have tested out both multi-currency cards and Trust cards. The results are that the rates offered by Trust cards are fairly comparable to those of multi-currency cards such as YouTrip, and sometimes, they offer the same rates.

While we can’t say for sure that it will always be competitive, it’s worth trying based on its features alone.

Read more: Best Digital Bank Savings Accounts: Trust Bank vs GXS Bank vs MariBank

Other Multi-Currency Accounts

These traditional multi-currency accounts are offered by banks and have a poorer exchange rate compared to the ones above. They also lack as many useful features when compared to digital multi-currency accounts.

We generally do not recommend them unless you are already within the bank’s ecosystem and do not want the extra hassle of signing up for yet another account.

HSBC Everyday Global Account (EGA)

Not a card per se, the HSBC Everyday Global Account (EGA) is a multi-currency account that facilitates transactions in 10 currencies.

The currencies available include the following:

- Australian Dollar

- Canadian Dollar

- Chinese renminbi

- Euro

- Hong Kong Dollar

- Japanese Yen

- New Zealand Dollar

- Pound Sterling

- Swiss Franc

- US Dollar

There are $0 fees when you make retail purchases and cash withdrawals in these 10 currencies.

When using the HSBC Everyday credit card or debit card, you will be able to earn 1 per cent cash back on all eligible spends and GIRO payments, and a 1 per cent bonus interest on every increment in SG average daily balances.

UOB Mighty FX

The UOB Mighty FX is a multi-currency account with 11 major currencies:

- Australian Dollar

- Canadian Dollar

- Chinese renminbi

- Euro

- Great Britain Pound

- Hong Kong Dollar

- Japanese Yen

- New Zealand Dollar

- Singapore Dollar

- Swiss Franc

- US Dollar

They offer no conversion fees, admin fees, and the ability to withdraw from overseas ATMs.

Going on a Trip? Get Your Travel Insurance and a Free Travel eSim (Worth US$10)!

If you’re considering travel insurance, make sure you check out Seedly Travel Insurance!

This travel insurance is ideal for everyone, particularly families, as it automatically includes insurance protection for children without additional add-ons!

Built from the ground up based on what users want in a travel insurance plan, Seedly Travel insurance includes COVID-19 coverage, personal accident benefits per child, and all your travel essentials covered:

Sign up now to enjoy 50% and an additional 7% off with promo code ‘march7‘, receive a 3GB Airalo Travel eSim (worth US$10), and up to S$50 Grab vouchers!

Get 4 KrisFlyer Miles per $1 spent and stand a chance to win 100,000 KrisFlyer Miles!

Finally, for every plan purchased, you might walk away with an iPhone 15!

Advertisement