3 Major Risks to Know About Nanofilm Technologies International Ltd (SGX: MZH)

Sudhan P

Sudhan P●

Nanofilm Technologies International Ltd (SGX: MZH) is a leading provider of nanotechnology solutions in Asia.

The company was successfully listed on 30 October 2020, debuting at S$2.77 per share, up from its initial public offering (IPO) price of S$2.59.

Nanofilm is the first local tech unicorn to list in Singapore, and its listing is also the biggest here in eight years.

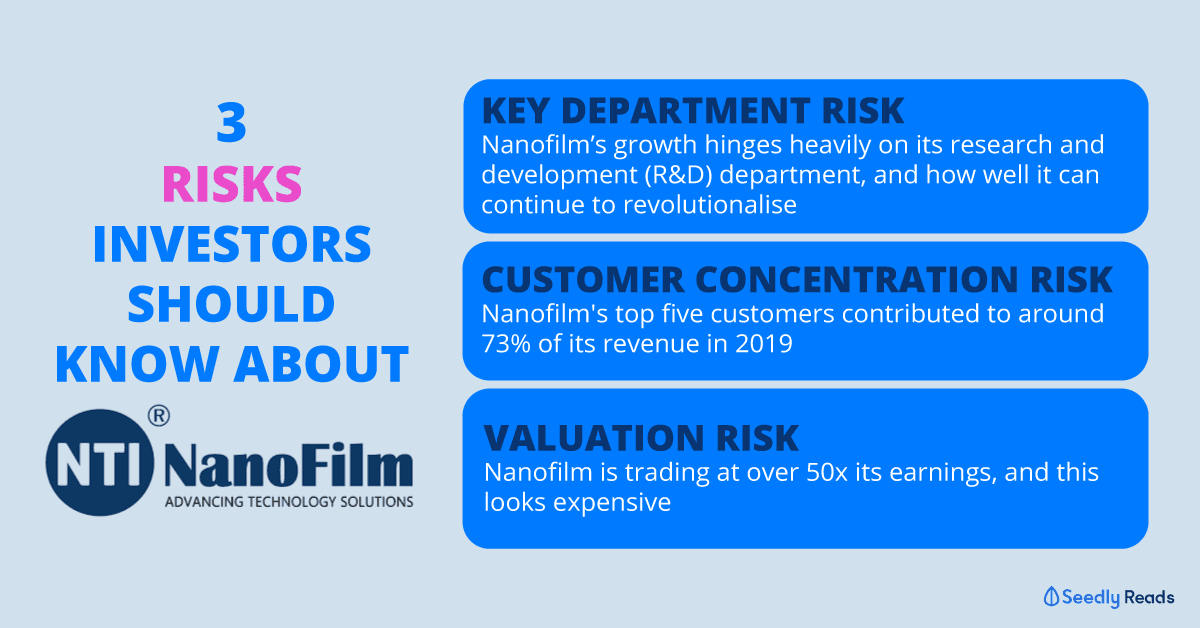

But as is with every company, there are also risks associated with it, and Nanofilm is no exception.

With that, let’s look at three key risks with the firm that investors should be aware of.

Key Department Risk

Nanofilm was started by Dr Shi Xu in 1999.

He has been instrumental in the growth of Nanofilm over the years, and currently oversees Nanofilm’s operations and research and development (R&D).

The following is an organisation chart of Nanofilm’s R&D department to give some context:

R&D is vital for Nanofilm to maintain its competitive advantage, as well as to keep up with industry demands.

And Nanofilm’s continued growth hinges on how well and quickly its R&D team adapts and develops new nanotechnology solutions to cater to customer demand.

Any failure by the company to adapt or develop solutions for its customers for use in their end-products, or the departure of key R&D employees, is likely to hit Nanofilm’s business.

Customer Concentration Risk

Although Nanofilm has more than 300 customers across different industries, its main customers take up a huge portion of its revenue.

Nanofilm’s largest customer, which is an end-customer, accounted for over 51% of its revenue for 2019, and the figure jumped to around 57% for the six months ended 30 June 2020.

Meanwhile, Nanofilm’s top five customers (both direct customers and end-customers, including its largest customer) contributed to around 73% of its revenue in 2019, and 82% for the six months to 30 June 2020.

If any of Nanofilm’s key customers pull out for any reason, its business would be hit.

An example of a customer concentration risk that surfaced recently is Fastly (NYSE: FSLY).

Its shares plunged after the company revealed that the impact of an uncertain geopolitical environment has caused the usage of Fastly’s platform by its largest customer not to meet expectations, resulting in a huge fall in revenue from this customer.

Also, if Nanofilm’s major customers are unsuccessful in addressing any competitive challenges, their businesses may be affected, in turn reducing the demand for Nanofilm’s solutions, decreasing its revenues.

Valuation Risk

At Nanofilm’s current share price of S$3.03, Nanofilm is trading at around 56x its 2019 earnings, which looks exorbitantly high.

If we were to annualise its earnings for the six months ended 30 June 2020, Nanofilm shares still look overpriced at a price-to-earnings (P/E) ratio of 54x.

In comparison, the Nasdaq Composite Index, a barometer for US tech stocks, has a P/E ratio of around 21x while Singapore’s Straits Times Index has a P/E ratio of 12x.

Nanofilm’s high valuation could be substantiated if the company can grow by at least 50% annually in the foreseeable future, giving a price/earnings-to-growth (PEG) ratio of around 1x.

But from 2017 to 2019, Nanofilm’s net profit grew by just 15% per annum. It’s hard to see how Nanofilm can grow by 50% yearly in the coming years, even if it increases its market share in existing markets.

Want to Discuss Further?

Why not check out the SeedlyCommunity and participate in the discussion surrounding stocks like Nanofilm Technologies International Ltd (SGX: MZH) and many more!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement