National Day Rally 2023: Key Highlights on Majulah Package, New Housing Classification & More

I know it’s the weekend but…

Did you catch the National Day Rally 2023 tonight?

There are some major housing policy changes and a new Package introduced.

If you missed it or simply need a Too-Long-Don’t-Read, here’s all you need to know!

TL;DR: National Day Rally 2023 Summary on Retirement and Housing in Singapore

Click here to jump:

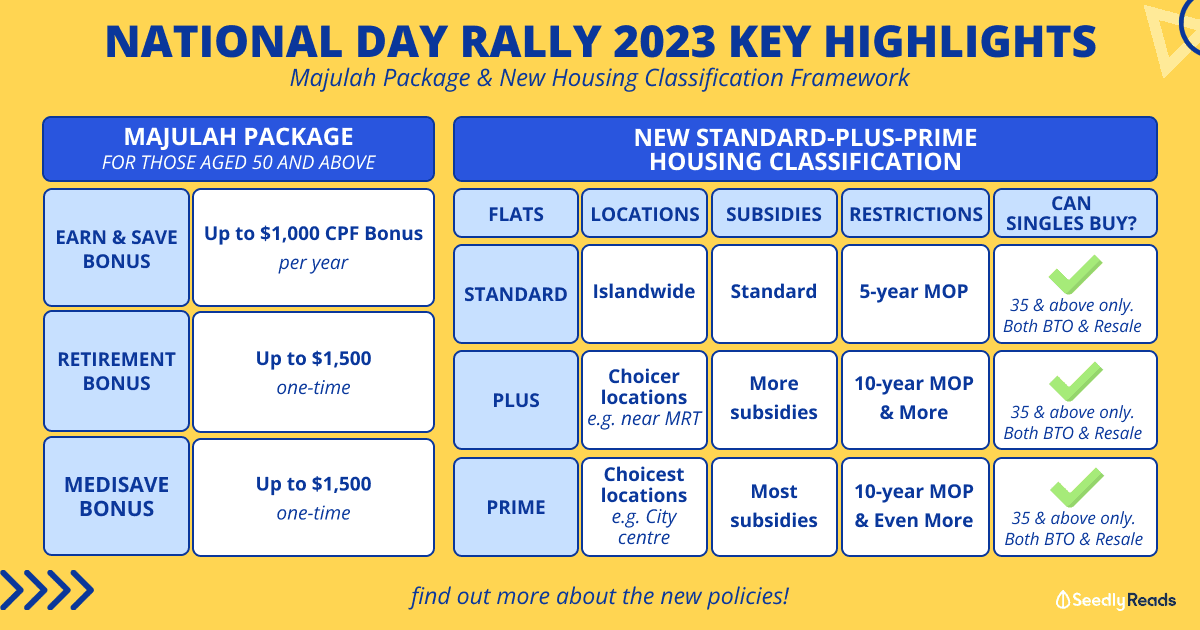

- Majulah Package For Younger Seniors – Earn and Save Bonus, Retirement Savings Bonus, and MediSave Bonus

- New Public Housing Framework

Majulah Package For Young Seniors

Are you planning to retire by 65?

Chances are, a lot of you will be worried about the rising cost of living and some may even have to shelf their retirement plans in order to keep up.

While there are existing schemes such as the Central Provident Fund (CPF) Matched Retirement Savings Scheme (MRSS) to help Singaporeans build up retirement funds, Singapore’s ageing population is growing and more and more seniors, especially those who are sandwiched between the Pioneer and Merdeka Generation, are concerned if they can retire comfortably.

And with that, the NDR has unveiled the Majulah Package that’ll cost about $7 Billion and benefit over 1.4 million Singaporeans who are born in 1973 and earlier.

So for those who are aged 50 and above, you can look forward to the following:

1. Earn and Save Bonus

Targeted at both lower and middle-income workers, regardless of whether part-time or full-time, you can get up to a $1,000 CPF bonus per year.

This bonus will be distributed to you, on top of employer-contributed CPF.

2. Retirement Savings Bonus

There will also be a one-time top-up to your CPF account if you have not reached the CPF Basic Retirement Sum.

Depending on income and age, you may receive up to $1,500.

And for those who are not working, including homemakers, you can also get this bonus.

3. One-time MediSave Bonus

We know that inflation is a pain in the a**, but so is rising healthcare costs.

To help seniors defray the cost of healthcare, you will also receive a one-time MediSave Bonus of up to $1,000.

New Public Housing Classification Framework From Mid-2024

Standard-Plus-Prime Classification

For those who’re looking to ballot for any upcoming Built-to-Order, Sales of Balance projects or planning to get a resale, you can now ditch the idea of Mature and Non-mature estates.

Traditionally, the Mature Vs Non-mature framework is how the Housing Development Board classify housing estates.

However, as Non-mature estates grew and developed, thereby making things more convenient, more home buyers are also becoming more discerning when choosing a flat that’s based on facilities and not simply by location. And in Prime Minister Lee Hsien Loong’s words: ‘The Non-mature estates are also becoming Mature…”

With the lines of non-mature and mature estates blurring, the HDB is introducing – Plus flats category.

For the uninitiated, HDB launched the Prime Location Housing (PLH) framework in 2022 for new BTO flats that are right smack in the city centre, often in Mature estates.

Projects that fall under this framework will have a 10-year Minimum Occupation Period (MOP) and have tighter selling restrictions, in order to curb the lottery effect of good BTO flats.

But as we’re saying, buyers are aware of ‘choicer’ locations due to better views, better connectivity, better facilities etc. This means that even flats in Non-mature estates might also become expensive when it becomes available in the resale market. These flats are less centrally located than Prime flats, but more desirable than Standard flats.

And with that, HDB flats that are in choicer locations will be categorised as Plus flats. These flats will have a MOP of 10 years and have more subsidies, but similar to a PLH flat, a subsidy recovery will be applied to the resale price to claw back the additional discounts given.

Also, there will be an income ceiling on resale buyers of these flats.

The ‘Plus’ flats fill in the gaps between a Standard and Prime flat, so to speak. This new classification of Standard-Plus-Prime will be put in place from mid-2024.

Existing Flat Owners Will Not Be Affected

This new classification will apply only to new BTO flats launched from the second half of 2024, and existing flat owners or those who have already booked their flats will not be affected.

Here’s a table on the differences between categories of the new classification.

| Locations | Subsidies | Restrictions | |

| Standard | All locations | Standard standardise | Standard 5-year MOP |

| Plus | Choicer locations within regions (e.g. near MRT) | More subsidies | 10-year MOP

Subsidy recovery after selling Owners of Plus flats will also not be allowed to rent out their entire flats at any time. Resale buyer restrictions: Some BTO eligibility conditions – Buyers of Resale Plus flats will be limited to Singaporeans with a household income ceiling of $14,000 for both families and singles. If they are private homeowners, there will be a 30-month waiting period before they are allowed to buy these flats on the open market. |

| Prime | Choicest and most central locations (e.g. city centre) | Most | 10-year MOP

6% subsidy recovery after selling Owners of Plus flats will also not be allowed to rent out their entire flats at any time. Resale buyer restrictions: Full BTO eligibility conditions on resale including income ceiling |

Source: Channel NewsAsia

If you’re planning to apply for an HDB flat soon, consider if the area you want to pick falls under which category:

Singles Can Purchase 2-room Flexi Under New Classification

Currently, Singles who are 35 and above can only apply for a two-room flexi flat in Non-mature estates, and they are not allowed to buy any PLH flats, even in the resale market.

With the new classification from mid-2024, during the BTO/SBF process, Singles will be allowed to buy all types of two-room flexi in all locations, regardless of Mature or Non-mature estates.

And with the changes, in the resale market, Singles can also buy two-room Prime Flexi resale flats, or Standard or Plus resale flats of any size except 3Gen flats, subject to their income ceiling.

Yes, you’re no longer limited!

This is definitely an upgrade to those who’ve been trying to ballot for a flat for the longest time.

What Are Your Thoughts On This Year’s NDR2023?

For me, I thought these are welcomed changes to the housing situation we face in Singapore (including myself).

Certainly, for the seniors who are moving into their golden years, retirement gracefully is something everyone hopes for.

Though we can’t see the effect immediately, let’s hope that things will change for the better!

Related Articles:

- Ultimate Joint Singles Scheme Operator-Run (JS-OR) Pilot Guide

- What Type of HDB Flats Can Single Singaporeans Buy?

- Be Rich Or Wait Till You’re Over 35 For a Home To Your Name – Public Housing for Singles

- Should You Top-Up Your CPF MA or CPF SA First?

- Ultimate Guide to CPF Interest Rates: Latest Rates, Calculation Methodology & Additional CPF Interest Explained

Advertisement