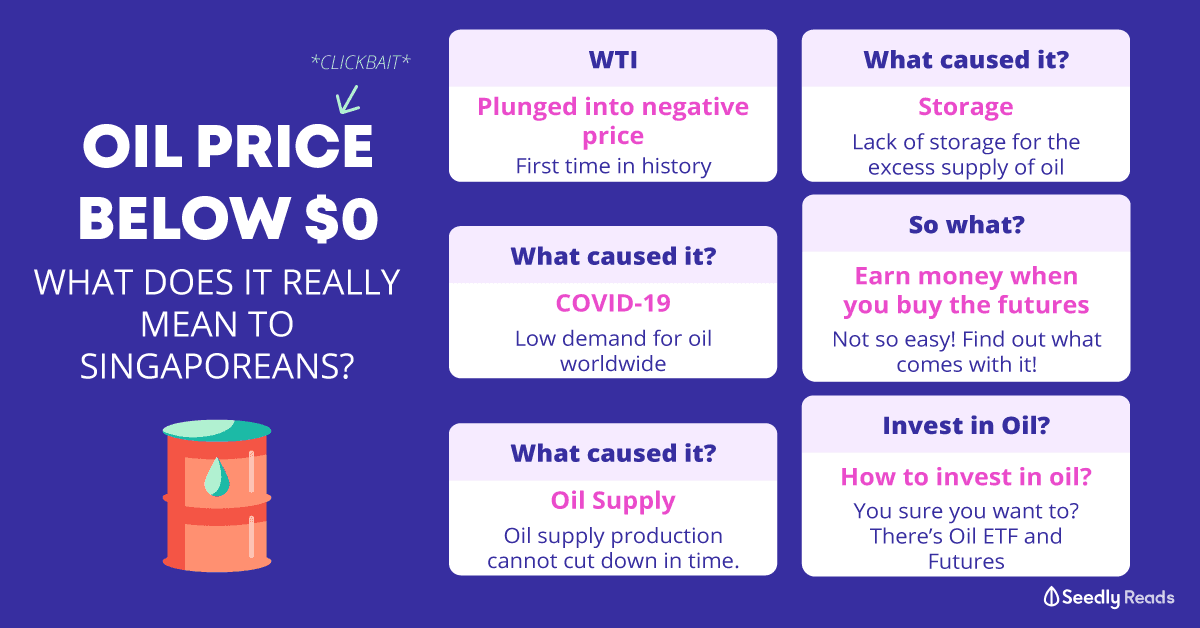

Negative Crude Oil Price: What Singaporeans Need to Know? Should You Invest?

Negative Crude Oil Price

For the first time in history, the trading price for oil falls below zero.

Source: Bloomberg

To look at it from another perspective, traders are paying you to take a barrel of crude oil off their hands.

” Take the oil and go. Here’s $40 while you are at it.”

Is it really as easy as it sounds? Isn’t it too good a deal?

Enough click baits going around. Let us break it down for you.

It is the price on the futures contract for West Texas Intermediate (WTI) futures that we are talking about here.

It does not mean that you can go to a petrol kiosk right now, pump a full tank for free and get some cash out of it. While we are indeed living in some crazy times right now, to think along that line would be absurd.

What on Earth Are West Texas Intermediate (WTI) Futures?

Oil price is traded based on futures contracts. The WTI is one of those futures, and it is the benchmark for America’s oil industry.

To understand this better, it is the near-term WTI futures contract for the month of May expiring on Tuesday that is experiencing the dip.

The rest of the futures contract remains positive.

What on Earth Are Futures?

Futures contracts are simply financial instruments that allow the buyer of a contract to “lock-in” the price of something in future.

This is to ensure better calculation and cost management.

In fact, an answer from the Seedly Community gave a really good illustration on how futures work (Thanks Cedric Jamie Soh for the answer):

- Assuming SIA needs to confirm the current oil price to better operate their business at a stable cost.

- They will buy oil futures to lock in the oil price. Eg. 6 months down the road

- When oil price increases 6 months down the road, they earn a profit from the futures contract they bought.

This profit will offset the increase in cost. - Should the oil price decrease, SIA will make a loss from the futures contract they purchased.

Given that oil price is lower now, operating their flights will be cheaper, offsetting the loss.

What Caused the Dip?

Back in March, we covered a little on the 34% dip in oil price.

The reason behind this is a simple Supply and Demand summation.

Low Demand for Oil Worldwide

The fact that you are probably at home reading this and not on a plane to Hawaii indicates that the demand for oil is low.

With COVID-19 affecting the world. Most countries are on lockdown, or… Circuit Breaker. The world is now put on a strict travel restriction which means that most of the flights are grounded.

This results in a sharp decline in demand for oil.

Supply for Oil

Now that the demand for oil has dropped, crude explorers started cutting down 13% of their American drilling fleet last week to reduce the supply of crude oil in the market.

However, this attempt to reduce the supply of oil could not catch up in time, resulting in more supply of crude oil than the world can handle.

More Supply Than Demand for Oil. So What?

Now that we have an oversupply in oil that the world is not going to consume, there is a need to find storage for the excess supply of oil.

We are looking at an average of 745,000 barrels a day, with only enough storage by the end of May. There will then be no storage available to store oil which is the reason why oil producers are frantically paying buyers to take the oil away from their hands.

Storage for oil is not as easy as you taking your Tupperware from home and filling it to the brim hoh!

It requires special facilities such as oil tankers and oil tanks!

Storing in oil tankers and oil tanks require cost too!

So Do I Get Paid If I Buy Oil Futures Now?

In fact, you DO GET PAID if you buy the futures right now.

But you also have to prepare to receive and store the oil delivered to you. You will also probably need to pay for the transportation costs, storage costs and all the costs involved in that delivery just because you wish to receive that tiny bit of money from your “investment”.

And…

Storing barrels under your HDB void deck just won’t do.

What Does This Mean for Singaporeans?

The dip in crude future prices may or may not affect the price of your petrol at the petrol kiosk.

In fact, there are a lot more factors involved before we see any change to it.

The decline in crude oil prices, however, means that it is cheaper to operate flights and Singaporeans can expect cheaper airfare. Yet, in times like this, it is as good as a piece of good news that you cannot do anything about.

Cheap crude oil will have zero impact given that the demand for travel is low, due to COVID-19. Airlines will not increase the frequency of their flight, simply because of cheaper oil. COVID-19 still “triumph” the situation right now.

The only plane we can fly right now.

What Does This Mean for Investors? Is It A Good Time To Buy Crude Oil?

If you are asking this question right now, we suggest you stay away from this “investment opportunity” until you find out more information about it.

Investing in crude oil right now means that you believe that:

- The temporary shutdowns around the world will end soon, and that the COVID-19 situation will die down by a certain time.

- After which, the economy will be able to pick up from the damage left behind by COVID-19 really quickly

Expecting to make money from the possible rebound of oil price is not as easy as it looks. A good example will be those investors who tried to do so during the 34% price dip in March. They definitely did not see this coming.

Unless you have a crystal ball, oil trading is not something an average investor should be looking at.

How to Invest Oil?

If you are still keen on investing in oil, here are a few ways and instruments you can do so.

We do not recommend average investors to be looking into this.

Invest in an Oil ETFs

One can invest in oil through an oil Exchanged-traded Fund.

Here’s a list of Crude Oil ETFs traded in the USA:

| Symbol | ETF Name | Total Assets ($MM) | YTD |

|---|---|---|---|

| USO | United States Oil Fund | $4,263.25 | -67.14% |

| UCO | ProShares Ultra Bloomberg Crude Oil | $1,003.40 | -92.28% |

| OIL | iPath Series B S&P GSCI Crude Oil Total Return Index ETN | $314.18 | -67.81% |

| DBO | Invesco DB Oil Fund | $292.85 | -42.17% |

| SCO | ProShares UltraShort Bloomberg Crude Oil | $143.75 | 162.22% |

| USL | United States 12 Month Oil Fund | $59.11 | -44.93% |

| DTO | DB Crude Oil Double Short ETN | $34.70 | 204.72% |

| OILK | ProShares K-1 Free Crude Oil Strategy ETF | $30.01 | -65.67% |

| OILX | ETRACS S&P GSCI Crude Oil Total Return Index ETN | $5.87 | -67.70% |

| OLEM | iPath Pure Beta Crude Oil ETN | $1.82 | -47.89% |

Trading Brent or WTI Crude Futures

Most CFD brokerages allow you to trade the futures on their platform.

Futures is a leveraged product and it is definitely not for any average investors.

Advertisement