Food For Thought: What Is Your Net Worth?

Nobody likes tracking their finances despite it being really important to do so.

This is simply because people want to feel good about themselves and tracking their finances doesn’t really help people to “feel good”.

One of the more common mistakes that many of us (ironically, even some established financial advisers are guilty of this) make, especially in Singapore, is to believe that a big-ticket item such as driving a luxury car is a big indicator of your wealth.

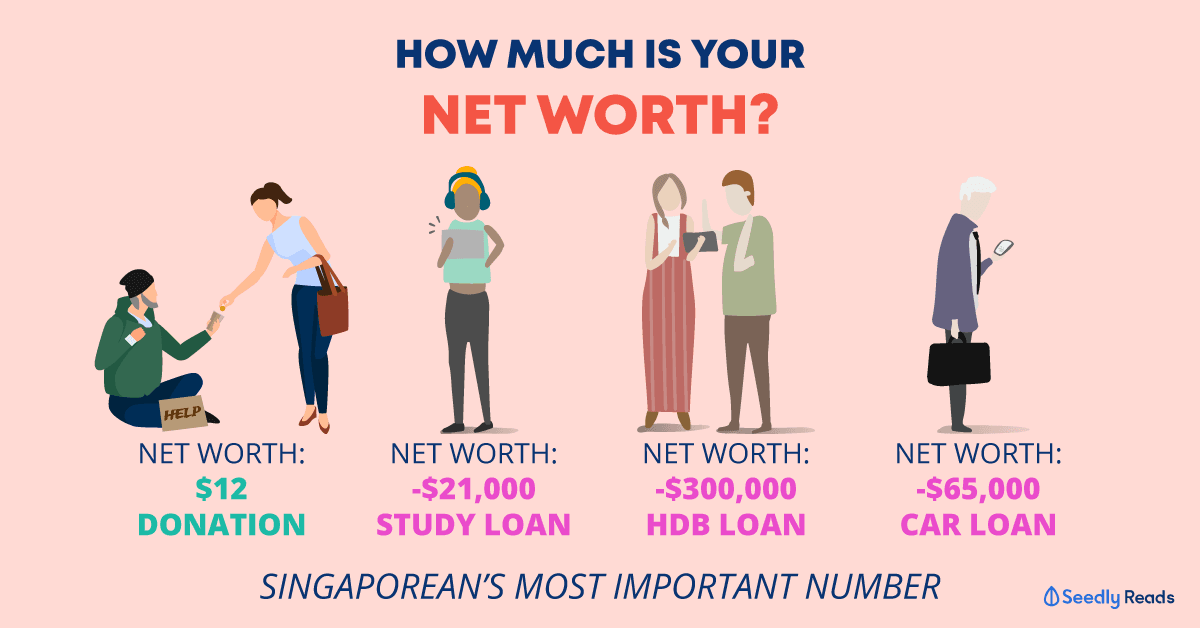

But as we can see in the illustration below, your personal net worth and your financial situation might be very different from how people actually see you.

So why bother calculating our net worth?

Well, for one, it acts as a good measurement of your financial situation and gives you a better grasp of your financial progress and goals.

How Do I Calculate My Net Worth?

Calculating your personal net worth is easy.

It’s simply the difference between things you own vs things you owe.

Here’re 3 simple steps to follow in order to calculate your net worth:

- List down all your assets

- List down all your liabilities

- Subtract liabilities from your assets to get your net worth

Calculating Your Assets

Calculating your assets might actually be therapeutic since it tells you what you own.

Below are some examples of assets which you may wish to list as “Assets”.

| Assets | Current Value |

|---|---|

| Cash and cash equivalents | |

| Cash in your wallet | |

| Money in savings account | |

| Fixed Deposit | |

| Others | |

| Investments | |

| Life insurance cash value | |

| Stocks | |

| Singapore Savings Bonds | |

| Bonds | |

| Mutual Funds | |

| Unit Trusts | |

| Exchange Traded Funds (ETF) | |

| Retirement Plans - CPF | |

| CPF Ordinary Account | |

| CPF Investment Schemes | |

| CPF Special Account | |

| CPF Medisave Account | |

| Personal Property | |

| HDB/ EC/ Private property | |

| Vehicles | |

| Jewelry ( eg. Rolex, or that gold necklace) | |

| Collectibles (eg. art collection, antiques) | |

Calculating Your Liabilities

Calculating your liabilities, on the other hand, potentially incurs a high level of stress. We recommend that you do this with a glass or cup of your favourite beverage, as well as keep the first aid box handy.

Below are examples of liabilities which an average Singaporean will have:

| Liabilities | Current Value |

|---|---|

| Credit Card Debt | |

| Property Mortgage | |

| Study Loan | |

| Personal Loans | |

| Car Loan | |

| Renovation Loan |

Once you have listed out both, just do this:

For reference, an average Singaporean will take up close to a $397,056 worth of liabilities before age 30. Wondering where all these liabilities come from? Have a look:

Ways To Increase My Net Worth

The components involved in calculating your net worth will give you insight as to how you can improve and potentially increase your net worth.

Here are just some examples of things you can do:

- Monitor your expenses and trim off unnecessary expenses

- Pay off your debts (eg. student, credit card)

- Review your assets and liabilities, reduce or eliminate where possible

- Save and invest your monthly income

Are There Any Tools That Can Help Me?

- Seedly Personal Finance Mobile App – A FREE automated expense tracking mobile app

- Net Worth Calculator – A calculator to help you take stock of your current financial situation by MoneySense

- Personal Net Worth Statement – A detailed excel sheet to track your personal net worth by Investment Moats

- WealthPlus Net Worth – An app that tracks your net worth over time

So What’s My Net Worth Telling Me?

There are usually a few questions that pop up after the calculation of your net worth.

What If I Have A Negative Net Worth?

Fresh graduates and young Singaporeans with a good amount of study loans or mortgage loan have a high chance of having a negative net worth.

Relax. This is normal.

It simply shows that you have yet to earn enough to overcome your debt. The situation will improve when you start clearing your liabilities slowly.

However! If it’s credit card debt or debts that are a huge contributing factor to your liabilities, then you should be very concerned. And need to work on reducing it ASAP!

How Does My Net Worth Affect Inform My Personal Finance Decisions?

- Net worth is more important than you think when it comes to retirement

- Components of your net worth will eventually be used as your living expenses when you retire

- Whatever you leave behind will be passed down to your next generation if you want to do so

If you have questions like, “Should you calculate your net worth before investing?” or any other personal finance-related questions which you need help with, why not check out our Seedly Community?

You can tap on the knowledge and expertise of our community members and even help answer questions in areas which you’re familiar with!

Advertisement