NTUC Care Fund (Special Assistance) 2022: Eligible NTUC Members Can Apply To Receive Up to $150 in Cash

●

For the past few months, I have noticed that everything around me seems to be getting more expensive.

For example, I saw the price of the Bak Chor Mee near my office go up from $3.50 a bowl to $5 a bowl.

One possible explanation for this is inflation:

Overall inflation or the Consumer Price Index (CPI) inflation increased to 6.7% year on year (y-o-y) in June 2022, up from 5.6% y-o-y in May 2022.

Whereas the Monetary Authority of Singapore (MAS) Core Inflation (excludes accommodation and private transport costs) in June 2022 soared to 4.4% y-o-y, up from 3.6% y-o-y in May 2022, the highest it has been since November 2008.

In an interview with the Straits Times, Deputy Prime Minister Lawrence Wong stated that:

inflation may well settle at a higher rate, especially since geopolitical uncertainty, persistent supply chain difficulties and rising costs of the green transition do not look to be dissipating any time in the near future.

But, most groups would experience inflation differently.

The rich in Singapore would probably survive and have to do a bit of belt-tightening to cope with increasing prices.

But those in the lower income group might not be doing so well.

A recent DBS study analysed about 1.2 million of its customers’ bank balances and found that:

Customers earning less than $2,500 a month saw income grow by only 2.5 per cent between May 2021 and May 2022. Also, this group saw that their expenses grew almost six times faster than their income (i.e. 15%),.

In other words, the most vulnerable groups in our society are facing the most trouble with high inflation.

But, there is a bit of relief for this group on the way.

The National Trades Union Congress (NTUC) will be providing those in the lower income group a bit of financial support with the NTUC Care Fund (Special Assistance) programme.

This new $3.66 million initiative will benefit 28,000 NTUC members belonging to the lower income groups.

Here’s all you need to know!

TL;DR: NTUC Care Fund Application (Special Assistance) — Financial Assistance in Singapore For Low Income Singapore Union Members

What is the NTUC Care Fund (Special Assistance) + What Is Ntuc U Care Fund?

For context, the NTUC Care Fund (Special Assistance) provides one-time cash relief to ease their financial burden on the rising cost of living for daily essentials.

This programme’s funding stems from the NTUC U Care Fund, which was established to compile the trade union centre’s fund-raising efforts.

Since its establishment in 2019, the NTUC U Care fund has given out a little over $110 million to workers.

Who is Eligible for NTUC Care Fund (Special Assistance)? Spoiler Alert: You Need an NTUC Membership

To apply, you will need to be a union member for at least six months prior to the point of application, and your membership cannot be in arrears.

E.g. If you applied tomorrow (22 August 2022), you would need to have been a union member since 22 February 2022.

FYI: To be a Union member, you need to be 16 years old and above with a valid NRIC/FIN number. Do note that personnel from the Singapore Police Force, Singapore Prison Service, Civil Defence Force, Narcotics Service, Singapore Armed Forces, or Auxiliary Police bodies (Certis Cisco, Aetos and SATS) and foreign domestic workers are not eligible for the membership. Not to mention that the NTUC Membership fee is $117 per annum ($9 per month from January -November & $18 in December).

Also, here are the additional eligibility criteria for the Programme:

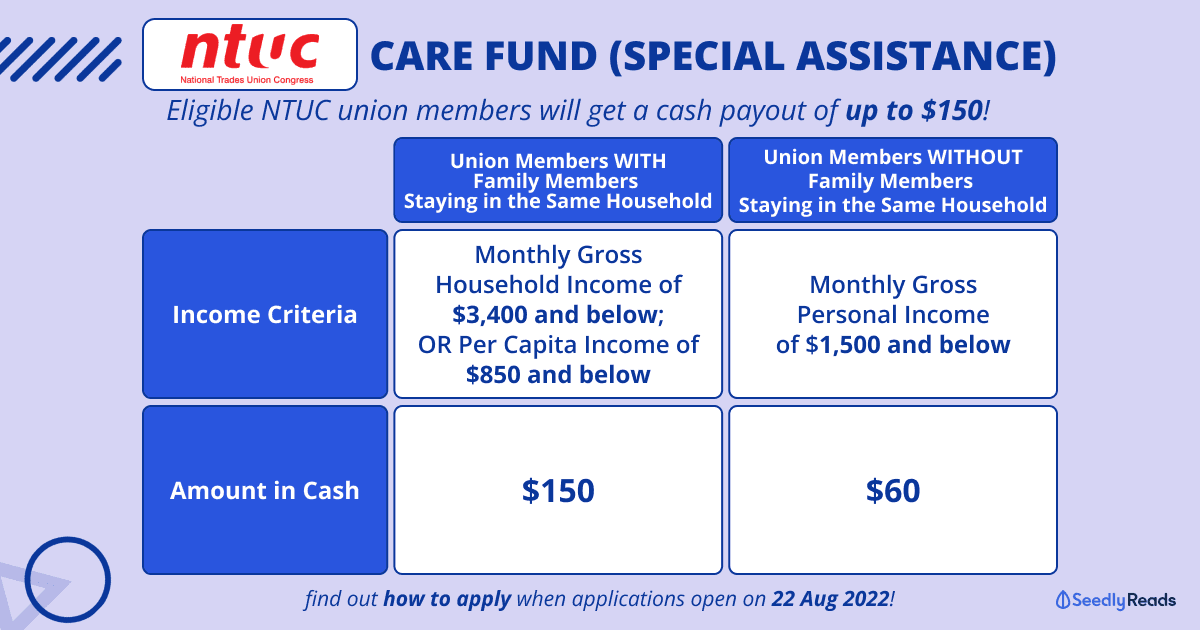

| Details | Members WITH family members staying in the same household in Singapore* | Members WITHOUT family members staying in the same household in Singapore* |

| Income Criteria | Monthly Gross Household Income** of $3,400 and below; OR Per Capita Income of $850 and below |

Monthly Gross Personal Income** of $1,500 and below |

| Amount in Cash | $150 | $60 |

*Applicant’s immediate family members living in the same household in Singapore, excluding domestic helper.

**Gross income is defined as all income derived from employment/business, inclusive of overtime and allowances.

NTUC Care Fund Special Assistance Documents Required

According to NTUC, here are the documents required to apply for the NTUC Care Fund (Special Assistance) cash payout:

| If Employed | |

| Member with a Singpass account – automatic retrieval of the following information via Myinfo with consent | CPF Contribution History (past 15 months) |

| Member without a Singpass account– manually upload the following information | Notice of Assessment from IRAS (for Year of Assessment 2022) |

| If Self-employed | |

|

Member with a Singpass account – automatic retrieval of the following information via Myinfo with consent

|

CPF Contribution History (past 15 months) |

| Notice of Assessment from IRAS (for Year of Assessment 2022) | |

|

Member without a Singpass account – manually upload the following information

|

If your Annual Trade Income is less than $6,000 Copy of acknowledgement after submitting IRAS Form 144 (for Work Year 2021) |

| If your Annual Trade Income is $6,000 and above Copy of Notice Assessment from IRAS (for Year of Assessment 2022) |

|

NTUC Care Fund Application: How Do I Apply for NTUC Care Fund?

Eligible union members can apply for the NTUC Care Fund (Special Assistance) programme through the new OneCare portal (one-stop system for U Care) from tomorrow (22 August 2022) to Friday (30 September 2022).

Note that you will need a valid email address and mobile number to register for an NTUC Linkpass account.

Successful applicants will be notified by email and receive their one-time cash relief via bank transfer.

All cash pay-outs, including those made through appeals, will be disbursed within 30 days of application.

Related Articles:

Advertisement