NTUC Income Capital Plus: Short-Term Endowment Plan with 2.13% p.a. Guaranteed Returns

NTUC Capital Plus

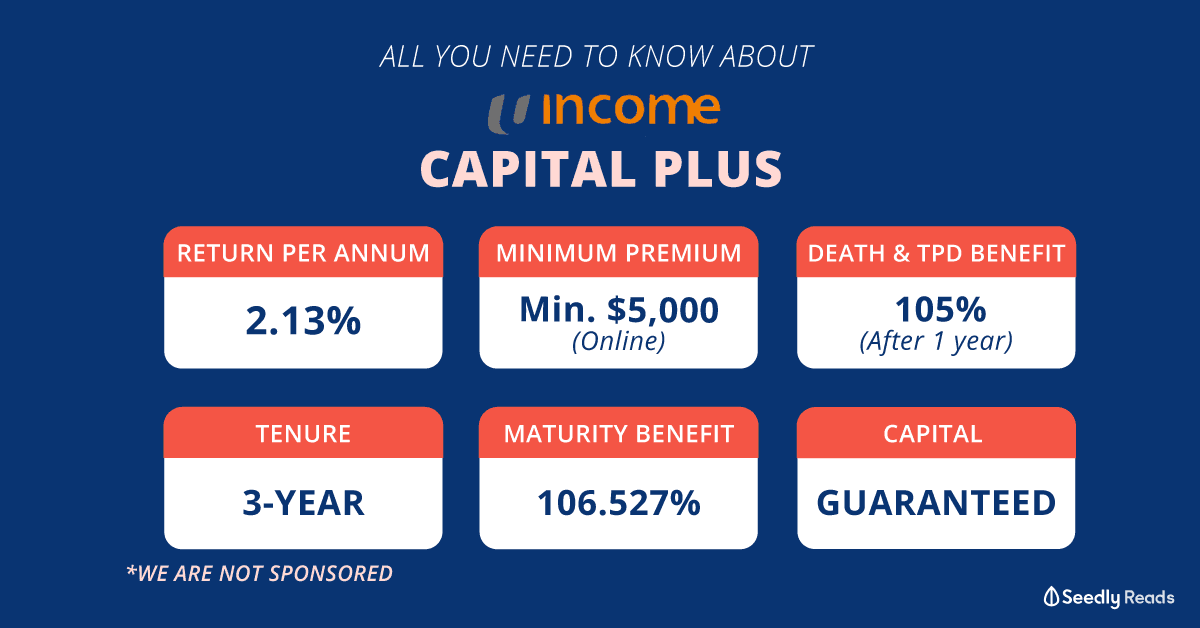

NTUC Income just launched Capital Plus, its new online endowment plan offering a guaranteed return of 2.13% per annum. There is a slight decrease in returns as compared to the previous Capital Plus tranche at 2.30%.

Pretty competitive, I’d say, since your fixed deposits only give you up to 2.1% p.a. even with their promotional rates. On top of that, with the current stock market situation, this might be a good alternative to your investments.

But let’s not digress, here’s all you need to know about Capital Plus.

Disclaimer: This is not a sponsored post. All opinions are our own, we just like to help you!

Capital Plus with 2.13% Returns

1. Minimum Premium Of $5,000 For Online Purchase

Previously available through advisers only, you can now invest in Capital Plus online with just $5,000.

The maximum for online application is capped at $100,000.

However, if you still prefer investing in Capital Plus through an adviser, the minimum single premium remains at $20,000.

2. Short Term Investment With 3-Year Tenure

As a short-term investment, your money can be redirected again after your 3-year tenure.

3. Death Benefit & Total and Permanent Disability Benefit

Even though it’s a short investment, this endowment plan also covers death and total and permanent disability (TPD) before age 70.

| Time the Insured Event Happens | Benefit |

|---|---|

| Within one year from the cover start date | The net single premium |

| After one year from the cover start date | 105% of the net single premium |

4. Invest with eNETs, Cash or SRS Funds

Good news guys!

Applying online makes it rather simple since you can simply use eNETS for your payment. Do ensure that your eNETS limit is updated before applying using eNETS though!

Otherwise, if you’re investing through an adviser, you can choose to use either cash or your Supplementary Retirement Scheme funds to invest in this plan. Ensure that your SRS contribution does not exceed your balance contribution limit available.

Do note that the maximum yearly contribution limit for SRS is $15,300 for Singapore citizens and PRs.

How Capital Plus Grows Your Wealth?

I know what you’re thinking, you don’t have $100,000 sitting around somewhere, neither do I.

Setting aside $5,000 for 3 years? I think I can live with that.

With the guaranteed maturity benefit of 106.53%, you will receive your total guaranteed maturity benefit of $326.50 provided you hold on until the end of the 3-year policy term.

Psyched about Capital Plus’ 2.13% Returns?

Pros Of NTUC Income Capital Plus:

- Guaranteed returns

- Capital Guaranteed upon 3-year maturity

- Hassle-free online application with no medical check-up required

Cons Of NTUC Income Capital Plus:

Similar to other endowment plans, NTUC Income Capital Plus requires you to lock in your money for a period of time, albeit being a short time period.

If for some reason, you need to cancel your Capital Plus plan before the end of the policy term, your surrender value will be lower than your initial premium.

| End of Policy Year | Total Premiums Paid to Date | Death Benefit (Guaranteed) | Surrender Value (Guaranted) |

|---|---|---|---|

| 1 | 1,000 | 1,000 | 920.70 |

| 2 | 1,000 | 1,050 | 941.90 |

| 3 | 1,000 | 1,050 | 963.55 |

Remember, you know your own situation the best, so plan ahead and make sure your cash flow works!

Psyched about Capital Plus’ 2.13% Returns?

Should I Invest In NTUC Income Capital Plus?

If you were previously looking at low-risk investments such as Singapore Savings Bonds and Fixed Deposits, you can now add Capital Plus into your list for consideration.

But if you foresee yourself needing your capital in the next 3 years, a word of advice, this might not be as suitable since your money will be locked in for the policy term.

I’m sure you’ll know this by now, but always do your own homework, even after reading our articles!

Advertisement