OCBC 360 Account February 2021 Revision: Will This Round of Changes Benefit Me?

OCBC 360: Revision of Interest Rates on 360 Account From 1 Feb 2021

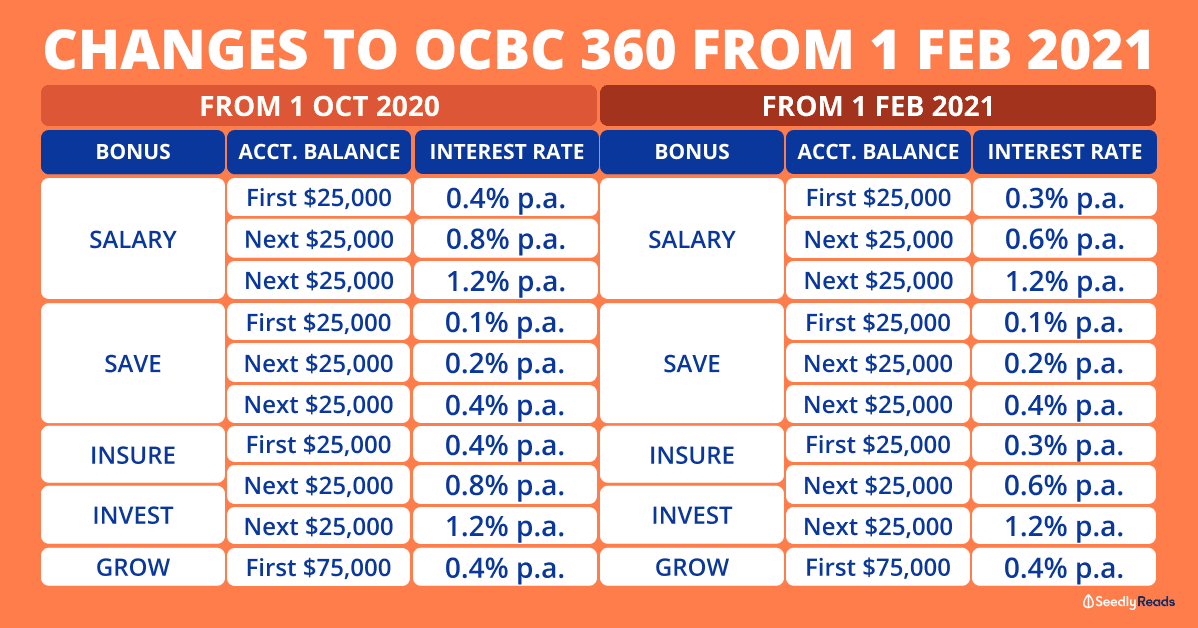

Unfortunately, OCBC will be changing the interest rate for its OCBC 360 savings account yet again in 2021!

After the latest interest rate changes implemented on 1 October 2020; OCBC will be reducing the interest rates for OCBC 360 on 1 February 2021.

This comes as no surprise after the Federal Reserve cut US interest rates near zero in March to mitigate the economic impact of the COVID-19 pandemic.

We can only mentally brace ourselves for these cuts.

Enough with the bad news already!

TL;DR: OCBC 360 Account Changes From 1 February 2021

Latest Revision of Interest Rates for OCBC 360 Account

This round of interest rates changes will take effect from 1 February 2021.

| Requirements | From 1 October 2020 | Requirements | From 1 February 2021 | Changes |

|---|---|---|---|---|

| Salary Bonus (Credit at least $1,800 through GIRO) | First $25,000: 0.4% p.a. | Salary Bonus (Credit at least $1,800 through GIRO) | First $25,000: 0.3% p.a. | -0.1% |

| Next $25,000: 0.8% p.a. | Next $25,000: 0.6% p.a. | -0.2% | ||

| Next $25,000: 1.2% p.a. | Next $25,000: 1.2% p.a. | No change | ||

| Save Bonus (Increase your average daily balance by at least $500 from the previous month) | First $25,000: 0.1% p.a. | Save Bonus (Increase your average daily balance by at least $500 from the previous month) | First $25,000: 0.1% p.a. | No change |

| Next $25,000: 0.2% p.a. | Next $25,000: 0.2% p.a. |

|||

| Next $25,000: 0.4% p.a. | Next $25,000: 0.4% p.a. |

|||

| Insure Bonus (Insure with OCBC Bank and earn this bonus interest for 12 months) | First $25,000: 0.4% p.a. | Insure Bonus (Insure with OCBC Bank and earn this bonus interest for 12 months) | First $25,000: 0.3% p.a. | -0.1% |

| Next $25,000: 0.8% p.a. | Next $25,000: 0.6% p.a. | -0.2% | ||

| Next $25,000: 1.2% p.a. | Next $25,000: 1.2% p.a. | No change | ||

| Invest Bonus (Invest with OCBC Bank and earn this bonus interest for 12 months) | First $25,000: 0.4% p.a. | Invest Bonus (Invest with OCBC Bank and earn this bonus interest for 12 months) | First $25,000: 0.3% p.a. | -0.1% |

| Next $25,000: 0.8% p.a. | Next $25,000: 0.6% p.a. | -0.2% | ||

| Next $25,000: 1.2% p.a. | Next $25,000: 1.2% p.a. | No change | ||

| Grow Bonus (Maintain an average daily balance of at least $200,000 to earn this extra bonus each month) | First $75,000: 0.4% p.a. | Grow Bonus (Maintain an average daily balance of at least $200,000 to earn this extra bonus on the first $75,000 in your account each month) | First $75,000: 0.4% p.a. | No change |

Information accurate as of 3 January 2021.

If you are keeping score, OCBC changed the interest rates for the OCBC 360 savings account a total of three times in 2020!

Sadly, it is more of the same for 2021, as OCBC will be revising the interest rates for their OCBC 360 yet again.

But, you can still earn bonus interest on the first $75,000 of your account balance if you fulfil the requirements across any or all of these categories:

OCBC 360 Salary Bonus:

Credit your salary of at least S$1,800 through GIRO.

OCBC 360 Save Bonus:

Increase your average daily balance by at least $500 from the previous month.

Insure Bonus:

Insure in eligible OCBC wealth products to earn this bonus interest for 12 months.

Purchase any new eligible financial product from OCBC of at least the minimum amount as follows:

- Single-Premium Insurance: $20,000

Invest Bonus:

Invest in eligible OCBC wealth products to earn this bonus interest for 12 months.

Purchase any new eligible financial product from OCBC of at least the minimum amount as follows:

-

Structured deposits: $20,000

-

Bonds and structured products: $200,000

Grow Bonus:

Maintain an average daily balance of at least $200,000 to earn this extra bonus each month.

However, do note that you will still earn a base interest of 0.05 per cent per annum (p.a.) on your entire account balance regardless of whether you fulfil the above categories.

OCBC 360 Review: Is It Still Worth Opening an OCBC 360 Savings Account After 1 February 2021?

To answer this question, we will break down the changes taking place from 1 February 2021 into positives and negatives.

Positives

Unfortunately, there are no positives for this round of changes as interest rates are being cut.

Perhaps we can take solace because the cuts are not as bad this time around as the Save and Grow bonus categories are not affected.

Also, once the interest situation improves, OCBC is likely to adjust their product offerings accordingly.

Negatives

The upcoming changes taking place from 1 February 2021 represent a reduction of interest rates for the Salary, Insure and Invest bonus categories.

However, these cuts will only affect you if you have less than $50,000 in your OCBC 360 account.

If more than $50,000 in your account, you will still enjoy an unchanged 1.2 per cent p.a. interest rate for each of the categories you can fulfil.

Hence, if we solely focused on the interest rates alone, the pros of OCBC 360 savings account are limited.

We think that OCBC will not be the only bank reducing their interest rate again in 2021.

So do keep track of updates from the rest of banks and their savings accounts and only then can you decide on the best savings account to get.

For now, we can only adopt a “wait and see” approach.

If you are unsure if the OCBC 360 savings account is still the best savings account out there for you, you can always use our FREE savings accounts calculator to optimise the amount of interest you can get based on your saving and spending habits.

Singapore Savings Accounts Alternatives

But if you’re looking for similar options which could possibly give you a better rate of return for your money.

You might want to consider an insurance savings plan.

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

Advertisement