My Parents' Retirement: What Can I Do To Protect Them, Their Future and My Future?

Only 15% of youths in Singapore believe that their parents have adequately planned for their retirement that they need not worry about their parents during their golden years.

Us, as Millenials, will undeniably be the new Sandwiched Generation the moment we start being parents ourselves. And of course, like everything, with proper planning we will be in control of our situations better. Zero preparation equals disaster, period.

Yes, I know that I am part of the 75%, and I am my parents’ retirement plan. So while remaining objective instead of blaming them for being “The Worst Parents in The World” (according to the NTUC Income’s advertisement).

What can I do to help protect their future as much as protecting mine?

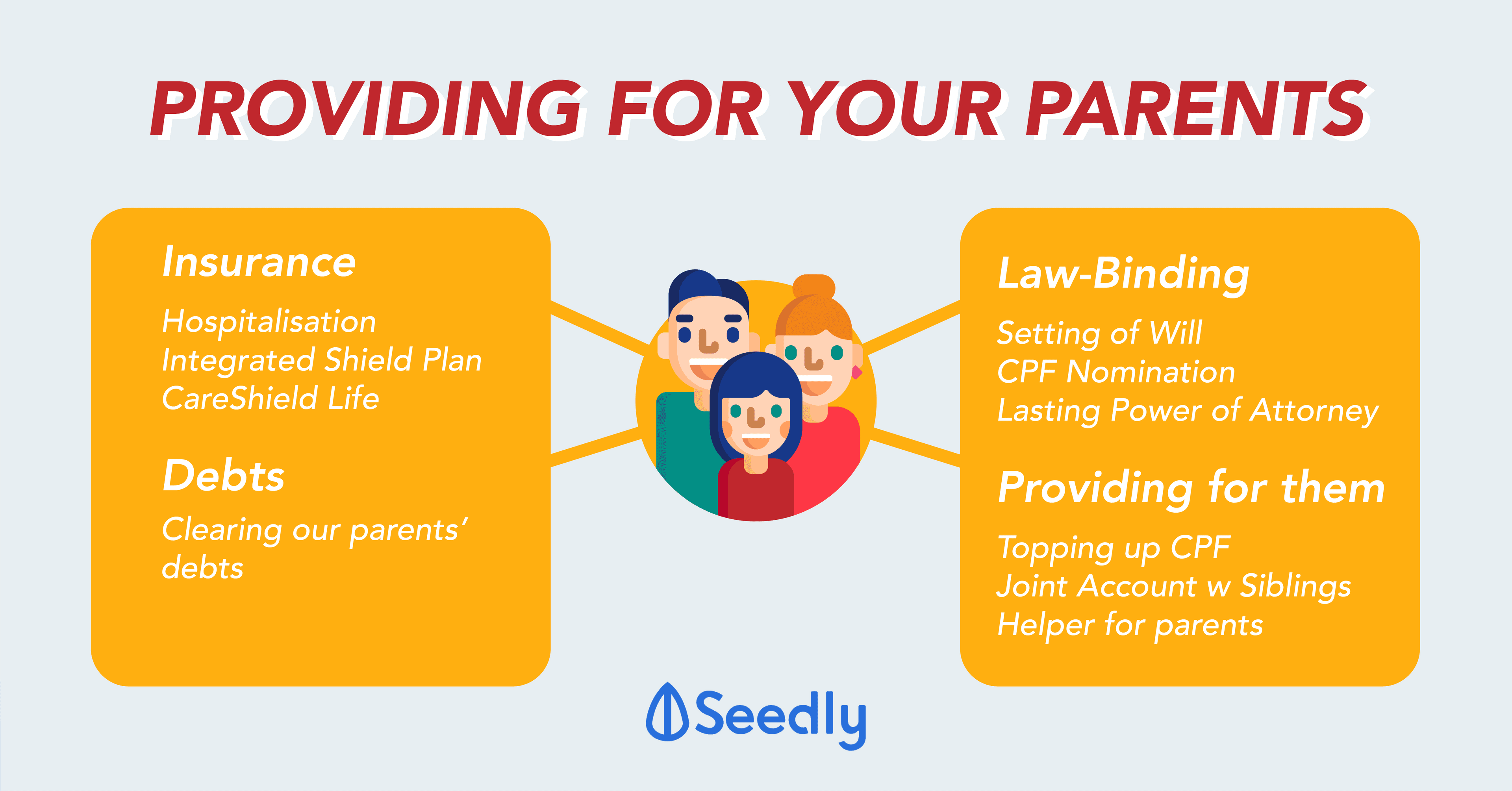

TL;DR – Some things you can look to do

- Get insurance for your parents – Hospitalisation Plans, Disability Income;

- The setting of will, CPF Nomination and Appointing a lasting power of attorney;

- Topping up their CPF to provide a form of retirement income;

- Having a joint account with your siblings for your parents’ future expenses;

- Plan for a helper to take care of your parents (last resort).

Insurance for Our Parents

Before I go on I would like to say that, as much as we want to protect our parents’, getting insurance for our parents’ at their current age would be a huge and costly commitment.

Do consider your affordability before actually committing, it is important to find a financial advisor that you could trust to give you proper advice for your current situation.

Hearing thoughts and opinions from people’s experience might help you see your situation clearly and make better decisions, feel free to ask our Community any questions and they would love to share with you their personal experience.

Hospitalisation (MOST IMPT!) – Integrated Shield Plans

I feel having a hospitalisation plan for our parents is most important as hospital bills can get exorbitant, and there is no certainty on the frequency of hospital visits.

ElderShield / CareShield Life

Both provide income in case of a disability, which will ease the burden on you if you are supporting your parents.

If your parents are neither subscribed to ElderShield or CareShield Life, weigh the pros and cons for opting into ElderShield or upgrading to CareShield Life.

Preparing For Our Parents’ Future (For the After-Retirement Stage)

As Asians, talking about the future after retirement can get a bit uncomfortable to do so. But objectivity, when the time comes, it is always better to have things legally prepared to not incur additional costs.

Some things we can help our parents’ with are:

- CPF Nomination

- Setting of Will

- Appointing a Lasting Power of Attorney

- Clearing My Parents’ Debts

Setting of Will

Settling one’s estate and assets privately by writing a will would be faster compared to going according to the Intestate Succession Act or the Inheritance Certificate (for Muslims). Having a will is going to be less emotional for me and my family as everything is prepped beforehand according to the deceased choices.

CPF Nomination

By doing a CPF nomination, my parents would get to choose how their CPF savings get distributed upon their demise. Which also saves a lot of headaches. Some things that they can choose would be:

- Who will be able to receive their CPF savings;

- How much each one should receive.

Without a CPF nomination, the distribution of assets will also go according to the Intestate Succession Act or the Interitance Certificate (for Muslims) which may or may not be according to what my parents’ would like.

Lasting Power of Attorney (LPA)

What is the LPA?

LPA is a legal document that allows you to choose one person to make the decisions for you, should you lose your mental capacity or become unable to think on your own. For example, if you developed dementia.

Application Fees for LPA Waived

The application fees for LPA has been waived for 2 years as to encourage people to get their LPA done. So do use this opportunity to convince your parents to do up their LPA.

Read More: How Much Does It Cost To Hold A Funeral Service In Singapore?

Our Parents’ Debts

Personally, I thought I would be liable for the debts of my parents’ upon their dismiss, pretty sure most of us think the same too. According to the team at Singapore Legal Advice, we are not legally responsible. However, there are a few exceptions:

- Credit card debts

- Loans

- Taxes

- Debt incurred illegally

Which is still pretty much majority of debts one could possibly incur (sorry, no good news). Thus, it is important that we manage our expenses and prepare ourselves for the worst-case scenario.

Providing for Our Parents’ in Their Golden Years

Since I am my parents’ retirement plan, I needed to look for ways that I can provide for my parents’ in their golden years.

Topping Up Our Parents’ CPF

Topping up CPF is definitely not a popular opinion because the idea of having your money locked in stirs fear into people. However, by doing so, you get to:

- Get tax relief same as the cash amount you have topped up (capped at S$7,000);

- Allow the money to compound 4% in the CPF Special Account;

- Help them achieve retirement sum to receive CPF Life monthly payouts;

Views on CPF is never unanimous but it depends on how you view it and your parents’ current situation.

Joint Account with Your Siblings

You have heard of parents keeping a separate bank account for their children’s education. Same logic, but this time for our parents’ future expenses ranging from medical bills to

It is up to you and your siblings if you would like to invest that savings to earn a better return than keeping it in an ordinary savings account. However, I would not recommend investing in high-risk investments as we would not know when we would need the money.

Plan for Someone to Take Care of Your Parents

If necessary, plan for a helper to take care of your parents if no one else is able to look after them. It would be best if you are able to support without looking for external help but we all understand sometimes our circumstances would not allow that.

Work Within Your Means – Stop and Think

This list is not exhaustive and there are a million and one ways we can provide for our parents. It is okay if you are unable to do all of the above, do not overstretch yourself to provide for your parents’ future at the expense of your own.

The idea is minimising unnecessary expenses on yourself for your own future and your children’s future.

If you would like to hear what your peers have experienced and done in their situation, we have an open community for you to hear from different perspectives. Check out our blog for more unbiased opinions on your personal finance journey.

Share with us if you have any experience with these or even a better alternative by commenting below! Also, don’t forget to share it with your friends who might need this!

I’ll see you in the next one, and until then, may the Personal Finance force be with you!

All Gifs Credit: Giphy

Advertisement