3 Things to Like About Parkway Life REIT's (SGX: C2PU) 2020 Earnings

Sudhan P

Sudhan P●

Parkway Life REIT (SGX: C2PU) is one of Asia’s largest listed healthcare real estate investment trusts (REITs).

It has 54 properties in total in Singapore, Japan, and Malaysia.

In our country, the healthcare REIT has ownership over Mount Elizabeth Hospital, Gleneagles Hospital, and Parkway East Hospital.

Parkway Life REIT just posted an uninterrupted distribution per unit (DPU) growth for its financial year ended 31 December 2020.

Let’s find out more about the REIT’s latest earnings right here!

1. Uninterrupted DPU Growth Since IPO

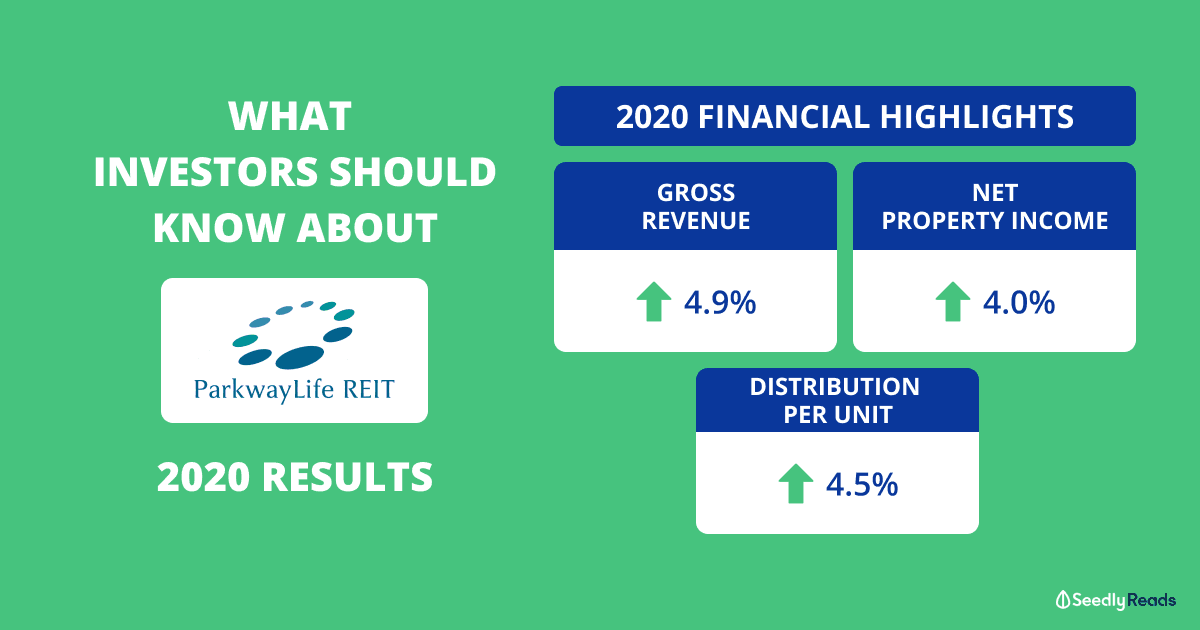

For 2020, Parkway Life REIT’s gross revenue grew around 5% year-on-year to S$120.9 million.

The growth was largely due to revenue contribution from Japanese property acquisitions in December 2019 and 2020, higher rent from Singapore properties, as well as the appreciation of Japanese Yen.

Meanwhile, the REIT’s net property income rose 4% to S$112.5 million on the back of rent contribution from the properties acquired and rental reversion of Singapore hospitals by 1.17%.

The rentals from Parkway Life REIT’s Singapore assets include a built-in rental escalation, based on the consumer price index (CPI), a measure of inflation.

This feature guarantees a 1% growth in minimum rental each year.

With distributable income to unitholders growing, DPU for 2020 increased by almost 5% to 13.79 Singapore cents, up from 13.19 cents in 2019.

The DPU increase marks the 13th year of uninterrupted growth since Parkway Life REIT’s initial public offering (IPO) in 2007.

Stable DPU growth is what REIT investors look out for and Parkway Life REIT has certainly delivered on this front.

2. Balance Sheet Remains Strong

As of 31 December 2020, Parkway Life REIT’s gearing ratio was 38.5%, up from 37.1% exactly a year back.

However, the latest ratio is still within the current regulatory gearing limit of 50% and the previous limit of 45%.

Parkway Life REIT’s interest coverage ratio, another measure of financial strength, was also high at 18.1x, a vast improvement from 14.1x at the end of 2019.

Another thing to like is the REIT’s long weighted average debt maturity of 3.5 years, with no long-term debt refinancing need till 2022.

3. Room to Grow Further

According to Credit Suisse, the world’s senior population will double to more than two billion by 2050.

And it is estimated that two-thirds of the incremental number of seniors will be living in Asia by that year, more than the contribution from any other parts of the world.

With a focus in Asia, Parkway Life REIT is poised to benefit from this megatrend, as alluded by Yong Yean Chau, chief executive of the REIT’s manager:

“The healthcare industry continues to remain critically essential in a rapidly ageing population and with greater demand for better quality healthcare and global aged care services. PLife REIT’s portfolio of 54 high-quality healthcare and healthcare-related assets places it in a good position to benefit from the resilient growth of the healthcare industry in the Asia Pacific region.”

At Parkway Life REIT’s current unit price of S$4.04, it has a price-to-book ratio of 2.1x and a distribution yield of 3.4%.

Have Burning Questions Surrounding The Stock Market?

You can participate in the lively discussion regarding stocks here at Seedly and get your questions answered right away!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the company mentioned.

Advertisement