Best Ways For Repaying Debts: Debt Consolidation Plan, Debt Repayment Scheme & Debt Management Programme

Let’s face it, most of us have some debts at a certain point in our lives.

It could be when you’re a student, or… you’re a homeowner and you’ve taken up a housing loan.

We’re living in a messy world where prices are rising rapidly, and we definitely should try not to live on the paycheck because if not, would we ever have enough for our later years?

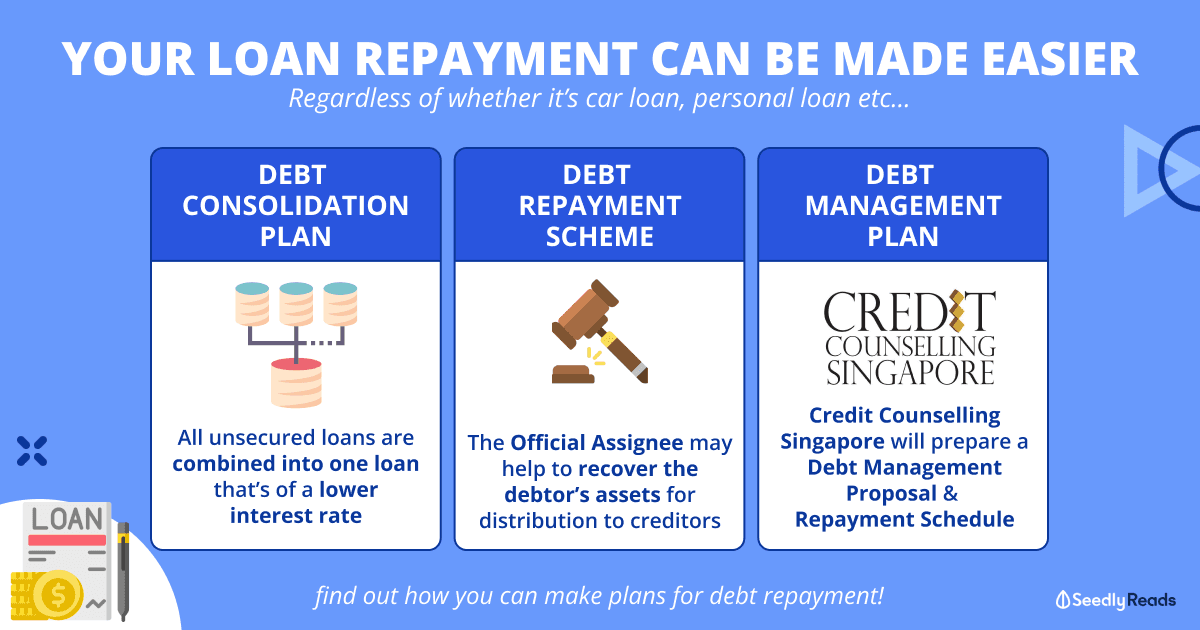

Regardless of your reason for taking up a loan, here’re three ways to help you clear your debt as soon as you can!

TL;DR: What Is Debt Repayment And How Can I Pay Off My Debts Faster?

This is a summary of the pros and cons of the debt repayment methods:

| Pros | Cons | |

|---|---|---|

| Debt Consolidation Plan | Debts are paid off in monthly payments A lower interest rate with the right plan and if your credit score is ideal | Not sticking to the payment plan would cause a financial burden e.g., an early repayment fee, late fees and a lower credit score |

| Debt Management Programme | Realistic monthly budget with a financial goal to pay off debt Timely payments will improve credit score | Some creditors may not be involved in this programme |

| Debt Repayment Schemes | The final option for those approaching bankruptcy | Unable to apply on your own, only the court can refer The scheme is not free |

Teleport here:

- Definition of good and bad debt

- Unsecured and secured loans

- What is debt repayment?

- Debt Consolidation Plan by financial institutions

- Court of Singapore ordered Debt Repayment Scheme

- Debt Management Programme by Credit Counselling Singapore

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised financial advice. Readers should always do their own due diligence and consider their financial goals before committing to any financial product and consult their financial advisor before making any decisions.

Good Debt vs Bad Debt

If you are just starting out your financial journey or your first time learning about debt, you may be surprised that not all debt is bad but how can you tell the difference between good debt and bad debt?

Good Debt

Basically, good debt is anything that increases your future value or net worth.

Debt such as taking out a mortgage or taking a loan for education is considered good debt, this is because although it may cost you money now, it will benefit you in the long run.

Bad Debt

Bad debt is the complete opposite of good debt, it is something that decreases in value after it has been bought.

Debts such as credit card and car loans will not increase your financial value in the future and your aim is to clear your bad debts first.

Fortunately for you, there are a few plans available out there to help when you find yourself in bad debt!

Unsecured Loans & Secured Loans

An Unsecured loan means that you are not required to put up any collateral (e.g., house, car) to borrow the money. It is definitely NOT about borrowing from unlicensed moneylenders such as loan sharks.

On the flip side, a secured loan is backed by something you own, and you can lose the asset if you default.

Regardless of whether the loan is an unsecured or secured loan, it is important to know the bank cannot hold you responsible for not repaying and writing off the debt as a loss.

This also means that the borrower is in default and there are severe consequences.

When you have defaulted on a loan, this affects your employment, access to money from your accounts, go through legal proceedings when initiated by the lender, and may potentially experience limited to no access to loans such as education, housing etc., due to poor credit record.

Some organisations require a yearly declaration of your financial status (at least it’s so in the Civil Service), so you’ll be required to declare your financial status.

Read more:

- Best Personal Loan Rates in Singapore For April 2022

- Which To Choose: Credit Card vs Personal Loan

- Switching From HDB Loan to Bank Loan to Take Advantage of Low-Interest Rate? Here Are 5 Practical Things to Consider First

What is Debt Repayment?

Debt repayment refers to paying back the money you borrowed from a lender, including both the principal amount and interest.

Car loans, mortgages, student loans, and credit card debt are examples of common debts that many individuals must repay.

The failure to make timely payments on any debts can leave a trail of credit problems in its wake, including bankruptcy, higher late payment fees, and adverse lowering of your credit scores.

Is It Better To Pay Off Debt All at Once or Slowly?

It depends. Every loan has its repayment terms and conditions, with some imposing an early repayment penalty.

So, read the terms carefully before taking up one!

What Should I Pay First When Paying Off Debt?

Start with the most expensive loan first, i.e. the one with the highest interest rate.

This is because you can reduce the overall amount of interest you need to pay, hence decreasing your overall debt.

If you have trouble paying the full amount, pay it off in parts.

There are in fact, three ways to pay back loans and you should check them out below.

What Is a Credit Bureau Report?

Your credit report gives you and the lenders a snapshot or idea of your ability to repay credit.

In Singapore, the Credit Bureau (Singapore) CBS keeps credit reports for consumers in Singapore, and they partner with The Association of Banks in Singapore (ABS) and Infocredit Holdings Pte Ltd, which represent the majority of the retail banks and major financial institutions in Singapore to compile credit reports.

Your credit report matters as it affects your loan quantum and how much the financial institution is willing to lend you.

Debt Consolidation Plan

Just as the name says, it’s a program that combines your unsecured loans/debts across all financial institutions, into a single loan by one institution with a lower interest rate. This helps to reduce your monthly debt repayment obligations.

The program was created by the Association of Banks in Singapore to help Singaporeans and Permanent Residents with multiple high-interest rate and unsecured debts who are struggling to repay their creditors.

You can apply for this at any of the 14 participating financial institutions. However, these categories of unsecured credit facilities are excluded from the DCP:

- Credit facilities are granted for businesses and business purposes

- Education loans

- Joint accounts

- Medical loans

- Renovation loans

You will also not be able to do a partial consolidation of the outstanding amount you owe as the DCP requires complete repayment of the total outstanding amounts you owe with a single financial institution.

Once your DCP is approved, you will just have to repay the single DCP loan via monthly instalments for a time period of up to 10 years.

Eligibility of Debt Consolidation Plan

To be eligible for the Debt Consolidation Plan, you will have to:

- Be a Singaporean Citizen or Permanent Resident

- Earn between $20,000 and $120,000 per annum

- Have interest-bearing unsecured debt on all credit cards exceeding 12 times your monthly income

Note: Some financial institutions may look at your Net Personal Assets, which refers to the total value of an individual’s assets less their liabilities.

Will The Debt Consolidation Amount Be Deposited Into My Bank Account?

No!

The amount is disbursed directly to the respective financial institutions for which you have outstanding unsecured credit facilities.

Note that all your existing unsecured credit facilities will be closed or suspended once your DCP application is approved.

Instead, you’ll be given a revolving credit facility with a credit limit of 1x your monthly income when you apply for the DCP.

You are free to use the money that you borrowed however you wish, but, there’ll be fees charged by the participating FI for use of the revolving credit facility according to their terms and conditions – you can choose not to use it at all if there is no need to.

Can Debt Consolidation Help You Save?

You might.

One of the benefits of a Debt Consolidation Plan is that you can pay a lower interest rate.

For example, a credit card interest rate is typically around 25%, which is quite significant, while the effective interest rate of a Debt Consolidation Plan can range between 6.38% and 8.36%.

With a lower interest rate through such plans, you might be less burdened by the high-interest debt.

Can Debt Consolidation Solve Your Debt Issues?

Unfortunately, this plan does not guarantee that you won’t go into debt again.

Sometimes, it boils down to your personal expenses, habits and whether you are living beyond your means.

Besides, if you don’t already have an emergency fund set aside, you can start considering having one so that you don’t incur more debts when surprises happen.

Debt Repayment Scheme

This is a pre-bankruptcy scheme that aims to have a win-win situation for both debtors and creditors.

This program is intended for people who are in a precarious financial situation where they might file for bankruptcy.

When you have unsecured debts not exceeding $150,000, the High Court of Singapore may refer your application to declare bankruptcy to the Insolvency Office for the Official Assignee (OA) to look further into your eligibility.

The OA is tasked to investigate the conduct of the debtor and help to recover the debtor’s assets for distribution to creditors.

This scheme prevents unsecured creditors from proceeding with any legal action against the debtor unless given permission by the court.

Just like any debt repayment, you will be required to repay your debts within the stipulated five years and you will be released once the financial obligations under Debt Repayment Scheme have been met.

Do note that unlike Debt Consolidation Plan and Debt Management Programme where information is restricted to financial institutions when you’re on the Debt Repayment Scheme, it’ll be on public record.

Furthermore, there might be a small fee charged by the OA when dealing with your case:

- $300 as the first annual fee (for the first 2 years, and $350 for the subsequent 3 years)

- $250 for the meeting of creditors

- 1.5% of the total amount collected (as a collection fee to the OA)

- 3% of the amount distributed (as a fee to the OA for distributing dividends to creditors)

Debt Management Programme

Unlike Debt Consolidation Plan that’s offered by financial institutions, the Debt Management Programme is solely offered by Credit Counselling Singapore (CCS).

The organisation works with you on your budget and what needs to be set aside for your daily expenses.

The CCS will prepare a Debt Management Proposal and Repayment Schedule that will allow you to fully repay each creditor via monthly instalments, at a lower interest rate, and over a reasonable period until the obligations are fully settled.

All unsecured personal debts that have been accrued with banks and/or credit card issuers, including credit cards, credit lines or overdrafts, personal loans, renovation loans, and study loans, will be paid off as part of the payback arrangement.

Similarly, the proposed monthly instalment amounts will be within your ability to pay after deducting costs for you and your family and are based on the budget that you and the credit counsellor have created.

Similar to Debt Consolidation Plan, all your existing credit cards and unsecured facilities will be cancelled, and your credit report will be made available to Credit Bureau Singapore.

Only after you’ve completed your settlement with all creditors, your status will be removed and you can gradually improve your credit worthiness.

Which Method Would You Choose?

Be sure to always identify your good debts and your bad debts before approaching any financial institution.

When you have taken up a loan, you should draw up a budget, do a debt review and pay on time!

If you’re in doubt or have any questions, hop over to the Seedly Community and ask away!

Related Articles:

- Home Loans: Should You Lock In Current Rates Before They Rise Further

- Shorter vs Longer Home Loan Tenure: What Is Best For You?

- Protect Your Loved Ones From Home Loan Debt: Home Protection Scheme (HPS) Vs Private Mortgage Insurance vs Term Life Insurance

- Which To Choose: Credit Card vs Personal Loan

- How I Repaid My $28,000 Student Loan In Full After Graduation

Advertisement