Singapore is a vibrant and cosmopolitan city-state with a large number of foreigners residing in the country.

This means there’s a huge group of people who’re always remitting money back to their home countries, and we know that some of you might be losing out because of the foreign exchange rates, and these remittance services might not be instant in cases of emergencies.

But this is no longer something to fret over!

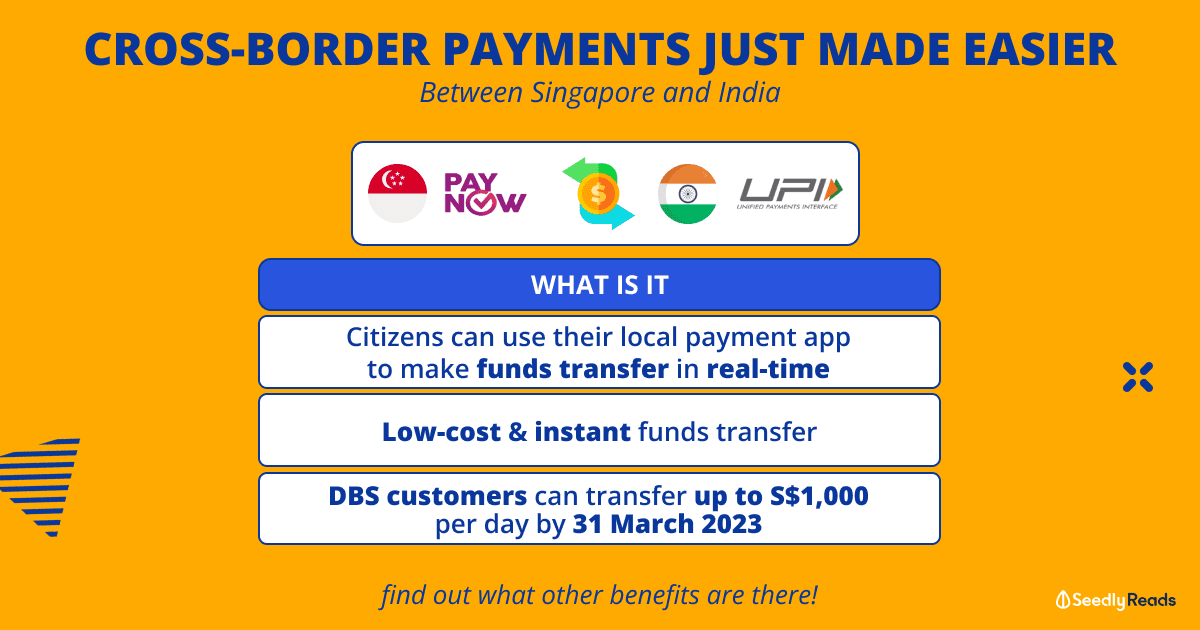

The Monetary Authority of Singapore (MAS) and the Reserve Bank of India have come together to link two amazing payment systems – Singapore’s PayNow and India’s Unified Payments Interface (UPI).

PayNow lets people transfer money using just a mobile number, and UPI is India’s real-time payment system.

This is great news for people who want to make cross-border payments between the two countries!

If you know someone who can benefit from this service, inform them now!

What Is PayNow-UPI Linkage?

For the uninitiated, PayNow is Singapore’s quick payment method that enables the instantaneous transfer of funds using a mobile phone.

With just a mobile number, users can send and receive funds from one bank or e-wallet account to another in Singapore which is enabled through participating banks and Non-Bank Financial Institutions.

The Unified Payments Interface (UPI) is its Indian counterpart.

The UPI is developed by the National Payments Corporation of India (NPCI), which supports both Person-to-Person and Person-to-Merchant payments through the creation of a Virtual Payment Address.

With the linkage between the two payment services, fund transfers can now be made from India to Singapore using mobile phone numbers, and vice versa using UPI Virtual Payment Address.

In Singapore, the service will be made available in phases to customers of DBS and the fintech company Liquid Group.

How Does This Work?

Citizens in each nation can use their local payment systems to send money to those in the foreign land in real-time.

The experience of making a PayNow transfer to a UPI Virtual Payment Address will be similar to that of a domestic transfer to a PayNow Virtual Payment Address.

For those who are unfamiliar, non-bank financial institutions in Singapore that are connected directly to PayNow and Fast And Secure Transfers (FAST) rely on Virtual Payment Addresses to send and receive real-time payments from users of other e-wallets or mobile banking applications.

By linking PayNow to India’s UPI, customers of the participating financial institutions can send and receive funds between bank accounts and e-wallets using their mobile number, UPI identity, or Virtual Payment Address.

In India, four banks – State Bank of India, Indian Overseas Bank, Indian Bank, and ICICI Bank – will facilitate both inward (receiving) and outward (sending) remittances, while Axis Bank and DBS India will facilitate inward remittances.

This service is available 24/7 and can be used by Indians using Google Pay, Paytm, and other similar digital payment systems to transfer money to people in Singapore.

For businesses and individuals alike, the process of cross-border retail payments and remittances that are directly between bank accounts or e-wallets is now faster and cheaper.

How Much Can You Remit or Transfer?

For a start, selected DBS customers will be able to transfer funds of up to S$200 per transaction, capped at S$500 per day.

By 31 March 2023, the service will be available to all DBS customers, who may transfer funds of up to S$1,000.

Who Will Benefit From PayNow-UPI Linkage?

As we move towards digitalising most services, this tie-up will certainly be beneficial to those who frequently remit between both countries, seeing that cross-border retail payments and remittances between India and Singapore currently amount to more than US$1 billion annually.

Previously, besides going to remittance houses such as banks, you can use multicurrency accounts such as Instarem and Wise Singapore.

But such services although convenient, come with a remittance or transfer fee, with the global average cost for sending money around 6.5%.

As such, services such as the DBS Remit Service allows people to send money overseas without incurring a transfer fee and saw a 25% increase in the total value of remittances made by migrant workers in 2022, compared to 2021.

The number of new customers who remitted funds to India via DBS Remit also jumped 63% over the same period.

Now that PayNow-UPI is available, the foreign exchange rates for DBS PayNow users will be the same as those offered on the DBS Remit service.

With that being said, this also eliminated the need to top-up e-wallets using debit or credit cards, which can be a challenge for lower-income migrant workers who might not be able to transfer money as they do not own these cards.

Saving time is a key benefit too. It typically takes about two days for transfers, but now transfers can be instant.

Hopefully, local businesses and Indian tourists in Singapore can now enjoy smoother fund transfers!

After all, this is not the first time Singapore has had a real-time payment partnership.

In April 2021, the PayNow service also tied up with Thailand’s PromptPay in April 2021. And since then, the number of transactions made between both sides has jumped from 12,000 that month to 51,000 currently, while the value has surged from $3 million to $14 million.

Closer to home, while the launch has not been announced, we can expect to transfer funds instantly when PayNow is linked with Malaysia’s DuitNow, via cross-border payments firm Instarem.

Afterthoughts

We live in a world that’s not crime-free, and scams remain one of the top crimes in Singapore.

Hopefully, this wouldn’t open up an opportunity for scammers and criminals.

With all that said, this is a milestone worth celebrating as we pave the way for faster and cheaper transactions!

What are your thoughts?

Join our Seedly Community and share them with us!

Related Articles:

- Which International Money Transfer Platform Is The Cheapest?

- SG Multi Currency War: Revolut vs YouTrip vs Transferwise vs InstaRem

- A Cashless Future? Exploring the Benefits and Disadvantages of a Cashless Society for Singaporeans

- Visa Credit Card Surcharge Fees in Singapore: Avoid These to Protect Your Hard Earned Money!

- Bank Account in Singapore for Expats: Convenience First or Interest First?

Advertisement