Here's How to Pick Strong Dividend Companies That Can Survive Recessions

Sudhan P

Sudhan P●

In these tumultuous times, investing in the stock market may seem daunting.

With many stocks being battered down, they could be selling at enticing dividend yields, giving investors a massive headache when it comes to choosing the sustainable ones to invest in.

Should you pick StarHub Ltd (SGX: CC3), with a dividend yield of 6.3%, or choose Overseas Education Ltd (SGX: RQ1), which yields close to 10%? Or do both companies not make good dividend stocks?

How about Hutchison Port Holdings Trust (SGX: NS8U), which has a much higher dividend yield than say, Singapore Exchange Limited (SGX: S68), but may not necessarily make a good investment for the long-term?

So, to make things easier for you, here are three simple criteria for picking strong dividend companies that have the ability to withstand recessions.

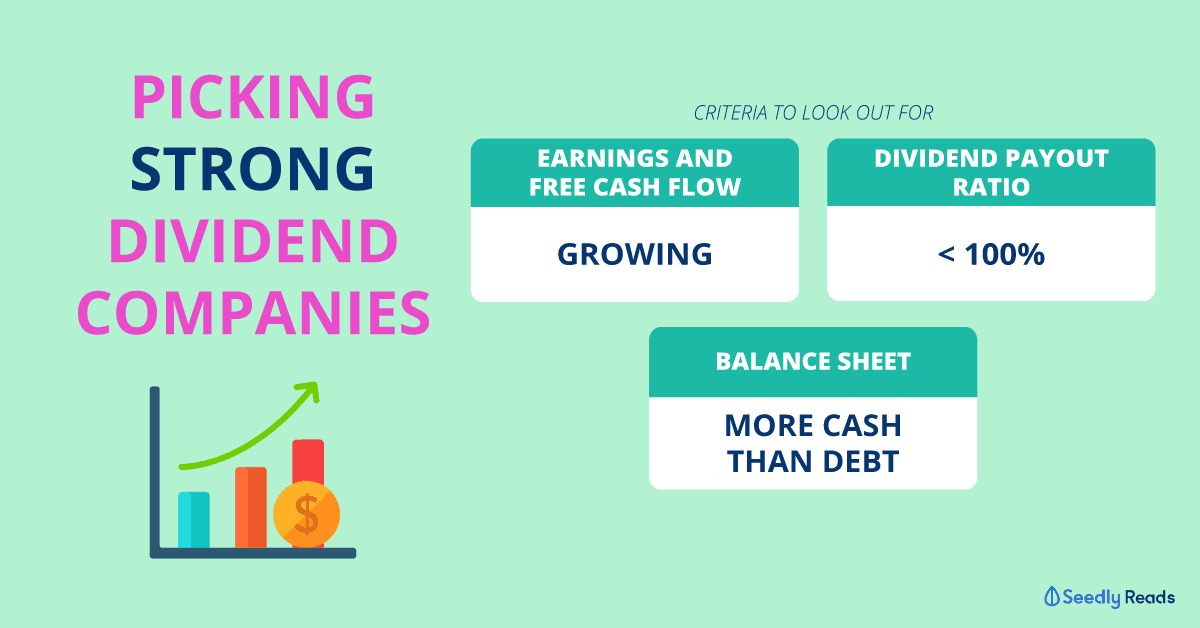

TL;DR: Picking Strong Dividend Stocks to Withstand Recessions

Companies that are able to sustain their dividends have the following characteristics:

- Growing earnings and free cash flow, which speaks well of its business;

- Dividend payout ratio that is less than 100%; and

- Strong balance sheet with little or no debt.

Before we get to the steps, as investors, we must realise that not all dividends are created equal.

A stock that has a lower dividend yield may be a better dividend share than a company with a higher dividend yield.

A high dividend yield, as compared to its peers, may mean that the company is fundamentally weak and thus, has a depressed share price.

On the flip side, a low dividend yield does not necessarily mean that the company is a lousy one.

It may mean that the company’s share price has run up a lot due to its strong business.

So, instead of looking at dividend yields in a vacuum, we should focus on three other aspects of a company if we are investing in it for its dividends.

Those factors are:

- Earnings and free cash flow growth

- Dividend payout ratio

- Balance sheet strength

Let’s explore why those criteria are more important than the headline dividend yield of a company.

1. Earnings and free cash flow growth

Firstly, dividend companies should exhibit stable growth in both earnings and free cash flow.

Earnings (also known as net profit) are what is left after a company pays off all its expenses, such as cost of raw materials, salaries, and taxes using its revenue.

On the other hand, free cash flow is cash flow from operations minus capital expenditure.

A company’s free cash flow shows how much money the firm has to dish out dividends to shareholders, buy back its shares, reinvest into its own business, or pay off debt (if any).

A company with consistently growing earnings and free cash flow over many years hints to us that it has a strong business, and that’s what investors want.

Such a company would also be inclined to pay out higher dividends as its business grows over time.

For example, Singapore Exchange hopes to pay a sustainable and growing dividend over time, consistent with its long-term growth prospects.

On the flip side, a company with falling earnings and free cash flow would be pressured to cut dividends or worst still, stop paying dividends entirely, to sustain its business.

An example of such a company is Hutchison Port Holdings Trust, whose earnings have tumbled over the years, and consequently, seen its dividends being slashed drastically.

2. Dividend payout ratio

The dividend payout ratio tells investors what percentage of a company’s earnings or free cash flow are paid out yearly as a dividend.

I prefer businesses that pay less than 80% of their free cash flows as dividends.

This gives enough margin of safety in case the business takes a short-term hit for any reason.

For example, if a company has a 50% dividend payout ratio, it would mean that free cash flow has to fall by more than 50% before dividend may be cut.

| Dividend ($) | Free cash flow per share ($) | Dividend payout ratio | |

|---|---|---|---|

| Original | 0.10 | 0.20 | 50% |

| If free cash flow falls by 40% | 0.10 | 0.12 | 83% |

| If free cash flow falls by 50% | 0.10 | 0.10 | 100% |

| If free cash flow falls by 60% | 0.10 | 0.08 | 125% |

A 50% dividend payout ratio would also mean that there’s space for dividend growth in the future if free cash flow doesn’t grow as much, before a 100% dividend payout ratio is hit.

| Dividend ($) | Free cash flow per share ($) | Dividend payout ratio | |

|---|---|---|---|

| Original | 0.10 | 0.20 | 50% |

| If free cash flow grows by 10% | 0.12 | 0.22 | 54% |

| If free cash flow grows by 5% | 0.14 | 0.21 | 66% |

| If free cash flow grows by 2% | 0.16 | 0.204 | 78% |

| If free cash flow doesn't grow at all | 0.20 | 0.20 | 100% |

Some companies have a fixed dividend policy of paying out a certain amount of earnings as dividends.

For example, Valuetronics Holdings Limited (SGX: BN2) has a formal dividend policy of declaring 30% to 50% of its earnings as ordinary dividends each year.

On the other hand, companies that pay out more than 100% of their earnings or free cash flow as dividends may have to cut dividends to bring them to more sustainable levels.

An example of a company cutting its dividends is StarHub. It had to slash its dividends from 2017 onwards as they were unsustainable.

3. Balance sheet strength

The balance sheet reveals the financial strength of a business.

Companies with lots of cash and little or no debt have the financial muscle to navigate through tough economic conditions.

Such companies don’t have to worry about paying off exorbitant interest expenses when revenues get hit during tough times.

Banks hounding on their backs during a recession is the last thing that companies want.

As mentioned earlier, free cash flow can be used to pay dividends or pay off debt.

If a company doesn’t have loans to deal with, it can focus on things that matter, such as keeping shareholders happy with higher dividends or reinvesting into its business for further growth.

It can also use the opportunity to acquire other companies at cheaper valuations during an economic downturn, setting itself up for greatness when the economy recovers.

Parting Thoughts

I hope that you are now armed with the right knowledge to pick dividend companies that can withstand recessions.

Don’t get me wrong.

If companies possess all three criteria listed above, it doesn’t mean that their dividends are 100% guaranteed (nothing is guaranteed in investing anyway).

It just means that you tilt the probability of investing in companies that pay out sustainable dividends in your favour.

With that, happy dividend hunting!

Have Burning Questions Surrounding The Stock Market?

Why not check out the Seedly Community and participate in the lively discussion regarding stocks!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the companies mentioned.

Advertisement