I don’t know about you, but I enjoy being treated like VIP, and I’m sure I’m not the only one.

This is probably why many businesses have VIP programmes with exclusive perks that make you feel like royalty.

Banks are not different as they offer Priority Banking status to wealthy individuals who can afford to deposit and transact large amounts with the bank.

And if you are curious, there is also the higher tier Private Banking status offered to ultra-high-net-worth individuals (UNHWIs).

Generally speaking, Priority Banking clients will get exclusive lifestyle and financial perks.

But, each bank puts a unique twist on this privileged banking relationship.

If you have at least six-digit figures worth of cash and investable assets and would like to get these perks, here’s how to find the best Priority Banking programme for you!

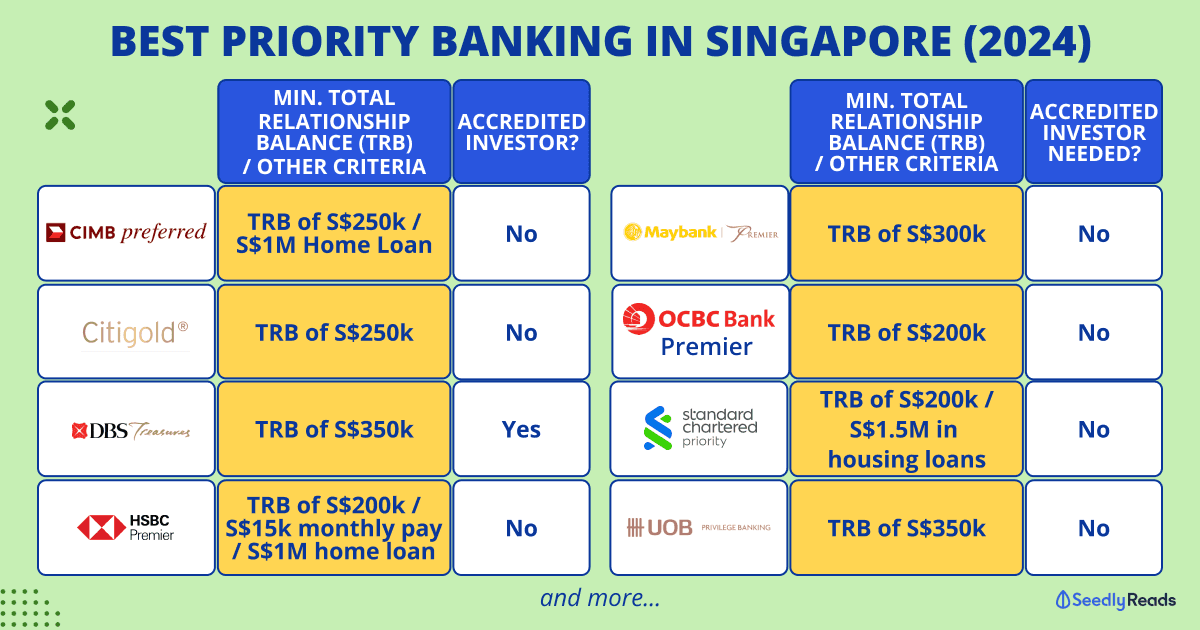

TL;DR: Best Priority Banking Singapore 2024: Which is the Best in Singapore?

| Priority Banking Programme | Min. Total Relationship Balance (TRB) / Other Criteria |

Accredited Investor Status? |

|---|---|---|

| CIMB Preferred | TRB of S$250,000 OR S$1M Total Mortgage Loan size |

No |

| TRB of S$250,000 | No | |

| DBS Treasures | TRB of S$350,000 | Yes |

| HSBC Premier | TRB of S$200,000 OR Credit monthly salary >S$15,000 OR S$1,000,000 SG Home Loan / AU$200,000 AU Home Loan |

No |

| Maybank Premier | TRB of S$300,000 | No |

| OCBC Premier | TRB of S$200,000 | No |

| Standard Chartered Wealth $aver | TRB of S$200,000 OR S$1.5 million in housing loans |

No |

| UOB Privilege | TRB of S$350,000 | No |

Click to Teleport:

- What is Priority Banking in Singapore? What are the Perks of Priority Banking?

- What’s the Difference Between Priority Banking and Private Banking?

- How To Qualify for Priority Banking in Singapore?

- How Do I Open a Priority Account?

- CIMB Preferred

- Citigold

- DBS Treasures

- HSBC Premier

- Maybank Premier

- OCBC Premier

- Standard Chartered Wealth $aver Priority Banking

- UOB Privilege

What is Priority Banking Account? Privilege Banking / Premier Banking in Singapore Explained

As mentioned above, Priority Banking / Premier Banking / Privilege Banking is an exclusive membership offered to affluent customers who can afford to deposit and transact large amounts with the bank.

VIP banking status, if you will.

What Is the Benefit of Priority Banking? What Is the Interest Rate for Priority Banking in Singapore?

In return for your investment, Priority Banking customers enjoy perks like:

- Having a personal banker or relationship manager to attend to your queries

- Access to a whole suite of wealth management solutions

- Preferential rates on loans, savings accounts and fixed deposits

- Priority counter at bank branches so you can skip the regular line to get your banking done

- Waiver of banking fees like convenience fees and other fees.

What’s the Difference Between Priority And Private Banking?

The main difference is that Private Banking targets the ultra-rich, or UHNWI, who have at least S$1 million worth of AUM/TRB with a bank.

And with that, the perks are expected to be more exclusive, and most benefits are geared towards growing your wealth.

Like priority banking, you will have a dedicated person assigned to you, and most of the time, it will be a private banker or a team of private bankers who are more focused on growing your portfolio.

How To Qualify for Priority Banking in Singapore?

To qualify for a Priority Banking relationship in Singapore, you generally need to deposit or transact a minimum qualifying amount with the banks. In bank speak, this is called Assets Under Management (AUM) or Total Relationship Balance (TRB).

Also, this qualifying AUM amount with a bank for a Priority Banking relationship is not limited to cash deposits. It can comprise cash, investments and insurance products.

However, note that Singapore’s minimum qualifying AUM for a Priority banking relationship ranges anywhere from S$200,000 to S$350,000.

How Do I Open a Priority Account?

Opening a Priority Banking account is as simple as applying online, in person, or at the bank’s physical branch.

It is not that much different from opening a regular savings account.

With that out of the way, here are some of the best Priority Banking accounts to consider.

CIMB Priority Banking: CIMB Preferred

First up, we have the CIMB Preferred Priority Banking relationship.

To qualify, you will need a minimum TRB of S$250,000 or a total Mortgage Loan size of at least S$1 million with CIMB. But, like many Priority Banking programmes on this list, you do not need to be an Accredited Investor (AI) to qualify.

On top of that, you can receive a Private Wealth status when you have S$1 million TRB with S$200,000 wealth balances.

The qualifying requirements might be steep, but CIMB ensures that membership perks are worth the price of entry.

CIMB Preferred Benefits

You’ll get to enjoy benefits like:

- Preferential rates for Premium Financing, Portfolio Financing & Fixed Deposits

- Assigned a dedicated relationship manager to advise you and assist with your banking needs

- Curated monthly financial insights

- Shopping and dining deals

- Enjoy high return of up to 3.5% per annum on your account balances

- Priority treatment across CIMB branches across ASEAN

- Nominate up to three immediate family members to enjoy the same benefits (min. AUM ≥ S$5,000)

- Complimentary invites to exclusive lifestyle and financial events and more.

But note that there is only one CIMB Preferred branch in Singapore which doubles up as the bank’s main office.

CIMB Preferred Promotions

CIMB is also offering a Welcome Reward if you fulfil the promotion’s conditions:

For the uninitiated, these are the participating savings accounts that are eligible for this welcome offer:

- CIMB StarSaver/StarSaver-i accounts

- CIMB StarSaver (Savings)/StarSaver Savings-i accounts

- CIMB FastSaver and FastSaver-i Account

Do remember to read through the campaign’s terms and conditions as well.

Citi Priority Banking: Citigold

Next up, we have the Citigold Priority Banking programme.

To qualify, you will need a minimum AUM of S$250,000 to start and maintain a Citigold relationship. But, like many Priority Banking programmes on this list, you do not need to be an AI to qualify.

Citigold Privilege Banking Benefits

With Citigold, which is more investment-focused, you’ll get to enjoy benefits like:

- Citigold Insights: Make better-informed decisions with an in-depth understanding of markets, trends and opportunities, all brought to you by our award-winning analysts

- Premium Citigold Wealth Management Products: Long-term or short-term Investments, liquid assets or insurance Plans

- Relationship Manager: Your dedicated relationship manager and a team of experts will always be at hand to help you achieve your financial goals

- Lifestyle and Banking Privileges: As a Citigold customer, you’ll enjoy an array of exclusive, curated lifestyle and banking privileges

- International Coverage: Your Citigold privileges are extended worldwide, making it convenient for jet setters to access Citibank branches on the go.

Citigold Welcome Rewards Promotion 2024

Sign up now, and you can get rewards worth up to S$13,865 and more!

Citigold SingSaver Exclusive Offer

On top of that, you might want to consider applying through our sister company SingSaver’s Exclusive Offer!

Receive 1x Apple iPhone 15 Pro Max 256GB (worth S$2,017.50), 1x Apple iPad Pro 11″ Wi-Fi + Cellular 256GB (worth S$1,659.40), or S$1,500 Cash when you make a minimum deposit of S$250,000 within three calendar months of account opening. Valid till 29 February 2024. T&Cs apply.

DBS Privilege Banking: DBS Treasures

In addition, we have DBS’s Priority Banking programme DBS Treasures.![]()

DBS Treasures has the strictest qualifying criteria on this list, as to qualify, you will need a minimum AUM of $350,000 in investable assets and be an AI.

But it’s not all bad if you are an AI; your DBS relationship manager can recommend a broader range of more sophisticated financial instruments.

DBS Treasures Benefits

With a DBS Treasures relationship, you’ll get to enjoy perks like:

- Exclusive access to four DBS Treasures centres across Singapore and better service at other DBS and POSB branches

- Relationship Manager: Your dedicated relationship manager and a team of experts will provide personalised financial advice on your investing and legacy plans

- Sophisticated Products: AIs get access to a wider range of more sophisticated investment products

- Intelligent Wealth App: Provides insights into the markets

- Exclusive investment webinars and networking events

- Lifestyle Perks: A suite of curated indulgences and privileges.

DBS Treasures Promotion

In addition, DBS is offering a welcome gift of up to S$17,200 if you fulfil the following requirements from 1 January 2024 to 31 March 2024:

- Deposit Fresh Fund(s) from outside DBS/ POSB of at least S$350,000, S$500,000 or S$1,000,000 (“Fresh Funds Deposit”), or its foreign currency equivalent to their DBS/POSB Current Account/ Savings Account (“CASA”) tagged to their current DBS Treasures relationship. The Fresh Funds Deposit must be maintained with DBS for at least 3 months from the date of deposit, with a corresponding increase in Customers’ total assets under management (“AUM”)Fresh funds deposited must be maintained for at least three months from the date of last deposit

- Purchase a minimum of S$100,000 in Eligible Wealth Product(s)

- Successfully declare Accredited Investor (“AI”) status with DBS Treasures and complete your financial profile with your relationship manager.

Customers who meet ALL the requirements to qualify for the Fresh Funds Offer are entitled to these cash gifts, which will be credited to their DBS/POSB CASA by 30 June 2024:

| Fresh Fund Deposit | Cash Gifts |

| At least S$350,000 | S$2,800 |

| At least S$500,000 | S$4,000 |

| At least S$1,000,000 | S$8,000 |

As compared to someone who has declared the AI status, if you meet the requirements to qualify for the Fresh Funds offer but did not declare AI status with DBS Treasures, you can still receive a lower cash gift, which will be credited to your DBS/POSB CASA by 30 June 2024.

| Fresh Fund Deposit | Cash Gifts |

| At least S$350,000 | S$1,800 |

| At least S$500,000 | S$3,000 |

| At least S$1,000,000 | S$7,000 |

In summary, it will look like that:

HSBC Priority Banking: HSBC Premier

HSBC Premier has the most flexible qualification requirements, with three options to choose from:

- Place a minimum of S$200,000 (or its equivalent in foreign currency) in your TRB

- Credit your monthly salary of ≥S$15,000

- Take up an HSBC Home Loan: A Singapore property loan of at least S$1,000,000 or an Australian property loan of at least AU$200,000.

No AI status is needed here, too.

HSBC Premier Benefits

HSBC Premier customers will get to enjoy these family-focused benefits:

- Gain access to HSBC’s qualified HSBC Premier Relationship Directors and carefully tailored wealth management solutions, including legacy planning and tax advisory

- Enjoy prioritised service, preferential pricing on selected products and access to selected HSBC Global Private Banking wealth insights and events

- Unlock a world of extraordinary and lasting experiences with access to HSBC Concierge Service globally

- An exclusive range of Premier rewards, offers and partnerships

- Premier status for your spouse and up to three children (aged 12 to 30), with no minimum TRB requirement

- Lifestyle benefits are tied to the HSBC Premier Mastercard rather than the Priority Banking programme.

Note: Children under 18 cannot hold Premier status in other countries/regions.

HSBC Premier Promotion

Plus, you’ll enjoy a welcome gift of up to S$28,708 when you join HSBC Premier.

Maybank Priority Banking: Maybank Premier

Alternatively, you can look at the Maybank Premier Priority Banking programme.

To become a Maybank Premier Client, you must make deposits and/or investments of S$300,000 or more with Maybank, which is one of the highest qualification amounts on this list.

No AI status is needed here, too.

Maybank Premier Wealth Singapore Benefits

As a Maybank Premier customer, you’ll enjoy privileges like

- A dedicated relationship manager who will offer you financial advice

- Preferential rates for banking transactions and investments and faster processing for credit facilities

- Earn interest of up to 8% p.a. when you save, spend, invest, insure and borrow with Maybank via the Maybank Save Up Programme

- Privileged access to Maybank Premier Lounges

- Privileged access to five Premier Wealth Centres catered in Singapore

- Priority service at all Maybank branches in Singapore, Malaysia and Bank Internasional Indonesia (BII) Branches in Indonesia

- Withdraw cash in local currency from any Maybank ATM in Malaysia, Brunei, the Philippines, Indonesia (BII ATMs) and Cambodia without any service charge

- Exclusive deals and invitations to private functions, such as special previews and lifestyle events

- Birthday, dining, golfing and travel perks.

Maybank Premier Wealth Singapore Promotion

That’s not all; Maybank is offering users up to S$1,800 Cash Credit* when they join Maybank Premier:

OCBC Priority Banking: OCBC Premier Banking

There’s also the OCBC Premier Banking programme.

To qualify for OCBC Premier Banking, you must deposit or invest S$200,000 in fresh funds.

No Accredited Investor status is needed here as well.

OCBC Premier Banking Benefits

- Priority queues at selected OCBC Bank branches

- Tap into Singapore’s first low-carbon ETF – a diversified fund that gives you access to 50 Singapore companies with a lower carbon footprint, available via an Online Equities Account or as a Blue Chip Investment Plan counter.

- Preferential fees and charges for selected transactions

- S$250 cash reward when you refer a friend

- Invest in shares, ETFs, REITs and bonds across 15 global exchanges, including China, Hong Kong and the US

- Invest in gold and silver with no storage required and zero service fees.

- Send money overseas with S$0 cable and commission fees for 18 currencies

- A dedicated relationship manager who will assist you with your financial planning and investments

- A complimentary OCBC Premier Visa Infinite credit card that has its own set of privileges.

OCBC Premier Banking Promotion

Receive up to S$13,650 when you make a fresh fund placement of S$350,000!

By becoming an OCBC Premier customer, you can also enjoy up to 3.70% a year on your Premier Dividend + Saving when you deposit S$2,000 a month and make no withdrawals.

Standard Chartered Priority Banking (Wealth $aver) Review

Otherwise, you might want to consider the Standard Chartered Wealth $aver Priority Banking programme.

To qualify, you must have at least S$200,000 in deposits and/or investments or S$1.5 million in housing loans.

No AI status is required here too.

SCB Priority Banking Benefits

With Standard Chartered Wealth $aver, you’ll get to enjoy benefits like:

- An SC Priority Banking Visa Infinite Credit Card with a complimentary Priority Pass membership allows you to access more than 1,000 airport lounges worldwide. No annual fee if you maintain your Priority status with SC the following year

- Earn 360 Rewards points through card spends on your Standard Chartered Priority Banking Visa Infinite credit card and other product holdings, such as mortgage loans, select investments and deposits

- Enjoy preferential rates on SC’s Online Equities platform and for select products and services, such as fixed deposits, and waivers on most account maintenance fees and charges, such as deposit account fall-below fees and chequebook fees

- Market Research and Advisory from SC experts

- Dedicated relationship manager to assist you with your banking and investment needs

- Global recognition of Priority status in a second country of their choice if they wish to open an account in

- Extension of Priority benefits to family members and referral benefits.

Standard Chartered Priority Banking Promo

You can receive a reward of up to S$13,000 cash when you make a fresh fund placement of S$200,000 in eligible deposits or investments, complete a Financial Needs Analysis (FNA) and upgrade to Priority Banking.

On top of that, valid from now till 31 March 2024, you can enjoy a time deposit rate of 3.20% p.a. (for Priority Banking) and 3.30% p.a. (for Priority Private) for 6 months.

Bonus$saver Account

| Credit your salary, spend and pay bills | Up to 4.88% p.a. |

| Insure and invest | Up to 3.00% p.a. |

Wealth $aver Deposit Account

| Priority Banking Relationship-based | Up to 3.00% p.a.* |

| Insure and invest | Up to 2.00% p.a.** |

*Based on your Asset under Management (AUM), which includes total deposit balance, investment and insurance with the bank.

**The Wealth Booster promotion can earn you a bonus interest of up to 2.00% p.a. for 6 months. Invest a minimum of S$200,000 or insure a minimum of S$20,000 in one of the eligible products within a calendar month (T&Cs apply).

UOB Priority Banking: UOB Privilege Banking

Lastly, we have the UOB Privilege Banking Priority Banking programme.

![]()

UOB’s requirements are the lowest on this list. To qualify as a UOB Privilege Banking customer, you must maintain a minimum qualifying AUM of S$350,000 (or its equivalent in a foreign currency) in deposits and/or investments.

You don’t need AI status, either.

UOB Privilege Banking Benefits

With UOB Wealth Banking, you’ll get to enjoy:

- A dedicated Relationship Manager who will work with a team of specialists to provide you with tailored financial solutions that match your risk profile

- Investment Insights and Advisory for all your wealth goals

- Exclusive access to five UOB Wealth Banking Centres across Singapore and four overseas

- Priority queues and service at regular UOB branches

- Preferential services and pricing on products such as Telegraphic Transfers, FX rates, demand drafts and cheque fees at any of UOB’s branches islandwide

- Invitation to exclusive UOB Privilege Banking events

- Preferential rates on financial products like Fixed Deposits, Global Currency Premium accounts and more

- Lifestyle, travel and medical concierge

- Education advisory

- S$1,000 when you refer someone

- Birthday privileges carefully curated dining and retail offers and promotions all year.

UOB Privilege Banking Promo

In terms of promos, deposit a minimum of S$200,000 in fresh funds, and you now enjoy a higher interest rate of 3.40% p.a. for three months on your incremental fresh funds’ balance.

Related Articles:

Advertisement