Property Tax Singapore 2022 Increase: Majority of HDB Flat Owners Will Pay More Property Tax Next Year

●

When it rains, it pours.

Following the recent National Environmental Agency (NEA) announcement that household refuse collection fees will be raised in January 2022; the Inland Revenue Authority of Singapore (IRAS) announced yesterday (1 December 2021) that it will be raising the annual value (AV) of HDB flats in concert with soaring market rentals.

IRAS has stated that the AVs of all HDB flats will be revised upwards by about 4% to 6% from 1 January 2022.

This increase came about from IRAS’s yearly review of properties which is then utilised to determine the amount of property tax that needs to be paid.

As a result, most HDB flat owners will have to pay more property tax next year.

But thankfully, there is a silver lining.

Even with this revision, owner-occupiers of all 1-room and 2-room HDB flats will still not be required to pay any property tax.

Here is all you need to know!

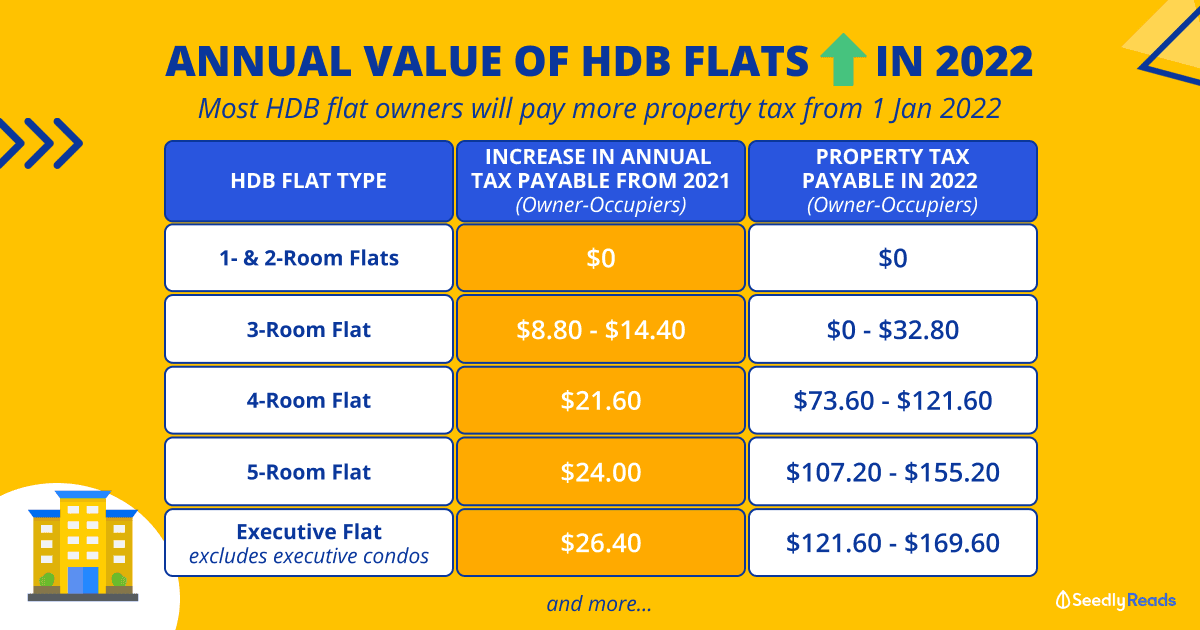

TL;DR: Property Tax in Singapore to Increase — Most HDB Flat Owners To Pay Higher Property Tax in 2022

| HDB Flat Type | 2022 Property Tax Payable For Owner-Occupiers | Increase in Annual Tax Payable from 2021 |

|---|---|---|

| 1- & 2-Room Flats | $0 | $0 |

| 3-Room Flat | $0 - $32.80 | $8.80 - $14.40 |

| 4-Room Flat | $73.60 - $121.60 | $21.60 |

| 5-Room Flat | $107.20 - $155.20 | $24.00 |

| Executive Flat (Does Not include Executive Condos) | $121.60 - $169.60 | $26.40 |

Source: IRAS

How Annual Value of Property is Determined in Singapore

Before we begin, you need to know how the annual value of property in Singapore is determined.

Contrary to popular belief, the Annual Value of residential property in Singapore is not based on the actual rental income you personally receive from renting out your home.

Instead, the IRAS defines the AV of buildings (inclusive of residential properties) as the ‘estimated gross annual rent of the property if it were to be rented out.’

This amount excludes furniture, furnishings and maintenance fees.

It is determined based on estimated market rentals of similar or comparable properties.

To determine the AV, IRAS evaluates market rentals of similar or comparable properties within your residential property’s area.

IRAS will usually update AV prices annually and update owners about any changes to the property’s AV.

IRAS will also review the property’s AV if there are any physical changes to the property that will affect the property’s rental value.

An important thing to note is that the way AV is determined is the same, regardless of whether the property is occupied by the owner, vacant or rented out.

The good thing is that the AVs of HDB flats have remained unchanged since its last revision in 2017.

Check out our guide below if you are curious about how AV of property in Singapore is calculated:

But with market rents of HDB flats in 2021 going to the moon, IRAS has stated that the AVs of all HDB flats will need to be revised upwards from 1 January 2022.

For context, you can look at the HDB website which provides quarterly median rent prices for HDBs, which could be used as a guide when you look into rental prices.

The prices for HDBs in different towns and flat types for the third quarter of 2021 are as follows:

| Town | 1-Room | 2-Room | 3-Room | 4-Room | 5-Room | Executive |

|---|---|---|---|---|---|---|

| Ang Mo Kio | - | * | $1,850 | $2,200 | $2,400 | * |

| Bedok | - | * | $1,800 | $2,200 | $2,400 | $2,700 |

| Bishan | - | - | $1,900 | $2,400 | $2,600 | * |

| Bukit Batok | - | * | $1,750 | $2,100 | $2,300 | $2,500 |

| Bukit Merah | * | * | $2,000 | $2,600 | $2,900 | - |

| Bukit Panjang | - | * | $1,680 | $2,000 | $2,100 | $2,200 |

| Bukit Timah | - | - | * | * | * | * |

| Central | - | * | $2,230 | $2,800 | * | * |

| Choa Chu Kang | - | * | $1,700 | $2,000 | $2,000 | $2,200 |

| Clementi | - | * | $2,000 | $2,500 | $2,700 | * |

| Geylang | - | $1,300 | $1,810 | $2,400 | $2,860 | * |

| Hougang | - | * | $1,700 | $2,030 | $2,200 | $2,330 |

| Jurong East | - | * | $1,850 | $2,200 | $2,400 | $2,500 |

| Jurong West | - | * | $1,800 | $2,150 | $2,350 | $2,450 |

| Kallang/ Whampoa | - | * | $2,000 | $2,500 | $2,600 | * |

| Marine Parade | - | - | $1,900 | $2,200 | * | - |

| Pasir Ris | - | * | * | $2,050 | $2,300 | $2,300 |

| Punggol | - | * | $1,950 | $2,000 | $2,000 | * |

| Queenstown | - | * | $2,000 | $2,750 | $3,000 | - |

| Sembawang | - | * | - | $1,900 | $2,050 | $2,200 |

| Sengkang | - | * | * | $2,100 | $2,100 | $2,200 |

| Serangoon | - | - | $1,880 | $2,300 | $2,500 | * |

| Tampines | - | * | $1,850 | $2,200 | $2,300 | $2,450 |

| Toa Payoh | - | * | $1,900 | $2,300 | $2,600 | * |

| Woodlands | - | * | $1,650 | $1,900 | $2,000 | $2,300 |

| Yishun | - | * | $1,700 | $2,000 | $2,150 | $2,300 |

* Indicates that the median rent is not shown because there are less than 20 rental transactions in the quarter for that particular town and flat type.

– Indicates that there are no rental transactions in the quarter.

Likewise, IRAS reviews the AVs of private residential properties yearly.

This means that private residential property owners can expect to see an increase in their AVs in 2022.

Singapore Property Tax Rates For HDB Flats

In Singapore, the property tax payable is derived by multiplying the property tax rate with the AV of the property.

If you are an owner-occupier, you will have to pay concessionary property tax at rates that range between 0% and 16%.

Whereas if you rent out your flat and do not occupy it, you will have to pay residential concessionary property tax at rates that range between 10% and 20%.

In addition, you’ll be glad to know that the rates are progressive. This means that higher value properties like your million-dollar HDB flats are being taxed at higher rates.

As such here is a breakdown of the property tax rates:

Property Taxes Singapore: Owner-Occupier Tax Rates

| Owner-Occupier Tax Rates | Tax Rate |

|---|---|

| First $8,000 of AV | 0% |

| Next $47,000 of AV | 4% |

| Next $15,000 of AV | 6% |

| Next $15,000 of AV | 8% |

| Next $15,000 of AV | 10% |

| Next $15,000 of AV | 12% |

| Next $15,000 of AV | 14% |

| Above $130,000 of AV | 16% |

Source: IRAS

Property Taxes Singapore: Residential Tax Rates (For Non-Owner-Occupied Residential Properties)

| Residential Tax Rates (For Non-Owner-Occupied Residential Properties) | Tax Rate |

|---|---|

| First $30,000 of AV | 10% |

| Next $15,000 of AV | 12% |

| Next $15,000 of AV | 14% |

| Next $15,000 of AV | 16% |

| Next $15,000 of AV | 18% |

| Above $90,000 of AV | 20% |

Source: IRAS

Note: The applicable tax rates for HDB flats are up to 4% for owner-occupied flats and 10% for non-owner-occupied flats.

IRAS Property Tax Calculator Singapore

Alternatively, you can use this property tax calculator from IRAS to figure out how much property tax you need to pay.

Increase in Property Taxes Payable For HDB Flat Owners in 2022

The 2022 property tax payable for HDB flat owner-occupiers is summarised below:

| HDB Flat Type | 2022 Property Tax Payable For Owner-Occupiers | Increase in Annual Tax Payable from 2021 |

|---|---|---|

| 1- & 2-Room Flats | $0 | $0 |

| 3-Room Flat | $0 - $32.80 | $8.80 - $14.40 |

| 4-Room Flat | $73.60 - $121.60 | $21.60 |

| 5-Room Flat | $107.20 - $155.20 | $24.00 |

| Executive Flat (Does Not include Executive Condos) | $121.60 - $169.60 | $26.40 |

If you are a property owner, you will receive your property tax bills by the end of December 2021.

Once you have received your property tax bill, remember to pay your 2022 property tax by 31 January 2022, as there will be a 5% penalty imposed for property owners who fail to pay their property tax by the due date.

You can choose to pay using GIRO and enjoy up to 12 interest-free monthly instalments or opt for a one-time deduction.

Taxpayers who have bank accounts with major banks like DBS/POSB, UOB or OCBC can apply for GIRO via Internet Banking and receive instant approval.

However, if you are facing financial difficulties, you may approach IRAS for assistance to discuss a suitable payment plan before 31 January 2022.

IRAS has stated that

Property owners can appeal for a longer payment plan via the ‘Apply for Payment Plan’ e-Service at myTax Portal using your Singpass or Singpass Foreign user Account (SFA).

Property owners may also contact IRAS at 1800 356 8300.

Advertisement