Does this look like you when you are trying to understand a company’s annual report?

If you are bored stiff reading annual reports but still wish to make sense of them to be a better investor, fret not.

We are here to make life easier for you, as always!

Here, we will break down a typical annual report of a Singapore-listed firm for you and let you know which are the areas to focus on.

The annual report details information of the company, such as its business profile, the management team, and its financial statements, among others.

Reading the annual report allows investors to make informed decisions about the company they have part-ownership in, and whether it makes sense to continue holding its shares.

After all, a company’s annual report is just like the report card of a student.

Everything you need to know about the student’s performance is in there, including how naughty he has been in school!

“Other guys read Playboy. I read annual reports.” – Warren Buffett

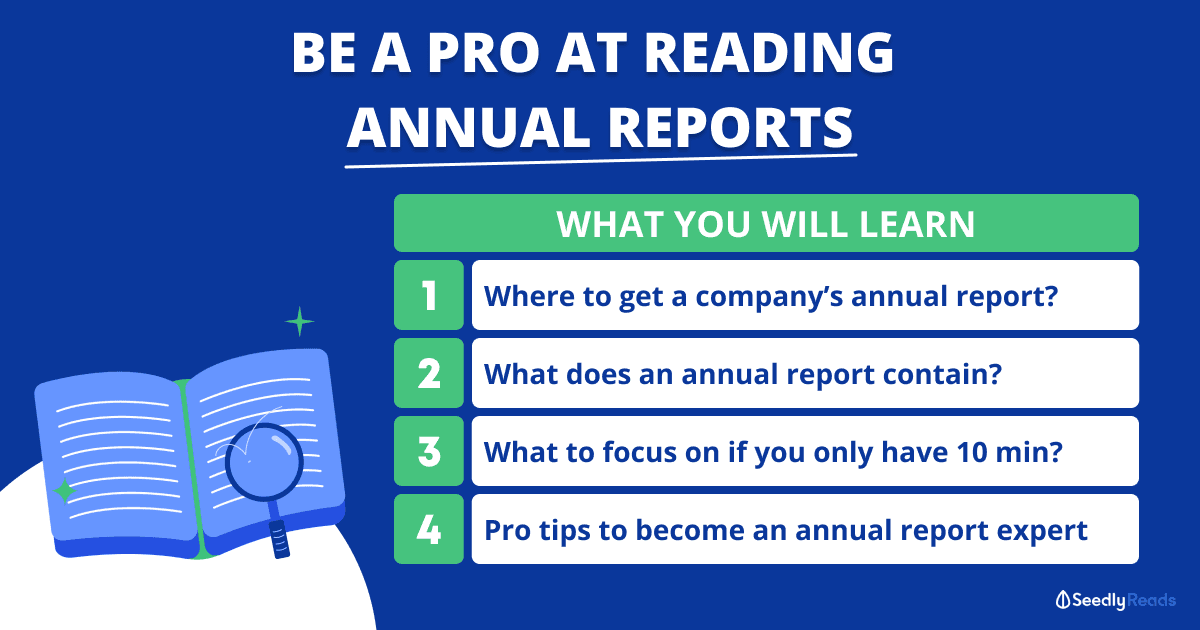

TL;DR: Here’s How to Make the Most of a Company’s Annual Report

You will learn in this article that:

- You can get a company’s annual report online from its investor relations website or SGX website.

- An annual report contains more than 15 sections, including the company’s corporate profile, chairman statement, operations review, financial statements, and statistics of shareholders.

- If you don’t have time to pore through a 100-page annual report, you can focus on the chairman statement, auditor’s report, and financial highlights/statements.

- If you wish to be an expert at reading annual reports, you may want to explore studying annual reports of different companies, both profitable and loss-making ones.

Where to Get a Company’s Annual Report?

The annual report is released after each financial year, and a listed company in Singapore must provide the annual report to its shareholders at least 14 days before its annual general meeting. The rules governing the release of annual reports are stipulated in the SGX Rulebook, Chapter 7, Part III.

If you are a shareholder of a Singapore-listed company, you will usually receive a notice, through the trusty-old snail mail, that the latest annual report has been released.

The notice will contain the details on how to get the electronic copy of the annual report, or if you wish to get the physical copy, you can request it through the letter that’ll be enclosed.

Alternatively, you can also obtain the annual report online through the company’s investor relations website or Singapore Exchange’s website.

If You Only Have 10 Minutes to Spare to Go Through the Annual Report, What Should You Do?

The first thing you should do is….

not to chuck the annual report into your recycling bin.

If you can only afford 10 minutes, you can still extract information about the company by zooming in on the important sections of the annual report.

- Speed read through the Chairman and/or CEO’s statement(s). If you can’t speed read like me, you should at least read the commentary on the company’s past year performance and what the company plans to do moving forward.

- Check if the independent auditors have given the company a clean bill of health.

- Look at the financial highlights page to see if the company’s financial metrics have been growing over the years. If this section is not present, you can head over to the financial statements section to check if revenue, net profit, and free cash flow are increasing year-on-year. Along with that, ensure the company’s balance sheet is strong (decreasing borrowings and increasing cash levels).

To know what each of the term/section means, you can continue reading on below…

What Does an Annual Report Contain?

An annual report of a Singapore-listed company will typically contain the following:

- Corporate Profile

- Financial Highlights

- Chairman’s Statement

- CEO’s Statement

- Operations Review

- Board of Directors and Key Management

- Corporate Information

- Sustainability Report

- Corporate Governance Report

- Report of the Directors

- Statement by Directors

- Independent Auditors’ Report

- Financial Statements

- Statements of Financial Position

- Consolidated Statement of Profit or Loss and Other Comprehensive Income

- Statements of Changes in Equity

- Consolidated Statement of Cash Flows

- Notes to the Financial Statements

- Statistics of Shareholders

- Notice of Annual General Meeting

- Proxy Form

Some of the terms above may vary among annual reports of different companies.

Corporate Profile

The corporate profile section summarises what kind of business the company is involved in and the various business divisions or segments that it has.

It might also showcase the various countries the company has operations in.

Financial Highlights

The financial highlights section gives investors a quick overview of how the company has performed over the past few years.

It provides the company’s historical (usually five years) key financial metrics such as its:

- revenue;

- net profit;

- earnings per share;

- net debt or net cash position; and

- dividend paid out;

The information presented may differ from company to company, and they can be shown either in a graphical form or table format. Do note that all companies may have this section.

Below is an example from Singapore-grown supermarket chain Sheng Siong Group (SGX: OV8):

Chairman’s and/or CEO’s Statement(s)

One of the most critical aspects of the annual report is the chairman’s statement. Sometimes, the chief executive officer (CEO) joins the chairman in this statement or both have their own statements, depending on the company.

This section covers the company’s financial performance for the immediate past year, its accomplishments and challenges faced, and what the company foresees its future to be.

Investors have to be wary when reading through the chairman and CEO statements and not take everything at face value.

For example, if the chairman states, “Despite the economic headwinds, the company has seen stable performance for the year”, but the firm’s net profit actually fell, then you know something is amiss.

The statement also allows investors to know if the management is honest and forthcoming.

If a mistake was done over the past year, the statement should acknowledge that candidly instead of sweeping it under the carpet. Some companies that are not doing well financially may even be skimpy on the performance details, so do look out for such yellow flags.

Those who wish to dig deeper can go on to read at least the past five years’ chairman statements to look out for consistency and determine if the plans put out previously are still on track.

Reading the past statements also allows investors to know whether the company has delivered on its promises.

For example, if in 2015, the company you are analysing said that it will expand into China by 2018, it would be good to ensure that the company has delivered on its promise.

If it has not done so, you may want to check with the company during its annual general meeting as to what happened to its plans. If the plans have been shelved, did management provide a valid reason for the change?

Also, note if there is any change in the tone of the statements over the past years. Has it become more optimistic or pessimistic?

Pro tip: To hone the skills of reading between the lines of a chairman’s statement, investors can read the chairman’s statements of various companies, especially those that are loss-making. By comparing the tone and forthrightness among the various chairman’s statements, investors can become wiser and easily sieve out the good companies from the bad ones.

In my opinion, some Singapore companies with well-written and candid chairman statements include that of The Hour Glass (SGX: AGS) and Boustead Singapore (SGX: F9D).

Operations Review

This part of the annual report shows how the company’s various divisions have fared over the past financial year. This section lets you understand more about the firm and how it makes money.

Pro tip: Let’s say after reading through a company’s corporate profile, financial highlights, chairman’s statement, and the operation review, you still do not understand how the company makes money or worse off, smell a rat, it is better to pass on this company. There are so many other better companies out there, so don’t have to be FOMO.

Board of Directors and Key Management

This section shows the profile of various directors and key managers of the business.

The board of directors usually consists of the chairman, chief executive officer, managing director, executive directors, vice-chairman, non-executive directors and independent directors. The key management usually comprises the general managers, chief financial officer and chief executive officer.

The structure may differ from company to company.

Sustainability Report

The Singapore Exchange introduced sustainability reporting on a “comply or explain” basis in June 2016.

The sustainability report communicates to shareholders key information related to a company’s economic, environmental, social and governance (EESG) factors.

Some companies have the sustainability report embedded within its annual report, while others publish a separate sustainability report.

For example, Venture Corporation‘s (SGX: V03) sustainability report is part of its annual report while Sheng Siong’s sustainability report is produced separately.

Corporate Governance Report

This part of the annual report shows things like the number of board meetings held for the past year and the board members’ attendance, date of appointments and date of last re-election of the directors, remuneration of the directors and top executives of the company, among others.

If the company has any interested party transactions, they are shown here as well.

The dividend policy of a company is discussed here as well.

Pro tip: The most crucial part of this section is the remuneration of the leaders of the company. Investors should scrutinise the remuneration packages and ensure that the directors are not overly compensated.

This can be done by comparing the remuneration with its revenue. If the remuneration is, 50% of revenue, for example, it will mean that the management is over-paid.

Also, if the management is paid higher total compensation for the year, but the company’s sales and net profit have fallen, it can be a red flag.

Report of the Directors, Statement of Directors and Independent Auditors’ Report

The Report of the Directors consists of the direct and deemed interest in shares of the directors of the company. The Statement of Directors is simply a statement by the directors saying that the financial statements to be presented in the annual report are true.

The Independent Auditors’ Report states that the financial statements have been audited and are in accordance with the standards.

Pro tip: Investors have to check if the independent auditors have given the company a clean bill of health. Also, investors should make sure the auditors are not changing hands frequently. If this is the case, it could be a strong indicator of trouble in the company.

Financial Statements

This is another vital part of the annual report.

The three main sections of the financial statements that investors look at are the Statements of Financial Position, Consolidated Statement of Profit or Loss, and Consolidated Statement of Cash Flows.

The Consolidated Statement of Comprehensive Income and Statements of Changes in Equity are not that important, as they are not really financial statements but more of supporting schedules.

If you wish to know how to read a company’s financial statements, you can check out the guides below:

- Income statement (or Consolidated Statement of Profit or Loss) — shows how much a company has made or lost in any given period.

- Balance sheet (or Statements of Financial Position) — gives a snapshot in time of the company’s assets, liabilities, and shareholders’ equity.

- Cash flow statement (or Consolidated Statement of Cash Flows) — shows the company’s ability to generate cash to fund its operations, as well as investments and debt obligations.

You can usually see the sub-heading — “The Group” and “The Company” — under the financial statements. As investors, we focus on the group level as we want to have a holistic view of the numbers.

Notes to Financial Statements

This part follows the financial statements, which provides a detailed explanation of how some of the figures in the financial statements were obtained. It forms an integral part of the financial statements and should be read together.

Statistics of Shareholders, Notice of Annual General Meeting (AGM) and Proxy Form

The Statistics of Shareholders shows the number of issued shares, class of shares, and the voting rights.

It also shows a list of the substantial shareholders of the company. By looking at this list, investors can know if management holds a significant portion of the firm’s outstanding shares.

The Notice of AGM lets shareholders know when and where the upcoming AGM will be held and the resolutions to be passed.

With the COVID-19 restrictions in place now, virtual AGMs are commonplace, which is great for shareholders to attend various AGMs from the comfort of their homes.

The Proxy Form is for shareholders to appoint another party to attend the AGM on his/her behalf.

Pro tip: Look out for high insider ownership. If management owns a huge chunk of shares in the company it’s running, minority shareholders like you and me can rest assured that the interest of the management and ours are aligned.

There you go!

By using this guide and going through the annual reports of various companies from different industries, you should become a pro at reading annual reports in no time…

Have Burning Questions Surrounding The Stock Market?

Why not check out the community at Seedly and participate in the lively discussion regarding stocks!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the companies mentioned.

Advertisement