Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

In the land of Kiasu-Singapore, one of the most common questions I get amongst friends are…

What accounts do you recommend for savings, spending & investing for beginners?

Look no further, here’s my own list of what I would recommend as logical choices for ALL beginners to start with. It will take you a few minutes to set up and optimise.

Disclaimer: You should definitely do your own due diligence and this post is a recollection of my own experiences which has naturally evolved over my 5 working years.

Benefits of being in the personal finance industry, you can read 33 of my product reviews here. Again, this is my unbiased opinion on what I recommend.

I will segment each portion with the following:

- What I recommend for fresh graduates today (in 2020)

- My personal story on what started with as a fresh graduate and what I am using now (after 5 working years)

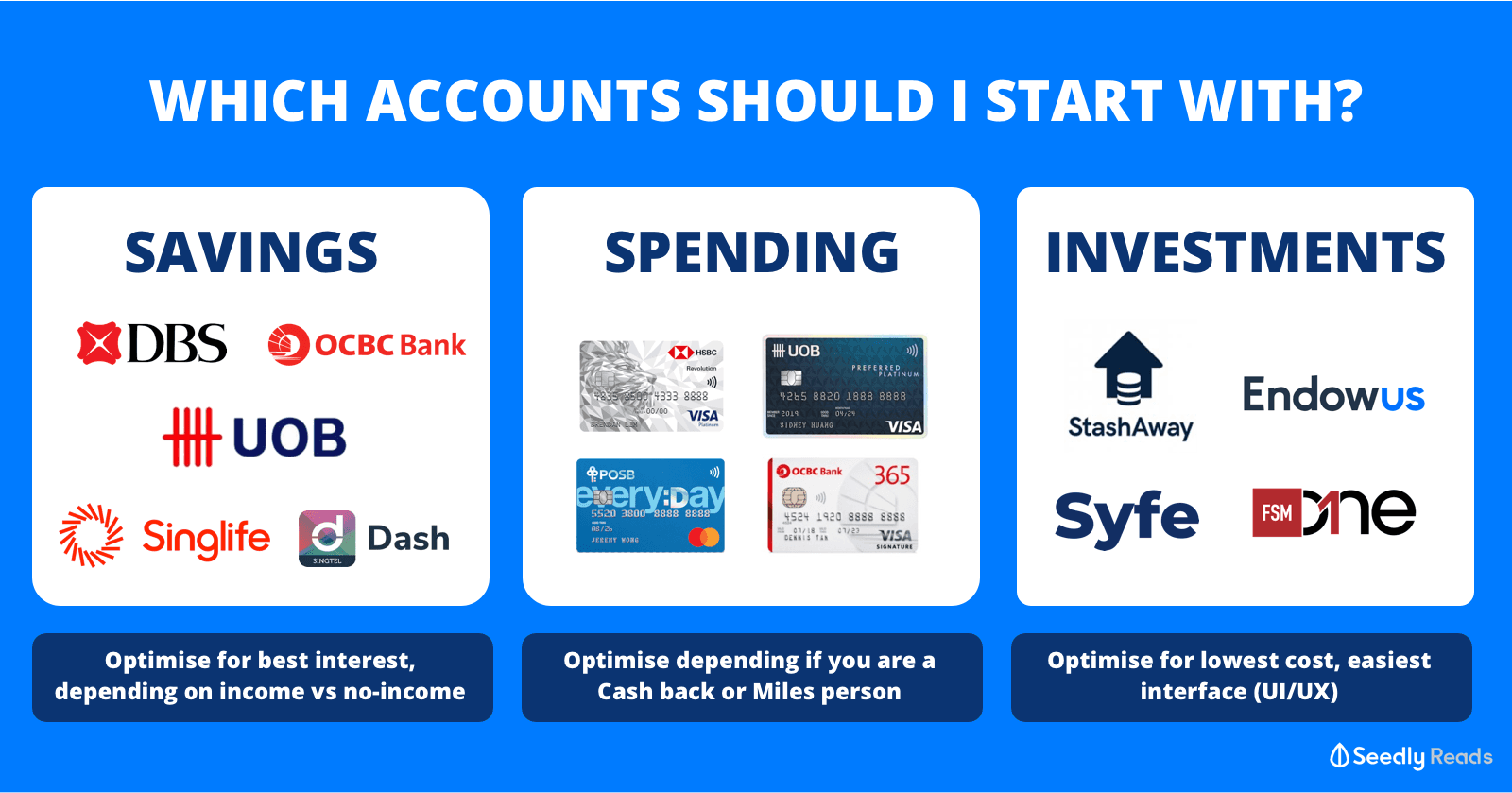

TL;DR: Basic principles behind each personal finance tool optimisation

- Savings – Optimise for best interest, depending on income vs no-income

- Spending – Optimise depending if you are a Cash back or Miles person

- Investments – Optimise for lowest cost, easiest interface (UI/UX) to get started

Segmenting Your Monthly Salary

I think if you landed on this article, you should be probably pretty convinced that as a financially savvy working adult, you should look to segment your monthly salary into 3 various components, based on the “Pay Yourself First” principle.

The reasons for adopting this are very clear, easily growing your total balance of more than $25k in just 2 years if you follow this principle.

P.S: I know I definitely did it, so can you!

1) Savings Accounts

What I Recommend For Working Adults Today:

- Main banking account: Either DBS Multiplier, OCBC 360 or UOB ONE depending which you prefer (realistically gets you 0.4% to 1% now)

- Secondary savings account: SingLife account or Dash-Tiq EasyEarn for your rainy day funds (gets you up to 2% to 2.5% p.a now)

Your Main banking account is for your daily needs, salary crediting, paying off your bills etc. The amount here would most likely fluctuate up and down monthly.

Your Extra savings account is for your extra future needs, for your rainy day funds so this pile of cash should just build up but never drawn down.

My Personal Story:

- I started with OCBC360 then jumped over to DBS Multiplier but got tired of switching my salary input so I reverted back

- After 5 working years, I am still using OCBC360 as my Main banking account, and a combination of SingLife account, SCB Jumpstart account and CIMB FastSaver together with my joint account needs as well.

2) Spending Accounts

What I Recommend For Working Adults Today:

- Main Spending Account: You should always default to your Bank Debit Card first, as a fresh graduate or young working adult. The reason you should do this is that you are spending money you have, not money you do not have (e.g Credit)

- Secondary Spending Account: Once you have used your debit card for a minimum of 6 months to build up a healthy spending habit and not overspend, you should then move on to a Credit card. Now the best Everyday cashback card I would think is the OCBC 365 card, POSB Everyday card, UOB ONE card and the best Everyday Miles card would be the HSBC Revolution or UOB Preferred Platinum VISA.

Your Main Spending (Debit card) would be also likely linked to your ATM cash withdrawals if you do need to do that, always a back up in my wallet.

Your Secondary Spending (Credit cards) are for your rewards game (eg Cash back OR Miles) I suggest that you focus on building up one reward type, instead of being a headless chicken and trying to optimise for both.

A word of caution: once you go down the credit card route, always pay your bills in FULL and ON TIME. If not, please stick to your debit cards. It can be a very dangerous rabbit hole to fall into, and the whole premise of rewards are to get you to aggressively spend more.

My Personal Story:

- I started with the DBS Black Debit Card for almost a year as a really poor fresh graduate, then jumped over start with a BOC cashback card as my first card

- After 5 working years, I opened my eyes to the world of Miles cards and have optimised around this strategy instead. Look out for sign up bonuses, and all in all, I’ve racked up over 250,000 miles in just 2 years.

- For context, that amount of miles would allow me to travel 3 return Economy class trips to anywhere in Europe (when COVID recovers)

- I am using my trusty HSBC Revolution card (4mpd up to first $1,000 spend), my DBS Altitude card as a larger spend card, and my OCBC 90N card (previously was to earn higher interest on my everyday savings account). I am also keeping my AMEX Krisflyer Ascend card for AMEX related deals.

3) Investments Accounts

What I Recommend For Working Adults Today:

- Main investment account: Start with one of the Robo-Advisors, it’s really super easy to get started. I would recommend either Stashaway, EndowUs or Syfe. I’m personally using all three of these for a few years now.

- Secondary investment account: If you are ready to buy individual stocks, you should consider getting a brokerage. I would think either FSM ONE or POEMS or SAXO are good starting brokerages to begin your stock trading journey. Do take note of the fees per trade though.

Your Main investment account should be one which you find really easy to use, and for the long term. You should definitely start with these instead of trading. Robo-advisors mainly buys up Globally diversified ETFs (Exchange traded funds) and you get a better sense of what Investing is through a simple onboarding education. I personally setup a monthly top up to these accounts, a strategy called Dollar Cost Averaging (DCA).

Your Secondary investment account is for ad-hoc trading needs. I suggest that you only proceed to this level if you understand what you are doing first. Basically getting to a level which is understanding how to value a business, what metrics to look at before buying individual stocks.

My Personal Story:

- I started with the STI ETF (Straits Times Index Exchange Traded Fund) with $100 a month. It was a good start into the whole world of investing and I did it through my POSB/DBS invest-saver account. I bought REITs using DBS Vickers (which I really don’t recommend because of cluttered UI/UX and no mobile app)

- After 5 working years, I have ‘graduated’ from the STI ETF, and locally I am picking my own stocks now, of which, I am using FSM ONE as my main brokerage account. Apart from that, I am also using robo-advisors Stashaway, EndowUs and Syfe Stashaway, EndowUs and Syfe for my regular investments.

Just Take The First Step

Overall, as you would have seen from my own experience, it’s a process that all working adults would have to go through.

Much like your own health and fitness, ultimately the only one who is really responsible for your financial health would be yourself. Take the first step and learn to optimise along the way, it will be fun, I promise you!

Conclusion: Stay Constantly Informed and Make Adjustments Along the Way

Let’s face it.

Every month, new financial products and instruments are always being launched in the market.

So the best thing you can do for yourself is to stay aware and be informed about these updates.

Because you never know what can help you attain your financial goals faster!

The best way to do it?

Join the SeedlyCommunity by signing up for a FREE Seedly account.

You’ll even get weekly newsletters and exclusive money guides to hack your way to financial independence and freedom.

Related Articles

- Best Saving Account in Singapore (2022): Which Bank Is Best for Monthly Interest?

- Best Fuss-Free Savings Accounts With No Conditions in Singapore 2022

- Best Savings Accounts for Kids 2022: Best Places to Grow Your Child’s Money

- Cheat Sheet: Best Savings Accounts in Singapore For Working Adults – Highest Interest Rates

- Ultimate Cash Management Accounts Comparison

- Best Saving Accounts For Students

- Still Holding Onto Your First Savings Account? Here’s Why You Should Change It

- Which Child Development Account (CDA) Should You Open for Your Child in 2022?

- Cheat Sheet: Best Savings Accounts With No Conditions

Advertisement