My parents have often talked about retirement in Malaysia.

Think living in a landed property, eating good food that’s close to home, cycling and exploring nature as you enjoy the good life…

And they aren’t wrong with Malaysia being the third-best country in Southeast Asia to retire in, according to International Living.

The best part?

You can retire in Malaysia and live a pretty comfortable life on just S$2,000 a month.

Interested? Here’s all you need to know about the Malaysia My Second Home (MM2H) Visa and retiring in Malaysia.

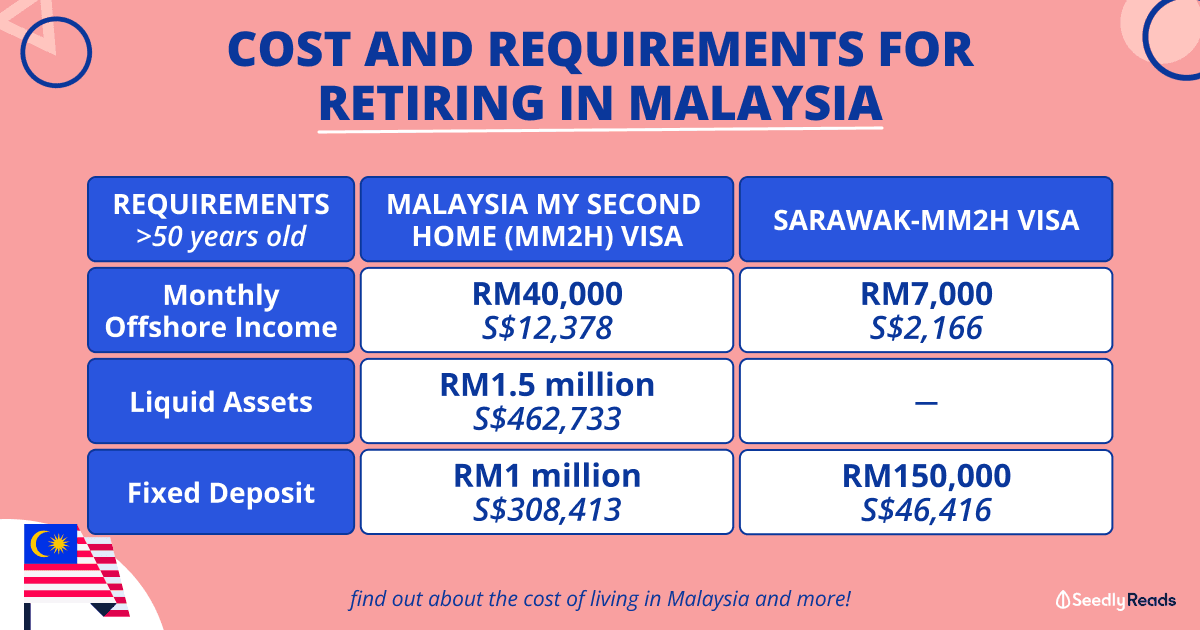

TL;DR: Cost and Requirements for Retiring in Malaysia with MM2H

To retire in Malaysia, you’ll need to successfully apply for the national Malaysia My Second Home programme which requires at least RM1.5 million (S$462,733) in liquid assets and a monthly offshore income of RM40,000 (S$12,378).

If you are unable to qualify for the national MM2H, you can apply for the Sarawak-MM2H (S-MM2H) which has a lower requirement of RM150,000 (S$46,416) or RM300,000 (S$92,845) fixed deposit for couples and a monthly offshore income* (or government pension funds) of at least RM7,000 (S$2,166) or RM10,000 (S$3,085) for couples.

At the time of writing, the S-MM2H does allow you to live in West Malaysia, but this may change following the more stringent changes to the national MM2H programme.

*According to a Facebook user, the monthly offshore income must be regular payments from a company or a government pension fund. Rental/dividend income will not be considered.

For a comfortable retirement from 65 to 85 years old, expect to save at least S$700,000 to S$1.1 million after accounting for inflation.

Jump to:

- Malaysia My Second Home (MM2H) Retirement Visa

- Sarawak-MM2H Retirement Visa

- Cost of Living in Malaysia

- How Much You Need to Save Up for Retirement in Malaysia

- Why Retire in Malaysia?

Disclaimers: All currency conversions are rounded off to the nearest dollar. Information is accurate as of the time of writing and may change without further notice.

Malaysia My Second Home (MM2H)

Before we delve into the nitty-gritty, let’s address the big elephant in the room; obtaining a retirement visa in Malaysia.

Malaysia offers a transparent 5-year renewable visa with the Malaysia My Second Home (MM2H) programme.

Under MM2H, you can bring your spouse and unmarried children (below the age of 21) along as dependents.

However, you are expected to be financially capable of supporting yourself.

Requirements of MM2H:

- Age 35 and above

- Provide proof of RM1.5 million (S$462,733) in liquid assets

- RM1 million (S$308,413) fixed deposit to be made after approval

- Have a monthly offshore income* of at least RM40,000 (S$12,378)

- Participants need to be in the country for at least a cumulative 90 days in a year

- Visa fee: RM 500 (S$154) a year

There is also a processing fee of RM5,000 (S$1,547) for the main applicant and an additional RM2,500 (S$774) per dependent.

*According to a Facebook user, the monthly offshore income must be regular payments from a company or a government pension fund. Rental/dividend income will not be considered.

Am I Allowed to Make a Withdrawal From My Liquid Assets?

After a period of one year, you are allowed to withdraw a maximum of 50% of your liquid assets for approved expenses related to:

- House purchase

- Car purchase

- Education for your children in Malaysia

- Medical purposes

However, you’ll have to maintain a minimum balance of RM500,000 in your fixed deposit account.

Medical Requirements

On top of providing financial statements, you and your dependants must:

- Submit a medical report from any private hospital or registered clinic in Malaysia

- Possess valid medical insurance coverage that is applicable in Malaysia from any insurance company (exemptions may be given for participants who face difficulty in obtaining a medical insurance due to their age or medical condition)

Sarawak-MM2H

For most Singaporeans, having a S$12,728 monthly offshore income is a pipe dream.

BUT! You may still have the option to retire if you consider the Sarawak-MM2H visa.

Both Sabah and Sarawak control their own immigration. Sabah has chosen to follow the national MM2H programme, while Sarawak has a somewhat more relaxed version of MM2H.

At the time of writing, the S-MM2H supposedly allows you to live in West Malaysia, but this may change following the more stringent changes to the national MM2H programme.

Requirements of S-MM2H:

- Age 50 and above

- RM150,000 (S$46,416) or RM300,000 (S$92,845) fixed deposit for couples to be made after approval

- Present the latest 3 months’ government-approved pension funds of at least RM7,000 (S$2,166) or RM10,000 (S$3,085) for couples

- Age 40 to 49

- RM150,000 (S$46,416) or RM300,000 (S$92,845) fixed deposit for couples to be made after approval

- Provide the latest 6 months’ payslip and bank statements as proof of monthly offshore income funds* of at least RM7,000 (S$2,166) or RM10,000 (S$3,085) for couples

- Buy a house with a minimum purchase price of RM600,000 (S$185,090) per unit for Kuching and RM500,000 (S$154,185) per unit for other divisions.

- Have children below 18 years old enrolled in school in Sarawak OR

- If they are undergoing long-term medical treatment in Sarawak with his/her condition verified by Private/Government Physicians who are registered with Malaysian Medical Council

- Age 30 to 39

- RM150,000 (S$46,416) or RM300,000 (S$92,845) fixed deposit for couples to be made after approval

- Provide the latest 6 months’ payslip and bank statements as proof of monthly offshore income funds* of at least RM7,000 (S$2,166) or RM10,000 (S$3,085) for couples

- Have children below 18 years old enrolled in school in Sarawak OR

- If they are undergoing long-term medical treatment in Sarawak with his/her condition verified by Private/Government Physicians who are registered with Malaysian Medical Council.

- Participants need to be in the country for at least a cumulative 30 days in a year

- All applicants must be bonded by a Sponsor who originated from and currently staying in Sarawak OR by a S-MM2H Licensed Agent that is registered in Sarawak

- Visa fee: RM 500 (S$154) a year

- Personal bond: RM200 (S$62)

*According to a Facebook user, the monthly offshore income must be regular payments from a company or a government pension fund. Rental/dividend income will not be considered.

Am I Allowed to Make a Withdrawal From My Liquid Assets?

After a period of two years, you are allowed to withdraw a maximum of 40% of your liquid assets for approved expenses related to:

- House purchase

- Car purchase

- Education for your children in Malaysia

- Medical purposes

You’ll have to maintain a minimum balance of RM90,000 or RM180,000 for couples in your fixed deposit account.

Medical Requirements

On top of providing financial statements, you and your dependants must purchase medical insurance in Sarawak and show proof of purchase before obtaining the S-MM2H sticker.

Cost of Living in Malaysia

Here’s where the fun begins: how much would we really need to enjoy a comfortable retirement?

Assuming that you are retiring with your spouse in Penang Malaysia (a popular choice for many to retire in), here is a rough estimate of how much you’d be spending to enjoy a comfortable lifestyle:

| Rent (3-bedroom condo/house) | S$969 |

|---|---|

| Groceries | S$300 |

| Electricity | S$132 |

| Water | S$14 |

| Cell Phone | S$14 |

| Internet and Landline | S$53 |

| Gas for Cooking | S$6 |

| Domestic Helper (four hours per week) | S$26 |

| Entertainment (eating out five nights a week, local and western food, alcohol not included) | S$396 |

| Total | S$1,910 |

Source: International Living

Of course, how much you want to spend during your retirement years really depends on the type of lifestyle you want to live.

If you really want to stretch your dollar, you can still live a decent lifestyle for as low as S$1,500 a month.

How Much You Need to Save Up for Retirement in Malaysia

With the life expectancy of Singaporeans being 83.9 according to SingStat, and increasing over the years, we’ll assume that we’ll age gracefully till the ripe old age of 85 years old.

Assuming that we retire at 65 years old, that gives us a good 20 years to enjoy our retirement.

Total cost of living over 20 years

= 20 years x 12 months x S$2,000/month

= S$480,000

If you’d like to travel around Malaysia or even take a trip up north for a vacation in Thailand, you may also want to consider owning a car.

In Malaysia, the cost of owning a car for five years is roughly RM100,000 (S$31,784) according to CompareHero. So, assuming that we buy a new car every five years:

Owning a car in Malaysia over 20 years

= 4 x RM100,000/5 years

= RM400,000 (S$127,152)

Last but not least, we’ll need to account for inflation.

You know, that pesky lil bug that sucks the value of our money away.

In Malaysia, the average inflation rate from 1973 to 2022 was 3.39 per cent.

Taking this into account, here’s the total sum that you’ll need to retire comfortably:

Total retirement amount

= S$480,000 + S$127,152

= S$607,152

After accounting for inflation (20 years): S$1,182,682

If we’re looking at a more conservative lifestyle:

Total retirement amount

= S$1,500 x 12 x 20

= S$360,000

After accounting for inflation (20 years): S$701,251

While these figures may seem intimidating, do note that you will still have access to your CPF contributions via CPF LIFE payouts, so long as you keep your Singaporean citizenship of course.

And while inflation will chomp away at our savings, you can use the power of compounding by doing CPF contributions or investing to counter the effect of inflation.

Why Retire in Malaysia?

Aside from the much lower cost of retiring in Malaysia compared to Singapore, here are some of the pros and cons of retirement in Malaysia.

Culture

Despite the fierce food rivalry that Singaporeans have with Malaysians, retiring in Malaysia lets you enjoy similar foods such as nasi lemak for a cheap price.

Compared to Australia for example, nasi lemak costs more than S$15 at PappaRich…and that’s if you’re lucky enough to have an outlet in your city.

If you’re retiring in Costa Rica, you can forget about indulging in nasi lemak at all.

On the social side of things, Malaysians are a friendly bunch (if you don’t have Malaysian friends already) and you can find plenty of other Singaporean retirees to befriend.

Moreover, you won’t have to deal with much of a language barrier as most Malaysians speak English.

So if you’re worried about settling in, Malaysia is probably the easiest country to adjust to as a Singaporean.

Nature and Climate

While you won’t get to experience the four seasons or snowfall in Malaysia, our neighbour is known for its beautiful beaches, waterfalls and forests.

Nature lovers will relish the experience of living in Malaysia and exploring nature whenever they want, without crossing the border.

Healthcare

As we age, healthcare costs are also something we should take note of.

Thankfully, healthcare costs are relatively affordable, and you’ll have access to some of the best healthcare professionals and facilities.

According to Numbeo, Malaysia has a healthcare system index of 70.14, not too far off from Singapore’s 71.18.

But if you really want to, you can always go back to Singapore to get any treatments done.

Safety

Unlike Singapore however, Malaysia is not entirely safe and security could be an issue depending on where you live.

Retirement in Malaysia

Retiring under the national MM2H programme is a far stretch for most Singaporeans. However, if you qualify for the current S-MM2H programme, you still could retire anywhere in Sarawak or West Malaysia. Technically anyways and IF you have monthly offshore income from a company since dividends and rental income are not considered.

To be safe, the best way is to get a reliable agent online to help with your retirement visa as they are the most updated when it comes to the requirements and have been authorised by the Malaysian government.

If you have yet to start retirement planning, start out with our guide:

Want to hear more opinions about retirement in Malaysia or retirement planning?

Head on over to the Seedly Community’s Retirement group to ask for first-hand experiences and advice!

Advertisement