“Eh bro, you know how Seedly helps people to sort out their personal finance through the blog, asking questions on the Q&A, and track their expenses via the app?”, asked my friend one day.

“Erm… Yeah… Why?”

“Are you guys thinking of educating the more senior population?” she probed.

“Good point… Where’re you going with this?”

“What if. What if only ah. Not saying it’s me…” she paused for a second.

“What if your parents’ financial planning and retirement plans are damn cui? And they’re just going on holidays and eating out at restaurants when they don’t have that much to retire on, to begin with. Would you support them?”

I noticed that her face was becoming increasingly red, “Well… I suppose I have to..?”

“They’re FINANCIALLY NEGLIGENT leh. Then it becomes YOUR problem,” she said while jabbing a finger into my shoulder.

“Fair meh? I think it’s damn important to educate them as well, if not, no matter how much I save and invest. This is going to be a huge drain on my resources!” my friend exclaimed indignantly.

“Your resources?” I asked with concern.

“I mean…” embarrassed at her slip-up, “Would you support your financially negligent parents?”

Should We Support Our Parents?

The question of whether to support your parents in their golden years is a no-brainer.

Of course, we should…

Right?

I mean, you don’t want them to be walking around the whole day collecting cardboard boxes or empty drink cans just to make ends meet. Or worse, sitting in a corner begging for food.

I cannot sia.

The fact that we’re Asians also means that filial piety has pretty much been imbued in our psyche. Remember Sivik dan Pendidikan Moral or Hao Gongming (好公民)?

Besides, you would want to show them your gratitude for raising you, paying for your expenses, and perhaps even for helping you financially till you secured your first job. Wouldn’t you?

But what if they decide to live an extravagant lifestyle and squander their retirement savings? And they were purposefully negligent because they believe that it’s your job to support them?

Will you support them financially then?

The Maintenance Of Parents Act

The Maintenance of Parents Act Is an “Act to make provision for the maintenance of parents by their children”.

To put it simply, it’s a law that allows any person who is:

- a resident or treats Singapore as a permanent home,

- above 60 years old, and is

- unable to maintain himself or herself adequately

to apply to the Tribunal for the Maintenance of Parents (TMP) for an order that his or her children pay a monthly allowance or lump sum for maintenance.

But this is, of course, assuming that mediation at the Commissioner for the Maintenance of Parents (CMP) has failed.

If this is the first time you’ve heard of the TMP, you’ll be surprised to know that a total of 262 maintenance applications were submitted between 2013 to 2018.

That’s about 44 applications a year, or 3 a month.

However, not all parents are awarded maintenance.

In 2014 for example, 65 per cent of the cases were awarded maintenance, while 15 per cent were dismissed and 11 per cent of parents withdrew their petitions. For some of the other cases, the parent(s) passed away before the case was heard. ?

But most importantly, the TMP is fair.

In fact, it may even dismiss an application or reduce the sum sought if it is shown proof that the parent had abandoned, abused, or neglected his or her children.

So if you find yourself in a similar position as my friend who I talked about earlier? You really should talk to your parents. Or if they refuse to listen to reason, start collecting proof that they’re being financially irresponsible.

How Can You Help Your Parents Build Their Retirement Nest?

In a recent survey conducted, only one in every five Singaporean youth believes that their parents have enough personal savings to finance their retirement.

While only 15 per cent trust that their parents have planned for retirement and that they would not have to worry about them in their golden years.

These are all very worrying stats which can derail our plans for financial independence and early retirement.

So how can we avoid this? By starting the conversation with our parents TODAY.

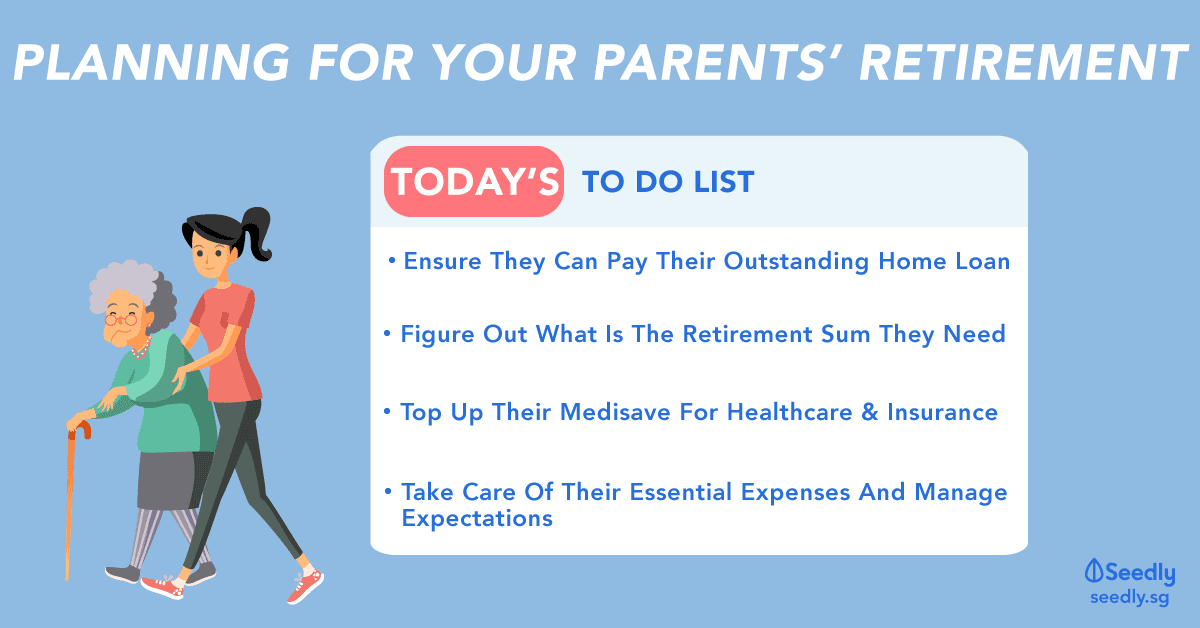

Here are some things which you might like to talk to your parents about:

1. Ensure They Can Pay Or Have Settled Their Home Loan

Assuming that your parents still have an outstanding housing loan before reaching their 55th birthday, they can submit an online application through CPF to reserve their Ordinary Account monies for housing.

The money kept in CPF also earns higher interest rates. The first $30,000 in the Special, Medisave, and Retirement Accounts, earn 6 per cent. While the next $30,000 earns 5 per cent, and amounts above $60,000 will earn 4 per cent.

2. Top Up Their Medisave For Healthcare And Insurance

It’s a given that your parents will incur more expenses to stay healthy in old age, so one way of supporting them is to top up their Medisave Account (MA) so that it meets the Basic Healthcare Sum. This sum is the estimated savings that your parents will need for basic subsidised healthcare needs.

MA savings can also be used to pay for hospitalisation and outpatient treatments, as well as for their MediShield Life and ElderShield insurance premiums.

3. Figure Out How Much They Need For Retirement

Talk to your parents and understand what they would like to do in their retirement. Would they like to spend more time with their grandchildren? Or would they like to travel the world?

All parties involved have to be realistic about this. Obviously, your parents can’t expect to you to foot their bill for a holiday in the Bahamas when you can’t even put food on the table.

Based on how much your parents need every month, you can then determine the retirement sum they should have in their Retirement Account (RA) which can provide them with the corresponding monthly payouts they need to sustain the retirement lifestyle they have in mind.

To help them achieve the retirement sum they need, you can make a voluntary cash top up OR transfer your CPF monies to their Special Account (SA) or RA.

Oh, and did you know that cash top-ups also grants you tax relief of up to $7,000?

4. Establish What Their Essential Expenses Are

Household expenses like utility bills and groceries are pretty fixed.

Unless your dad decides to build a mini particle accelerator, which guzzles electricity like no tomorrow.

If not, have an understanding with them with regard to how much allowance they’ll need to cover their basic expenses. And if you have siblings, rope them in so that everyone chips in.

Again, all parties involved have to be realistic about this as well. Bringing them out to a nice restaurant once a month is doable. For them to expect steak dinners every night is not possible, and probably a bad idea for their cholesterol.

Retirement Planning For Your Parents

It’s okay to help your parents out when they need it. But only when they are not taking advantage of you or making you feel like you owe them a living.

This is especially true if you’re struggling to make ends meet and your parents have the financial literacy of a 5-year-old.

So make the effort to constantly check in on them, and don’t be afraid to have the “money talk” with them to avoid any unexpected surprises in the future.

A huge part of retirement planning depends on you reaching out today to help them get their finances sorted out for tomorrow.

By proactively engaging and having open conversations with your parents, you can help make it easier for them to enjoy their golden years. This also helps you budget better, and be able to start making financial decisions on their behalf to safeguard their retirement and your future financial health.

Excuse me while I go give my parents a call.

Advertisement