Have You Started Your Retirement Planning? 54% Of Middle-Aged Singaporeans Have Not

When it comes to planning for retirement, most of us would’ve heard that we need to start early.

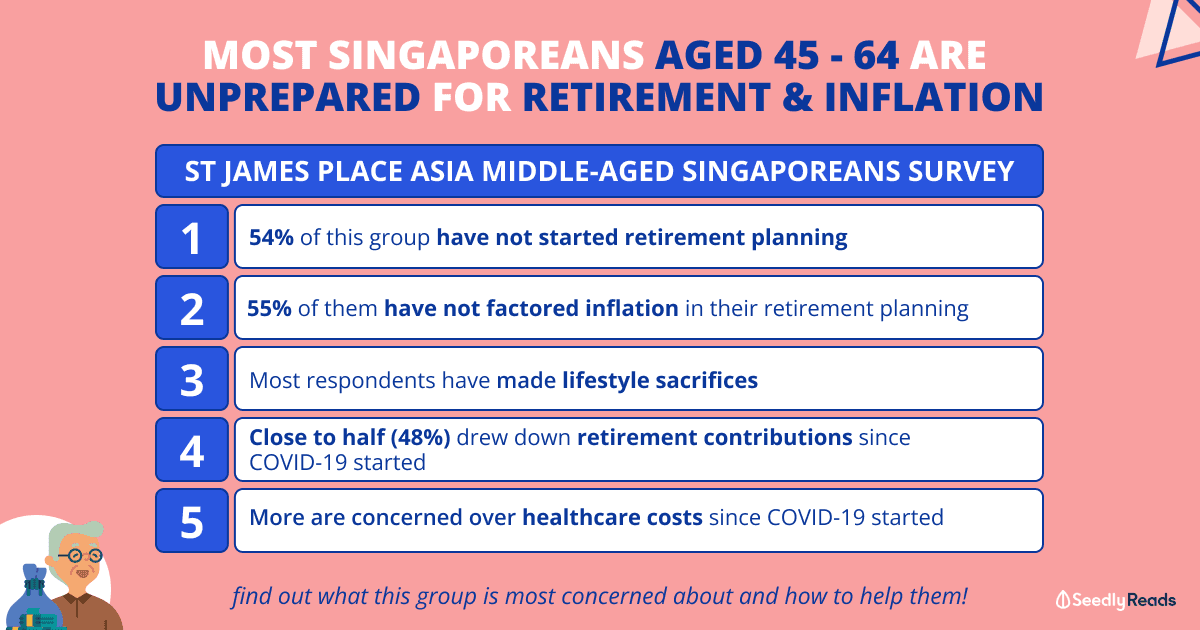

But, a survey study by St. James’s Place Asia (SJP Asia) found that 54% of Singaporeans aged between 45 and 64 have not started planning for retirement! And… 55% of those surveyed have not accounted for inflation in their financial planning. 😲

These numbers are… alarming considering we’re always bombarded by the importance of planning for retirement.

So, why is this happening?

Let’s find out!

TL;DR: Reasons Why Singaporeans Have Not Started Planning For Retirement

SJP Asia Study’s Research Methodology

The wealth management conducted 2,780 online interviews with respondents from Singapore (1,420) and Hong Kong (1,360). All respondents were aged 25 to 64 years old and those who held personal investments in stocks, property, shares, funds etc. and were from households with a minimum annual income of S$70,000 to over S$250,000.

Retirement Planning Becomes Harder Due to COVID-19

The pandemic has severely impacted the world and created lots of uncertainties, and retirement planning is no less affected.

The study also finds that 67% of the Singaporeans of ages 45 to 64 are more concerned about their ability to pay for medical expenses in their retirement since the pandemic started.

As a result of uncertainties, 72% of the Singaporeans surveyed have made lifestyle adjustments in the hopes of having a better retirement, and 48% of these respondents needed to draw down or reduce their retirement contributions due to immediate financial issues caused by the pandemic.

For the uninitiated, Singapore has increased its retirement age to 63 this year, and this number will increase to 65 by 2030. The average life expectancy of a Singaporean is 83.5 years.

Surely, if we retire at 65 years, we still have 20 years or so to spend in retirement, and there are knowledge gaps here that we’ll need to address below.

Read more:

- CPF Calculator 2022 Guide: Use This Tool to Forecast Your CPF Retirement Payout & More

- Retirement in Singapore: Is it just another pipe dream?

Not Understanding Financial Products And Services

Unsurprisingly, the survey reported that 57% of Singaporeans did not fully understand the financial products and services for retirement.

A similar report by OCBC late last year also reported that while close to half of Singaporeans have used financial tools to manage their personal finances, most of them are still unable to project their longer-term needs for retirement, hence they’ve underestimated the amount they need by 31%.

I’m guilty of this as well.

Before joining Seedly, I didn’t feel equipped to plan my retirement nor my parent’s retirement.

At Seedly, we aim to bridge the knowledge gap and build financial literacy among Singaporeans. As new products and services are launched in the market, the lesson here is to keep learning and learning.

For starters, consider using a Robo-Advisor or speaking to a financial advisor!

Wealth Transfer & Succession Planning Strain Family Relationships

Interestingly, 63% of Singaporeans of this age group shared that they don’t know how to manage intergenerational wealth transfer.

Also, 65% of them are unaware of potential tax implications.

Wealth planning may be a difficult topic to broach since money is often a sensitive topic.

If you’ve watched enough tv dramas, you will know that money is often a source of family disputes, and this can actually make retirement planning stressful for some.

Read more:

- CPF Investment Guide: Ultimate Compilation of CPF Investment Scheme Investment Products (OA + SA)

- Avoid This Retirement Planning Mistake That High-Income Earners in Singapore Are Making

- Property Tax Singapore 2022 Increase: Majority of HDB Flat Owners Will Pay More Property Tax Next Year

How to Start Planning For Retirement?

When we talk about retirement, the first thing that often comes to mind is always… the Central Provident Fund (CPF).

But, even so, do you know how to leverage your CPF accounts and interest rates?

For working Singaporeans, this is the cornerstone for funding their retirement.

When you reach 55, a Retirement Account (RA) will be created for you. The savings from your Special Account (SA) and/or Ordinary Account (OA) up to your Full Retirement Sum (FRS) will be transferred to your RA to form your retirement sum.

The retirement sum will provide you with a monthly payout from the payout eligibility age, which is 65 for members born on or after 1954.

How Much Money Do You Need To Retire in Singapore?

While working Singaporeans are required to contribute to our CPF accounts, not all Singaporeans are required especially Self-Employed Persons.

We estimated that Singaporeans need to save about $400,000 to retire at 55 years old in Singapore, but this is in the context without inflation and with the assumption that your investment will beat inflation every year.

In general, you should be saving at least $1,361 per month if you’re 25 years old this year, and at least $2,032 per month if you’re 45 years old this year.

Read more:

- Freelancer Guide: All You Need To Know About Your Income Taxes

- Are You Self-Employed? Don’t Miss Out On Your Income Tax or CPF Contribution

- A Self-Employed Individuals’ Guide To CPF Contributions

Afterthoughts

Retirement planning is definitely something we should not overlook, and require lots of planning ahead.

It’s good to establish your financial goals early so that you’ll be able to work towards achieving them earlier.

Suffice to say, start as early as you can so that you can enjoy the fruits of labour during your golden years.

Do you have an opinion on this topic?

Share your thoughts with the Seedly Community today!

Related Articles:

- Supplementary Retirement Scheme (SRS): What Is SRS + What Can You Invest in & Everything You Need To Know

- How Much Singaporeans Need To Save Now To Retire At 55 Or 62 Years Old

- Raising of Re-Employment & Retirement Agre in Singapore (PLus CPF COntributions): Here’s What Singaporeans Need To Know!

- Let’s Be Real, Most of Us Won’t Achieve FIRE

- Barista FIRE: An Alternative Retirement Plan Which Could Actually Work

Advertisement