How I’m Helping My Parents Plan For Retirement Using Their HDB Flat: Downsizing vs Lease Buyback Scheme

So… I had a discussion with my mother on the topic of retirement and downsizing our HDB flat.

This conversation came about as my sister will be moving out early next year, and I might be moving out in the next two years.

For context, my mother is 62 years old this year.

As a self-employed small business owner, she works six days a week, 8am to 6pm.

And just last year, the Government passed the Retirement Age and Re-Employment bill to increase the Retirement Age from 62 to 63 years old.

This means that with effect from 1 July 2022, she’s officially one year away from the full retirement age.

FYI: The Government will be raising the Retirement and Re-Employment Ages to 65 and 70 respectively by 2030.

With my mother, we’ve discussed whether to downsize our current home, jump on the Lease Buyback Scheme, and if she should retire at 63 years old.

Read on to find out the different considerations you (and your parents) should have when planning on downsizing!

TL; DR: Why Downsizing Is Important & Why You May Not Need To Retire Immediately

Click here to jump:

- Reasons to downsize

- Financial incentives from downsizing

- Downsizing alternative: Lease Buyback Scheme (LBS)

- Choosing between downsizing and LBS

- Should our parents retire once they’ve reached the retirement age?

Why You Should Consider Downsizing Your Flat

There are two main considerations why one should downsize their flat.

1. Lifestyle Reasons

The primary motivation for older Singaporeans to downsize is probably this – to reduce the upkeep they would have to pay to maintain a large house.

As our parents get older, it can be harder for them to keep up with the chores and maintenance of their homes.

If they are living alone, they may not even need a home as big as their current one.

A smaller home that is easy to manage and costs less money to maintain at that stage of life is probably more appropriate.

Also, HDB calls this shift a “right-sizing” of your home.

2. Financial Reasons

I’m sure all of us want to stay lit when we retire.

In fact, to incentivise people to make the transition, the Government has introduced the Silver Housing Bonus and other schemes and grants.

All of these could help our parents to free up cash flow as they approach their golden years.

How To Reap Financial Incentives From Downsizing

“I can lease out to earn extra income instead.” this could have crossed your parents’ minds.

We’re not eliminating the fact that this could be an option as you can earn extra income, but your parents will also have to deal with tenants at the same time.

As they start ageing, dealing with difficult tenants is the last thing one wants.

On the personal finance front, you would’ve known from Budget 2022 that there will be an increase in property taxes.

Regardless of all Annual Value tiers, all non-owner-occupied properties will have their tax rates increased from the original 10% to 20% to the new 12% to 36%.

All owner-occupied properties too will have their tax rates increased from the original 4% to 16% to the new 6% to 32%.

Unlike non-owner-occupied properties, this will only affect the portion of their annual value that exceeds $30,000.

This scenario is applicable for those with a second property such as a condo, but for most Singaporeans, downsizing is a practical approach that allows us to reap some incentives.

1. Silver Housing Bonus

To encourage older homeowners to downsize, the Government has introduced the Silver Housing Bonus (SHB), which is a cash bonus of up to $30,000 for downsizing.

There are several criteria to be eligible for SHB:

| Criteria | Eligibility |

|---|---|

| Age & Citizenship | At least one owner is a Singapore Citizen aged 55 or above |

| Income | Gross monthly household income is within $14,000 |

| Existing Property | HDB flat (met Minimum Occupation Period for resale), or |

| Private property of Annual Value of $13,000 or less; and | |

| No concurrent ownership of second property | |

| Property You Are Buying | 3-room (excluding 3-room terrace) or smaller; and |

| of a smaller room type than the last sold property; and | |

| Purchase price does not exceed selling price of the current/last sold property | |

| Housing Transactions | Booking of new HDB flat, or application to buy resale flat must be: |

| before sale of existing property; or | |

| within 6 months of completing sale of existing property |

Your household’s SHB cash bonus depends on your net sale proceeds, the amount you’ve topped up to your CPF Retirement Account (CPF RA) and joining CPF Life to reach your Full Retirement Sum (FRS).

If your parents are already CPF Life members, it’s important to have enough in their CPF RA.

The CPF RA will determine how much payout they get from CPF Life, which is meant to take care of retirement expenses.

There are two scenarios:

- By topping up $60,000 to their CPF RA, you will enjoy the maximum cash bonus of $30,000.

- If the top-up is less than $60,000, you will receive a pro-rated cash bonus based on a 1:2 ratio, i.e., a $1 cash bonus for every $2 top-up made.

| Net sales proceed | CPF Top-up | Cash Bonus into CPF Retirement Account |

|---|---|---|

| < $60,000 | All net sale proceeds | Pro-rated cash bonus based on a 1:2 ratio, i.e. $1 cash bonus for every $2 top-up made. For example, if net sales proceed is $35,000, your CPF top-up will be $35,000, and this will mean that you will receive a cash bonus of $17,500. |

| ≥ $60,000 | $60,000 + further top-up to reach Full Retirement Sum | $30,000 |

Unfortunately, calculating your HDB sales proceeds is not as easy as taking the difference between the amount you sold your house and the amount you bought your new flat.

There are several factors that can affect how much you’ll receive as net proceeds:

| Fact: Actual Sales Proceeds for Your Retirement |

||

|---|---|---|

| 1 | Sales Proceed from my current house | |

| 2 | Less: Remaining Mortgage Loan (if not fully paid up) | |

| 3 | Less: CPF Monies Used (including Accrued Interest of 2.5%) | |

| Part A: CPF Used for Downpayment | Part B: CPF Used for Monthly Loan Repayment |

|

| 4 | Less: Agent Commissions | |

| 5 | Less: Misc Costs & Fees | |

| 6 | Less: Purchase of Next Home | |

| 7 | Less: Resale Levy, if applicable | |

| 8 | Less: Upgrading Costs, if applicable | |

| 9 | Less: Upgrading Levy, if applicable | |

| 10 | Equals: Your Retirement Savings, FINALLY | |

To ease cash flow, there are also Government schemes available to help you cope with the transition:

- Deferred Downpayment Scheme

- Staggered Downpayment Scheme

- Temporary Loan Scheme.

It is important to note that even though SHB is a popular option, if your net sale proceeds are going to be lesser than $60,000 or zero, then SHB might not be that beneficial for you.

This is because you won’t be able to receive any of your proceeds in cash and you’ll also be receiving a prorated SHB Cash Bonus.

Pro-tip: As parents, you will enjoy a Proximity Housing Grant (PHG) of up to $20,000 by buying a three-room or smaller resale flat within four kilometres near your children.

Do note that if your net proceeds are deemed to be zero, you will not be eligible for SHB.

In such cases, the Lease Buyback Scheme may be more appropriate.

2. To Get Silver Support From the Government

The Silver Support Scheme is an initiative to provide additional support for elderly Singaporeans who had low incomes during their working years and now have less in their retirement.

There is no need to apply for Silver Support.

All Singaporeans aged 65 and above will be automatically assessed for their eligibility to receive Silver Support payouts. They will be assessed according to:

- The type of HDB flat they live in

- Their household monthly income per person.

| Eligibility for Silver Support | ||

|---|---|---|

| Contributed not more than $140,000 to your CPF by age 55. If self-employed, earned not more than $27,600 between ages 45 and 54. Live in a 5-room or smaller HDB flat. You or your spouse do not own a 5-room or larger HDB flat, private property, or multiple properties. Your household earns not more than $1,800 per person. |

||

| HDB Flat Type | Payout Per Quarter | |

| 1-room or 2-room | $900 | $450 |

| 3-room | $720 | $360 |

| 4-room | $540 | $270 |

| 5-room | $360 | $180 |

With downsizing, this means that the smaller the flat, the higher the payout.

Is Downsizing The Only Choice?

While downsizing is a practical choice, it might not be worth doing so if your net sales proceeds are zero as you will not be eligible to receive the SHB.

This is because the SHB aims to encourage households to top up their CPF.

Similarly, to be eligible for SHB, you’re not allowed to use personal savings for the top-up.

Hence, without net sale proceeds, you will not be able to do so.

What should we do then?

In such cases, you can consider the Lease Buyback Scheme (LBS).

The LBS is designed for those who prefer to monetise their existing flat by selling the remaining lease (of at least 20 years) to the HDB.

Your household will have the flexibility to choose the length of the lease to be retained, based on the age of the youngest owner.

| Criteria | Eligibility |

|---|---|

| Age | All owners must have reached the eligibility age (currently set at age 65) or older |

| Citizenship | At least one owner must be a Singapore Citizen |

| Income | Gross monthly household income of $14,000 or less |

| Flat type | All flat types* *Excluding short-lease flats, HUDC, and Executive Condominium units |

| Property Ownership | No concurrent ownership of second property |

| Minimum Occupation Period | All owners have been living in the flat for at least 5 years |

| Minimum Lease | At least 20 years of lease to sell to HDB |

Like the SHB, the money from the sale will first need to go to your CPF RA – FRS (single applicant) or Basic Retirement Sum (two or more owners).

Unless you already have the FRS in your CPF RAs, you will receive the excess from sales proceeds in cash.

Your household will also receive the LBS Bonus of up to $30,000 based on your flat size and the amount of proceeds topped up.

| Flat Type | Flat Owners' Total Top-Up to CPF | |

|---|---|---|

| $60,000 or more | Less than $60,000 | |

| 3-room or smaller flats | $30,000 | $1 for every $2 CPF top-up for 3-room or smaller flats |

| 4-room flats | $15,000 | $1 for every $4 CPF top-up for 4-room flats |

| 5-room or bigger flats | $7,500 | $1 for every $8 CPF top-up for 5-room flats or bigger flats |

Finally, the balance in your CPF Retirement Account will then be used to purchase your CPF Life Plan, where you’ll receive monthly payouts for your retirement years.

For self-employed persons, it is not compulsory to top up their CPF OA and OA accounts – which directly affects their RA account.

This could then lead to them not being able to join CPF Life to enjoy a monthly payout at all.

So, if your parents didn’t have sufficient savings in their CPF Retirement Accounts previously, applying for LBS for them may potentially unlock the CPF Life plan for them.

Disadvantages of Lease Buyback Scheme

Of course, the LBS is not without caveats.

There is a chance that you will not be getting your net sales proceeds in cash since you need to top up your CPF RA first.

Another thing to note is that after you opt for the Lease Buyback Scheme, you won’t be able to sell your flat and you’ll lose your flat lease.

This means you can’t include the flat in your will.

If you had family members who wished to continue living in the flat, they wouldn’t be allowed to.

Note: You can only apply to either the SHB or LBS and not both.

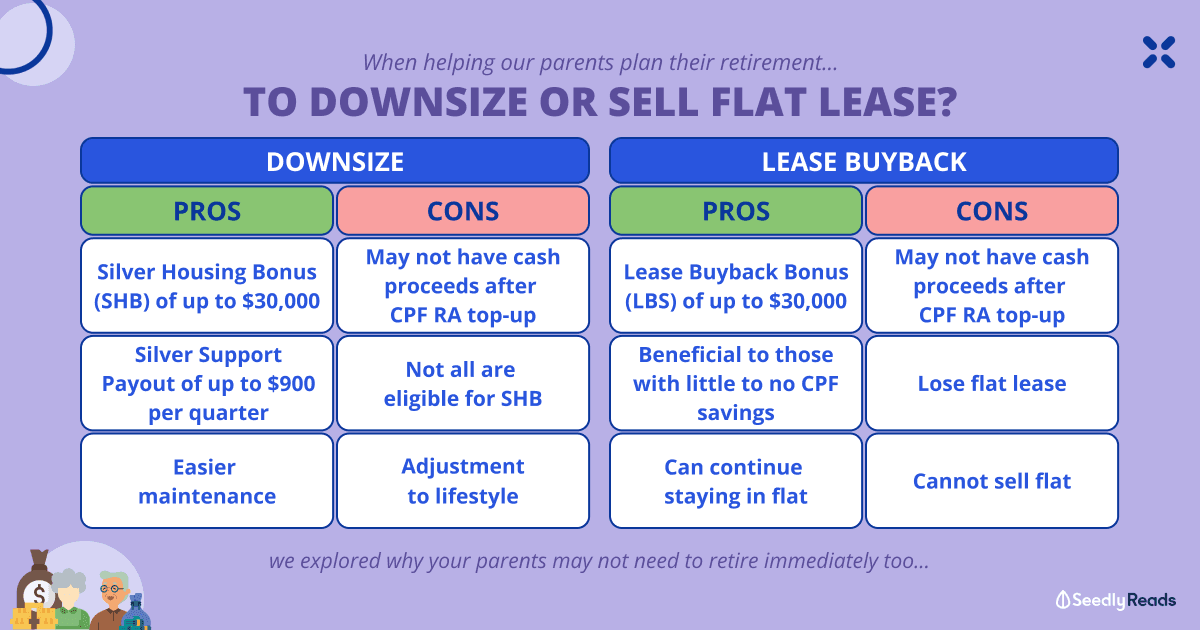

So, Should I Encourage My Parents To Downsize With Silver Housing Bonus (SHB) or Choose the Lease Buyback Scheme (LBS)?

SHB is for seniors who prefer to sell their current home and buy a three-room or smaller flat.

If I were to choose, downsizing to a smaller flat makes more sense than opting for HDB’s LBS.

Just looking at the Singapore property market over time, you’ll notice that prices tend to rise and stay up with inflation.

This implies that, rather than having HDB take back part of your lease, with the help of a capable property agent, you’ll probably be able to obtain a better price selling your house on the open market.

Ultimately, the choice is your parents’, and not one to be taken lightly.

Bonus: Should Our Parents Retire Once They Hit The Minimum Retirement Age?

We’ve talked about practical reasons to downsize our homes while helping our parents to work towards their retirement, but are they ready?

I’ve learned from my mother that the only thing that worries the elderly (including herself), is having a roof over their heads and having their basic needs met.

She has also shared that beyond money, there are other considerations.

Our parents deserve to enjoy their retirement without being financially burdened after many years of hard work and saving for the family.

However, if they desire to remain self-sufficient and independent and are in good health, they might want to consider continuing to work.

That said, some parents may not have a choice as they do not have enough money saved and will have to continue working.

What we can do is encourage them to have frequent health checkups to ensure that they are in good health.

Whatever their choice, we should communicate with our parents and support them in their choice with these retirement planning tips.

Closing Thoughts

Retirement planning is a long journey and definitely one that shouldn’t be taken lightly.

As I help my mother to work towards her retirement, I also realised that it’s better to start early when planning for our retirement.

How are you planning for your parents?

Share your thoughts with us by creating a free Seedly account and fire away within the Seedly Community today!

Advertisement