The COVID-19 pandemic is an unprecedented crisis which has affected businesses and put many jobs and livelihoods at risk.

Many companies have implemented cost-saving measures like no-pay leave and pay cuts.

But the worst-case scenario, for those of us who are employed, is (touch wood)…

Retrenchment.

While retrenchment should always be the last resort to manage manpower costs…

What if retrenchment is inevitable due to the current economic climate?

Or maybe your company has to restructure its business and has no choice but to let people go?

Find out what kind of retrenchment benefit is payable to you if you’re unfortunately retrenched due to COVID-19.

TL;DR: What Are The Retrenchment Benefits Payable To Me If I’m Retrenched Due to COVID-19?

If retrenchment is inevitable…

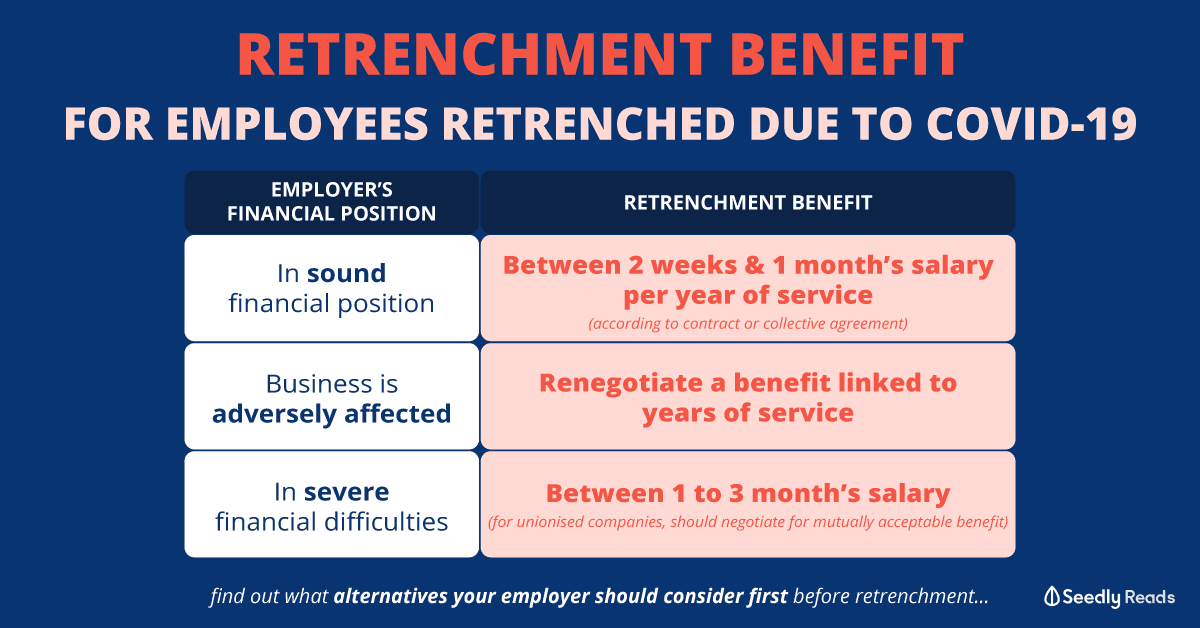

Your employer should provide retrenchment benefits based on their financial position:

| Employer's Financial Position | Retrenchment Benefit |

|---|---|

| In sound financial position | Pay retrenchment benefit according to contract or collective agreements Between 2 weeks and 1 month's salary per year of service |

| Business is adversely affected | Work with union or employees to renegotiate a fair retrenchment benefit linked to the employee's years of service |

| In severe financial difficulties | For unionised companies: Should negotiate with unions for mutually acceptable retrenchment benefit package |

| For non-unionised companies: Should provide a lump sum retrenchment benefit (between 1 to 3 months of salary) |

Note: the above guideline is based on a Ministry of Manpower advisory

While it sucks that you’re in this predicament.

Know that you’re not alone!

If you (or a friend or loved one) need help restarting your career after retrenchment.

We’ve put together this step-by-step No B.S. Guide to Restarting Your Career After Retrenchment which should help you get back on track!

Retrenchment Should Always Be the Last Resort

While our economy has pretty much ground to a halt due to COVID-19 and Circuit Breaker.

Your employer should utilise available Government support measures like the Jobs Support Scheme to retain and provide you with baseline wages even if you’re not working.

Before considering retrenchment, your employer should abide by the Tripartite Advisory on Managing Excess Manpower and Responsible Retrenchment and consider alternatives first.

Note: the tripartite refers to the Ministry of Manpower (MOM), the National Trades Union Congress (NTUC), and Singapore National Employers Federation (SNEF)

For example, your employer can:

- Send you for training to upgrade your skills and employability

- Redeploy you to alternative areas of work within the company

- Implement flexible work schedule, flexible work arrangements, shorter work-week or a temporary layoff

- Adjust wages in line with tripartite norms (read: paycut)

- Implement no-pay leave

If retrenchment is inevitable…

Your employer should abide by the Tripartite Guidelines on Fair Employment Practices when carrying out the retrenchment exercise.

This will ensure that the retrenchment is conducted fairly and without discrimination.

Notifying the Government and Unions

If your company is unionised, your employer should consult the relevant unions as early as possible.

They will also have to comply with the Mandatory Retrenchment Notifications requirement under the Employment Act.

This means that your employer MUST notify MOM of the retrenchment exercise.

Note: this applies if your employer has at least 10 employees and retrenches 5 or more employees within any 6-month period

This notification will enable tripartite partners and other relevant agencies to help affected employees seek alternative employment.

Or identify relevant training to enhance employability.

Communication to Employees

Naturally, your employer should inform you of their intentions of retrenchment as early as possible.

As well as before the public notice of retrenchment is given.

This communication may include:

- Explaining the company’s business situation resulting in the need for a retrenchment exercise

- Outlining how the retrenchment exercise will be carried out

- Elaborating on factors that will be considered

- Specifying the assistance being offered to those affected

Retrenchment Notice Period

Under the Employment Act, here are the minimum requirements for notice period for termination:

| Length of Service | Notice Period |

|---|---|

| Less than 26 weeks | 1 day |

| 26 weeks to less than 2 years | 1 week |

| 2 years to less than 5 years | 2 weeks |

| 5 years and above | 4 weeks |

Requirements aside.

Employers are encouraged to adopt a longer retrenchment notice period as compared to the normal termination of an employment contract.

This should also be worked out with the unions or with employees in their contracts of service.

Your employer should also pay ALL wages due as well as any retrenchment benefit to you by the last day of work.

So… What Kind of Retrenchment Benefit Can I Get?

Eligibility

Your employer should provide retrenchment benefits based on their financial position:

| Employer's Financial Position | Retrenchment Benefit |

|---|---|

| In sound financial position | Pay retrenchment benefit according to contract or collective agreements Between 2 weeks and 1 month's salary per year of service |

| Business is adversely affected | Work with union or employees to renegotiate a fair retrenchment benefit linked to the employee's years of service |

| In severe financial difficulties | For unionised companies: Should negotiate with unions for mutually acceptable retrenchment benefit package |

| For non-unionised companies: Should provide a lump sum retrenchment benefit (between 1 to 3 months of salary) |

As a general guideline, you are eligible for retrenchment benefit if you have clocked 2 years’ service or more.

If you have less than 2 years’ service, you could be granted an ex-gratia payment (read: given in gratitude without any contractual or legal obligation).

How Much Will I Get?

This will depend on what is stated in the collective agreement or your individual contract of service.

If there is no provision for this, the amount is to be negotiated between you and your employer.

The prevailing norm varies between 2 weeks to 1 month’s salary per year of service.

BUT this depends on the financial position of the company and the industry norm.

For unionised companies where the retrenchment benefit is stipulated in a collective agreement, the norm is 1 month’s salary per year of service.

What If I Had a Pay Cut Before the Retrenchment?

Your salary prior to the pay cut should be used to compute the retrenchment benefit.

This way, cuts are not implemented to reduce retrenchment payments.

Consideration for Lower Wage Employees

Employers are also urged to be more generous towards lower wage employees (read: those who are eligible for the Workfare Income Supplement).

Such as providing more weeks of retrenchment benefit pay-out per year of service.

Or additional training grants.

Support For Retrenched Employees

Your employer should also support you in seeking new employment.

Either through their business networks or by referring you to Workforce Singapore (WSG) or Employment and Employability Institute (e2i) for employment opportunities.

Oh, and if you’re a Singaporean or Permanent Resident, be sure to check if you are eligible for the COVID-19 Support Grant too!

That should help tide you over this period of transition.

If you need assistance or have further queries about what kind of retrenchment benefits are payable to you, you can contact:

| Contact | |

|---|---|

| Ministry of Manpower | Online enquiry |

| National Trades Union Congress (NTUC) | [email protected] |

| Singapore National Employers Federation (SNEF) | [email protected] |

Advertisement