Revolut Metal Just Launched in Singapore, Is It Worth Paying For?

Did you make an early Christmas wish for another numberless card to spend on?

Oh, but you want something that feels nicer in your palm, just like the Apple Card?

Well, it seems like someone heard you, Revolut Metal is finally available in Singapore!

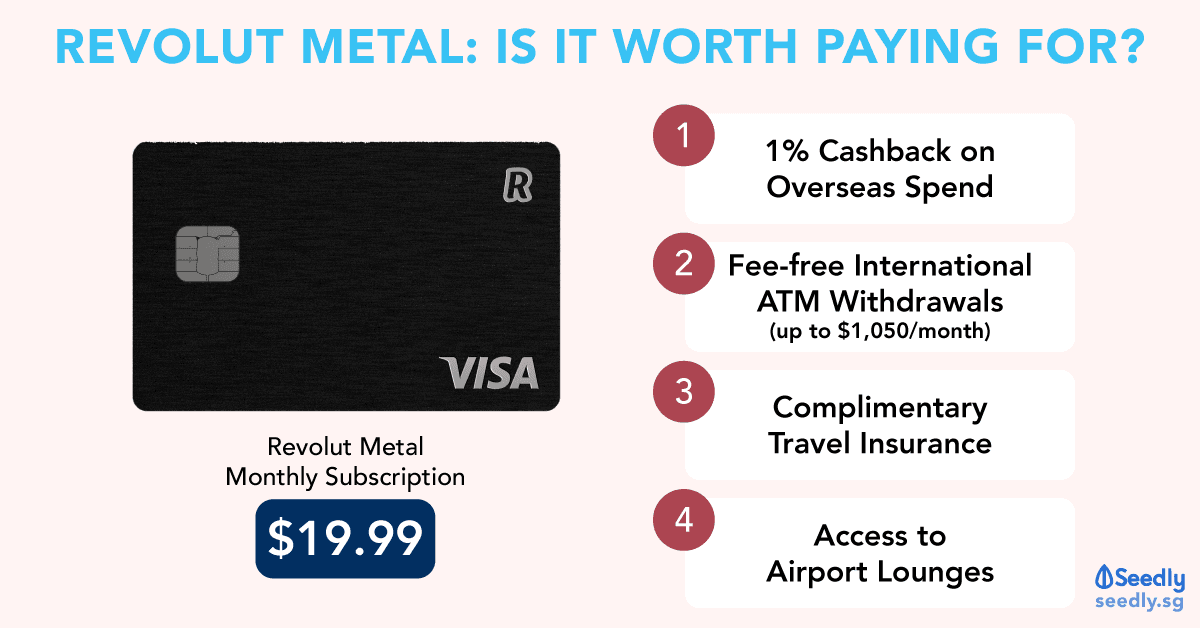

TL;DR – Revolut Metal: Is It Worth Paying For?

Hopefully I don’t sound like Captain Obvious here, but the Revolut Metal is only worth paying for if you’re a frequent traveller!

Otherwise, the free Revolut Standard subscription should be good enough for you.

While $19.99 per month might sound like it’s a lot to pay for a multi-currency card subscription, it sounds reasonable seeing that you’ll get to enjoy these features:

- 1% cashback on overseas spend in 28 currencies

- Free currency exchange at interbank exchange rate

- Fee-free international ATM withdrawals up to $1,050 per month

- Complimentary travel insurance covering medical, dental, baggage delay and loss or damaged items

- Access to over 1,000 airport lounges

- 24/7 dedicated concierge for hotel reservations, flight bookings and more

- Send money domestically and overseas in 28 currencies

Is Revolut Metal Worth Paying For?

If you’re a true Singaporean, you probably already have at least one multi-currency card in your wallet.

Psst, is it the Revolut Standard?

Don’t be shy if you’ve collected all of them, we just want the best deals for ourselves!

It’s fine if you’ve got no clue what I’m talking about, let’s take a quick look at the features of Revolut Metal.

| Membership Tier | Metal |

|---|---|

| Cost | S$19.99/month |

| Card Type | Visa Signature |

| What You Get | Spend in > 150 currencies at interbank exchange rate |

| 1% cashback in 28 supported currency on all overseas spending | |

| International ATM withdrawals (free, up to S$1,050/month) | |

| Unlimited exchange in 28 fiat holding currencies | |

| Send money domestically and overseas in 28 currencies | |

| Global express delivery | |

| Priority customer support | |

| 24/7 concierge (for hotel reservations, flight bookings, etc.) | |

| Disposable virtual cards | |

| LoungeKey Pass access (over 1,000 airport lounges) | |

| Global medical and dental insurance | |

| Baggage delay insurance | |

| Loss or damaged items insurance |

You must be wondering, is it worth paying $19.99 per month for Revolut Metal membership?

That’s right, with that amount, you could have gotten your good friend an awesome Secret Santa gift!

It probably goes without saying that you should be a frequent traveller before you even consider getting a Revolut Metal subscription.

Even though some of you might not care about getting access to airport lounges or a 24/7 dedicated concierge to help out with your concerns, there are other perks you might be interested in!

1% Cashback on Overseas Spend

Of course, there are other credit cards that may be able to give you way more cashback on your overseas spend.

Although I’m sure you’re aware that you’ll have to pay a foreign transaction fee, for every single transaction, essentially lowering the amount of cashback you’re receiving.

It’s a little different if you’re spending with a multi-currency card like Revolut Metal, since you’ll enjoy free currency exchange, which means the 1% cashback is entirely yours!

Did I also mention that of the three Revolut membership tiers, only Revolut Metal gives you the 1% cashback?

Travel Insurance Coverage

I know what you’re thinking, it’s impossible to spend $1,999 overseas every month to make the subscription fee worthwhile.

I wish I get to travel every month too…

But hey, you’ll enjoy complimentary travel insurance covering any emergency medical and dental needs, baggage delay, and loss or damaged items purchased through your Revolut Metal.

If you’re a frequent traveller, you should know that annual coverage by most insurers would cost you at least $200 per year, which is similar to what you’ll be paying for Revolut Metal subscription.

Now, don’t tell us travel insurance is not important and you don’t get it for your trips. We’ll probably be giving you the death stare.

International ATM withdrawals

While this is not a unique feature to Revolut Metal, you can make fee-free international ATM withdrawals of up to $1,050 per month.

If you’ve ever had to withdraw money overseas, like I did when I went to Bangkok with only SGD$250 worth of Thai Baht, you’ll know that this is a godsend!

Just because Revolut doesn’t charge you any fees for your withdrawals below $1,050 doesn’t mean you can do so without thinking twice!

Some ATM operators may still charge their own fees, so be sure to check the different operators available.

What happens if you spent too much? Just take note that you’ll be subject to a 2% withdrawal fee for the amount above $1,050, so plan wisely!

Remember, as with any financial product, it’s important that you do your own homework even after reading this article so that you’ll make an informed decision.

Also, travel safe!

Advertisement