Top 5 Billionaires in Singapore (2023): Here's How They Gained Their Wealth

●

How Many Billionaires Are There in Singapore?

For better or worse, there are a heck load of billionaires in Singapore.

According to Forbes, there are 35 billionaires in Singapore in 2023 — up from 26 a year ago.

Also, the total wealth of the country’s 50 richest individuals soared 8 per cent to S$254.5 billion (US$177 billion) from S$223.8 billion (US$164 billion) a year ago despite Singapore’s economy slowing.

To put this into context, the Unity Budgets, Resilience Budgets, Solidarity Budgets and Fortitude Budgets rolled out to support Singaporeans cost only about S$93 billion.

Out of these 35 billionaires, there is an elite tier of billionaires in Singapore who hold immense wealth, significant influence and have enough money to spend on ridiculous things for several lifetimes.

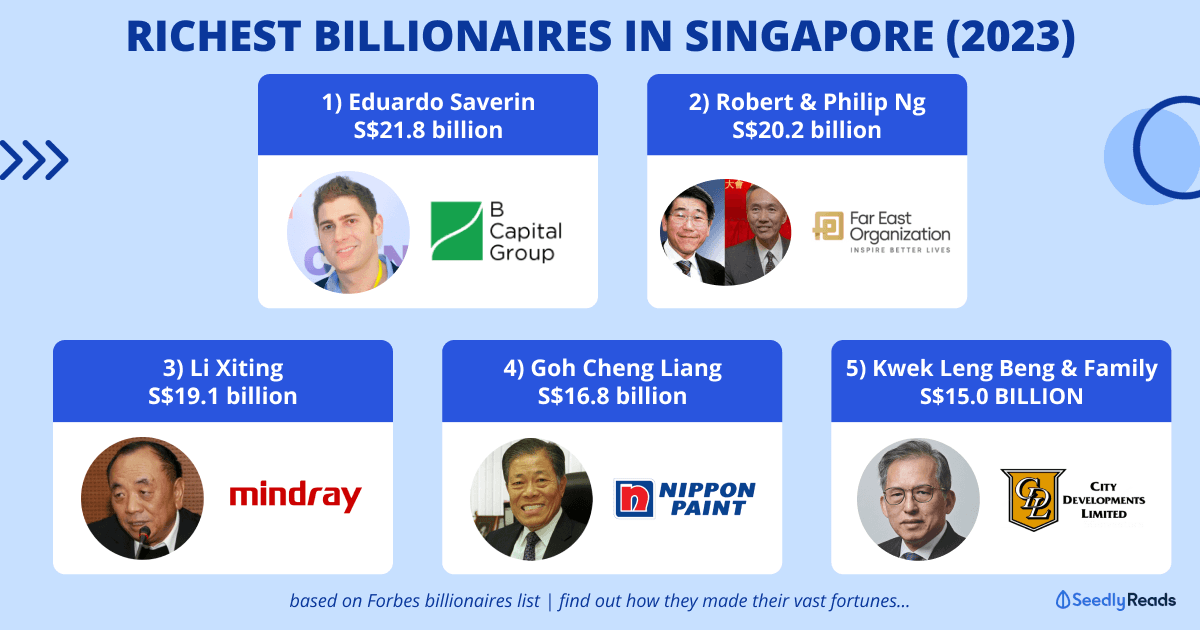

These top five billionaires range from a social media scion, real estate tycoons, a medical devices magnate and a paint power broker.

Here are their origin stories and how they really attained their wealth.

TL;DR: Top 5 Richest People in Singapore 2023 Bio and How They Gained Their Wealth

| Rank | Name | Net Worth (As of 31 Aug 2021) | Source of Wealth |

|---|---|---|---|

| 1 | Eduardo Saverin | S$21.8 billion (US$16.0 billion) | Technology Co-Founder of Meta Platforms Inc. (formerly Facebook) |

| 2 | Robert & Philip Ng | S$20.2 billion (US$14.8 billion) | Real Estate They control Far East Organisation, Singapore's biggest private landlord and property developer |

| 3 | Li Xiting | S$19.1 billion (US$14.0 billion) | Medical devices Founder of Mindray Medical International Limited |

| 4 | Goh Cheng Liang | S$16.8 billion (US$12.3 billion) | Paint Majority stake in Japan's Nippon Paint Holdings, the fourth biggest paint manufacturer in the world |

| 5 | Kwek Leng Beng & family | S$15.0 billion (US$11.0 billion) | Real Estate Executive Chairman of City Developments Limited |

*Here is Forbes’ methodology:

The list was compiled using shareholding and financial information obtained from the families and individuals, stock exchanges, analysts and other sources. Unlike Forbes’ billionaire rankings, this list includes family fortunes, including those shared among extended families such as that of Kwek Leng Beng and his cousins. Net worths are based on stock prices and exchange rates as of the close of markets on Aug. 18, 2023. Private companies were valued based on similar companies that are publicly traded. The list can also include foreign citizens with business, residential or other ties to the country, or citizens who don’t reside in the country but have significant business or other ties to the country. The editors reserve the right to amend any information or remove any listees in light of new information.

Click to Teleport

- Forbes Billionaire List Singapore 2023: Why the List Changed, Who’s in, Who’s Out and Why

- Eduardo Saverin

- Robert and Philip Ng

- Li Xiting

- Goh Cheng Liang

- Kwek Leng Beng and Family

Forbes Billionaire List Singapore 2023: Why the List Changed, Who’s in, Who’s Out and Why

Eduardo Saverin, one of the founders of Meta Platforms (formerly known as Facebook) and a resident of Singapore for over ten years, has become the new top billionaire with a net worth of S$21.8 Billion (US$16.0 billion). He saw the most significant increase in wealth this year in terms of dollars, adding S$8.7 billion (US$6.4 billion) to his fortune as Meta’s shares surged by nearly 70 per cent since the last time Forbes assessed his wealth.

Holding onto the second position are the brothers Robert and Philip Ng from the Far East Organization, with a total wealth of S$20.2 billion (US$14.8 billion), slightly down from their S$20.7 billion (US$15.2 billion) last year. Li Xiting, the chairman of Shenzhen Mindray Bio-Medical Electronics, has slipped to the third spot after spending two years as the wealthiest due to a decline in healthcare stocks caused by China’s anti-corruption crackdown on the pharmaceutical sector. His net worth dropped to S$19.1 (US$14.0 billion) from S$21.3 (US$15.6 billion) last year.

In the fourth position is Goh Cheng Liang, who controls Japan’s Nippon Paint Holdings. His wealth decreased slightly from S$16.8 billion (US$13 billion) last year to S$16.8 billion (US$12.3 billion) this year. Kwek Leng Beng, a prominent figure in the real estate industry, maintained his fifth position, with his fortune rising by 18% to reach a record S$15.0 billion (US$11 billion), up from S$12.7 (US$9.3 billion) the previous year. Following the pandemic, Kwek’s City Developments, a listed company, is again considering global acquisitions and recently purchased the iconic St Katharine Docks in central London for S$682.3 (US$500 million) in March.

1. Who is Eduardo Saverin? Social Media Scion With a S$21.8 Billion Net Worth

Number one, Numero Uno on our list of billionaires is 42-year-old social media scion Eduardo Saverin:

Born into a prosperous Brazilian Jewish family in 1982, Saverin relocated to Miami during his childhood and later pursued his education at Harvard University.

Eduardo Saverin Company and Industry

Saverin is one of the co-founders of Meta Platforms, the parent company of Facebook, the world’s largest social network. Headquartered in Menlo Park, California, Meta boasts approximately 3.8 billion monthly users and reported a staggering S$159.5 billion (US$117 billion) in revenue in 2022. Meta’s initial public offering (IPO) in 2012 was, at the time, the largest-ever technology IPO.

In February 2004, he collaborated with Mark Zuckerberg and two other classmates to start Facebook, originally conceived as a social networking platform for college students. While his peers eventually moved to Silicon Valley, Saverin remained on the East Coast and was eventually removed from the company in the summer of 2004 due to disagreements in management.

This dispute resulted in the reduction of his ownership stake as new investors entered the picture, which he contested in the legal arena. In 2009, a legal settlement was reached, granting him an undisclosed portion of the company and formal recognition as a co-founder on Facebook’s official website.

In 2011, Saverin made the significant decision to renounce his U.S. citizenship and become a Singapore resident. Renunciants, particularly American citizens, must pay an exit tax on the estimated capital gains from their stock holdings at the time of renunciation. Bloomberg data suggests that Saverin’s tax liability would amount to approximately S$347.7 billion (US$255 million). This tax obligation can be deferred indefinitely until the shares are sold, thus being recorded as a financial liability until that time.

In 2016, he started the B Capital venture fund in partnership with Raj Ganguly, an experienced professional with backgrounds at BCG and Bain Capital. Over time, this fund has amassed assets totalling S$8.9 billion (US$6.5 billion), underscoring its considerable influence.

In July 2022, B Capital achieved a notable milestone by securing an additional S$340.9 million (US$250 million) in funding, earmarked for investments in early-stage startups. This development signifies the fund’s unwavering commitment to nurturing innovative entrepreneurship.

Eduardo Saverin’s Net Worth

Although he has since become a venture capitalist, most of his net worth of S$21.8 Billion (US$16.0 billion) comes from his 2 per cent stake in Meta Platforms, as seen in the company’s 2022 proxy statement.

2. Who is Robert and Philip Ng? Far East Movement Billionaires With a S$20.2 Billion Net Worth

Next, we have the brothers Robert and Philip Ng.

Robert and Philip Ng Company and Industry

They are best known for their controlling stake in the Far East Organisation (FEO), Singapore’s largest private property developer and sponsor of the Far East Hospitality Trust REIT.

Philip Ng heads the local operations with his other siblings, who serve as executive directors.

The older brother, Robert Ng, is the chairman of their Hong Kong-based sister company, Sino Group.

Robert and Philip Ng Net Worth

The brothers are currently worth about S$20.2 billion (US$14.8 billion) combined, with their wealth stemming from FEO and its associated businesses.

Holding onto the second position are the brothers Robert and Philip Ng from the Far East Organization, with a total wealth of S$20.2 billion (US$14.8 billion), slightly down from their S$20.7 billion (US$15.2 billion) last year.

Robert and Philip Ng Bio

A conversation about their wealth cannot exclude their late father, Ng Teng Fong.

FEO was started by their late father back in 1960, reportedly with some assistance from one of Singapore’s earliest billionaires, Eliya Thamby.

He was known as the “King of Orchard Road” for developing the Far East Shopping Centre (1974), Lucky Plaza (1978), Orchard Plaza (1981), Far East Plaza (1983) and Claymore Plaza (1984).

Despite his fortune, he was known for leading a frugal and simple lifestyle.

Although he controlled at least a quarter of Singapore’s housing market, Ng lived in the same house he had had for 30 years and used to take his own lunch onto aeroplanes.

He also developed FEO into a mega-conglomerate that owned over 700 malls, hotels and condos in Singapore and Hong Kong worth over S$6 billion.

After their father passed away in 2010, the brothers teamed up to expand their father’s empire further, making further inroads into Hong Kong and expanding to Australia.

3. Who is Li Xiting? Medical Devices Tycoon With a S$19.1 Billion Net Worth

The person who currently holds the title of the third richest person in Singapore is naturalised Singapore citizen and entrepreneur Li Xiting.

He has also been a Singapore citizen since at least 2018.

Li Xiting Company and Industry

Li is the Chief Executive Officer (CEO) and founder of Shenzhen Mindray Medical International, a company that supplies medical devices like ventilators, imaging devices and patient monitors.

According to the company, its products and services are used by healthcare facilities in over “190 countries and regions”.

To say his rise was meteoric is an understatement. In January 2020, he wasn’t even in the top 15 list of richest people in Singapore.

Li Xiting Net Worth

Now, with a net worth of S$19.1 billion (US$14.0 billion), Li has barely kept his top spot.

His growth in wealth can be mostly attributed to the COVID-19 pandemic, which saw demand for medical devices skyrocket.

This is especially true for ventilators, a hot commodity worldwide as nations rush to get their hands on these devices.

Moreover, unlike other medical equipment like gloves, which can be mass-produced in factories, manufacturing ventilators require highly specialised knowledge and technical expertise.

There is also a shortage of critical components, which makes the manufacturing of these devices even harder.

Ventilators, essentially, breathe for a patient. They move air into and out of the lungs mechanically.

These life-saving devices are critical in the fight against COVID-19 as COVID-19 patients whose lungs have been attacked by the virus require these devices to survive.

Li Xiting, the chairman of Shenzhen Mindray Bio-Medical Electronics, has slipped to the third spot after spending two years as the wealthiest due to a decline in healthcare stocks caused by China’s anti-corruption crackdown on the pharmaceutical sector. His net worth dropped to S$19.1 (US$14.0 billion) from S$21.3 (US$15.6 billion) last year.

Li Xiting Bio

According to the South China Morning Post (SCMP), 69-year-old Li originates from Dasngshan, a province in rural Anhui renowned for its peaches and pears.

Li obtained his degree from the University of Science and Technology in China. After he graduated, he worked as a researcher in various institutes in China and was a visiting scholar at the University of Paris-Sud in the early 1980s.

He then secured a job at a medical equipment company in Shenzhen for four years until 1991, when he founded Mindray with co-founders Xu Hang and Cheng Minghe.

The company co-founded went public on the New York Stock Exchange in 2006 and was subsequently taken private by Li and a consortium in 2016. However, in October 2018, the company was relisted on the Shenzhen stock exchange.

It was reported by Forbes that the company donated Mindray medical devices worth about S$$6.3 million to hospitals in Wuhan and northern Italy in 2020.

4. Who is Goh Cheng Liang: Paint Power Broker With a S$16.8 Billion Net Worth

Look around you.

There’s a good chance you used Nippon paint for the walls in your house.

This leads us to the next billionaire on this list: paint power broker Goh Cheng Liang.

Goh Cheng Liang Company and Industry

His wealth is largely derived from a 39.5% stake in Japan’s Nippon Paint Holdings, the fourth largest paint manufacturer in the world.

Goh Cheng Liang Net Worth

Currently, Goh Cheng Liang is valued at S$16.8 billion (US$12.3 billion).

His wealth decreased slightly from S$16.8 billion (US$13 billion) last year to S$16.8 billion (US$12.3 billion) this year.

But the story behind how he attained his wealth is also pretty interesting.

It is certainly more interesting than watching his paint dry.

Goh Cheng Liang Bio

Goh’s story is one for the history books.

In an interview with Forbes, Goh revealed that he was born in 1928 to a poor family in Singapore who lived in a one-room tenement.

He was one of four children, and as a boy, he toiled away at a hardware store and sold fishing nets to make ends meet. This provided him with the business skills and grit that served him well over the years.

At the age of 28 in 1955, he set up his first paint shop in Singapore and became the main local distributor of Nippon Paint.

In a bid to grow his business, Goh went to visit Chiakai Obata, known as the second founding father of Nippon Paint.

Impressed by Goh’s eagerness, Obata took him under his wing. However, the relationship was not formalised until 1962, when Singapore imposed a 20 per cent tariff on all imported paint.

Nippon Paint and Wuthelam then set up a joint venture, with Nippon Paint taking up a 40 per cent stake in Goh’s business.

This joint venture became known as the NIPSEA Management Group, jointly owned by Goh and Nippon Paint Holdings.

Today, the NIPSEA group is Asia’s largest paintmaker and has operations in 17 geographical locations.

The duo also strengthened their relationship when Goh boosted his stake in Nippon Paint Holdings to 39.56 per cent, making him the largest shareholder in the company.

His son, Goh Hup Jin, is also the Director of the Board for Nippon Paint Holdings and runs their privately held joint venture, the NIPSEA group.

Goh has also diversified over the years, founding his private investment company Wuthelam Holdings in 1974 and investing in properties like the Liang Court shopping complex, hotels, electronics, logistics, manufacturing and trading.

Goh also started the Goh Foundation, which gives generously to charitable causes like the S$12 million given to the National University Hospital, Singapore, for leukaemia research in 2013 and the Goh Foundation Endowed Scholarship for SMU students.

5. Who is Kwek Leng Beng and Family? Property Tycoons Worth S$15.0 Billion

Rounding up this list is 82-year-old Kwek Leng Beng and his family:

Kwek Leng Beng Company and Industry

Kwek Leng Beng serves as the executive chairman of the Hong Leong Group in Singapore, an organization established by his father in 1941. Additionally, he holds the position of executive chairman at City Developments, the second-largest property developer in Singapore.

His son, Sherman, assumed the role of group CEO at City Developments in 2018, following a decade of diverse responsibilities within the company.

Kwek gained international recognition during the 1990s by acquiring a series of hotels, leading to the formation of the Millennium & Copthorne hotel chain. Notably, in 1995, he made a high-profile acquisition of the Plaza Hotel in New York, partnering with Saudi prince Alwaleed Bin Talal.

City Developments possesses a portfolio of rental apartments in various countries, including the UK, Japan, Australia, and the US. This includes a student accommodation development located in the United Kingdom.

Kwek Leng Beng Net Worth

Kwek Leng Beng, a prominent figure in the real estate industry, maintained his fifth position, with his fortune rising by 18 per cent to reach a record S$15.0 billion (US$11 billion), up from S$12.7 (US$9.3 billion) the previous year. Following the pandemic, Kwek’s City Developments, a listed company, is again considering global acquisitions and recently purchased the iconic St Katharine Docks in central London for S$682.3 (US$500 million) in March.

An important thing to note is that ‘this list includes family fortunes, including those shared among extended families such as that of Kwek Leng Beng and his cousins.’

What Are Your Thoughts on These Billionaires?

Is there anything we can learn from them? Share your thoughts with our friendly community on Seedly!

Read More

Advertisement