Road Tax Renewal Guide for All Drivers: Here’s How To Check Expiry, Pay, Renew & More

You’ve just gotten a car and car insurance, and now you’ll have to… pay the road tax.

Regardless of whether you’re a new or old driver, a road tax has to be paid by law.

A road tax may or may not be included in the total cost of a new car, so you should always check with the dealer before paying any.

Similarly, if you’ve just bought a used car, you should check if it has a valid road tax before you drive it.

In this article, we’ll share with you everything you need to know about road tax!

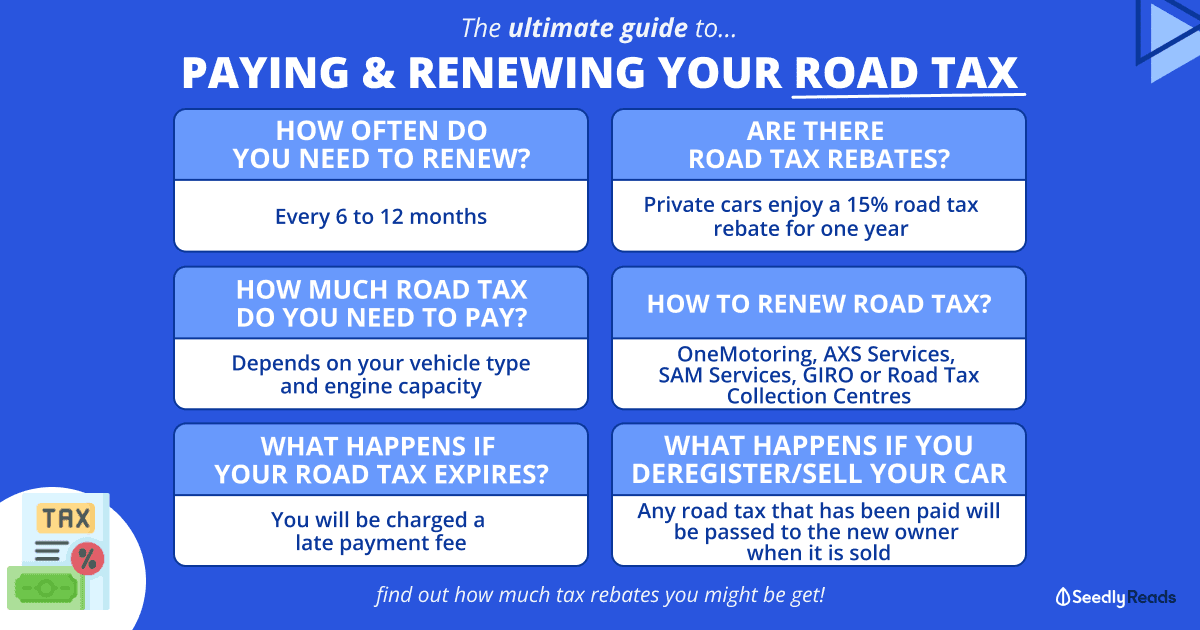

TL;DR: Ultimate Singapore Road Tax Guide — Find Out if There Are There Road Tax Rebates and How To Renew Your Road Tax

Click here to jump:

- What is road tax?

- Road tax rebates (as of Aug 2022)

- How much road tax do you need to pay?

- How do you pay road tax, how to check road tax expiry and how do you renew your road tax?

- What happens if I pay my road tax late?

- What if I deregister or sell my car?

- Can I use a credit card to earn rewards?

What Is a Road Tax, and Why Do We Need To Pay It?

The Singapore Government imposes a road tax on a driver’s vehicle ownership to control road congestion.

Every registered vehicle in Singapore must have a valid road tax in order to operate on the road.

The road tax is renewed every six to 12 months, so you should always set a reminder to pay your taxes.

Road Tax Rebates

The Government announced during Budget 2021 that it’ll provide one-year tax rebates to help drivers ease into the transition of an increase in petrol duties,

This scheme is specifically targeted at registered owners of vehicles during the period 1 Aug 2021 to 31 Jul 2022, with commercial vehicles enjoying a 100% tax rebate, motorcycles enjoying 60% while all other vehicles (including taxis), a 15% tax rebate.

How Much Road Tax Do You Pay?

Road taxes are charged based on a vehicle’s engine capacity. Naturally, the bigger the car, the higher the fuel consumption and emissions, and the higher the tax.

Furthermore, you must pay an additional road tax surcharge on top of your vehicle’s original road tax if the vehicle is more than 10 years.

Curious how much more you need to pay for your oldies? Here’s the breakdown according to your vehicle’s age:

| Vehicle's Age | Annual Surcharge |

|---|---|

| > 10 years | 10% of road tax |

| > 11 years | 20% of road tax |

| > 12 years | 30% of road tax |

| > 13 years | 40% of road tax |

| > 14 years | 50% of road tax |

If you’re wondering how to calculate the tax, you can use the Land Transport Authority (LTA)’s calculator to do so. All you need to do is to key in your vehicle number, or engine and vehicle details.

How Do You Pay or Renew Your Road Tax?

There are multiple ways to pay and renew the road tax.

To pay your road tax dues or renew them, you can do so via the following methods:

- Online via OneMotoring (available all day except between midnight and 1am)

- AXS Services (available all day except between midnight and 1am)

- SAM Services (available all day except between midnight and 1am)

- GIRO

- Road Tax Collection Centres

Before you renew your road tax, note that you can only do so nearing its expiring date, which is three months before it expires.

Just one month before your road tax expires, you will receive a reminder letter from LTA.

However, there are a couple of things you need to do at least three days before you wish to pay your road tax:

- Car insurance: The vehicle must be insured for the period of road tax, and insurance should cover third-party liability for deaths and bodily injury

- Vehicle inspection: Must have passed any upcoming vehicle inspection, if any – as per LTA’s requirements, vehicles that are three years of age should be inspected once every two years, and once it reaches their 10th-year mark, they must be inspected every year

- Car plate inspection: Number plate inspection for weekend cars / off-peak cars / revised off-peak cars

- Fines: Clear any outstanding fines

- A Valid Vehicle Parking Certificate for heavy vehicles.

In short, this is a rough timeline you need to look at before renewing it.

Can I Renew My Road Tax After It Expires? Is There a Grace Period for Expired Road Tax?

Yes, you can still renew your road tax after it expires. However, you’ll need to pay an extra late payment charge depending on how late you are and your vehicle type.

The late payment fees are as follows:

| Cars | ||||

|---|---|---|---|---|

| Engine Capacity | Within 1 month of expiry date | Between 1 and 2.5 months | More than 2.5 months | More than 3 months |

| ≤1,000cc | $10 | $60 | $80 | $230 |

| 1,001 – 1,600cc | $20 | $70 | $90 | $240 |

| 1,601 – 2,000cc | $30 | $80 | $100 | $250 |

| 2,001 – 3,000cc | $40 | $90 | $110 | $260 |

| ≥3,001cc | $50 | $100 | $120 | $270 |

| Business service passenger vehicles (company cars) | ||||

| Engine Capacity | Within 1 month of expiry date | Between 1 and 2.5 months | More than 2.5 months | More than 3 months |

| N.A. | $50 | $100 | $120 | $270 |

| Motorcycles | ||||

| Engine Capacity | Within 1 month of expiry date | Between 1 and 2.5 months | More than 2.5 months | More than 3 months |

| <300cc | $10 | $30 | $50 | $130 |

| ≥300cc | $10 | $60 | $80 | $230 |

| Other Vehicle Types | ||||

| Engine Capacity | Within 1 month of expiry date | Between 1 and 2.5 months | More than 2.5 months | More than 3 months |

| N.A. | $50 | $100 | $120 | $270 |

While LTA did not state if there’s a grace period for expired road tax, it is an offence for anyone to keep, use or allow the use of a vehicle without a valid road tax and/or motor insurance in force for the vehicle.

There is a penalty of up to $2,000 if someone is found to keep, use or allow the use of a vehicle without a valid road tax.

Your vehicle may also be impounded, and you’ll need to pay for towing and storage, in addition to the road tax and penalty fees.

What If You Deregister or Sell Your Car?

If your road tax expires before you sell or deregister your car, you must renew it. Any road tax that has been paid for the vehicle will be passed to the new owner when it is sold.

This means that when you’re determining the selling price of your car, you can consider factoring in the unused road tax.

Can I Use a Credit Card to Pay Road Tax?

You can use a credit card to pay the road tax, but most credit cards do not award credit card rewards like cashback, miles and rewards for tax payments.

However, if you want to hit the minimum spending requirement to qualify for perks, you can consider using it.

Do check the Terms & Conditions before doing so, as tax payments might be excluded from ‘qualifying spend’!

Related Articles

- Electric Car Guide: How Much Does It Cost To Own One in Singapore?

- Car Sharing in Singapore vs Grab/Taxi: Which is Cheaper?

- GrabRewards Grab Points Nerf: From 1 Aug 2022 Grab Will Stop Awarding Points For Credit/Debit Card Transactions

- Grab Grace Waiting Time & Cancellation Fee: A Comparison With Ryde, Gojek & ComfortDelgro

- Should You Buy a Car For Social Status?

Advertisement