Since most active investors and even funds can’t even beat the market, why bother trying?

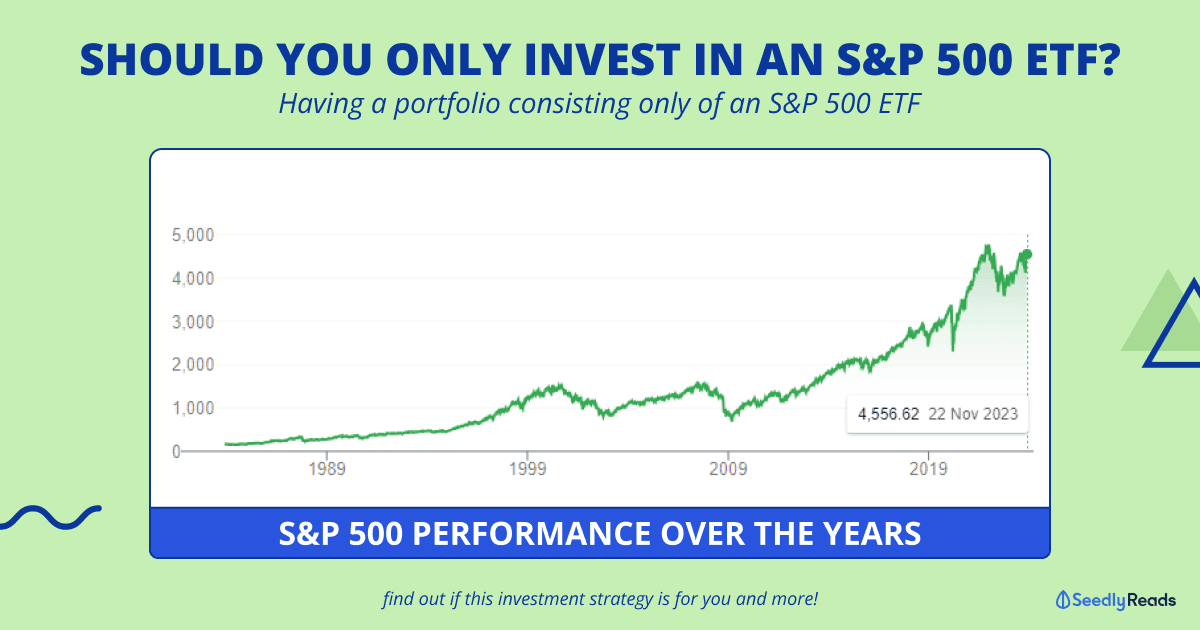

There’s been a long-standing notion that passive investors like you and I should simply invest in an S&P 500 ETF which tracks the S&P 500 index, the most popular index used to gauge the U.S. stock market. After all, the S&P 500 has seen an average annual return of 10.757% over the last 50 years, and is perceived to keep doing so.

But should you really just be investing in an S&P 500 ETF? And are we so sure that the S&P 500 will just keep going up for the long haul?

TL;DR: Is Investing In S&P 500 ETFs Only A Good Investment?

In This Article

- What is The S&P 500 Index & Can It Go Up Forever?

- For Investing Only In an S&P 500 ETF

- Against Investing Only In an S&P 500 ETF

- Who Should Invest In an S&P 500 ETF?

What is The S&P 500 Index & Can It Go Up Forever?

To understand if investing in the S&P 500 is a good investment in the first place, we need to break down the notion that the S&P 500 can continue performing well.

For the uniniated, the S&P 500 Index is a basket of 500 of the largest publicly traded companies in the U.S.

The whole index is dynamic and the companies selected must meet a strict criteria. Think companies like Apple, Microsoft, Netflix, Alphabet (Google), and Tesla. These are all companies with an international presence.

As time goes by, some companies may drop out of the S&P 500, to be replaced by another company that meets the requirements.

Thus when you invest in an S&P 500 ETF, you are investing in a fund that seeks to match the performance of the S&P 500, on the hope that these S&P 500 companies continue to do well in the future.

But wait a minute,

Can the S&P 500 Index keep going up?

The fundamental forces that drive the performance of the S&P 500 index, and the economy as a whole is that of productivity, which is the amount of work done over time.

Since the inception of the S&P 500, the productivity of the U.S. economy has drastically improved thanks to both an increase in population (manpower) and advancements in technology.

However, things are changing and population growth is seeing a declining trend. One might consider that companies in the S&P 500 hire globally, however, even global birth rates are falling in modern times with the problem exaggerated in developed nations where most of these companies operate from.

Should manpower available to these companies fall ceteris paribus (all other factors remaining the same), productivity would in turn drop, causing the performance of the S&P 500 to fall.

But of course, with Artificial Intelligence (AI), robotics and other advancements in technology in recent years, the effect of declining manpower could be completely overcome. According to various studies, productivity has increased by 66% across three case studies when users utilised generative AI. This is one example of how powerful advancements in technology can help us improve productivity.

Then again, such advancements are still in their infancy. Over the long-term however, it is highly likely that productivity will continue to improve, thus allowing the S&P 500 to continue moving up for the foreseeable future.

For Investing Only In an S&P 500 ETF

Now that we have established the basis of investing in the S&P 500, let’s talk about why one should consider only investing in an Exchange Traded Fund (ETF) that tracks the index.

As mentioned above, you will be investing in 500 of the largest U.S. companies. Compared to investing in a singular stock, you will get instant diversification.

And since the S&P 500 index is used as a measure for the overall U.S. stock market, you can expect your portfolio performance to be similar to that of the stock market, which most active investors cannot beat.

If you need more proof, Financial Times has illustrated that over 91% of large-cap funds have failed to beat the performance of the index from 2012 to 2022. And if you were to look at it over a period of 20 years, this percentage increases to 94%.

Perhaps the best part of investing in an S&P 500 ETF is that it suits a passive investor extremely well. There are plenty of S&P 500 ETFs to choose from with a low barrier to invest, as low as US$53 for the SPDR Portfolio S&P 500 ETF (SPLG) at the time of writing.

This means that it is easier for investors to practice dollar cost averaging (DCA).

Moreover, you don’t need to spend so much time doing research on a particular stock, keeping up with earnings calls, business developments and so on.

Against Investing Only In an S&P 500 ETF

On the flip side, since you are only investing in an S&P 500 ETF, you are only in the U.S. stock market. The S&P 500 only offers one level of diversification, which is diversification by industry. So while yes it is a diversified investment, some may argue that it is still not a well-diversified portfolio.

According to Nobel Prize laureate Harry Markowitz, who developed the Modern Portfolio Theory, the best way for investors to minimise risk is to have a portfolio of assets that are negatively correlated.

In other words, your portfolio should a range of assets that will not be influenced by others.

A simple example of this is the “60/40 portfolio” where you have bonds and stocks to balance each other out. When interest rates rise, bonds tend to do well while stocks suffer. When rates fall, the opposite happens.

An investment portfolio consisting of just an S&P 500 ETF does not have other asset classes to act as a counterbalance.

Another argument against investing only in the S&P 500 ETF is that it ignores “past performance is not a guarantee of future returns”. That said, we have already explained the fundamental forces that affect the S&P 500 index performance, and it is highly likely that productivity will improve for the foreseeable future.

Moreover, investing in the S&P 500 only means that you miss out on other opportunities in other asset classes and markets.

Who Should Invest In an S&P 500 ETF?

There are many investors whose portfolios only consist of S&P 500 ETF(s), mainly due to how simple and fuss-free it is to adopt such a strategy.

If you are looking for a passive investment strategy, just investing in an S&P 500 ETF is one way to do so. Of course, you need to consider the risks highlighted above as well.

Alternatively, if you have more time on your hands and are willing to put in more effort, you can consider adding other investments in addition to the S&P 500 ETF that you have chosen. These could include other broad based asset classes such as REITs or commodity ETFs, or individual stocks that you have a high conviction in.

In the end, remember that if you are investing only in the S&P 500, you must look at it from an ultra long-term perspective, at least 15 to 20 years!

Related Articles

Advertisement