"My Dad Was A Victim Of An Aggressive Sales Tactic." Here's What We Can Do To Protect Our Loved Ones.

My Dad Thought He Was There To Upgrade His Bank Account…

Having published an Email from our community with regards to sales tactics deployed by Bancassurance Specialists in December 2018, it did not take long before we received another of such incident.

We sat down with the Community member and his father over coffee, to understand the full story. We also managed to get the full permission to publish their story to help average Singaporeans should they be met with the same situation.

To have a deeper understanding of why certain actions were taken, we interviewed a few community members who were Bancassurance Specialists in the banks too.

Thanks for all the help guys!

Rundown Of Event, Sales Tactics And Rationale Behind It

Before we go ahead with the coverage of the community member’s encounter, here are some pointers to take note.

The victim:

- Is 62 years old

- Does not read or understand English

- Prefers someone to explained terms to him in Mandarin

This is what happened:

- A customer receives a call from Bank X’s Representative.

- The customer was told that he can actually change his bank account to one that gives a higher interest rate.

- All he needs to do is to head down to their branch in Yishun to sign a form.

- Bank representative followed up with him on Whatsapp.

- Customer, not wanting to trouble his children, went to the branch after work on his own.

- Upon reaching the branch, the customer was concern about how they managed to get his mobile number, and was told that they have a list and it is a normal procedure.

- Bank representative went on her sales pitch with regards to Retirement Plan, the policy was explained to him in Mandarin, his preferred language.

- Customer requested for a plan where he can put in a lump sum for 5 years and withdraw after that with interest.

- Bank representative sold him a product which was totally not what he wanted but hid the terms from him.

- The customer was told that at age 70 he will receive his payout, which was what he wanted. Little did he realised that it was only 50% of his capital.

- Upon signing, the customer received a phone call from the bank representative’s manager, which strategically conversed with him in English.

- Not understand most of it since it was in English, the customer said yes to everything.

- The customer told his two sons what happened and showed them his policy.

- When the son explained what the policy is about to him, he then realised that he was sold something which he did not want.

- What’s worse is that his account was not upgraded. The representative told him to apply online after he gets home.

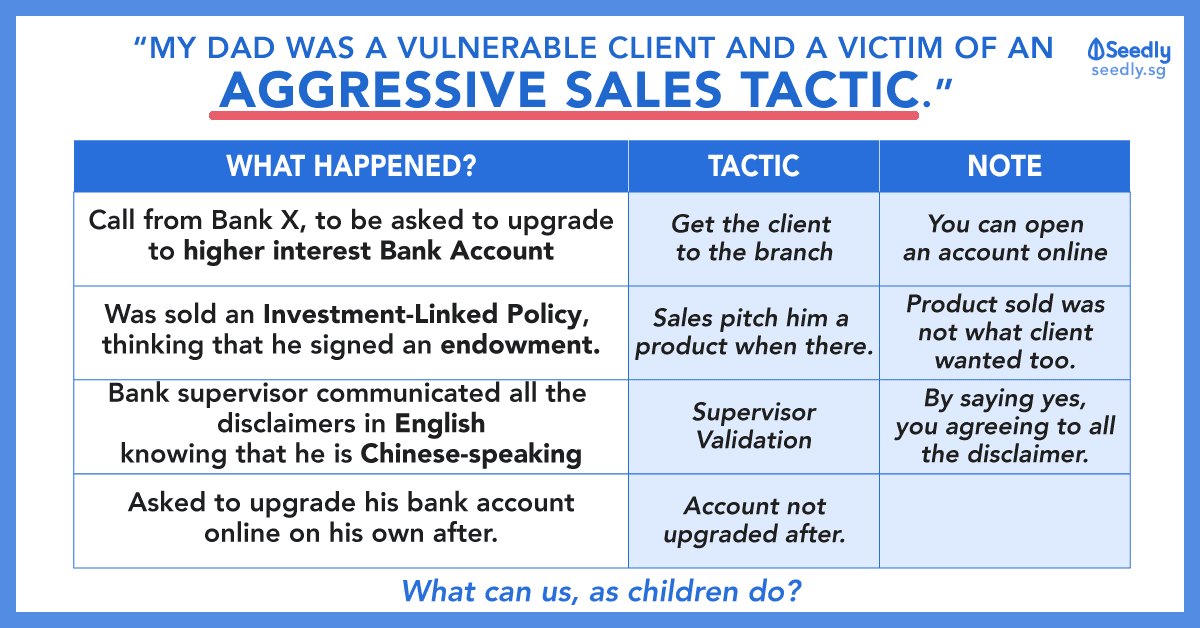

Breaking down the tactics

After running this story with a few sales representatives, here are some of the rationale behind some of the actions.

| What Happened? | Tactics | What's The Reason Behind It? | Note |

|---|---|---|---|

| Customer received a call from Bank X's Representative. | Customer was told that he can actually change his bank account to one that gives higher interest rate. All he needs to do is to head down to their branch in Yishun to sign a form. | To have a valid and enticing reason to have the customer visit the branch. | You can actually open a bank account online without really having to head down to the branch. |

| Bank representative went on to arrange a meeting with him through Whatsapp. | - | ||

| Customer, not wanting to trouble his children, went to the branch after work on his own. | - | ||

| Upon reaching the branch, customer was concern about how they managed to get his mobile number. | Bank representative told him that they have a list of clients which they will call, and assure him that it is normal. | - | |

| Bank representative went on her sales pitch with regards to Retirement Plan. | The policy was explained to him in Mandarin, his preferred language. | - | |

| Customer requested for a plan where he can put in a lump sum for 5 years and withdraw after that with interest. | - | Customer was more familiar with endowment plans which did well for him in the past. | - |

| Bank representative sold him a product which was totally not what he wanted, but hid the terms from him. | Highlighted that the product will give him payout when he is 70. Informed him that he can withdraw at 70, but did not specifically mention that only 50% of his capital can be done so. Used a 3% and 6% return illustration on customer. | Customer being fixated on endowment assumes that 3% to 6% was confirmed. | He was actually sold an Investment Linked Policy. (It is not that Investment Linked Policy is not good, but it is not what he wanted.) |

| Customer went on to sign the policy. | - | ||

| Upon signing, customer received a phone call from the bank representative's manager. | Client was not comfortable with the phone conversation being in English. The supervisor went on in English anyway, saying that he will speak slowly. (Hello! You don't understand French, I slow down got use ah?) | This practise is known as Supervisor Validation. This phone call is recorded and to ensure that the sales transaction is approved by the supervisor. With the supervisor mentioning all the disclaimer of the product and the client agreeing to all of it, the recording now is a good evidence that the client understands the risks of the product. | It is under the MAS best practise that members of public under the vulnerable clients be protected with such measure in place. |

| Customer told his two sons what happened and showed them his policy. | - | While this customer is fortunate enough to have his son help him vet through his policy. Imagine someone who does not have such luxury. |

|

| When the son explained what the policy is about to him, he then realised that he was sold something which he did not want. | What's worse is that, his account was not upgraded. The representative told him to apply online after he get home. | ||

Breaking down the tactics

Having spoken to the victim, we managed to get a hand of his documents and here are some screenshots of it.

We noticed that under his profile, it was labelled that he prefers the YFP to be conducted in English when he mentioned he prefers Mandarin. On top of that, the customer does not read nor understand English.

The customer was also a secondary school drop out.

Vulnerable Client

If your parents or loved ones fall under the vulnerable client list, we suggest we pay extra attention to them with regards to the financial products they purchase.

A vulnerable client, defined by the MAS, is any client who meets two of the following criteria:

- Age 62 years old and above

- Is not proficient in written or spoken English

- Has below GCE ‘O’ level or ‘N’ level qualifications or equivalent academic qualifications.

What Can We Do If Our Loved Ones Decide Not To Keep The Policy?

Upon purchasing, each insurance policy comes with a 14-days free-look period or cooling-off period. This is the period of time for one to review it.

Always read through the documents after signing a policy and think through if this was what you wanted in the first place.

Simply,

- Inform the representative that you would like to cancel the policy

- You may need to head down to the branch to sign a form

Should the representative be inactive in following up with it, it is important to identify the policy number and policy provider. From there, contact the respective policy provider/ Insurance company to cancel it.

In the above scenario, the family was actually on their way to cancel the policy. They were lucky enough to notice it within 14 days.

How can we prevent our daddy and mummy from being a victim of mis-selling?

Prevention is better than cure.

Let’s be objective and look at the problem at the root of its problem. Given that Singapore is facing an ageing population, how can we all prevent incident as such from happening?

Understanding the mindset of our parents.

- During our parents’ time, technology is less advanced than what it is today.

- Hence, the flow of information and maturity of financial products they were exposed to, is unlike what we have today.

- Our parents hold financial advisors’ advise with high regards (at times more than our opinion), because they were their only source of information to financial products back in those days.

- The word investment can be a huge “taboo” in their opinion due to the times they lived in.

What can we as children do?

After understanding the mindset of our parents, here’s what we should do:

- Constantly check-in with your parents and have open communication with regards to their financial needs and mindset.

- Let them know that you have their best interest at heart, and always be patient when communicating with them. Especially when personal finance is such a sensitive topic.

- We should acquire as much knowledge as possible to better determine what’s best for our family members. We now have the luxury of financial content online, so we should all make full use of it!

- If you are not sure, ask questions. Be it the Seedly Community or on any other platforms, ask questions.

Don’t feel paiseh! It is better to ask 1,000 questions and land yourself on a product you need than to not ask any and get a product you do not need!

Don’t feel paiseh! It is better to ask 1,000 questions and land yourself on a product you need than to not ask any and get a product you do not need!

Mis-selling Of Financial Products?

Just last year, 53% of financial services misconduct is actually linked to mis-selling.

As much as the Monetary Authority of Singapore (MAS) and respective financial institutes are trying to put certain measures in place to protect consumers, there are ways around such measures.

Also, sales target can sometimes cloud the judgement of a sales representative, resulting in them putting more emphasis on certain financial products.

Measures In Place And How Ineffective Are They?

Here are some questions we asked ourselves after understanding the story above.

With Do Not Call Registry, why does the customer still receive calls from the financial institution?

The DNC Registry focuses on telemarketing calls or message of commercial nature. If we use the above case as a case study, the bank representative’s phone call comes from an angle of servicing. She mentioned that she wishes to help the client get on a better bank account with a higher interest rate.

For sales conducted to clients with limited knowledge of investment products, how effective are the measures in place?

For sales conducted to clients with limited knowledge, here are examples of good practices in place:

- suggesting that the client be accompanied by a person who is able to explain to the client what is being presented or recommended by the representative unless the client decides otherwise.

- requiring that the representative’s supervisor be present during the sales presentation by the representative, where possible. The role of the supervisor is to ensure that the client fully understands all material facts necessary to make an informed decision including the product features, risks of the product, and the applicable fees and charges

- allowing the representative to execute the sales transaction only upon approval by the supervisor.

Source: Monetary Authority of Singapore

Despite such recommendations of good practices in place, the effectiveness will be reduced by the sales target of an organisation or a branch. This may result in a small number of supervisors finding ways around good practices to secure sales too.

Advertisement