Are You Trying To Save Or Invest? SSB vs REITs vs Short-term Endowment vs STI ETF

Discussions with regard to investing happen frequently on the Seedly Personal Finance Community. While most Singaporeans who are relatively new to investing understand that they should have a long-term approach to investing.

We look at some of the commonly asked questions and decide to draw a comparison across some of these frequently recommended products.

Here are some frequently asked questions on the community:

- Hi, I’ve emergency savings, purchased SSB and unit trust. I’m also saving for a house. Is my financial portfolio diverse enough at the moment or should I invest in REITs/stocks?

I’m stuck between putting my money into savings or investing? - Do you think investing in ETFs or SSB is better?

- Every month I will have average 3k of spare cash. How should I divide this among my POSB, CIMB, SSB and STI ETF?

TL;DR – Understanding Savings vs Investing, and choose the product more suited for it

The usual advice for Singaporeans looking to kick start their personal finance journey will be

- Singapore Savings Bond (SSB)

- Straits Times Index Exchange Traded Fund (STI ETF)

- REITs

- Short-term endowment

- and even getting onto the best savings account

SSB vs REITs vs STI ETF vs Short-Term Endowment

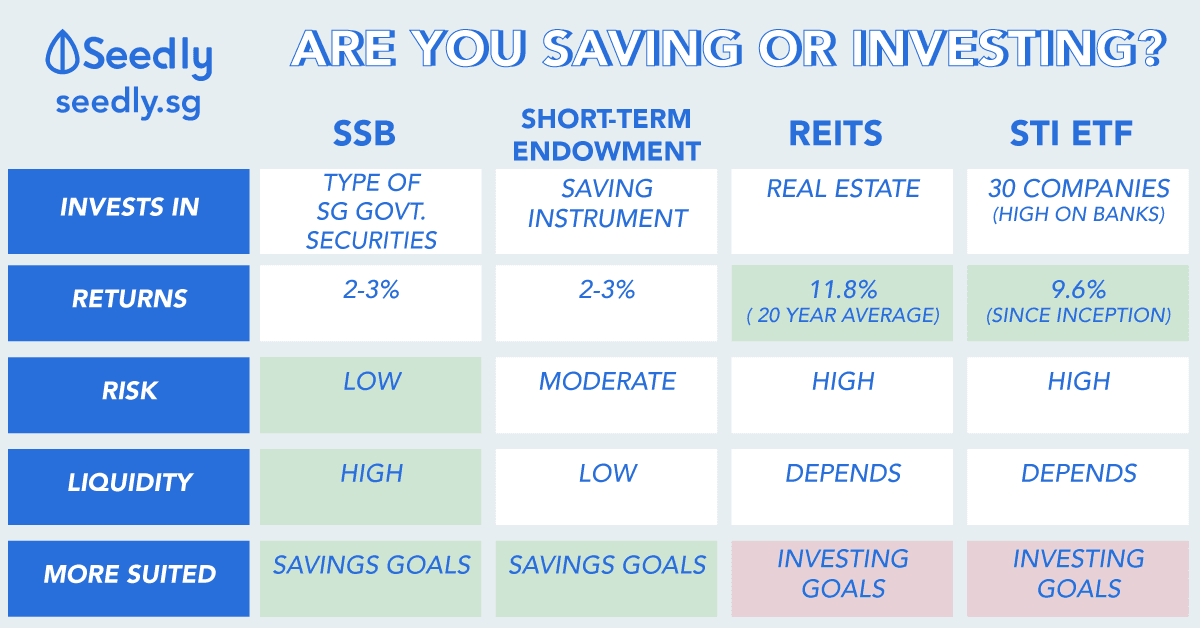

Given that these are the products that are usually being brought up and recommended, we are going to provide more details.

| SSB | Short-term Endowment | REITs | STI ETF | |

|---|---|---|---|---|

| Invests in | SSB is a type of Singapore Government Securities | More like a savings instrument | Real Estate | 30 Different Companies (Heavier weightage on Banks) |

| Returns | 2-3% | About 2-3% | 11.8% (20-year average) | 9.6% (Nikko AM since inception) |

| Duration | 10 Years (No early withdrawal penalty) | Usually 3 years | Depends | Depends |

| Risk | Low (Backed by Singapore Government) | Low to Moderate (Depends on the company) | High | High |

| Barriers to entry | Moderate ($500 at least) | Depends (On the minimum of the plan) | Depends | Low (if you use Regular Savings Plan) |

| Liquidity | High | Low | Depends | Depends |

Are you trying to save or invest?

While all of these products can potentially help a “Newbie” beat inflation rate, one needs to be able to differentiate if he is looking to save or invest.

Here’s the main difference:

| Savings | Investments | |

|---|---|---|

| The ultimate goal | Preserve assets Ensure liquidity Usually works for emergency fund or aiming for a one-time spending event (eg. Travel) | To grow wealth. Goal usually less-defined such as retirement |

| Time horizon | Usually short-term | Usually aiming for a longer-term time horizon |

| Risk Level | Try to keep it as low as possible | Depends on the product that one invests in |

- If you are looking to travel, you are saving up for a vacation

If you invest your travel savings for Japan, there is a risk of you ending up in Pula Ubin for holiday. So you may want to at least have a guaranteed amount!

- If you are looking increase your wealth for retirement, you are looking to invest for your retirement fund

A good practice will be to

- List down a few financial goals and how much they are going to cost you

- Identify if these goals are more suitable as savings or investments

- Plan your investment products accordingly, to the risk appetite of each financial goals.

Eg. You want to travel next year, you want something less risky, so you are saving!

There is no right or wrong product

Should I invest in an ETF or should I park my money with the Singapore Savings Bond (SSB)?

There is definitely no one-size fit all portfolio for everyone.

On top of one’s risk profile, understanding the intent of the sum of money and what is it can help one decide the types of product to invest in too.

Read also: Age vs Risk Profile: What Investments Should You Hold At Your Age

Advertisement