Saving Your First $1 Million. How Much You Need Per Month To Be A Millionaire in 5, 10, 20, 30 years?

Who Wants To Be A Millionaire?

There are 269,000 millionaires in Singapore as of the year 2019.

This number is projected to increase to 363,000 millionaires by the year 2024.

With 94,000 millionaires position “up for grab”, we did a bit of calculation to see how we can move towards “chope-ing” our position as a millionaire!

The previous time we talk about how much you need to save each month to save $100,000 in Singapore.

If you have yet to save $100,000, here’s the article that can help you do so:

If you managed to meet your target, it is about time to up the level a little.

Let’s Aim To Be a Millionaire!

We understand that the route to your first million can be challenging.

Also, in the context of Singapore, some of us are asset-rich with our Built-To-Order (BTO) flat or property.

In this case, we are going to assume that we want to have a million-dollar worth of liquid money. Nothing beats money in the bank anyway!

As all of us are in various life stages, we will assume a few initial savings amount:

- Initial Savings: $0

- Initial Savings: $100,000

- Initial Savings: $200,000

- Initial Savings: $500,000

We will also look at the various time horizon required:

- 5 Years

- 10 Years

- 20 Years

- 30 Years

The Route to Saving a $1 Million Dollar

Depending on your saving rate, using the average annual salary in Singapore at $67,152, and assuming 0% interest rate, here’s how long you need to save your first $1 million.

| Savings Rate | Income | Annual Savings | Target | Years to $1 million |

|---|---|---|---|---|

| 5% | $67,152.00 | $3,357.60 | $1,000,000.00 | 297.8 |

| 10% | $67,152.00 | $6,715.20 | $1,000,000.00 | 148.9 |

| 15% | $67,152.00 | $10,072.80 | $1,000,000.00 | 99.3 |

| 20% | $67,152.00 | $13,430.40 | $1,000,000.00 | 74.5 |

| 25% | $67,152.00 | $16,788.00 | $1,000,000.00 | 59.6 |

| 30% | $67,152.00 | $20,145.60 | $1,000,000.00 | 49.6 |

| 35% | $67,152.00 | $23,503.20 | $1,000,000.00 | 42.5 |

| 40% | $67,152.00 | $26,860.80 | $1,000,000.00 | 37.2 |

| 45% | $67,152.00 | $30,218.40 | $1,000,000.00 | 33.1 |

| 50% | $67,152.00 | $33,576.00 | $1,000,000.00 | 29.8 |

| 55% | $67,152.00 | $36,933.60 | $1,000,000.00 | 27.1 |

| 60% | $67,152.00 | $40,291.20 | $1,000,000.00 | 24.8 |

| 65% | $67,152.00 | $43,648.80 | $1,000,000.00 | 22.9 |

| 70% | $67,152.00 | $47,006.40 | $1,000,000.00 | 21.3 |

| 75% | $67,152.00 | $50,364.00 | $1,000,000.00 | 19.9 |

| 80% | $67,152.00 | $53,721.60 | $1,000,000.00 | 18.6 |

| 85% | $67,152.00 | $57,079.20 | $1,000,000.00 | 17.5 |

| 90% | $67,152.00 | $60,436.80 | $1,000,000.00 | 16.5 |

| 95% | $67,152.00 | $63,794.40 | $1,000,000.00 | 15.7 |

| 100% | $67,152.00 | $67,152.00 | $1,000,000.00 | 14.9 |

This means that even if you save 100% of your salary, you will still need about 15 years to be a millionaire!

Factoring in Interest Rate or Return on Investments

To break it down into how much you need to save each month to achieve your target within certain years, we lay out two assumptions:

- You save or invest a fixed amount every month

- Constant annual returns % per annum with interest compounded at the end of each year

We will be using some of the familiar percentage and products that Singaporeans are more familiar with:

Saving a Million Dollar in 5 Years

| Interest Rates/ Returns | How Much You Need to Save Per Month to Save $1 Million in 5 Years | |||

|---|---|---|---|---|

| Initial Savings: $0 | Initial Savings: $100,000 | Initial Savings: $200,000 | Initial Savings: $500,000 | |

| 0.5% (eg. deposit accounts) | $16,490.13 | $14,841.12 | $13,192.10 | $8,245.06 |

| 0.9% (eg. Singapore Savings Bond) | $16,349.68 | $14,714.72 | $13,079.75 | $8,174.84 |

| 2.0% (eg. Cash management accounts) | $15,967.10 | $14,370.39 | $12,773.68 | $7,983.55 |

| 2.5% (eg. Cash management accounts) | $15,794.97 | $14,215.47 | $12,635.98 | $7,897.49 |

| 5.0% (eg. CPF SA) | $14,951.18 | $13,456.06 | $11,960.94 | $7,475.59 |

| 8.0% (DIY) | $13,976.30 | $12,578.67 | $11,181.04 | $6,988.15 |

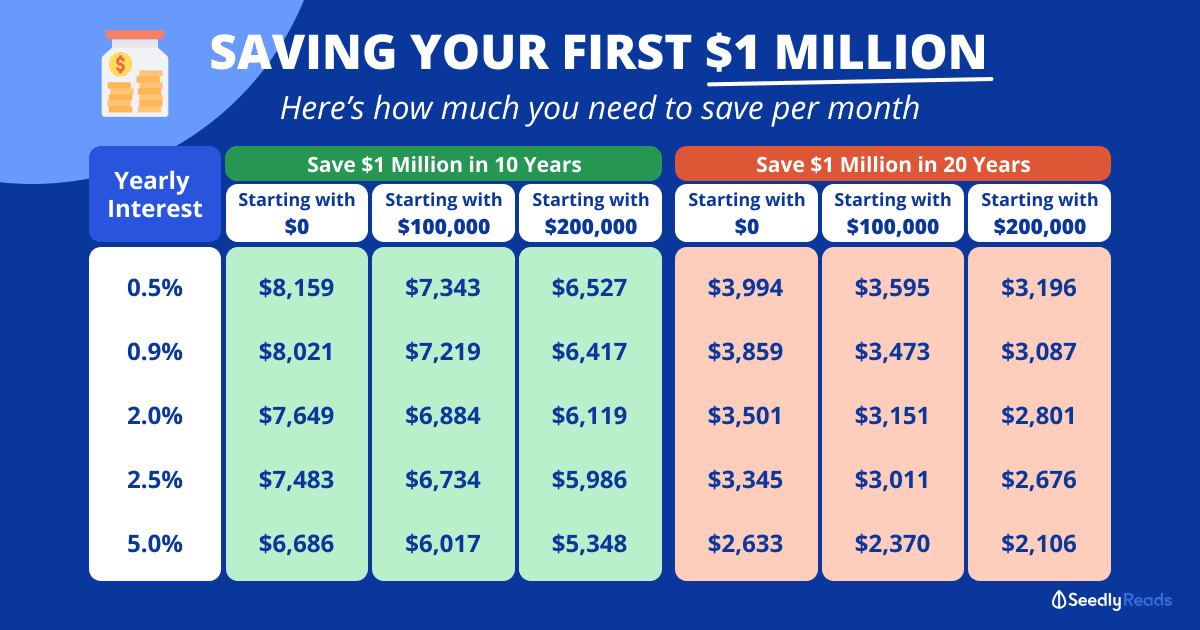

Saving a Million Dollar in 10 Years

| Interest Rates/ Returns | How Much You Need to Save Per Month to Save $1 Million in 10 Years | |||

|---|---|---|---|---|

| Initial Savings: $0 | Initial Savings: $100,000 | Initial Savings: $200,000 | Initial Savings: $500,000 | |

| 0.5% | $8,159.00 | $7,343.10 | $6,527.20 | $4,079.50 |

| 0.9% | $8,021.02 | $7,218.92 | $6,416.82 | $4,010.51 |

| 2.0% | $7,648.46 | $6,883.61 | $6,118.76 | $3,824.23 |

| 2.5% | $7,482.50 | $6,734.25 | $5,986.00 | $3,741.25 |

| 5.0% | $6,685.44 | $6,016.90 | $5,348.36 | $3,342.72 |

| 8.0% | $5,802.94 | $5,222.65 | $4,642.35 | $2,901.47 |

Saving a Million Dollar in 20 Years

| Interest Rates/ Returns | How Much You Need to Save Per Month to Save $1 Million in 20 Years | |||

|---|---|---|---|---|

| Initial Savings: $0 | Initial Savings: $100,000 | Initial Savings: $200,000 | Initial Savings: $500,000 | |

| 0.5% | $3,994.16 | $3,594.75 | $3,195.33 | $1,997.08 |

| 0.9% | $3,859.05 | $3,473.14 | $3,087.24 | $1,929.52 |

| 2.0% | $3,501.21 | $3,151.09 | $2,800.97 | $1,750.61 |

| 2.5% | $3,345.40 | $3,010.86 | $2,676.32 | $1,672.70 |

| 5.0% | $2,632.89 | $2,369.60 | $2,106.31 | $1,316.45 |

| 8.0% | $1,926.18 | $1,733.57 | $1,540.95 | $963.09 |

Saving a Million Dollar in 30 Years

| Interest Rates/ Returns | How Much You Need to Save Per Month to Save $1 Million in 30 Years | |||

|---|---|---|---|---|

| Initial Savings: $0 | Initial Savings: $100,000 | Initial Savings: $200,000 | Initial Savings: $500,000 | |

| 0.5% | $2,606.53 | $2,345.88 | $2,085.22 | $1,303.26 |

| 0.9% | $2,473.87 | $2,226.49 | $1,979.10 | $1,236.94 |

| 2.0% | $2,129.95 | $1,916.95 | $1,703.96 | $1,064.97 |

| 2.5% | $1,984.08 | $1,785.67 | $1,587.26 | $992.04 |

| 5.0% | $1,355.53 | $1,219.98 | $1,084.43 | $677.77 |

| 8.0% | $813.57 | $732.21 | $650.85 | $406.78 |

The speed at which you achieve $1 million in savings can be affected by a few factors:

- Your current life stage

- How much salary are you drawing at the moment?

Based on the above illustrations, some of the monthly savings amount can be difficult to achieve. - How much return can you constantly achieve over a long period of time?

If retiring early is your ultimate objective, you can also take into account the savings in your CPF account.

Lastly, compound interest is a ridiculously easy way to help you achieve your goals. That is provided you start as early as possible.

Advertisement