Seedly Credit Card Survey 2023: Top Cards, Preferred Features, and Insights

Credit cards have revolutionised the way we handle payments by providing unparalleled convenience and security.

They empower users to effortlessly make purchases both online and in-person, and with responsible usage of credit cards, you can also cultivate a positive credit history.

Nonetheless, not all credit cards are cut from the same cloth, each offering and catering to distinct needs and preferences.

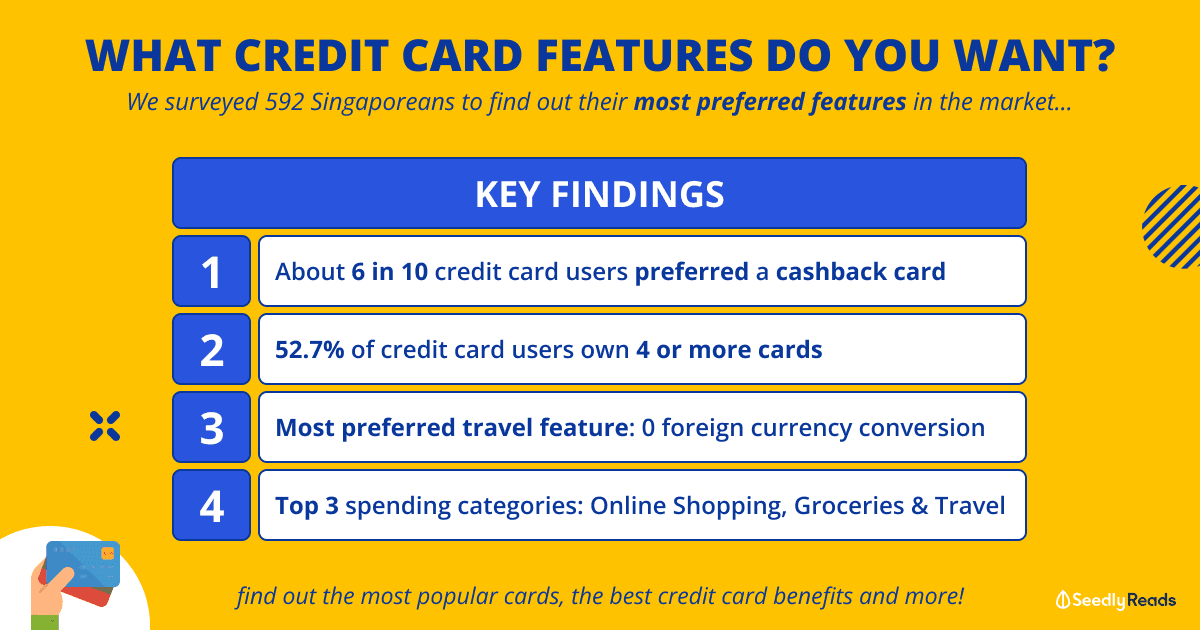

And that’s why, Seedly has conducted its very own credit card survey to find out where your needs are, and the gaps that should be filled!

If you’re thinking about getting your first credit card and would like to know the preference of the majority, we found that 6 in 10 credit card users preferred a cashback card.

In fact, more than half (52.7%) of the credit card users reported they own four or more credit cards.

In the Seedly Credit Card Survey 2023 report, we delve deep into the features that credit card consumers truly value. Let’s find out more!

TL;DR: Seedly Credit Card Survey 2023

Seedly’s objective has always been to help Singaporeans make smarter personal finance decisions.

With that being said, this survey aims to identify existing gaps between credit cards in the market, and the preferences consumers have for credit cards.

Click here to jump:

- Demographics of Respondents

- Spending Habits of Credit Card and Non-Credit Card Users

- Top 5 Most Used Credit Cards

- Consumer’s Most Preferred Type of Credit Card: Cashback, Miles or Rewards

- Top Features Consumers Want

- Conclusion

Disclaimer: The Seedly Credit Card Community Survey 2023 is based on an online survey with N=592 Singaporeans aged 18 years old and above, conducted via Seedly’s Facebook Community Group from 19 July 2023 to 9 August 2023. Any opinions stated in this article are of the writer only and are not representative of Seedly.

Demographics of Respondents

The survey was conducted from 19 July to 9 August 2023, and a total of 592 responses were collated. 51.9% of respondents fell within the age range of 25 to 34 years old, and a majority of the respondents (73.5%) held a Bachelor’s degree.

| Age | Proportion of respondents (%) |

| 18 – 21 | 1.5% |

| 22 – 24 | 3.4% |

| 25 – 34 | 51.7% |

| 35 – 44 | 30.3% |

| 45 – 54 | 7.9% |

| 55 – 64 | 2.9% |

| 65 and above | 2.4% |

| Highest Level of Education | Proportion of respondents (%) |

| No formal education | – |

| Primary/Elementary school | – |

| Secondary/High school | 6.4% |

| Bachelor’s degree (e.g. BA, BS) | 73.4% |

| Master’s degree (e.g. MA, MS, MBA) | 12.1% |

| Doctorate/Ph.D | 0.8% |

| Professional degree (e.g. MD, JD etc.) | 1.3% |

| Diploma | 4.7% |

| Others e.g. GCE Advanced Level, ACCA, Foundation in Music | 1.3% |

The survey classified its respondents into two categories – Working Adults and Non-Working adults. The distinction was necessary as there is an income requirement for most credit card applications in Singapore, and for those who do not meet this requirement, e.g. students, there are cards available in the market that they can benefit from.

Our respondent profiles were categorised as follows:

- Working Adults: Employed (full-time), Employed (Part-time), Self-Employed, Freelancer/Contractor, Others (for those who filled this, all were students on scholarship/full-time pay);

- Non-Working Adults: Homemaker, Unemployed, Retired, Student/Full-time National Serviceman.

| Occupation (Working adults) | Proportion of respondents (%) |

| Employed Full-time | 80.7% |

| Employed Part-time | 2.0% |

| Self-employed | 5.7% |

| Freelancer / Contractor | 1.0% |

| Others | 0.2% |

| Occupation (Non-Working Adults) | Proportion of respondents (%) |

| Homemaker | 1.2% |

| Unemployed | 2.9% |

| Retired | 2.0% |

| Student/NSF | 4.2% |

Credit Card Ownership

From the survey, we found that about 1 in 5 (21.3%) non-working adults reported that they do not possess a credit card. In contrast, the proportion of working adults who do not have credit card ownership is significantly lower, with just 1 in 50 (2.4%) falling into this category.

For the uninitiated, there are specialised credit card options tailored for non-working adults that come with a predetermined monthly spending cap of $500. Furthermore, non-working adults have the option to acquire supplementary cards or sustain the use of their existing credit cards even post-retirement.

Spending Habits of Credit Card and Non-Credit Card Users

Based on the findings, about 4 in 10 (40.2%) credit card users spend between $1,001 and $2,500 per month. This is in line with Seedly’s previous finding in 2021 that an average household member in Singapore needs about $1,600 a month.

Surprisingly, 29.6% spend between $501 and $1,000 per month, which is way below the average spending.

It’s evident that spending behaviours diverge significantly between the working adult group, with potential expenditures exceeding $5,000, and non-working adults, who adhere to spending limits ranging from less than $500 to $4,500. This contrast may be attributed to the absence of a consistent income source, necessitating careful budgeting and adherence to set spending boundaries.

| Spending Habits (Working Adults) | Percentage |

| Less than $500 | 8.5% |

| $500 – $,1000 | 29.6% |

| $1,001 – $2,500 | 40.2% |

| $2,501 – $3,500 | 9.2% |

| $3,501 – $4,500 | 5.1% |

| $4,501 – $5,000 | 1.3% |

| > $5,000 | 3.6% |

| Do not have a credit card | 2.4% |

| Spending Habits (Non-working Adults) | Percentage |

| Less than $500 | 29.5% |

| $500 – $,1000 | 24.6% |

| $1,001 – $2,500 | 23.0% |

| $2,501 – $3,500 | – |

| $3,501 – $4,500 | 1.6% |

| $4,501 – $5,000 | – |

| > $5,000 | – |

| Do not have a credit card | 21.3% |

Top Five Most Used Credit Cards

A notable 50.4% of individuals who own a credit card reported daily utilisation of their card(s). Within this group, over half (52.7%) reported ownership of four or more credit cards.

These are the top five cards in descending order:

- UOB One Card

- POSB Everyday Card

- Citi Cashback Plus Card

- Citi Rewards Credit Card

- HSBC Revolution Card

Top Five Categories For Spending

A distinguished spending pattern emerges between credit card users and individuals who do not possess credit cards.

Both profiles share three spending categories: Online Shopping, Bill Payments and Groceries, with Online Shopping taking the lead. However, the order of priority differs for Bill Payments and Groceries.

Survey insights reveal that credit card holders predominantly allocate card usage towards Dining and Transport. Conversely, those without credit cards expressed an inclination towards spending on Travel-related expenses and Retail Spending, both of which can potentially lead to greater out-of-pocket expenses.

Most Preferred Type of Credit Card: Cashback, Miles or Rewards?

We are in an era where travel has become a lifestyle and you will always hear about how others chase the miles game for an upgraded flight experience or a “free” trip overseas.

Yet, in an environment where inflation is high, one might have the urge to prioritise savings instead of spending more.

From the survey, we found that 6 in 10 (61.6%) credit card users preferred a cashback card. This is followed by 21.6% who leaned towards a miles card, while 17.3% expressed a preference for a rewards card that gives them the flexibility to choose their rewards.

| What type of credit card do you prefer? | |

| Cashback (Get a cash discount on your credit card bill) | 61.2% |

| Miles (Earn points to convert for miles to redeem for flight tickets) | 21.5% |

| Rewards (Option to choose between cashback/miles or rewards from a catalogue) | 17.3% |

Top Features Consumers Want

Preferred General And Payment Features

When asked about general and payment features of credit card users’ priority, cashback rewards were ranked top by most users, followed closely by Miles and No Minimum Spend requirement, both holding comparable positions in terms of preference.

This aligns with the survey’s observed inclination among credit card users towards cashback cards.

Likewise, when individuals without credit cards were queried about their preferred features, the top three selections all pertained to spending-related benefits (Cashback rewards, No minimum spend eligibility for rewards, and interest-free instalment payment plans). This could indicate a broad preference for cost savings and reduced out-of-pocket expenditures, especially among Students, National Servicemen (NSF), and the Unemployed.

This group is also most likely to use credit cards on:

- Online shopping

- Groceries

- Travel spending (hotel bookings/flight tickets)

It’s noteworthy that among credit card users, the highest spending categories include Online Shopping, Groceries, and Dining.

| Preferred General and Payment Features, in order of preference |

Credit Card Users |

Non-Credit Card Users |

| 1 | Cashback rewards | Cashback rewards |

| 2 | Miles rewards | No minimum spending requirement to qualify for rewards |

| 3 | No minimum spending requirement to qualify for rewards | Interest-free instalment plan |

| 4 | Interest-free instalment plan | Miles rewards |

| 5 | Point rewards | Point rewards |

| 6 | Adding to mobile wallet / Credit card app for enquiries and payments |

Adding to mobile wallets |

| 7 | Cash loan | Credit card app for enquiries and payments |

| 8 | – | Cash loan |

Preferred Travel Features

When asked about travel features that credit card users prefer, 45.6% preferred a credit card that has no foreign transaction fees, followed by hotel deals, and complimentary lounge access.

| Ranked ‘Most Preferred’, in descending order | Features | Proportion of respondents (%) |

| 1 | Zero foreign transaction fee | 45.6% |

| 2 | Hotel booking deals | 16.2% |

| 3 | Complimentary lounge access | 15.1% |

| 4 | Travel insurance deals | 10.7% |

| 5 | Multi-currency feature | 6.7% |

| 6 | Free overseas cash withdrawal | 5.6% |

Preferred Credit Card Partnerships

Next, both credit card users and those who do not own a credit card rated Dining partnerships as their top choice of credit card partnerships. This is followed by Groceries and Travel.

| In order of preference | Credit card users | Non-credit card users |

| 1 | Dining | Dining / Groceries / Travel |

| 2 | Groceries | Telco/Utilities |

| 3 | Travel | Fitness/Gym |

| 4 | Telco/Utilities | – |

| 5 | Fitness/Gym | – |

Preferred Cashback Features

For those who are avid cashback enthusiasts, the credit card landscape offers a multitude of possibilities, each with its own unique configuration.

There are cards in the market where you can either earn high cashback value with specific categorical spending (and most of the time, with a cap on the cashback you can earn), or, mid cashback value on all-spends (and sometimes this is unlimited cashback).

One might assume that the majority would lean towards the former option, as people generally have a clear idea of their primary spending areas. Surprisingly, our findings diverge from this presumption.

Spanning both credit card users and those without credit cards, 77.6% expressed a preference for earning a mid cashback across all spending categories (with no minimum spending requirements or cashback limits), rather than opting for a high cashback rate with associated minimum spending and capped earnings.

However, in a scenario where respondents were asked whether they would consider using a card that offered a high cashback percentage for their two most prominent spending categories while maintaining a mid cashback percentage for the remaining three categories, 92.2% responded ‘Yes’.

It’s worth noting that some of the motivations behind this inclination include the confidence to meet the minimum spending criteria and the prospect of amassing greater overall cashback rewards.

Moreover, the top five categories selected to earn cashback from are:

- Online shopping

- Groceries

- Dining

- Transport

- Bill payments

Preferred Miles Card Features

Among those who favoured a miles card, their top five categories to earn miles are Online shopping, Dining & Travel Spending (Hotel/Flight booking), Bill payments & Groceries.

As expected, this group wants a higher miles earned rate as the primary feature, and this is followed by no foreign currency conversion fee and complimentary lounge access capabilities.

Other noteworthy card features miles enthusiasts want are the absence of mileage earned, and the opportunity to earn bonus miles during their birthday months.

Preferred Rewards Features

As for those who prefer a rewards card, their top three categories for rewards are ranked as follows: Shopping vouchers/coupons, Dining and Miles.

This is in line with the follow-up question on what would they do with the rewards points earned, to which cashback appeared as the top choice, followed by gifts and vouchers, and miles redemption.

Conclusion

In summary, the study delved into consumers’ preferences for credit card features, with the intention of identifying areas for card enhancement and refining their credit card usage experiences.

The survey findings highlighted a shared inclination among both credit card and non-credit card users for cashback advantages. Specifically, there is a preference for cards that offer substantial cashback returns within specific categories, as well as an interest in rewards points to exchange for vouchers and coupons.

When it comes to travel features, there is a consistency in preference for complimentary lounge access and zero foreign currency conversion, highlighting card users’ preference for a more convenient, cost-efficient, and enjoyable travel experience.

Moreover, the prevalence of expenses in categories such as Online Shopping, Bill Payments and Groceries underscores the importance of optimising benefits within these categories.

These findings collectively emphasise the relevance of understanding our goals of using a credit card that suits our needs and spending habits. As we move forward, addressing these insights could also lead to more active card usage.

Last but not least, you should use a credit card responsibly, and only use it when you are confident in paying your bills on time.

Related Articles:

- Best Credit Cards for Families (2023): Vacations, Groceries, Dining, Petrol & More

- Best Credit Cards For High-Income Earners (120K Annual Income): Which Card Is Right For You?

- The Ultimate Credit Card Reviews Compilation in Singapore 2023

- Best Credit Cards For Petrol in Singapore (2023): Latest Petrol Prices & Discounts

- Best Student Credit Cards in Singapore (2023): No Min. Income Required

Advertisement