Here’s What I Learnt From Seedly’s Personal Finance Festival 2023 (Side Stage): Money & Life Lessons You Can't Buy

It’s been almost two weeks since Seedly Personal Festival 2023!

Didn’t get to attend the event and you’re not sure if you’ve missed out on good deals, or there were just too many exciting elements at the event that you felt overwhelmed?

Not to worry, this is why we’re here to share the key insights from the Side Stage of Seedly Personal Finance Festival 2023!

Let’s take this chance to level up your personal finance game!

P.S. Full recordings of the event talks will be available on SeedlyRewards very soon. So be sure to sign up if you haven’t already and click the gift icon on the top right of the screen once logged in to gain access to the recordings!

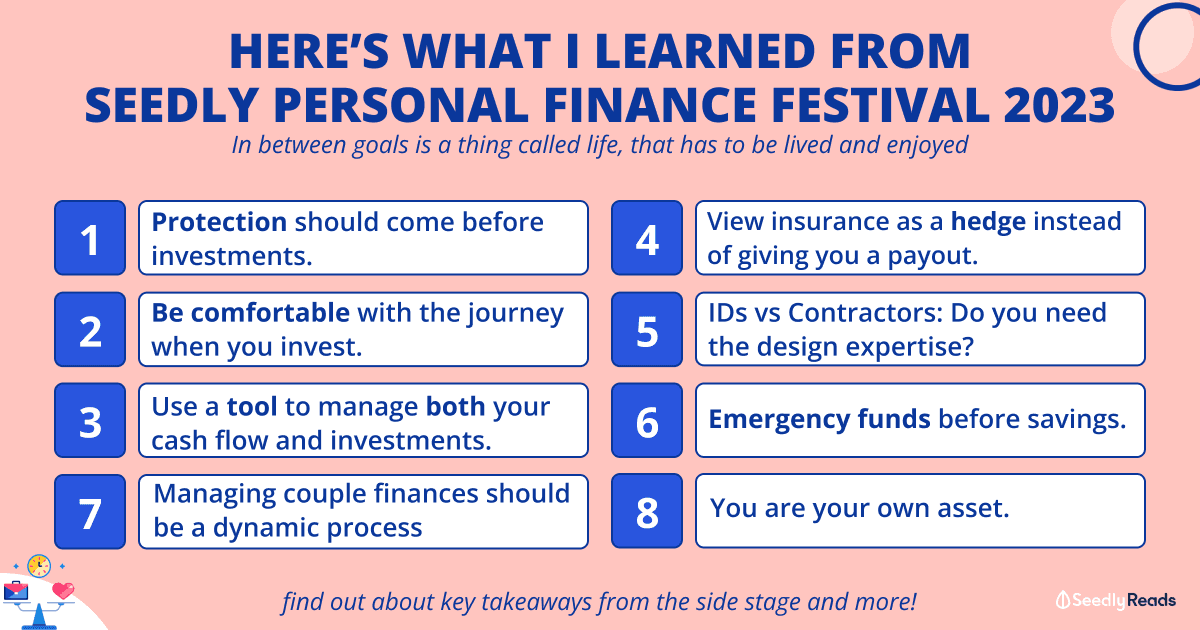

TL;DR: Seedly Personal Finance Festival 2023 Side Stage Takeaways

Disclaimer: If you want to view all the event recordings, you may find them in SeedlyRewards.

This summary categorises the keynotes and panels into themes so that you can have an easy reference.

Make Use of Financial Tools to Track Your Finances

The golden rule of personal finance: Pay Yourself First — which means you save a portion of your income upfront then you spend the rest.

Many would agree that managing and understanding cash flow is the first step you need to take if you want to level up your finances.

There are several financial tools such as the DBS NAV Planner which projects and analyses your cashflow habits and even identifies blind spots in your financial planning.

You can map out your finances for the future and put them through simulations such as high inflation, loss of income, and so on.

The Standard Chartered Mobile App allows you to DIY and track your budgets, and receive smart personalised insights to manage your finances.

For those who just started out investing, you can also use this app to identify your investment goals, horizon, and risk appetite, and read up on Unit Trust (Funds).

Both the DBS Nav Planner and SC Mobile App are powered by SGFinDex, which stands for Singapore Financial Data Exchange, which is a new digital infrastructure developed by the public sector in collaboration with the Association of Banks in Singapore and seven participating banks.

If you haven’t heard of SGFinDex, it’s time to check out this guide.

By having consolidated data from different financial institutions and government agencies, this system would help in providing a more holistic view of these platforms to help chart users’ financial progress and growth.

Building Wealth Is A Journey That You Need To Be Comfortable With

Throughout the journey of wealth creation, there are often trials and errors you will make in between.

Two Is Better Than One by Citibank

What’s the perfect pair for you? Is investment or protection more important?

During this segment, it was unanimously agreed that protection is more important and it has to come first.

It’s not to say that we have to choose one or the other, and when paired together, this means that while you’re investing and taking risks, you need to ensure that you have adequate protection for your finances.

A word of advice on building your wealth by Audrey Ho, CFA, Investment Analyst at Citibank:

“(It’s important) being comfortable with the journey. Asset allocation is important, when you have a pool of money coming in, how you allocate it is important. You need to understand your liabilities and ensure that the assets allocated can cover these liabilities.”

Moreover, since investing is a long-term game, we should also pick our brokerages wisely and opt for low-cost brokerages. That way, you can further diversify your portfolio across multiple markets and dollar-cost-average easily with fractional shares to maintain the percentage allocations in your portfolio.

Investing in The Future You with Moomoo

If you’ve been investing for a while or are new to investing, you would’ve heard of Moomoo.

Why is it so popular? Because it has multiple ways to help you invest.

With its Regular Savings Plan, you don’t have to set reminders to make investments as you can choose to do it bi-weekly, weekly, or even daily!

It even has a SmartSave feature which upon activating, your idle cash will automatically subscribe to Moomoo’s Cash Plus products where you can earn potential returns.

The Launch of CMC Invest

For the uninitiated, CMC Markets has been providing financial services for 34 years!

While it is based in the United Kingdom, it has operations in both Australia and Singapore and right now, CMC Markets will be launching CMC Invest, a new trading platform on 20 July.

A dark horse coming in strong, it promises users to enjoy zero deposit, withdrawal, platform, maintenance, hidden fees, or inactivity fees!

Giving users an all-rounded approach to investing, there will be educational content to help them to learn how to invest (we’re all in on financial education!).

Also, to start with, users will also gain access to 15 markets including Australia, the United Kingdom, Hong Kong, Canada, and the USA.

Chocolate Finance: A New Place For Your Spare Cash

When we talk about investing using spare cash, there are fixed deposits and savings accounts for reserved investors, but there are so many hoops that you have to go through in order to maximise the bonus interest rates.

Jumping through hoops is what Chocolate Finance is about.

Chocolate Finance is an investment account in partnership with Havenport, an asset management company licensed by the Monetary Authority of Singapore.

What entices me is that it is fuss-free, with no lock-ins, and no fees applied!

If the crypto winter scarred you last year, you will be pleased to know that the account does not offer cryptocurrencies at all.

Besides being an investment product, it comes along with a physical card that you can use at 7-Eleven and withdraw money with, and you can also send money to someone using the product!

HSBC Wealth: A Holistic Journey, Keeping Things Simple

The HSBC Wealth Digital Capabilities is designed to provide you a holistic overview of your investments with the bank.

You can build your portfolio, conduct portfolio analytics/stress tests that may concern you, and make use of Wealth Insights which provides you information regarding your portfolio.

What’s special about this, you ask?

Well, it enables relationship building with a relationship manager via SG Chat (through WhatsApp and WeChat) who can guide you remotely to address your queries and concerns. Now, that sounds like good customer service.

The More You Earn, The More You Should Protect

As the saying goes, “No boat should leave the harbor without a lifeguard”. Insurance is not about what you buy, but what you need and what you want.

Protecting Your Dreams with the Right Fit

Do you know that five to seven per cent of cancer patients are below 40 years old?

As I grew older, I’ve seen how cancer crept into the lives of people around me, sending them into a world of emotional and financial distress.

More often than not, in the process of seeking treatment, their finances have taken a blow due to the lack of insurance coverage.

Cancer treatment is not affordable and it can cost $8,000 to $17,000 a month without insurance coverage. I’m sure most people would not want to spend their hard-earned money on treatments.

So, are we able to afford treatment without worrying too much financially? Fortunately, you are able to if you have purchased cancer insurance with good coverage.

Singlife has just launched its Cancer Cover Plus (recommended to complement it with Singlife Shield) and if you’re curious about cancer insurance, we’ve also covered this topic previously.

But, How Much Insurance Is Too Much?

This is a golden question that has to be answered E.V.E.R.Y.T.I.M.E.

Being underinsured means we’re not getting enough coverage for our liabilities while overinsured means you might be overpaying or stretching yourself as you’re paying for insurance.

My main takeaway from protection planning is that it is an ongoing process, it evolves as your life stage changes, but you should always get medical insurance, and start early.

To avoid overinsuring, one should see insurance as a hedge to protect you in the event of unfortunate circumstances. It’s not a plan for you to get a huge payout if something happens.

Picking The Best Home Loans & Renovations

Tips & Tricks For Your Home Loan

If there’s one keynote that screams “This s*** is real”, it is David Baey, Founder and CEO of Mortgage Master sharing about the practicality of choosing a suitable housing loan.

Housing loan is definitely one of the important subjects you need to learn about when you purchase a house.

If you’re confused about whether to pick a bank loan or an HDB loan, consider engaging a mortgage broker who may offer better or the same rates as these two institutions.

As David shared, there are three questions you need to ask yourself before saying ‘Yes’ to the house:

- How much can you borrow?

- Do you have enough for the downpayment?

- Are you comfortable with the monthly installments?

You should feel comfortable when answering these questions. David shared that the cheapest interest rates in town might not be the most suitable for you.

Instead, the best interest rates will depend on the type of property you purchase, your risk level, and your risk appetite.

Finding The Right Fit For Your Renovation

Next up, once you’ve decided on a home loan and collected your keys, you will need to start looking at renovation.

Daniel Lim, Co-founder of Qanvast, mentioned that even before thinking about the budget, one needs to be familiar with the median spend which people throw into home renovation. He also emphasised the importance of having a buffer in cases of renovation delay.

This is also backed up by James Soh, founder of Renopedia, who shared five key steps in depending on a budget.

- Scope: Are you doing interior design or just renovation work?

- Multiple Quotes: To determine a rough estimation of the budget

- Estimated Budget

- Research: Are there areas where you can save on?

- Keep track

When choosing an interior designer or a contractor, the main difference between the two options is if you have a need for design expertise and time to project manage contractors.

One decisive factor is also the complexity of the project and whether you require someone who could provide professional advice on the technical aspects.

Saving & Managing Your Finances

When it comes to optimising your savings and spending to build wealth, the main key takeaway is that you need to have different pots of money — savings, emergency funds, and wealth.

Sara Wee (The Weeblings) and Christopher Tan (HoneyMoneySG) mentioned that an emergency fund is fundamental and something that everyone should have, in cash due to its liquidity.

We’ve previously covered the importance of having a layer of cash for emergencies and how you can put aside this amount:

- Best Cash Management Accounts in Singapore 2023 Edition

- The Best “Insurance” You Can Have: Preparing For Emergencies

- Here’s How to Start Over Financially From Zero After a Setback

The second takeaway is for beginner investors — to be clear with your investment objectives if you choose to invest. Being aware of your investment horizon and the amount of money you’re putting in, helps you with your decision-making.

To that, it’s also important to clear the misconception that risk does not equate to volatility:

“A fundamental concept of finance is that risk and return should go hand-in-hand, at higher risk you should be getting higher returns because risk is the probability of you actually losing money… that has to do with the value of the investment and the return should come together with that. Volatility, on the other hand, is just, price fluctuations. One has to do with value, the other has to do with price fluctuations.”

Audrey Ho, CFA, Investment Analyst, Citibank

Managing Your Finances as a Household

Couples can always start with a joint account first, but having different accounts is equally important.

Very importantly, when trying to identify a “fair” system between couples, the takeaway is to be dynamic in the way you make contributions as your income grows.

If you’re planning to have a kid, project an extra 30% more when you’re budgeting for kids. When deciding on financial protection for your kids, you might want to consider an endowment plan and hospitalisation plan for medical expenses.

Creating A High-Quality Lifestyle Requires You To Introspect

I’m sure you’ve attended career talks throughout your life, but it’s not the same with this.

Having been through 32 different careers, Jason mentioned that performance, pay, and passion have one area of intersection, and that is your calling.

While passion is the key to performance and therefore high pay, you need to build and play to your strength. Strength is not what people tell you what you are good at, but what you do that makes you feel energised.

Of all the tasks that you feel energised from, audit yourself on a scale of 0 to 10, and you will be clearer about where you perform at your best. And, that’s what makes you happy.

When we talk about happiness, we’re also referring to taking care of our mental health.

Dr. Karen Pooh shared that having self-compassion by practising mindfulness, self-kindness, and recognising that experiences are a normal part of being human are methods to help you juggle your everyday life, and these are good checkpoints to assess your needs.

“In between goals is a thing called life, that has to be lived and enjoyed.” – Sid Caesar

These are practical tips that we can all learn from and require a constant commitment to become habits that we practise every day. So, how about starting today?

Afterthoughts

This year, I’ve definitely gained a lot of money and life lessons.

If you’ve missed out on some of the great sharings, remember that you can catch the live recordings on the SeedlyRewards platform sometime next week! We’ll update you soon.

In the meantime, comment below on any insights you’ve gleaned and share them with your fellow Singaporeans!

Advertisement