“Wah… You’re lucky that you’re self-employed. Means don’t need to care about your money being sucked into CPF.”

Really?

Having been a freelance writer, marketer, and a tuition teacher for a year, I knew nothing about CPF contribution.

And I’ve assumed – for the longest time – that if I were to continue with this line of work, it’s just not something I have to care about.

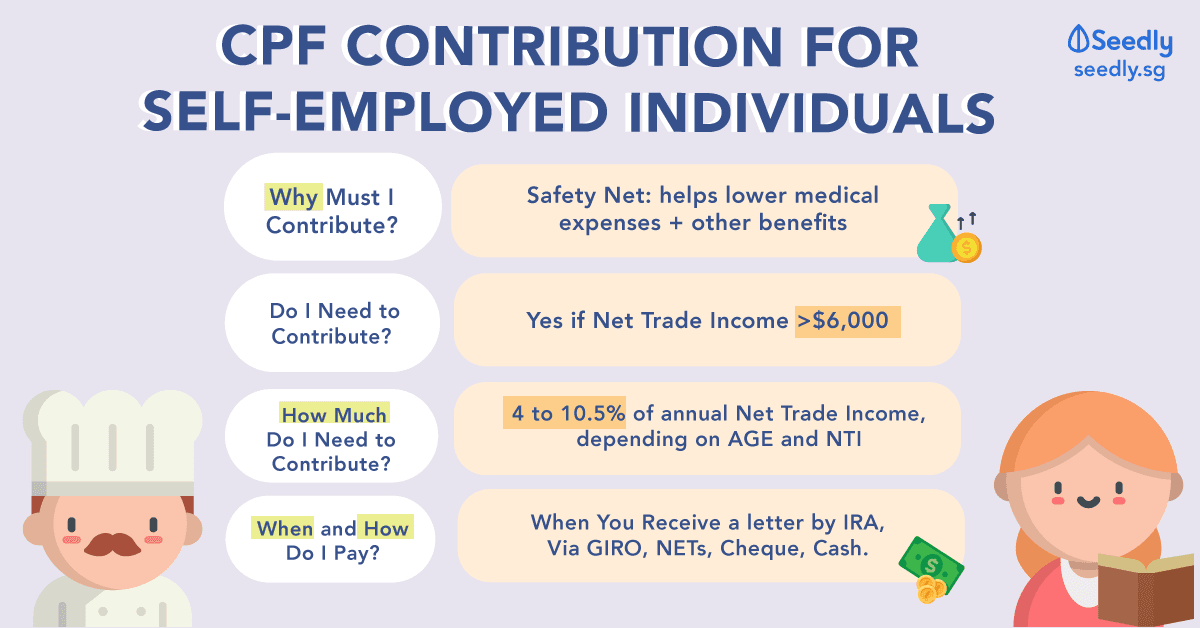

But as part of my efforts to embrace #adulting, I decided to read up on CPF contributions for self-employed individuals just to see why it’s mandatory (for MediSave at least) and find out if there’s even any benefit to doing so.

So if you’re currently self-employed, or are an entrepreneur starting your own business… I’ve already done the homework for you.

Here’s everything you need to know about CPF contributions if you’re a self-employed person.

Am I Considered “Self-Employed”?

Unsure if you’re considered “self-employed”?

Here’s a checklist to help you figure that out:

- If you have received full-time or part-time income from a business = You’re considered a Self-Employed Person

- If you are a person with your own business and you are in a position to realise a business profit or loss = You’re considered a Self-Employed Person

“Wah. Sian... I Self-Employed Why Must Contribute To My CPF?”

Honestly, I’m also not sure why.

It’s also not stated explicitly anywhere in the CPF or the Inland Revenue Authority Of Singapore (IRAS) website…

But if I were to hazard a guess, it’s probably to create a financial safety net.

Personally, I’m not the most disciplined person when it comes to saving for medical expenses and needs.

So if I am self-employed, my compulsory contributions to MediSave means that I at least have money in my MediSave for medical insurance and emergencies – especially since I don’t receive regular MediSave contributions from an employer.

Contributing to MediSave also has these few perks:

- Use of MediSave savings for

– Healthcare expenses for yourself and your family

– Premium payment for MediShield Life or MediSave-approved private integrated plans - Up to 6% (floor interest is 4%, but can go up to 5%) interest per annum for MediSave savings: so that you will not lose your money from inflation.

- Tax relief of up to 37% of your annual Net Trade Income.

Do All Self-Employed Individuals Need To Contribute?

If you are self-employed and earn a yearly Net Trade Income (NTI) of more than S$6,000, it is compulsory for you to contribute to your MediSave only.

Contributions to your Ordinary Account or Special Account are voluntary, but if you aren’t actively saving and investing for your future, then you might want to consider this as an option.

Read more: All You Need To Know About Central Provident Fund (CPF): Interest Rates, Contributions And More

What Is Net Trade Income?

If you’re a freelancer (like I used to be), your NTI would just be whatever you earn from your freelance jobs.

But if you’re a business owner, then your NTI is your gross trade income minus all allowable business expenses, capital allowances and trade losses as determined by IRAS.

So How Much Do I Need To Contribute To MediSave?

![]()

Here’s a quick overview of what kind of contribution you have to make towards your MediSave:

| Age | Income (NTI): Above $6,000-$12,000 | Above $12,000-$18,000 | Above $18,000 |

|---|---|---|---|

| Below 35 | 4% | 4-8% | 8% (Max: $5,760) |

| 35-45 | 4.5% | 4.5-9% | 9% (Max: $6,480) |

| 45-50 | 5% | 5-10% | 10% (Max: $7,200) |

| 50 and above | 5.25% | 5.25-10.5% | 10.5% (Max, $7,560) |

To make your lives easier, you can use this MediSave Calculator to calculate the contribution amount you have to make according to your profile.

Here’s an example of how to calculate how much you need to contribute to MediSave.

I am currently below the age of 35 and am a non-pensioner. Assuming my yearly net trade income is $10,000, I will have to pay $400 for MediSave Contribution.

When Do I Have To I Pay For My MediSave Contribution?

First, you will need to declare your actual income and file your Income Tax.

Next, IRAS will send you a Notice Of Assessment (NOA).

Then, IRAS will send you another letter called the Notice Of Computation (NOC), where your actual MediSave payable will be stated.

Your contribution must be made within 30 days of the date stated in the NOC. And this can be done at any CPF service centre or online using your SingPass.

Alternatively, you can just do a voluntary top-up to your MediSave account! With

How To Pay $$$

The most convenient way is to pay via a GIRO Instalment Plan – this can be arranged with CPF.

All you have to do is download this application form and submit it by mail to the CPF Board:

Central Provident Fund Board

Robinson Road

P.O. Box 0612

Singapore 901212

Otherwise, you can also make a lump-sum payment via NETs, Debit, cheque, cashcard, or by cash at any Singpost Office.

For Self-Employed: Other Than MediSave, What Else Can I Contribute?

Unlike the majority of working Singaporeans who are employed, self-employed individuals don’t have the safety net that a compulsory CPF contribution provides.

For those who feel uneasy about that, you can also make CPF contributions to yourself!

Here’s how:

- Making Voluntary Contributions

- You can make cash contributions to all three accounts – Ordinary (OA), Special (SA) and MediSave (MA)

- You can also top up your MediSave account directly, and the amount that you top up can be used to offset your MediSave contribution as a Self-Employed individual.

- Transfer From OA To SA

- If you have excess savings in your OA (up to 3.5% interest), you can transfer them to your SA (up to 5% interest) to earn more interest (note: this transfer is irreversible)

- If you’re above 55, you can transfer your money to your Retirement Account (RA) instead

- Retirement Sum Topping-Up Scheme (RSTU):

- You can make cash contributions to your loved ones’ or your own SA or RA as well!

- This is useful as you can increase your ‘safety net’ for your loved ones

Still unsure about your CPF contributions as a self-employed person? Why not ask our friendly community in our Seedly Q&A? If you’re shy… you can also ask anonymously!

Advertisement