Sell Car Singapore Guide: Can You Actually Sell Your Car for a Profit Now?

It’s a known fact that owning a car is notoriously expensive in Singapore.

In fact, you need to be earning at least $8,850 to own one!

Coupled with the Certificate of Entitlement (COE) and petrol prices that are constantly climbing, one can only imagine that owning a car in Singapore is really a luxury.

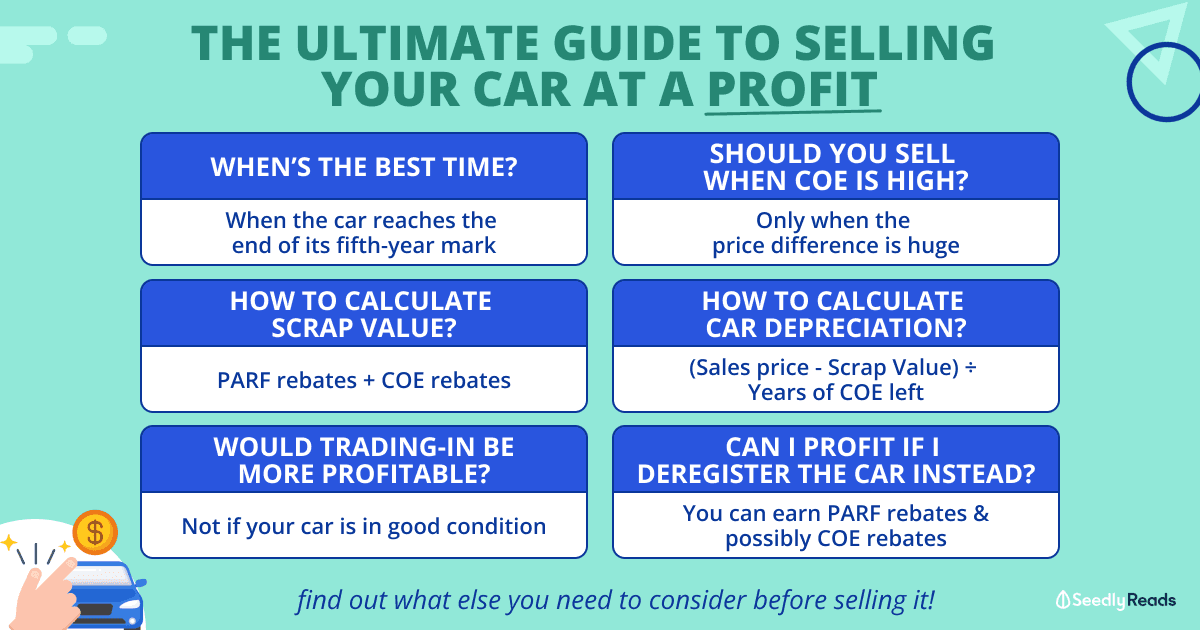

Some have also mentioned that they intend to sell it before the car depreciates, and this brings me to wonder how long it takes for a car to depreciate and when is the best time to sell it?

But, do people really profit from selling cars? Let’s find out!

TL;DR: Best Time To Sell Your Car, Selling vs Deregistration, What is Scrap Value & The Trade-in Value of a Car

Click here to jump:

- Understanding car deregistration and car depreciation

- How to calculate car depreciation and scrap value

- Selling your car in Singapore

- What is the trade-in value of a car

What’s Car Deregistration And Car Depreciation?

Before jumping into whether you’ll profit from selling a car, we should first understand what car deregistration is, and some of the terms that will be thrown around when dealing with it.

In Singapore, the cost of a car is made of several factors – Open Market Value (OMV), Additional Registration Fee (ARF), Goods and Services Tax, Registration Fees, Vehicular Emission Scheme (VES), surcharge (if any), dealer markup and COE.

| Terms | Definitions | How to Calculate |

|---|---|---|

| Car Deregistration Value / Paper Value | The deregistration value of a vehicle is the money you get back when you deregister the vehicle and is sometimes known as the 'paper value' of your vehicle | Deregistration value = [COE rebate + PARF rebate] |

| Certificate of Entitlement (COE) Rebate | A rebate for the unused duration of a vehicle's COE, if a driver deregisters the car before COE ends | COE rebate = [Quota Premium Paid x Number of months left] / 120 months |

| Scrap Value | Scrap value is the sum of your car's deregistration value plus your car's body value. The deregistration value is the sum paid by LTA while the body value is the amount your dealer is willing to pay to take the car off your hands | Scrap value = Deregistration value + Body value |

| Preferential Additional Registration Fee (PARF) Rebate | You are eligible for a PARF rebate based on a percentage of your ARF value if you deregister your car during the first ten years | 5% decrease annually after the 5th year |

| Open Market Value (OMV) | This is the cost of a vehicle imported into Singapore and assessed by the Singapore Customs after taking into account the purchase price, freight, insurance and all other sale and delivery charges for importing the vehicle to Singapore | |

| Additional Registration Fee (ARF) | A tax that is imposed when you register a car and calculated based on a percentage of your vehicle’s Open Market Value | First $20,000: 100% of OMV Next $30,000 (i.e. $20,000 - $50,000): 140% of OMV Above $50,000: 180% of OMV |

What Is Car Deregistration and How To Calculate Scrap Value?

In Singapore, unless you’ve renewed your COE, the lifespan of your car is capped at 10 years.

You can deregister the car if you’re not planning to renew your COE, and this means you either scrap or export your car (side note: this will be a topic that deserves an article of its own 👀).

In fact, the Land Transport Authority encourages you to deregister to earn rebates!

When you deregister a car, you are entitled to the Preferential Additional Registration Fee (PARF) rebate, which is based on a percentage of the ARF you paid when you registered your car.

If you’ve heard of “Scrap value”, this refers to the sum of your car’s deregistration value plus your car’s body value, and is commonly used interchangeably with PARF rebates.

Do note that cars that are more than 10 years will not be entitled to any PARF rebate even when the COE is renewed.

The ARF rate and PARF rebates that drivers are entitled to are as follows:

| Vehicle OMV | ARF Rate (% of OMV) |

|---|---|

| First $20,000 | 100% |

| Next $30,000 | 140% |

| Above $50,000 | 180% |

| Age of vehicle at deregistration | PARF rebate |

| ≤ 5 years | 75% of ARF |

| Above 5 years but not exceeding 6 years | 70% of ARF |

| Above 6 years but not exceeding 7 years | 65% of ARF |

| Above 7 years but not exceeding 8 years | 60% of ARF |

| Above 8 years but not exceeding 9 years | 55% of ARF |

| Above 9 years but not exceeding 10 years | 50% of ARF |

| Above 10 years | N.A. |

Pro-Tip: Check out the Land Transport Authority (LTA)’s online PARF Rebate Calculator for easier calculation!

Moreover, if a car owner deregisters a car before COE ends, they may receive a COE rebate for the unused duration of the driver’s COE.

When combining the COE rebate and PARF rebate (if applicable), we can determine the Car Deregistration Value = COE rebate + PARF rebate, aka ‘paper value’.

There are three ways to redeem these rebates:

- Encash within 12 months

- Use them to offset various taxes and fees when you register a new vehicle

- Transfer them to another party

What is Car Depreciation?

Car depreciation refers to the amount the owner loses on the value of the car per year, based on the assumption that the vehicle will be deregistered at the end of a car’s 10-year COE lifespan.

The depreciation varies mainly by two factors – OMV/Sales price of the car and PARF Rebates (COE rebates are not applicable if you want to use your car up till the last day of your COE).

This value is calculated by deducting the deregistration/scrap value of the car from the original sales price of the car, then dividing by the number of years left on COE.

Annual Depreciation = [Sale price of the car – Deregistration Value] / Remaining Years of COE

Note: Regardless of whether it’s a new or used car, you can negotiate the price of a car before purchasing it as the sales price of a car will affect your depreciation cost.

So, Should You Sell Your Car or Deregister It?

Let’s refer to two scenarios for illustration purposes.

We’ll be using Perodua Bezza 1.3 Premium X as the car you own.

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Car's Conditions | Open Market Value (OMV): $11,040 Additional Registration Fee (ARF): $11,040 Price of the car: $97,999 COE: 10 years / 120 months Year & Month of purchase: 1 December 2020 COE quota premium paid: $40,556 |

|

| Years of COE left | 0 | 5 years / 60 months |

| PARF Rebates | $5,520 (50% ARF) | $8,280 (75% ARF) |

| COE Rebates | 0 | $20,278 ($40,556 x 60) / 120 months |

| Deregistration / Scrap Value | $5,520 | $25,780 |

| Annual Depreciation | $9,247.90 ($97,999 - $5,520 / 10 years) | $13,888.20 ($97,999 - $28,558 / 5 years) |

| Should Deregister or Sell? | Deregister | Sell |

Scenario 2 shows a higher depreciation if you deregister after 5 years!

Now, it makes more sense to sell the car instead as you could possibly obtain a higher value via consignment, direct buyer or car dealership, especially if your car is in good condition.

If you noticed by now, it’s not the price of a car that makes it expensive to own, but rather, how quickly it depreciates, which then affects the scrap value.

It’s also worth noting that factors such as OMV, ARF and COE do have a significant impact on the sales price of a car.

Read more:

- Electric Car Guide: How Much Does It Cost To Own One in Singapore?

- Singapore Lifting Car Warranty Restrictions: A Game Changer for Car Owners?

Can You Profit From Selling Your Car?

It’s possible but it’s heavily dependent on your method of selling, your car’s depreciation rate, its COE, and even current COE prices.

In fact, the difference in COE prices has a great impact on your car’s valuation; A car may have high paper value if it was bought with an expensive COE and likewise, a car bought with low COE may not attract as much in terms of paper value.

For example, two drivers bought the same car but in different months in 2018 (Jan and Dec 2018 for instance) – Car A’s COE bid was $25,000 while Car B’s COE bid was $42,000.

You can tell by now that two cars would have different paper values as of 2022.

When both vehicles are put on the resale market where cars of a similar condition sell for the same price regardless of the paper value, Car A with the cheaper COE would match the valuation of other similar cars on the market that have higher COEs.

Consumers will likely choose the vehicle with the lower COE value over the one with a higher COE value if the price difference between the two vehicles is large enough (assuming the intrinsic value of your car didn’t change).

Because of this, you may be able to sell your cheaper COE car for more thanks to the price differential.

So if you want to make a profit from selling your car, then selling your car when COE prices are high would be a good idea.

Nonetheless, one thing for sure is the longer you hold your car, the more it loses in terms of value. This also includes the value in the car resale market and rebates upon deregistration.

So, When Should You Sell Your Car?

According to Carro.sg, the rate of depreciation is high in the first three years and only becomes ‘steady’ from the 4th year onwards.

This is because a new car will run relatively trouble-free for three to four years, or 60 to 8000km before you start noticing an increase in the number of visits to the workshop.

Furthermore, car dealers would have warranty periods for maintenance and electrical issues that cover up to three to five years.

And this is also why you don’t see a lot of one to three-year-old cars in the car resale market.

Not that just, if you’ve taken up a car loan, the bank may also charge you an early settlement penalty if you repay your loan earlier, especially within the first one or two years.

Given the various reasons above, and that after the 5th year, the PARF rebate will be reduced by 5% annually, it might be ideal to sell your car when it reaches five years.

How About Trading-in Your Car?

Trading-in is an alternative if your car is old and in need of major repairs since it might not stand a chance of fetching a good price in the resale market.

It could also be challenging to find a dealer that will buy your car for a good price if you have an unpopular car make or model.

In either scenario, trading in with a dealer lifts the burden off your shoulders and helps you offset your new vehicle; the trade-in value will be determined by the dealer.

Simply put, most people opt for trading-in as it’s convenient.

However, you may not get the best price and you’re faced with restrictions to negotiating for a better price when doing so.

Even Though You Might Profit…

Owning a car would already incur a high sunk cost.

Unlike property, most cars (except collectables) are depreciating assets as time goes by… and you would’ve spent quite a bit on car maintenance, petrol and other car-related expenses over the years.

At Seedly, we encourage our readers to be prudent in their expenses. It might be cheaper to rent a car instead.

Did you manage to profit from selling your car or have a question to ask?

Share them with us at the Seedly Community!

Related Articles:

Advertisement