Going Beyond Sheng Siong Group Ltd's (SGX: OV8) 4% Dividend Yield

Sudhan P

Sudhan P●

Insights into Sheng Siong’s Dividends

Sheng Siong Group Ltd (SGX: OV8) is a Singapore-grown supermarket chain with 63 outlets in Singapore. The company has also expanded into China to capture growth in that market.

Sheng Siong’s shares received a major uplift upon the announcement of further tightening in Phase 2 (Heightened Alert) last week following the rise in community cases here.

On a single day on 14 May, Sheng Siong’s stock price rose 11%, fuelled by speculation that the updated measures will elevate its business once again.

Despite the sudden rise in share price, Sheng Siong is trading at a dividend yield that is higher than what the Singapore stock market in general offers. This might attract dividend-hungry investors.

Here, let’s learn more about Sheng Siong’s dividends, including factors such as its dividend yield, dividend history, and most importantly, the sustainability of the dividend.

Dividend Yield

Sheng Siong shares are currently selling at S$1.62 each, giving a dividend yield of 4.0%.

For perspective, the SPDR STI ETF (SGX: ES3) had a distribution yield of 3.2% on the same day.

The SPDR STI ETF is an exchange-traded fund (ETF) that tracks the fundamentals of Singapore’s stock market benchmark, the Straits Times Index (STI).

Dividend Amount And Payout Periods

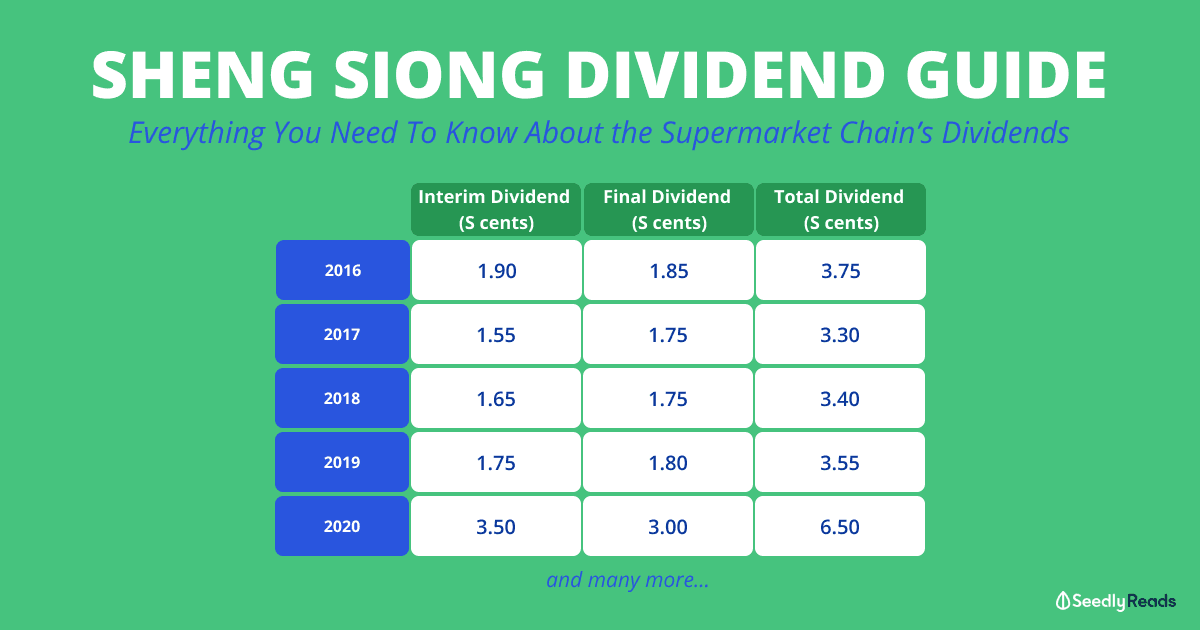

Sheng Siong paid out a dividend of 6.5 Singapore cents per share for its financial year ended 31 December 2020.

The company’s annual dividend is usually split into two parts – one part (interim dividend) is given out for the second quarter and the other for the fourth quarter (final dividend).

For 2020, Sheng Siong dished out a dividend of 3.5 Singapore cents per share for the second quarter and 3.0 cents for the fourth quarter.

Dividend History

Sheng Siong has paid dividends every year since its initial public offering (IPO) in 2011.

This is how Sheng Siong’s dividend performance has been from 2011 to 2020:

Year Interim dividend per share (Singapore cents) Final dividend per share (Singapore cents) Total dividend per share (Singapore cents)

2011 0.00

(not listed yet)1.77 1.77

2012 1.00 1.75 2.75

2013 1.20 1.40 2.60

2014 1.50 1.50 3.00

2015 1.75 1.75 3.50

2016 1.90 1.85 3.75

2017 1.55 1.75 3.30

2018 1.65 1.75 3.40

2019 1.75 1.80 3.55

2020 3.50 3.00 6.50

Sheng Siong’s total dividends have increased from 2.75 Singapore cents per share in 2012 (the first full year as a listed company) to 6.50 cents in 2020, giving an annual growth rate of 11.4%.

Last year, Sheng Siong dished out bumper dividends as net profit soared around 84% on the back of elevated demand arising from COVID-19.

Excluding that payout, Sheng Siong’s dividends grew 3.7% annually from 2012 to 2019, well above the average inflation rate in Singapore.

Dividend Policy

Sheng Siong doesn’t have a formal dividend policy. But it hopes to distribute up to 70% of its net profit as dividends.

Sheng Siong’s management said in response to queries for its 2020 annual general meeting that it will continue with the dividend payout practice unless there’s a need to conserve cash for operational reasons or major capital expenditures.

Under such circumstances, its main objective will be to optimise shareholder’s value when deciding how to deploy the cash.

Dividend Sustainability

To find out if a company’s dividends are sustainable, we can compare its earnings to the amount in dividends that it pays out.

Companies that pay less than 100% of their earnings have some room for error and have space for dividend growth in the future.

The following shows Sheng Siong’s earnings per share, total dividend per share, and dividend payout ratio (dividend as a percentage of earnings) since 2016:

2016 2017 2018 2019 2020

Earnings per share (Singapore cents) 4.17 4.64 4.71 5.04 9.22

Total dividend per share

(Singapore cents)3.75 3.30 3.40 3.55 6.5

Dividend payout ratio 89.9% 71.1% 72.2% 70.4% 70.5%

Sheng Siong’s dividend is well-covered, as it pays out below 100% of its earnings as dividends.

In terms of free cash flow, the supermarket chain dished out around 84% and 38% of it as total dividend for 2019 and 2020, respectively, which are also prudent.

Having said that, Sheng Siong’s 2020 dividend was particularly high due to elevated demand (which peaked in April/May 2020) from the pandemic.

Since then, there was a relaxation of COVID-19 restrictions with Singapore entering Phase 3 of re-opening on 28 December.

But we are back in a tightened mode under Phase 2 with work from home (WFH) being the default and dining out banned again. This should fuel demand for Sheng Siong as a business, at least in the short term.

Over the longer run, if flexible work arrangements become the norm in Singapore post-pandemic, Sheng Siong shareholders could benefit from higher dividends.

As for now, taking Sheng Siong’s 2019 dividend per share of 3.55 Singapore cents and its current share price of S$1.62 as a conservative measure, Sheng Siong’s dividend yield falls to 2.2% from 4%.

Can’t Get Enough of Seedly?

Now you can earn rewards while levelling up your investing knowledge! Sign up for a free Seedly account now and work your way up to a six months trial of StocksCafe.

We also have an Ultimate Cryptocurrency Guide waiting to be unlocked as well!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the company mentioned.

Advertisement