Singapore Budget 2019: GST Vouchers, More CHAS Subsidies, Income Tax rebates

“If there is something more exciting than the live telecast of the World Cup, it will be Budget 2019 simply because it affects our wallet directly whether you placed a bet or not.” – Overheard at a Coffeeshop

TL;DR: The Budget 2019. How it affects YOU?

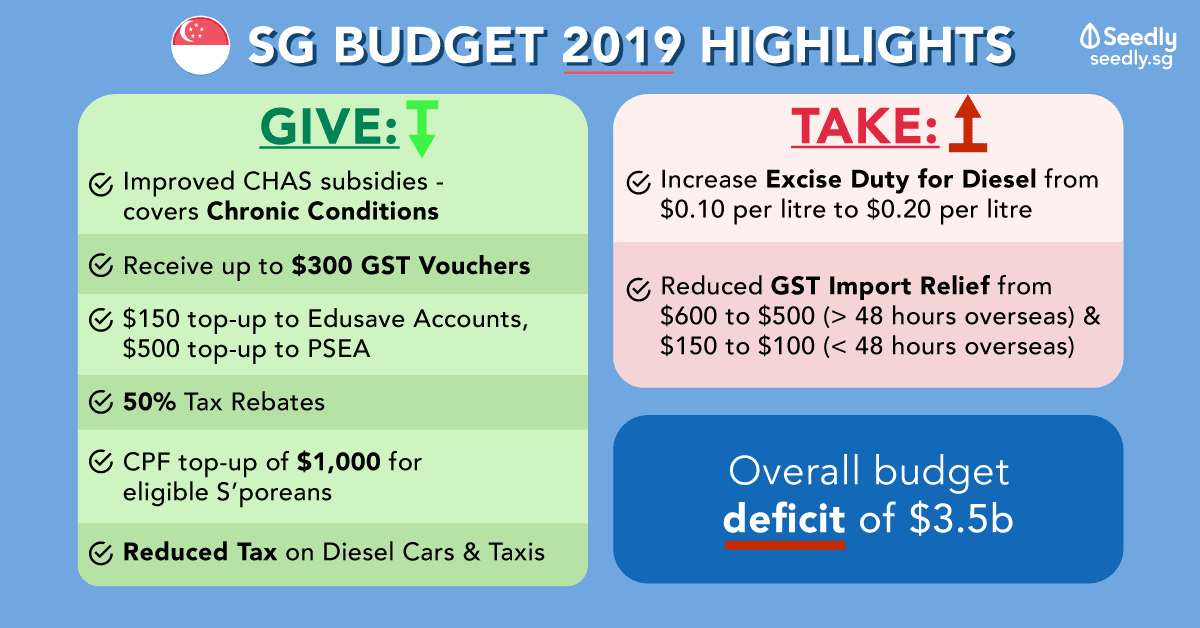

This year, the government expects an overall budget deficit of $3.5billion. There will, however, be no drawing on past reserves.

The YES:

- More CHAS subsidies and covers chronic conditions

- 1.4 million lower-income Singaporeans to receive up to $300 GST Vouchers

- $150 top-up to Edusave accounts, $500 top-up to Post-Secondary Education Accounts (Age 17-20)

- 50% Personal Income tax rebates (capped at $200)

- CPF top-ups of $1,000 for eligible Singaporeans (age 50-64)

- An annual special tax on Diesel Cars and Taxis reduced by $100 and $850 respectively

The NOs:

- Increase excise duty for diesel from $0.10 per litre to $0.20 per litre

- Reduced GST Import Relief from $600 to $500 (more than 48 hours overseas) and $150 to $100 (less than 48 hours)

Further Reading: Summary of Budget 2019

- Challenges Singapore face

- Singapore Economic Growth in the year 2018

- How Budget 2019 affects companies

- How Budget 2019 affects Singaporeans?

This year marks 200 Years since Raffles Landed in Singapore. This year, we reflect on history and see how we can chart a better future for Singaporeans.

In the global landscape, there is a decrease in support for globalisation. ASEAN however, is creating new opportunities for Singapore and the future is filled with potential.

The objective of SGBudget2019 will be to build a strong united Singapore.

Challenges Singapore face

Some of the issues Singapore faces are:

- Ageing Population

- Social Mobility

- Inequality

- Economic transformation

- Climate change

30% of Government expenditure: Support defence, security and diplomacy efforts

“This one cannot play play!”

- In order for Singapore to be a safe and secure home for all, deterrence and diplomacy are important to us as a nation.

- Singapore will find solutions to terrorism and cyber threats with the help of science and technology.

- Setting up of Home Team Science and Technology Agency to help deal with cyber threats.

Singapore Economy as a whole: 3.2% Growth in the year 2018 (HUAT AH!)

- Real median income of Singaporeans up by 3.6% over the past 5 years.

- Moderate global growth to be expected.

Strengthening Economic Competitiveness

“3 key trusts for Budget 2019 – Deep enterprise capabilities, deep worker capabilities, deep partnerships”

$100million to make Singapore companies more HUAT?

- Support in 3 areas to enable firms to grow: Customised assistance, better financing options and technological adoption.

- Innovation Agents Scheme: Allow firms to tap on the expertise of experienced professionals

- $100 million will be set aside to establish the SME Co-investment Fund III, to help SMEs scale up.

- SME Working Capital Loan Scheme is extended to 2 more years.

- SMEs encouraged to go digital at a better cost, with Go Digital programme expanded to more sectors.

Deepen capabilities of workers!

” Power to the People!”

- Allow Singaporeans to have good jobs and opportunities by investing in people across all ages.

- Upskilling, reskilling, increase training and job redesigning to allow Singaporeans to work better.

- New growth area to focus: Blockchain, embedded software, prefabrication (Blockchain doesn’t mean Bitcoin hoh!)

- Career Support Programme to extend 2 more years and local firms to revamp work processes, redesign jobs and reskill our workers.

- Foreign worker growth must complement our local workers, while local workers grow!

| Sector | Current | Changes |

|---|---|---|

| DRC | ||

| Manufacturing | 60% | No change |

| Services | 40% | 1 Jan 2020: 38% 1 Jan 2021: 35% |

| Construction | 87.5% | No Change |

| Process | 87.5% | No Change |

| Marine Shipyard | 77.8% | No Change |

| S Pass sub-DRC | ||

| Services | 15% | 1 Jan 2020: 13% 1 Jan 2021: 10% |

| Others | 20% | No change |

- Good News for business owners of Marine Shipyard and Process Sectors: Increased Foreign Worker Levy pushed back for another year.

Deep partnerships

- On business to business and government to government level.

- Singapore to aim to be a Global-Asia Node of Technology, Innovation and Enterprise (NTU will launch Centre of Innovation in Energy, Temasek Polytechnic will launch Centre of Innovation in Aquaculture.)

- Global Ready Talent Programme for students to be better ready through internships

- $4.6billion for new economic capability-building measures to support Singaporean workers over the next 3 years.

Social Focus of SGBudget2019

- Uplifting Singaporeans

- Providing Greater Healthcare Assurance

- Foster Community of care and contribution

Uplifting Singaporeans:

- Bottom 20% of workers: WIS Scheme will provide better support

Maximum Annual Workfare Income Supplement (WIS) Payout from 1 Jan 2020 AGE Employees

(Maximum annual WIS payout)Self-employed

(Maximum annual WIS Payout)35-44 $1,700 $1,113 45-54 $2,500 $1,667 55-59 $3,300 $2,200 60 and above $4,000 $2,667

CHAS subsidies for GP clinics changes

- More subsidies for lower to middle-income Singaporeans (Orange cardholders) receives subsidies for common illnesses too!

- CHAS will cover chronic conditions too! Regardless of income

- Increased subsidies for complex chronic conditions

$5.1billion into Long-Term Care Support Fund

- Fund CareShiueld Life subsidies

- Fund Long-term care support. Eg. Elderfund

$6.1billion into Merdeka Generation Package

“500,000 Singaporeans to benefit from this!”

- $100 top-up to Passion Silver Cards where they can use for activities at Community centres

- Medisave Top-up: $200 per year for 5 years!

- Additional MediShield Life Premium subsidies for Life (Starting from 5% of their MediShield Life Premium)

- $1,500 incentive when they joinCareShield Life

- Increase subsidies for outpatient

Medisave top-ups of $100 for the next 5 years (If you are above 50)

- Singaporeans aged 50 and above in 2019, not eligible for Merdeka Generation or Pioneer Generation benefits

- To be eligible, one must be Singapore citizen, born in or before 1969

Lower-income families and pensioners benefits

- Allowance and monthly pension to increase for government pensioners who draw lower pensions.

- Increase by $20 per month each to $320 and $1,250 respectively

Bicentennial Bonus and Community Fund

“GST VOUCHERS! WOOHOO!”

- $200million set aside for Bicentennial Community fund to provide dollar for dollar matching donations to IPCs

- $1.1billion set aside as bonuses to Singaporeans

- 1.4 million lower-income Singaporeans to receive up to $300 GST Vouchers

- $150 top-up to Edusave accounts

- $500 top up to Post-Secondary Education Accounts (Age 17-20)

- 50% Personal Income tax rebates (capped at $200)

- CPF top-ups of $1,000 for eligible Singaporeans (age 50-64)

- Service and Conservancy Charges (S&CC) rebate:

HDB Flat type April 2019 July 2019 October 2019 January 2020 Total for FY2019 1 and 2 rooms 1 1 1 0.5 3.5 3 and 4 rooms 1 0.5 0.5 0.5 2.5 5 rooms 0.5 0.5 0.5 0.5 2 Executive and Multi-generation 0.5 0.5 0.5 - 1.5

- $10 million top-ups to Public Transport Fund

Singapore Battling Climate Changes

- Carbon tax to be implemented

- Zero waste Masterplan introduced in the second half of the year

- The Govt will raise the excise duty for diesel by $0.10 per litre, to $0.20 per litre.

- Special tax on diesel cars and taxis to reduced by $100 and $850 respectively

Here comes the TAX!

Travellers take note:

-

Time spent overseas Value of Goods Granted GST Relief More than 48 hours $500

(Down from $600)Less than 48 hours $100

(Down from $150) - Duty-free alcohol allowance to be reduced to 2 litres for travellers returning to Singapore.

Quick Recap: How did the Singapore Budget last year impact us?

Read more: Singapore Budget 2018: Increase in GST by 2% in the period from the year 2021 to 2025

Advertisement