If you’re looking for Budget 2021 updates, check out our Budget 2021 Singapore Updates here

PSA: Singapore Budget 2020 LIVE UPDATE

The Singapore Budget is prepared for each financial year.

Budget 2020 will be delivered by Deputy Prime Minister and Minister for Finance, Mr Heng Swee Keat on 18 February 2020.

Seedly will be doing a LIVE UPDATE on this article.

Seedly readers can discuss the Budget on our Community Platform.

Singapore Budget 2020 Summary: What You Need To Know?

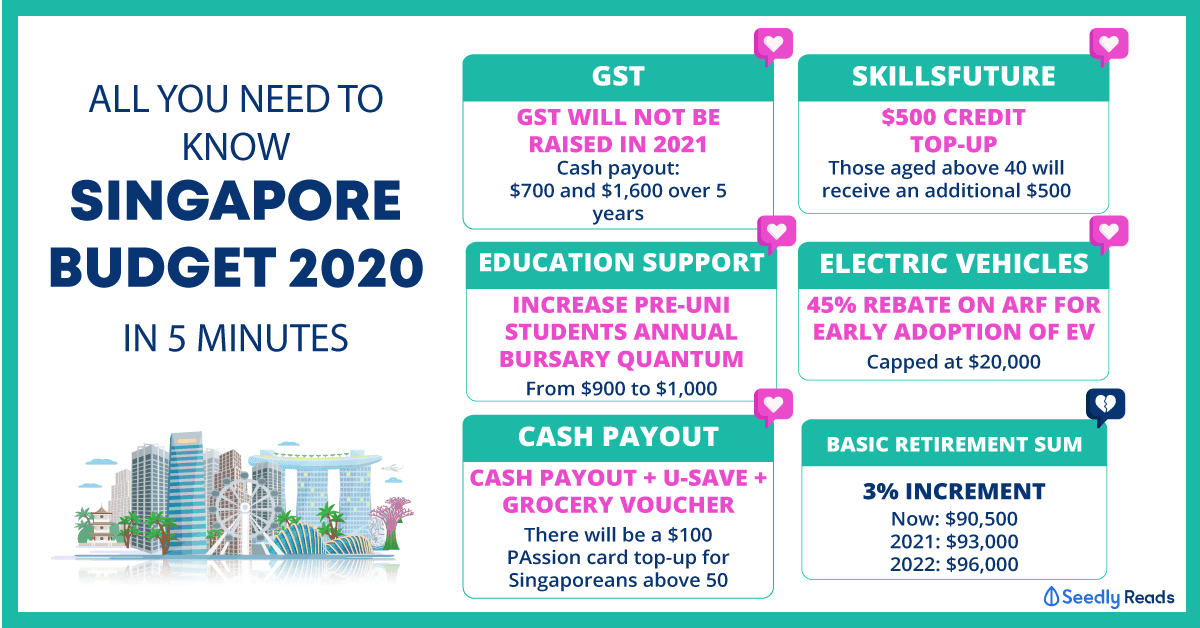

Given that the entire Budget is close to 3 hours long, here’s a quick summary:

We will break it down into THE GIVE, THE TAKE and THE CONFUSED

Budget 2020: The Give

- An additional $800 million will be set aside to support the efforts of containing COVID-2019

- GST increase will not happen in the year 2021

- SkillsFuture Top-up

- Enhanced MOE Financial Assistance Scheme

(Increase pre-university annual bursary quantum and bursaries for full-time ITE Students) - Cash Payout of $300, $200 or $100 for Singaporeans aged 21 and above

- $100 cash payout for adult Singaporean with at least one Singapore child aged 20 and below

- Grocery Vouchers for needy Singaporeans

($100 each year for the year 2020 and 2021) - Additional GST Voucher for any household with 5 or more members

- $100 top-up PAssion Card for Singaporeans above 50 years old

- Matched Retirement Savings Scheme that matches cash top-ups, capped at $600

- Silver Support Scheme quarterly cash payouts to increase by 20% per quarter

Budget 2020: The Take

- Basic Retirement Sum for CPF to increase by 3%

Budget 2020: The Confused

- 45% rebate on Additional Registration Fee (ARF) for environmentally friend vehicles. But it may also bring on board a new type of ERP that charges you based on usage.

We have also provided some insights to some of the major announcements this Budget 2020:

-

Singapore Budget 2020: GST Hike Delayed, $6b Package to Offset Costs

-

$1.6b Care and Support Package For Singaporean Households

-

Budget 2020: [CPF] Government Will Match Dollar for Dollar For Singaporeans to Reach BRS; More qualify for Silver Support Payouts

-

GST Voucher 2020: How Much Will You Be Getting?

-

Singapore Budget 2020: Here’s What The Government Is Doing To Help Older Singaporean Workers

Further Reading: Singapore Budget 2020 As It Happens

Impact of virus:

- Growth forecast of Singapore is now readjusted to -0.5% to 1.5% due to the economic impact of Coronavirus

A $800 Million will be allocated to the Ministry of Health, on top of the annual budget.

$5.6 Billion worth of package to help stabilise the economy

This will be done in two different packages:

- Stabilisation and Support package to help businesses and workers affected by this virus

- Care and support package to provide households with more help to get through the cost of living.

$4 Billion Stabilisation and Support Package

Objective:

- To help workers retain jobs

- To help workers upgrade their skills

- Help enterprises and businesses with the transformation

How is this done?

- The government will support enterprises for part of their wage cost

- Introduce Jobs Support Scheme

- Enhance the Wage Credit Scheme

- Tourism, Retail, Food Services, Point to Point transport service and Aviation are affected the most by this COVID-19 Virus. Hence, additional effort will be put to help employers retain workers, and to retrain them.

Perks

- Enhanced wage credit scheme.

The wage credit scheme for Singaporeans for up to $4000 dollars will be raised to $5000. - To help enterprises access working capital, the Working Capital Loan for enterprises will be increased for a year. It will be increased from $300,000 to $600,000.

More Perks: GST Increase will not take place in 2021!

To help Singaporeans, the GST increment that is supposed to take place in the year 2021 WILL NOT take place. The GST increase will have to, however, happen by the year 2025 to deal with the increase in cost for the country’s future need.

The Government will cushion the increase for Singaporeans as we move towards an increment.

How is this done?

- An Assurance Package in the GSTV Fund will be provided.

- This Budget 2020, $6 billion is set aside for that package.

- Under this Assurance Package, Majority of Singaporean households will receive offsets to cover at least 5 years worth of GST

- Adult Singaporeans will receive cash payouts between $700 and $1,600 over 5 years

The 4 Pillars of This Year’s Budget

Grow Economy, Transform Enterprises

$8.3 billion over the next 3 years to allow transformation and growth. This will cover three main objectives:

- Enable stronger partnerships between Government, industry and the research community

- Deepening enterprise capabilities

- Developing our people

Deepening Enterprise Capabilities

An addition $300 million under Startup SG Equity.

- GoBusiness platform to be launched

- Expanding SMEs Go Digital programme

- Enhanced Market Readiness Assistance Grant

- Enterprise Leadership for Transformation Programme will also be launch to support SME businesses.

- Expansion of the reach of the Enterprise Development Grant

Developing Our People for Our Future

- Introducing new Asia-Ready Exposure Programme to encourage learning from overseas.

- Enhance support levels for internships under Global Ready Talent Programme

SkillsFuture Top-up

Perks: $500 Skillsfuture top up from 1 October 2020. This top-up will expire in 5 years.

In order to encourage more learning, there will be a one-off SkillsFuture Credit top-up:

- $500 for every Singaporean aged 25 years and above.

- Additional $500 SkillsFuture Credit will be given to 40-50 Years old

On top of the SkillsFutute credit top-up, SkillsFuture Mid-Career Support Package will assist local workers age in their 40s and 50s:

- Increase the capacity of reskilling programmes

- There will be hiring incentive for employers that hire and reskill jobseekers over 40 years old

- Peer-level support and career guidance through a group of volunteer Career Advisors

On Employment

- To encourage the hiring of more Singaporeans, S Pass sub-DRCs of the construction, marine, shipyard and process sectors to reduce from 20% to 15%.

- Foreign worker levy rates for all sectors will remain for 2020.

Caring For Singaporeans, Building An Inclusive Home

- The government will increase spending in the early childhood sector to over $2 billion per year

- Enhance the MOE Financial Assistance: Raising the annual bursary quantum for pre-university students from $900 to $1,000

- Full-time ITE students from Academic Year 2020 will receive and enhance in bursaries too.

Helping Households With Cost of Living

- All Singaporeans aged 21 and above in 2020 will receive a one-off cash payout of $300, $200 or $100, depending on their income.

- The Government will provide further $100 cash payout for every adult Singaporean with at least one Singapore child aged 20 years and below this year.

- One-off GST Voucher U-Save Special payment

- Extension of S&CC rebate for another year

- Low-wage worker to receive a Workfare Special Payment of at least $100

- Needy Singaporeans to receive Grocery Vouchers worth $100 each year in the year 2020 and 2021.

- Additional GST Voucher for any household with 5 or more members

- $100 top-up to PAssion Card for Singaporeans age 50 and above

On CPF

- Basic retirement sum in CPF to increase by 3%

- Matched Retirement Savings Scheme for those aged 55-70 where cash top-ups are matched 1-for-1, capped at $600.

- Silver Support Scheme quarterly cash payouts to rise by 20%, up to $900 per quarter.

Government Provide Top-ups To Three Funds

- The Government will top up $750 million to the ElderCare Fund, $500 million to the ComCare Fund and $200 million to the MediFund.

On The Environment

- Objective: To phase out internal combustion engine vehicles and all vehicles run on cleaner energy by 2040.

- There will be enhanced incentives to encourage adoption of cleaner and more environmentally friendly vehicles

( Up to 45% rebate on Additional Registration Fee, capped at $20,000) - The government will move towards an infrastructure for Electric Cars

- The government will take lead and progressive procure and use cleaner vehicles.

- Singapore will commit $1 billion for research in Urban Solutions and Sustainability.

- $5 billion injected into Coastal and Flood Protection Fund

Our Budget Position

Advertisement