For a World That Runs on Debt Your Credit Bureau Report (Credit Score) Matters

●

My first brush with the Singapore Credit Bureau happened last year when my relatives had to close down their business.

Prior to this, my relative’s business had not been doing well for ages and they borrowed money from multiple banks to keep the business going.

My relative recounted that it was an extremely stressful time.

Not only did they have to worry about the business, but they also had to deal with multiple banks coming after them and all the accompanying late payment fees and interest

At one point their credit score was lowered to HH, the lowest grade you can get (see below).

Thankfully, the debt situation got resolved and they are now doing fine, but it was a really difficult time for them.

However, they did not escape unscathed as due to their low credit score, they now have difficulty getting approval for loans such as personal loans now.

Although this may form a good argument against debt, this is just one side of the story.

A World That Runs on Debt

When you are born, you have very little worth (rightfully so, you need to build that worth).

However, the problem is that to earn worth in today’s world and especially so in Singapore, you will generally need to have money to start with.

Whether it’s having money for healthcare, education, transportation, shelter, or basic necessities like food, internet, electricity, clothing, etc.

These things are not cheap, and we will often need to loan money so we can get them because they are required to get a job and live in today’s capitalistic society.

Our parents will supply some of those necessities for a certain time, but eventually, you will need to have these things yourself.

As much as they seem expensive in the short term getting them now will increase your growth, meaning it will benefit you in the long term.

Just think, how Singaporeans afford to buy a home in Singapore if we can’t get a HDB or Bank loan? How many less privileged students will forgo their chance to go to university to get that degree if not for the availability of education loans?

The stats back this up too.

According to data from CEIC, Singapore’s Household Debt reached $348.7 billion in December 2019. This accounted for 63.8% of the country’s Nominal Gross Domestic Product (GDP).

The banking system is inherently a useful system.

But of course, you can certainly misuse debt, screw up your cash flow and get into a lot of trouble with it.

You will also have to factor in corporate greed or some government policies that give it some of its toxic properties.

But overall, taking up good debt is what can help us grow and keeps the world growing.

This is why it is important for you to maintain a good credit score so that you can still borrow money responsibly and fuel your growth and pay for the important things in life.

What is a Credit Bureau Report?

In Singapore, the Credit Bureau (Singapore) CBS keeps credit reports for consumers in Singapore.

They are one of two Credit Bureaus, the other being the Monetary Authority of Singapore (MAS).

They partner with The Association of Banks in Singapore (ABS) and Infocredit Holdings Pte Ltd, which represent the majority of the retail banks and major financial institutions in Singapore to compile credit reports.

Simply put, your credit report is a record of your entire credit payment history based on data from CBS member banks and financial institutions that loan you money in Singapore.

In order words, the banks know all about your credit history.

Thus, your credit report gives you and the lenders a snapshot or idea of your ability to repay credit.

A credit report will look something like this:

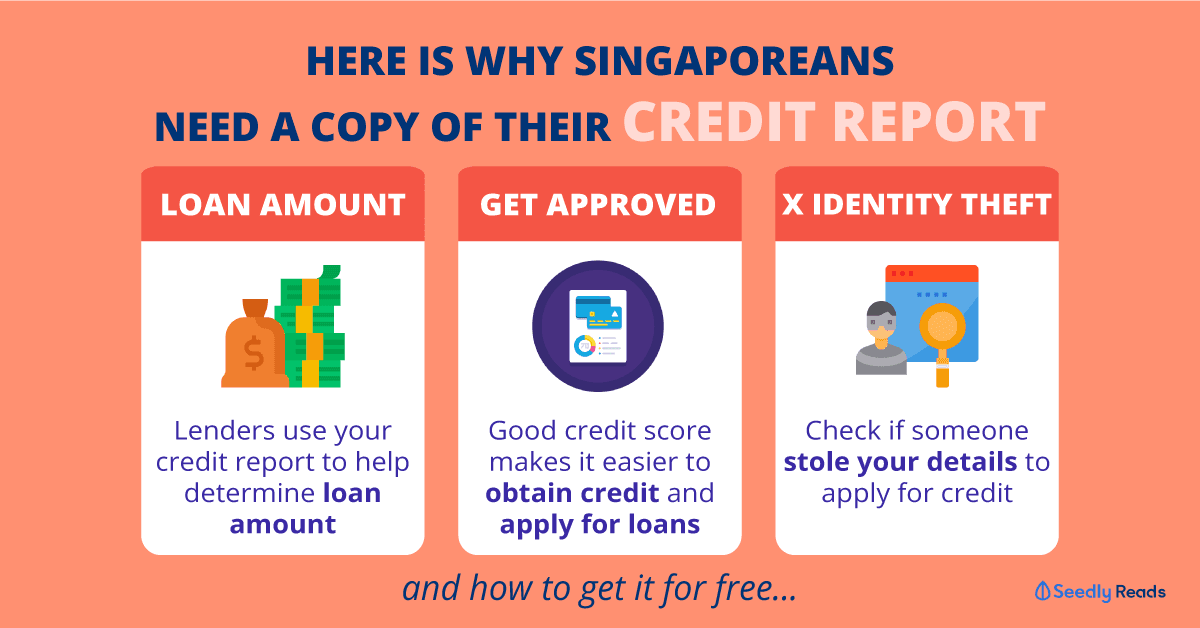

The majority of established lenders will check your credit report to assess your creditworthiness before coming to a decision.

Thus, having a good credit score and favourable credit report will make it easier for you to obtain credit and to qualify for loans.

With the Bureau in place, you can expect faster and more competitive services from the credit providers if you use your credit responsibly.

For most loans above $500, banks will use your credit score to determine your loan quantum, or how much they are willing to lend you.

Unlike some other countries, banks in Singapore seldom vary the interest rate based on your credit grade. If you have bad credit, you will either be given a smaller loan or be rejected.

There’s also another good reason for you to monitor your credit file too, as it tells you if you someone has stolen your identity to apply for credit.

This includes scenarios where the identity thief opens multiple lines of credit in your name, often accumulating debt and tarnishing your credit scores.

The CBS recommends that you apply for something My Credit Monitor which notifies you if there have been any key changes to your credit file.

What is a Credit Bureau Singapore Credit Score?

The credit report you obtain from includes a credit score.

This is the number used by lenders as an indicator of how likely an individual is to repay his debts and the probability of going into default.

It is an independent assessment of the individual’s risk as a credit applicant.

CBS credit scores are four-digit numbers derived from information of your past payment behaviour and history on your loan accounts.

The score you get ranges from 1000 to 2000. The score you get is further classified into graded bands which function like credit ratings.

Naturally, an AA grade with a score from 1911-2000 means that you are least likely (probability wise) to default on a payment.

The HH grade with a. score of 1000-1723 means that you are most likely (probability wise) to default on a payment.

Here is a table that breaks it down further:

| Score Range | Risk Grade | Probability of Default: Minimum | Probability of Default: Maximum |

|---|---|---|---|

| 1911-2000 | AA | 0.00% | 0.27% |

| 1844-1910 | BB | 0.27% | 0.67% |

| 1825-1843 | CC | 0.67% | 0.88% |

| 1813-1824 | DD | 0.88% | 1.03% |

| 1782-1812 | EE | 1.03% | 1.58% |

| 1755-1781 | FF | 1.58% | 2.28% |

| 1721-1754 | GG | 2.28% | 3.46% |

| 1000-1723 | HH | 3.46% | 100.00% |

Do note that your credit score is only one of many factors that lenders tend to look at when they process your loan application.

Aside from your credit report and credit score, other consumer information they look at include:

- Annual salary

- Length of employment

- Bankruptcy records

- Litigation information

- Number of credit facilities you own

You will need to know that the Credit Bureau (Singapore) CBS is not actively involved in the lending approval process.

CBS is only a source of factual credit information on the consumer (you) which lenders in Singapore have access to.

The lenders will then use this information in their credit business decisions.

What Affects Your Credit Score?

There are six factors that affect your credit score.

1. Use History

This factor points to the amount of credit owed/used on your accounts.

2. Recent Credit Applications

This factor reflects your recent credit facility applications like credit cards you apply for, personal loans, etc.

If you have recently applied for many credit facilities within a short time frame, lenders might think that you are overextending yourself.

This is why you should apply for new credit facilities in moderation.

3. Available Credit Accounts

This factor refers to the number of credit facility accounts available (open or active) that you have for credit.

4. Account Delinquency (Late Payment) Data

Records of delinquency (late payment) on your credit accounts will negatively affect your credit score.

5. Credit Account History

Consumers with a long and good credit history will be viewed more favourably than consumers with little or no credit history.

The consumer with a good and long credit history is viewed more favourably than consumers with little or no credit history.

More specifically the last 12 months of your account repayment conduct will be used to compute your credit score.

This is why it is good to spend responsibly with a credit card and make your payments promptly to build up a better credit score.

Plus, you’ll get benefits like miles and cashback too.

You can read credit card reviews from real users on the best cashback, air miles and rewards credit card in Singapore.

Here is an example of a review of the POSB Everyday Card by a user from our Seedly Community:

6. Enquiry Activity

This factor refers to the number of new application enquiries there are on your credit report.

Every time a potential bank/financial institution pulls your credit report in response to a new loan application, an enquiry is placed on your credit file.

If you have too many enquiries, lenders will think that you are unreliable borrower as you seem to be applying for too many credit facilities.

As far as possible, keep your enquiries to a minimum, by limiting the loan facilities and credit cards you apply for.

(Do note that review enquiries on existing loan facilities do not affect your score.)

How do I Get a Credit Bureau Report For Free?

You will also get a free credit report when you apply for a new credit facility with any CBS member banks or financial institutions

Credit Bureau of Singapore (CBS) Members

- American Express

- DBS

- Citibank Singapore

- HSBC

- Maybank

- OCBC Bank

- Standard Charted Bank

- UOB Bank

- Diners Club Singapore

- Bank of China

- Hong Leong Finance

- RHB Bank Berhad

- Sing Investments & Finance

- Singapura Finance

- State Bank of India, Singapore

- The Bank of East Asia, Singapore Branch

- CIMB Bank

- Bank Negara Indonesia

- BNP Paribas

- UCO Bank

- ICBC Bank

- Indian Overseas Bank

- HL Bank

- Credit Suisse, Singapore Branch

- Bank of Singapore

- Sumitomo Mitsui Banking Corporation

- ABN AMRO Bank NV (Singapore)

- HSBC

- LGT Bank

HSBC and iCompareLoan Singapore are also giving away free Credit Bureau Reports.

You can apply via HSBC’s website.

Do note that this promotion is only valid until 31 July 2020. Also, you will have to agree to provide OCBC with your personal details for marketing purposes for three months.

Not to mention that iCompareLoan participants with access codes will be able to get it for free as well. You can head to their website to apply.

Do note that this promotion is only valid until 31 October 2020 and you will have to agree to provide iCompareLoan with your personal details for marketing purposes.

Buy Credit Bureau Report

Otherwise, you can buy your credit report for $6.42 online with e-nets or your Visa or Masters credit/debit card here.

You can also head down to any Singpost Branches, the Crimsonlogic Service Bureau at Chinatown or the CBS office located at:

2 Shenton Way, #20-02, SGX Centre 1, Singapore 068804

Hotline: 6513 8393

Operating Hours :

Mondays to Fridays: 9am – 6pm

Closed on Saturdays, Sundays and Public Holidays

Advertisement