Is Singapore Exchange (SGX: S68) or Hong Kong Exchanges and Clearing (HKG: 0388) the Better Investment?

Sudhan P

Sudhan P●

Singapore Exchange (SGX: S68) and Hong Kong Exchanges and Clearing (HKG: 0388) made news recently when MSCI announced it would move licensing for derivatives products on a host of gauges from Singapore to Hong Kong in 2021.

MSCI is a New York-based global index publisher.

The announcement caused Singapore Exchange (SGX) shares to suffer their steepest decline in 17 years.

On the back of that news and steep fall in SGX share price, investors might be interested to dig deeper into the businesses of Hong Kong Exchanges and Clearing (HKEX) and SGX to find out which makes a better investment.

However, we understand it can be hard work.

So, let us do some of the heavy lifting for you right here!

.

.

.

“You’re welcome!”

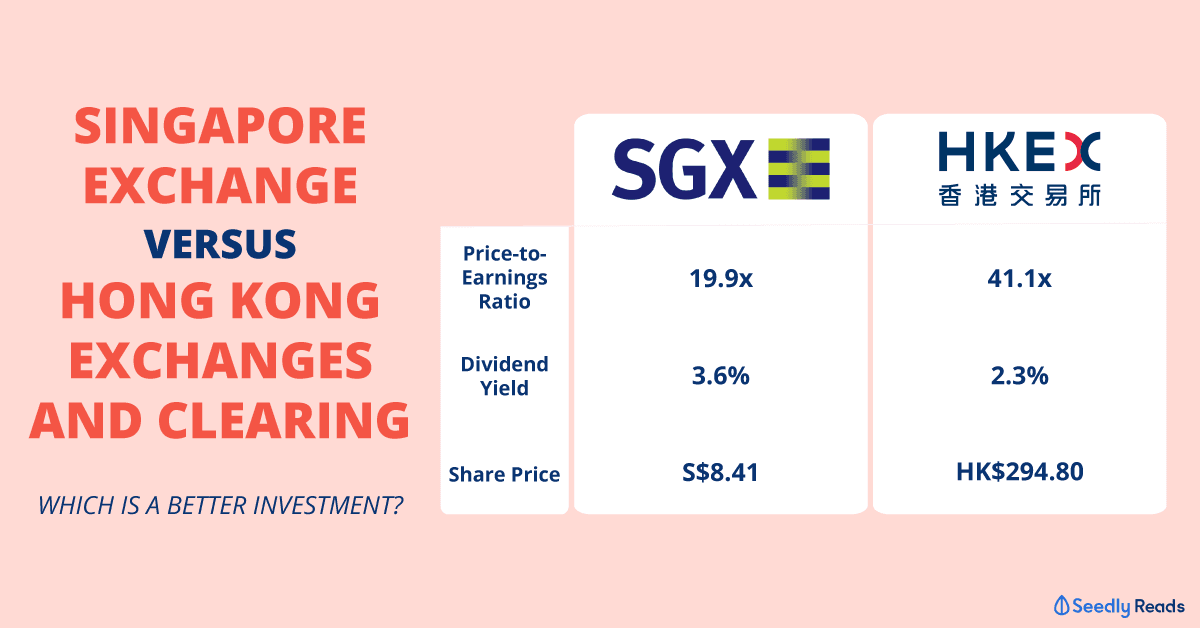

TL;DR: Singapore Exchange Versus Hong Kong Exchanges and Clearing

We pit the stock exchanges of Singapore and Hong Kong against each other to see which is the better investment.

In summary, we found that:

- HKEX is superior to SGX in terms of historical revenue, net profit, and dividend growth.

- The Hong Kong exchange also seems to have better growth ahead than its counterpart.

- Valuation-wise, however, SGX looks cheaper than HKEX.

Historical Financial Performance

SGX has a financial year that ends on 30 June each year while HKEX’s financial year ends on 31 December.

Firstly, let’s analyse the past financial performance of both the exchanges:

| Singapore Exchange | Hong Kong Exchanges and Clearing | |

|---|---|---|

| Revenue Growth Over Past Five Financial Years | 4.0% | 5.1% |

| Net Profit Growth Over Past Five Financial Years | 2.9% | 4.2% |

| Earnings Per Share Growth Over Past Five Financial Years | 2.9% | 2.8% |

| Net Profit Margin in Latest Financial Year | 42.4% | 57.6% |

| Return on Equity in Latest Financial Year | 35.8% | 21.0% |

| Net Debt-to-Equity Ratio in Latest Period | N/A | N/A |

From FY2015 to FY2019, SGX’s revenue has grown at an annualised rate of 4%, from S$779 million to S$910 million.

However, revenue from HKEX increased at a higher rate of 5% per annum from HK$13,375 million in FY2015 to HK$16,311 million in FY2019.

Likewise, HKEX’s net profit growth and net profit margin have been better than that of SGX.

The higher net profit margin from HKEX shows that for every dollar of revenue, it generates higher net profit than SGX.

However, looking at earnings per share (EPS), a different story is seen.

SGX edges out its counterpart slightly in this aspect.

This suggests that despite growth in HKEX’s net profit, its outstanding share count has been increasing at a faster rate than SGX’s.

In terms of return on equity (ROE), SGX has the upper hand with an ROE of around 36% versus 21% for HKEX.

ROE shows how efficient a company’s management is in using shareholders’ capital.

Both SGX and HKEX have strong balance sheets since they have more cash than debt.

Show Me the Dividends

Next, let’s look at how both companies have been rewarding shareholders through dividends.

| Singapore Exchange | Hong Kong Exchanges and Clearing | |

|---|---|---|

| Dividend Growth Over Past Five Financial Years | 1.7% | 3.1% |

| Dividend Payout Ratio in Latest Financial Year | 82.1% | 89.6% |

HKEX’s dividend has grown at a faster clip than that of SGX.

However, in terms of dividend payout ratio, SGX is slightly more conservative.

The dividend payout ratio tells investors what percentage of a company’s earnings is paid out yearly as a dividend.

SGX changed its dividend policy from FY2019, as shown below:

“From FY2019, SGX will revise its dividend policy from one based on a percentage of net profit, to one based on an absolute amount. The new policy aims to pay a sustainable and growing dividend over time, consistent with the company’s long-term growth prospects. This will provide flexibility for SGX to balance its dividend payments with the need to retain earnings to support growth.”

As for HKEX, it has the following dividend policy:

“The Group adopts a dividend policy of providing shareholders with regular dividends with a normal target payout ratio of 90 per cent of the Group’s profit of the year.”

Growth Potential

The past is history. What drives a stock’s price over the long-term is its future earnings.

On that front, let’s determine if SGX or HKEX has bigger growth potential in years to come.

SGX announced in October 2019 the establishment of a S$1.5 billion multicurrency debt issuance programme.

Then, Loh Boon Chye, chief executive of the local bourse operator explained the programme’s rationale:

“The establishment of the multicurrency debt issuance programme is in line with SGX’s priorities to grow our asset classes across geographies and to invest strategically as our business expands. The programme will provide us with the flexibility to capture growth opportunities quickly when the need arises, while allowing us to actively manage our balance sheet.”

Even though we may not know exactly how SGX plans to deploy the money when drawn down, we know that the company is not resting on its laurels and is always looking to grow its business.

SGX has a multi-asset exchange platform that allows investors to manage the investment risks of their equities, commodities and currencies portfolios. Its wide international footprint also allows participation from customers in the US and European time zones. These should bode well for the company over the long run.

On the other hand, HKEX has announced concrete growth plans with its HKEX Strategic Plan 2019-2021 launched on 28 February 2019.

The initiative has three focus areas of “China Anchored”, “Globally Connected”, and “Technology Empowered”.

HKEX aims to further increase its international relevance to China and Asia, on top of increasing its Asian relevance to the global markets.

The continuing growth of international portfolio investment in Mainland China (the “Northbound” arrow) and the early stage of Chinese outbound securities investment (“Southbound” arrow) should provide the basis for strong growth for HKEX for years to come.

Overall, from what I’ve read about HKEX and SGX, I believe HKEX has a better growth path ahead with its closer ties to the China market.

Valuation

Lastly, let’s analyse the key valuation metrics of SGX and HKEX.

| Singapore Exchange | Hong Kong Exchanges and Clearing | |

|---|---|---|

| Share Price | S$8.41 | HK$294.80 (~ S$52.80) |

| Market Capitalisation | S$9.01 billion | HK$373.8 billion (~ S$67.0 billion) |

| Price-to-Earnings (PE) Ratio | 19.9 | 41.1 |

| Five-Year Average PE Ratio | 22.8 | 36.0 |

| Dividend Yield | 3.6% | 2.3% |

When comparing the PE ratios and dividend yields of the two firms, SGX seems to offer better value than HKEX.

SGX also looks undervalued when we compare its current PE ratio to its five-year average.

However, growth investors may prefer HKEX due to its stronger past financial performance and probably better future prospects.

Have Burning Questions Surrounding The Stock Market?

Why not check out the Seedly Community and participate in the discussion surrounding stocks like Singapore Exchange Limited (SGX: S68) and many more!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer may have a vested interest in the companies mentioned.

Advertisement