Last month, I was fixing a TV because one of our tenants complained that it was damaged – one of the common tasks a landlord would need to do when renting out homes. ?

While trying to fix the damn thing as quickly as possible so that I can head back home and catch some Zs, I remembered reading that Singaporeans spend more time on property searches than reading bedtime stories to their kids.

Which got me wondering: Wouldn’t the Seedly community be interested in seeing how properties compare against another Real Estate Investment Trusts (REITs) – another Singaporean obsession?

I know that people often compare properties against REITs as the underlying asset for both investment instruments are real estate. In a country like Singapore which has a stable government and growing economy, it’s natural that property becomes a very attractive form of investment.

And yes, we do get these questions very frequently on our Seedly QnA.

TL;DR: Start With REITs, Then Invest In Property Once You Are Ready

- As a start, REITs are more accessible as they have a smaller initial capital outlay

- Young couples will usually start with an HDB BTO

- Once you are ready to own a second property and have leverage (read: bank loan) you can start on your property investing journey

- However, the Singapore property market has been hit by a series of cooling measures by the government which restricts multiple ownership of property and decreases rental yield

What’re The Differences When Investing In REITs And Property?

Property

Means buying an actual property like a condominium and renting it out for rental yield.

It also means that the property is managed by yourself and your property agent.

And if you’re a seasoned investor, you’ll know that selection criteria matters a lot when it comes to assessing your capital gain over the years.

Oh, and if you’re a noob when it comes to property. Did you know that 99.co is having an event on the 25 May 2019 that is about “Property Investing for Non-Millionaires”? Yep, it’s an event that teaches you how to get started, how to pick winning properites, calculate your return on investments and even learn cost-saving tips for your mortgage loans!

Interested? Read till the end for a special Seedly promo code to attend the event!

Just in case you’re wondering how I calculated the Rental Income Yield:

Rental Income Yield = [(Monthly Rent x 12) – Maintenance Fees – Property Tax – Income Tax] / Property Value ] x 100%

For example:

*Rental Income Yield = [($3,200 x 12) – $4,000 – $3,000 – $800] / $1,050,000 ] x 100% = 2.9% p.a

*Figures are rough estimates based on IRAS.

Real Estate Investment Trusts (REITs)

Buying REITs refers to buying the stock of a listed company that owns and operates income-producing real estate.

Instead of physically owning the property, the money you invested will be managed by professional property managers who will manage a collection of properties. In turn, these stocks will payout dividend to investors.

We’ve talked at length about REITs before so I won’t go into details.

And for the REITs fans, guess what? We’ve noticed your questions on our Seedly QnA and we’ve decided that SeedlyTV EP05 will be all about REITs!

The episode will air on 23rd May 2019 at 8pm, and it will be hosted by Rusmin, from The Fifth Person, and myself. We will be covering the basics and how you can get started in REITs in Singapore.

Some Key Considerations When Deciding Between REITs or Property

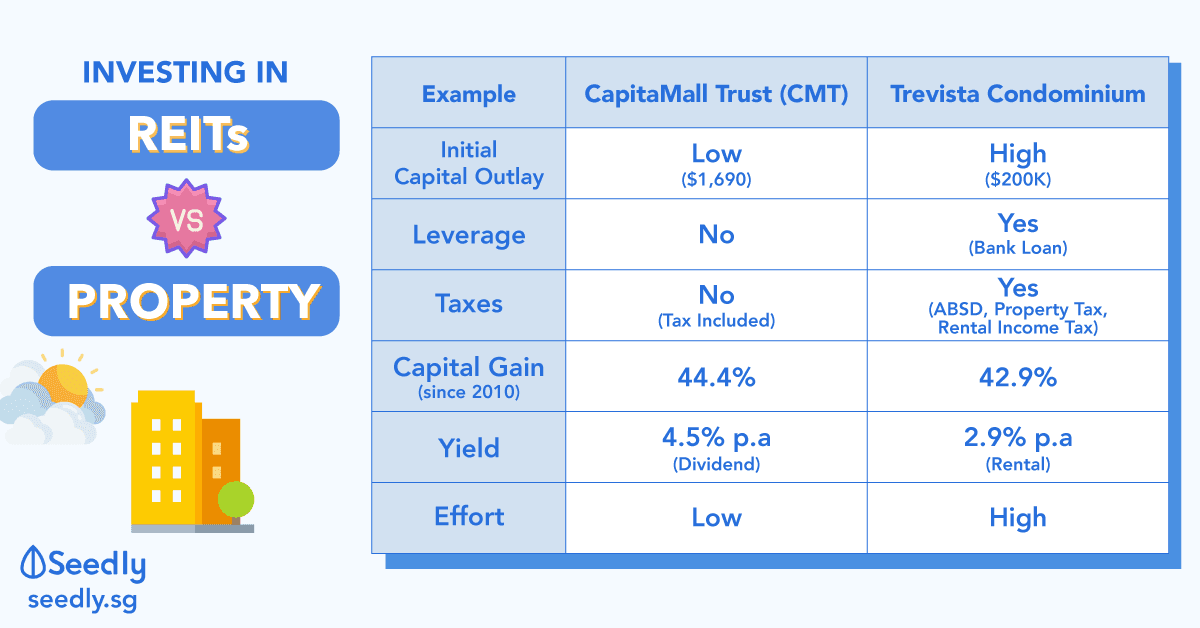

| REITs | Property | |

|---|---|---|

| Example | CapitaMall Trust (CMT) | Trevista Condominium |

| Initial Capital outlay | Low ($1,690 because of 1 lot) | High ($200k, which is 20% of total value) |

| Leverage | No | Yes (bank loan, monthly repayments) |

| Taxes | No (Included in company tax) | Yes (ABSD, Property Tax, Rental Income Tax) |

| Bought price (2010) | $1.69 per share | $1.05M |

| Current price (2019) | $2.44 per share | $1.50M |

| Capital Gain | 44.4% | 42.9% |

| Yield | 4.5% p.a (Dividend Payouts) | 2.9% p.a (Rental Payouts) |

| Effort | Low | High |

| Trends | Competitive market with decreasing population growth in SG | Tightening cooling measures for Singapore market to restrict multiple home ownership |

Some Numbers For Comparison Between Property Vs REITs

I’m thankful to have experienced with private properties in Singapore as well as personally investing in a portfolio of REITs.

For this comparison, I will be using Trevista Condominium (located in Braddell) and CapitalMall Trust (CMT) over a 9 year period as a comparison. All data used is correct as of 11 May 2019.

Property: Trevista Condominium

Trevista Condominium sits in District 12 – Toa Payoh/Balestier estate – and was built in 2010.

- Bought in: 2010

- Bought price: $1.05M

- Initial capital outlay: Around $200k, leveraged by bank loan

- Latest Transacted value: $1.50M

- Capital Gain: 42% since the start (unrealised)

- Rental Yield: $3,200 a month ($38,400 per year) = 2.91%

As seen above, you can use this handy tool by SRX, called X-Value which details the price that your property can fetch at the highest, as well as the trending of transacted price based on your address and unit.

It’s really quite an interesting tool to use!

REIT: Capitaland Mall Trust

- Bought in: 2010

- Bought price: $1.69 per share

- Initial capital outlay: 1 lot (at 1,000 shares) = $1,690

- Latest Price: $2.44 per share

- Capital Gain: 44.3% since 2010

- Dividend Yield: Average of 4.5% p.a

Closing Thoughts: Get Smarter Before You Start

As with all things in life, understanding, and accruing the right knowledge before you select your first property or REIT is highly important before making a decision.

Team Property: I Already Have Capital And Want To Buy My First Property!

If you happen to be in the Property camp, we managed to get an exclusive deal with 99.co to give our readers 60% off tickets (original price $20, discounted price $8) for their upcoming event on 25 May 19 (Saturday).

The event is about Property Investing for Non-Millionaires. Yep, that means Regular Joes and Janes like you and I can learn:

- How to get started

- How to pick that winning property

- How to calculate your return on investments

- Cost savings tips for your mortgage loans

and many more!

Simply use code: 99XSEEDLY to enjoy the special promo!

Team REITs: I Want To Learn More About REITs!

If you are in the REITs camp, SeedlyTV Episode 05 will be all about REITs!

The episode will air on 23rd May 2019 (Thursday) at 8pm, and it will be hosted by Rusmin (aka a Legend in REITs) from The Fifth Person. You’ll want to tune in because you’ll be able to ask your questions and get them answered by the pro.

Advertisement